-

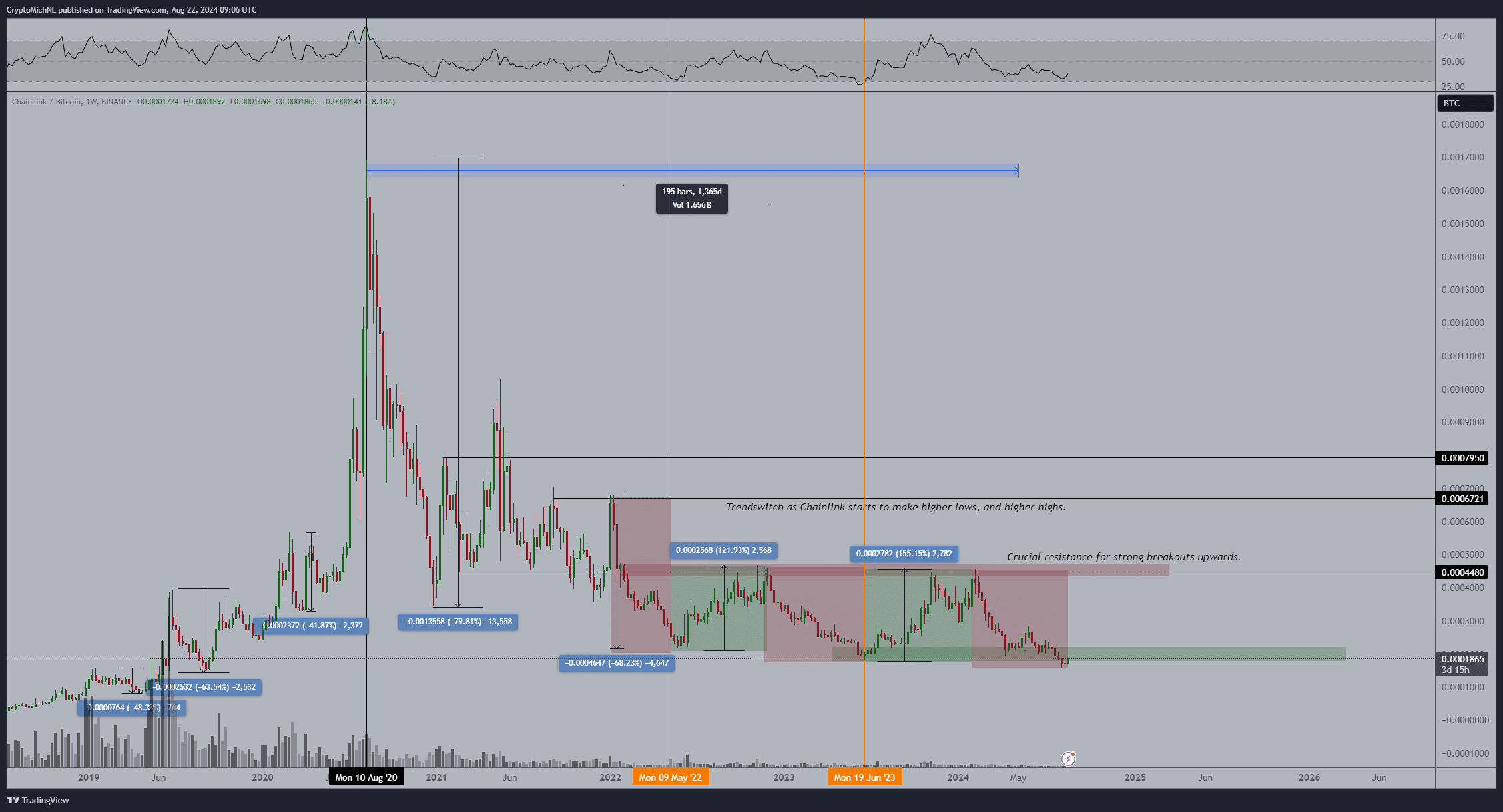

Analytical charts indicated that LINK/BTC reached its lowest point, signaling a potential surge in the near term

Further investigations highlighted an increasing interest in LINK, suggesting a likely upward trend in its price

As a seasoned analyst with years of experience navigating the cryptocurrency market, I find myself increasingly bullish on Chainlink (LINK) based on recent trends and technical indicators. The LINK/BTC chart suggests we may be witnessing a bottom out, indicating a potential surge in the near term, much like a coiled spring ready to unleash its energy.

Recently, the value of LINK/USDT has experienced a significant surge. Over the last seven days, it has risen by a substantial 13.12%. This upward trend hasn’t stopped; it has even gained an extra 2.26% in just the past 24 hours.

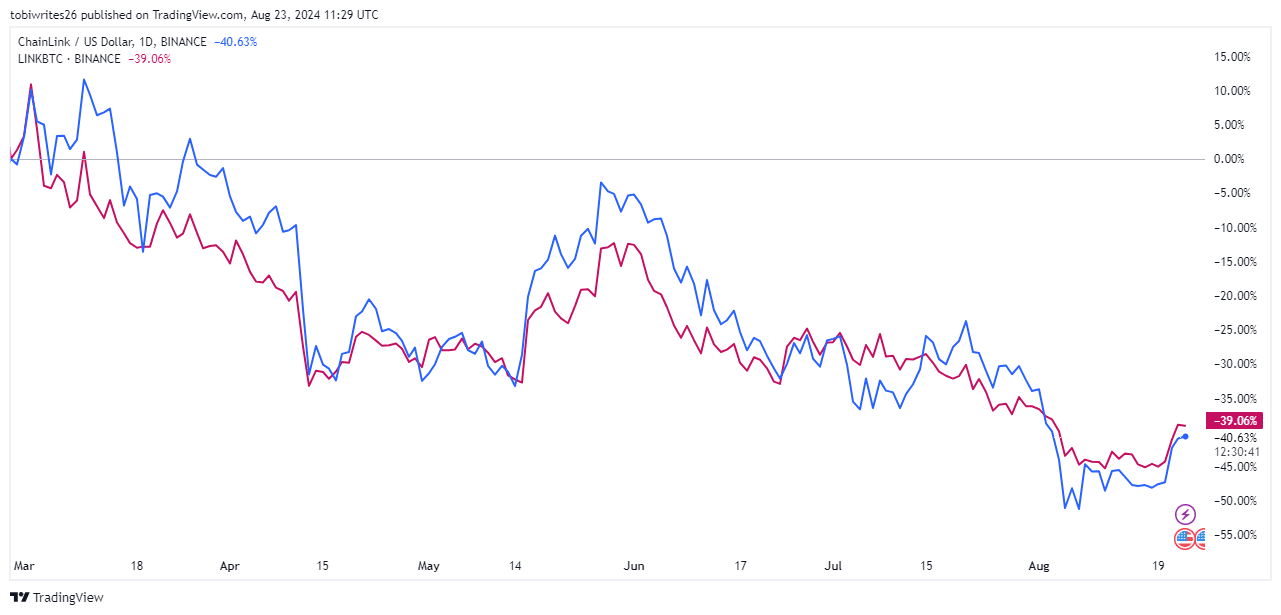

As the relationship between LINK/USDT and LINK/BTC grows stronger, their price fluctuations have a significant impact on each other’s market dynamics.

In light of the current optimistic market atmosphere, it’s also worth noting the recent observation made by a cryptocurrency analyst who sees Chainlink (LINK) currently trading in a crucial area.

Understanding LINK’s ‘bottom out’

crypto expert Michael van de Poppe signaled a possible reversal in the trend for the LINK/BTC exchange rate, suggesting that LINK could potentially start climbing again and even reach new peak levels, according to his prediction.

As an analyst, I’m observing that LINK is presently hovering around a lower support level. There’s a strong possibility that it could experience a reversal, potentially catapulting it towards the crucial resistance point at 0.0004480. However, upon reaching this resistance, LINK may encounter substantial selling pressure which it needs to surmount in order to maintain its upward trajectory.

When Chainlink (LINK) increases compared to Bitcoin (BTC), it usually suggests that the value of LINK is growing more strongly against BTC. Increases in LINK/BTC are frequently reflected in comparable movements for pairs like LINK/USD, so a rise in LINK/BTC tends to cause a corresponding increase in LINK/USD as well.

As an analyst, I examined a graph that illustrated the day-to-day fluctuations in the price of LINK relative to both BTC (in shades of purple) and USD (in hues of blue), starting from March onwards. The graph highlighted recurring trends between these two pairs, albeit with subtle differences that ultimately converged over time.

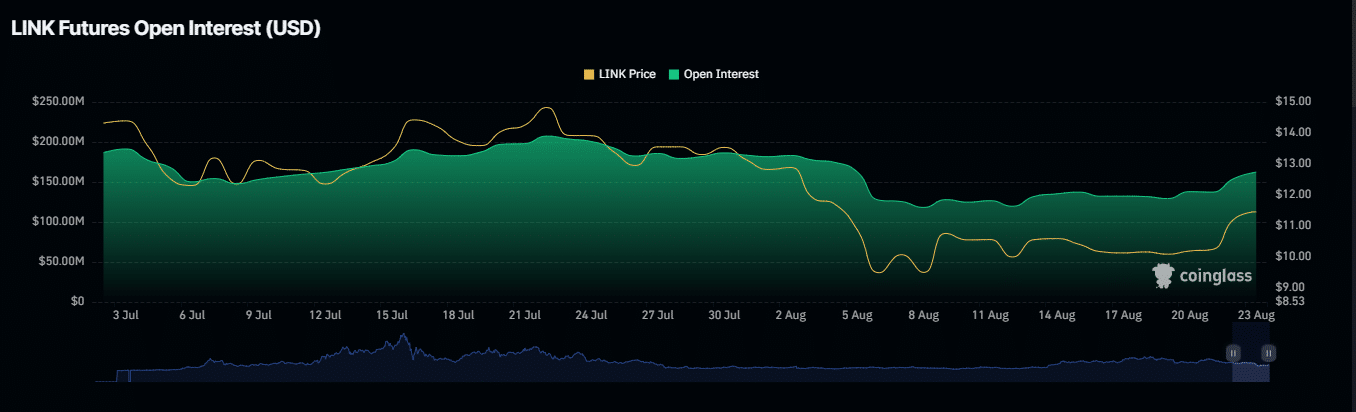

Support from on-chain metrics?

According to Coinglass, it’s been observed that the number of outstanding LINK derivative contracts has been gradually increasing, suggesting a higher number of these contracts yet to be settled. This Open Interest figure is vital as it helps us understand whether the market is leaning more towards buying or selling.

An uptick in OI suggests heightened buyer interest, with investors opening positions in anticipation of LINK’s price hike on the charts.

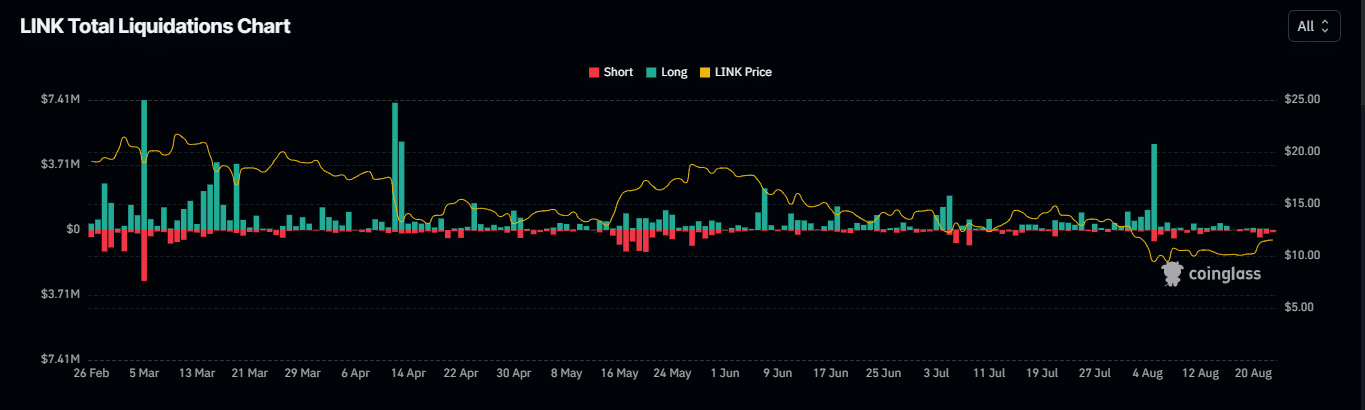

Further confirming this bullish sentiment is the recent struggle of short traders. Those betting on a decline in LINK’s price have faced major setbacks. In fact, over the last 24 hours alone, short positions valued at $234k have been liquidated.

In simpler terms, this action highlighted the power of long-term investors who are significantly raising prices, causing difficulties for those betting against the market (short sellers).

Momentum is on the rise

Ultimately, an examination of the Market Value to Realized Value (MVRV) and Relative Strength Index (RSI) revealed a growing momentum for Chainlink (LINK).

As an analyst, I find the MVRV (Market-to-Realized Value Ratio) to be a valuable tool for evaluating whether a cryptocurrency like LINK is overvalued or undervalued at any given moment. With its current MVRV sitting below 1, this suggests that LINK may be underpriced, implying a possible increase in its value in the near future.

In a similar manner, the Relative Strength Index (RSI) gauges market sentiment and trends. Values higher than 50 generally indicate positive momentum. With LINK‘s RSI at 54.24, it may suggest that its price might further increase in the short run.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-08-24 11:04