- Virtuals Protocol saw two spikes in its age consumed metric during the retracement

- Quick recovery from the local bottom gave bulls some hope

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. The recent performance of Virtuals Protocol [VIRTUAL] has been nothing short of impressive, but it’s important to remember that every coin has its own unique story.

Over the past month, Virtual Protocol (VIRTUAL) has shown exceptional performance, surging by approximately 33% from its recent minimal points. The optimistic traders are eager to jump back in following a temporary pullback, ready for another potential surge.

It’s noteworthy that there has been a significant level of involvement and some instances of profit-making actions observed on the blockchain lately.

VIRTUAL set to march higher

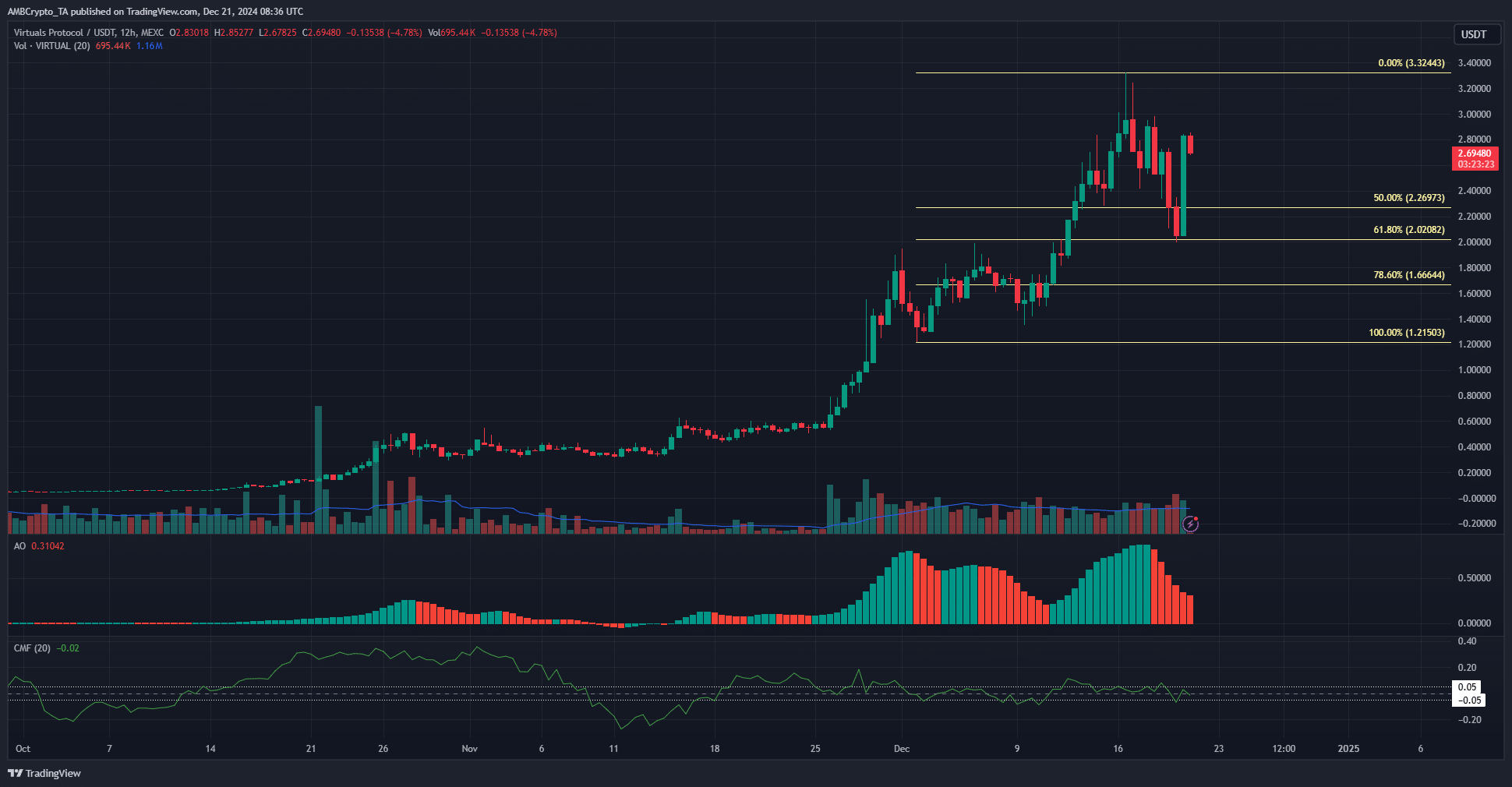

On the daily chart, the market’s structure shifted bearish following the decline that dropped below the latest higher low set on December 15 at $2.28. The Fibonacci ratios derived from the December price movement between $1.21 and $3.32 marked $2.02 and $1.66 as significant potential reversal points.

In simpler terms, the Awesome Oscillator on the daily chart shows that the strength of the upward trend may be decreasing, indicated by red bars in recent days. Yet, it hasn’t dropped below the neutral point (zero) as of now.

In the past few days, there was no significant movement of capital indicated by the Capital Movement Factor (CMF), which stood at -0.02. However, trading activity for the virtual asset saw a slight increase in early December and has consistently remained around 1.1 million trades per day since then.

On-chain metrics showed bullish sentiment has slowed down

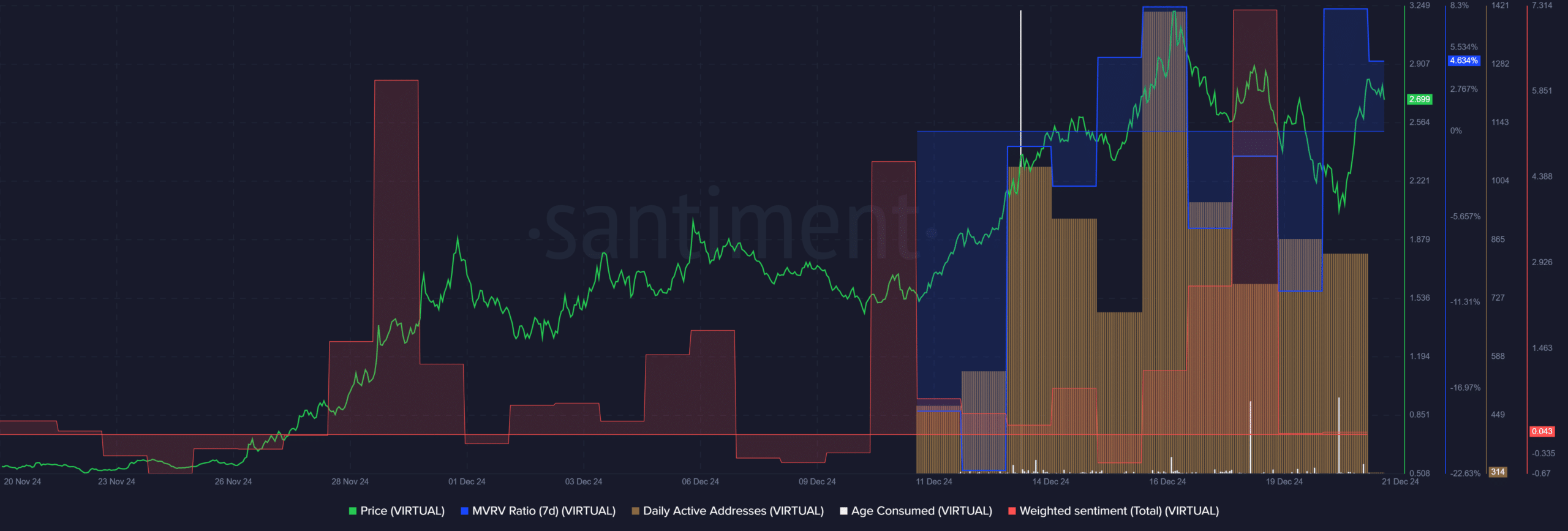

The Awesome Oscillator not only dropped significantly, but the weighted sentiment also plummeted drastically. It was exceptionally optimistic on December 18, due to social media activity. However, since then, it has trended back towards a neutral state. Moreover, the number of daily active addresses decreased compared to a few days ago, although it still exceeds 800.

In the past three days, the consumption rate peaked twice, yet these peaks were smaller compared to those observed earlier in the month. These occurrences took place during the surge of the Virtual Protocol token. This trend might suggest a buildup of selling activity, implying that sellers are exerting pressure on the market.

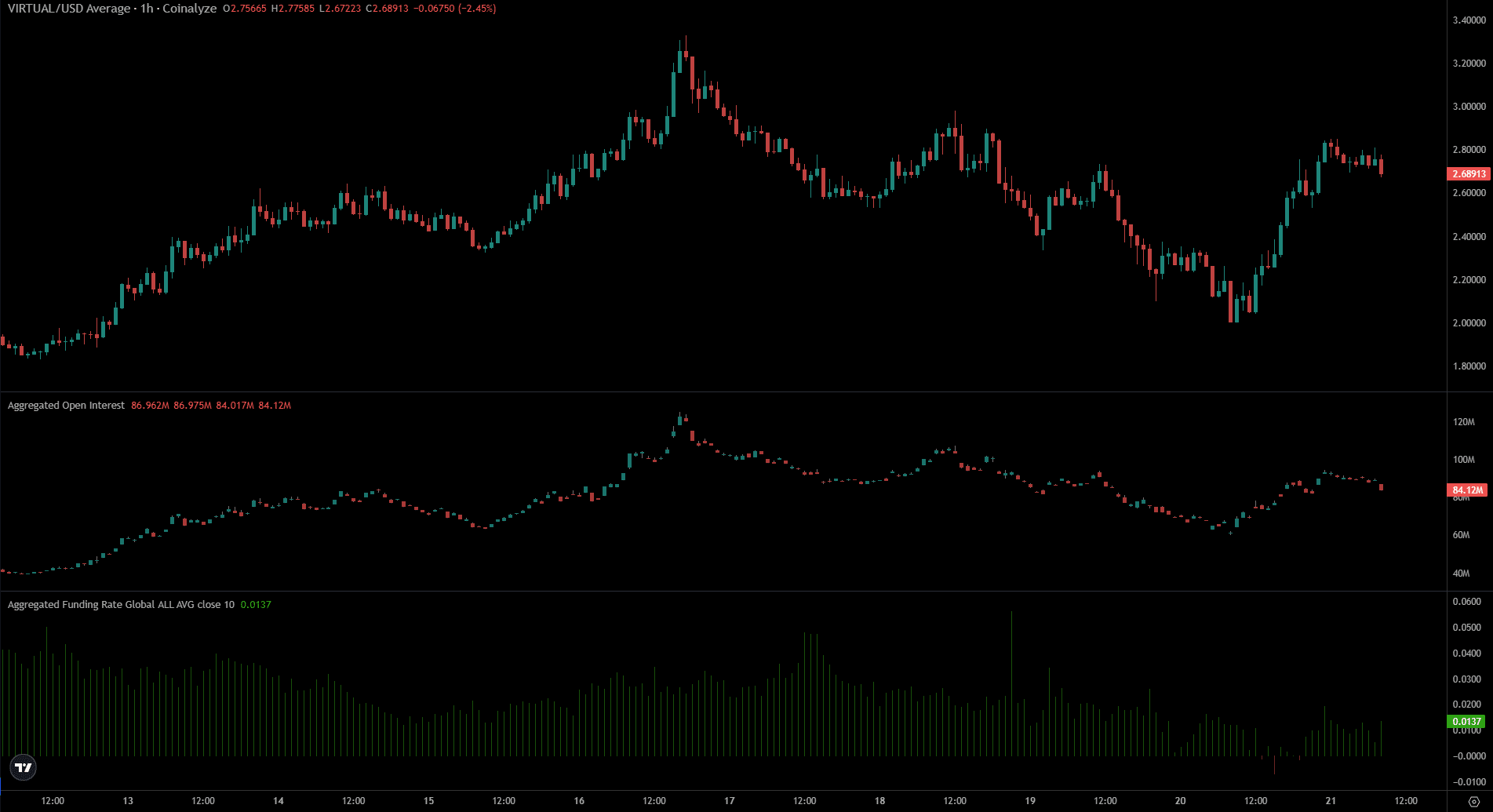

Reflecting on the latest futures data, it appears there’s still potential for growth. Although VIRTUAL experienced a swift rise in the past few hours, the funding rate didn’t soar to unprecedented heights. This could indicate a bullish sentiment among investors and a narrow gap between the spot and perpetual prices, suggesting that the market is optimistic about the future of this crypto.

Realistic or not, here’s VIRTUAL’s market cap in BTC’s terms

Over the past day, Open Interest increased by 33%, and simultaneously, the price rose by 27%. This surge suggests strong bullish trends and heightened speculative interest. If the Chaikin Money Flow (CMF) surpasses +0.05, it will serve as an additional indication of buyers holding the upper hand.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-21 23:06