-

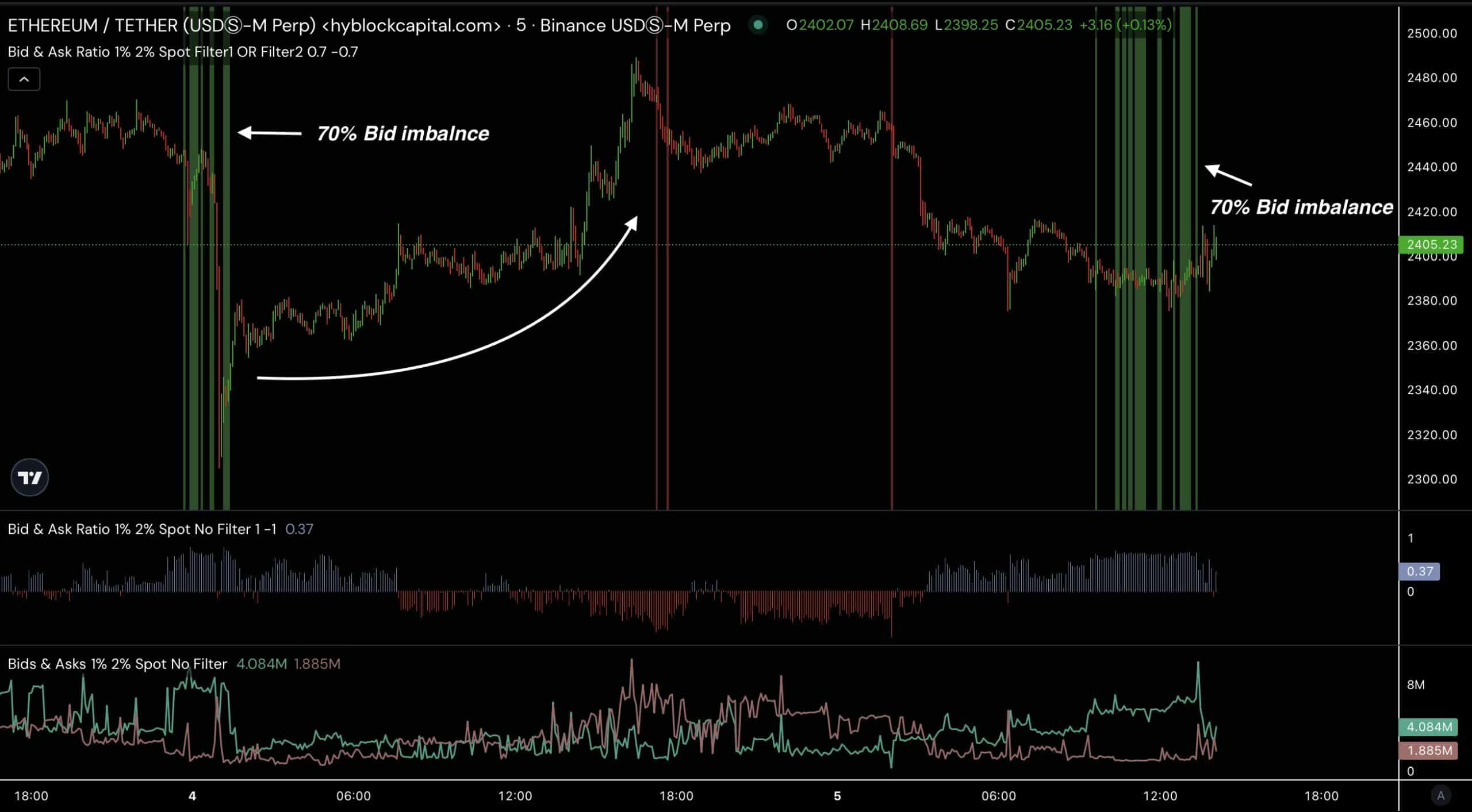

At the time of writing, ETH’s orderbook imbalance was at 70%

Ethereum may be set to hit new highs on the charts

As a seasoned crypto investor with a knack for deciphering market trends and recognizing patterns, I must say that the current state of Ethereum (ETH) is intriguing. With an order book imbalance at 70%, ETH seems primed to challenge its previous highs.

Discussions about the behavior of Ethereum’s [ETH] value have been heating up because it didn’t achieve a fresh record high in 2024, even though Bitcoin reached its own all-time high in March.

As expected, this has led to concerns that ETH may be losing momentum. Even so, recent developments in the ETH/USDT pair are providing hope for Ethereum enthusiasts.

Indeed, data from Hyblock Capital shows an overwhelming 70% order book imbalance in favor of bids for Ethereum at a depth of 1-2%. Typically, when Ethereum displays such a substantial bid imbalance, its price tends to reach a low point and subsequently starts increasing.

The current bid imbalance means that ETH could see a repeat of this upward price trend.

Ethereum in an ascending triangle

Currently, on a weekly basis, Ethereum is shaping an ascending triangle pattern. Notably, its value remains aligned with the 200-week moving average.

The formation of this consolidation pattern lends credence to the bullish outlook on ETH, since ascending triangles often result in price surges.

The 70% bid imbalance further reinforces the possibility of an upward move on the charts.

Typically, consolidation periods come before major price swings. If we’re currently in a consolidation phase, a breakout might propel Ethereum to considerably higher prices.

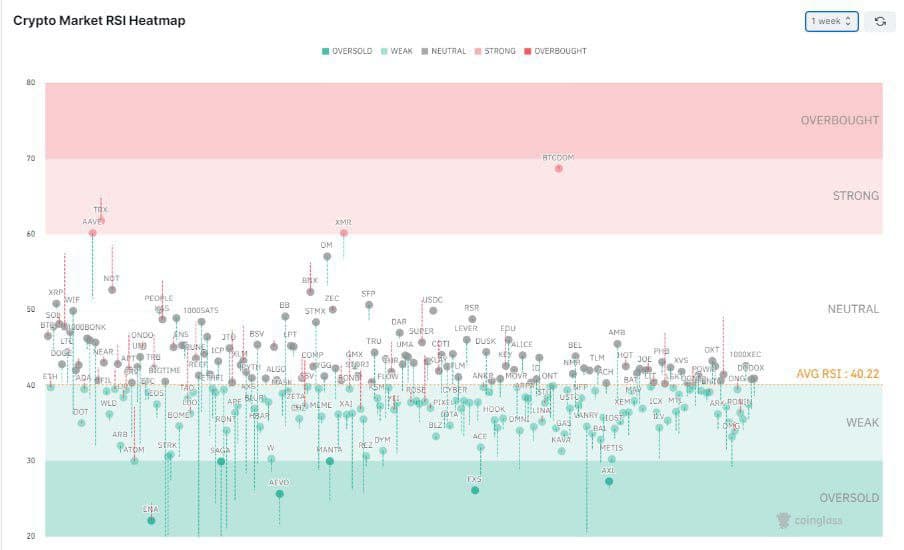

Weekly RSI heatmap

At the current moment, as shown on our weekly Relative Strength Index (RSI) chart, a majority of cryptocurrencies are found within the ‘weak’ or ‘neutral’ range, with an average RSI reading of approximately 40.22%.

This means that the market is transitioning from an oversold condition right now.

From my perspective as an analyst, as the Relative Strength Index (RSI) inches towards more neutral zones, it suggests a possible upswing for Ethereum (ETH). Notably, the 70% bid imbalance hints at a potential market bottom. This alignment aligns with our anticipation of a price surge on the charts, which could indicate a bullish trend for ETH in the near future.

ETH-based protocols booming…

Vitalik Buterin, one of Ethereum’s co-creators, has expressed his plan to give away his Layer 2 (L2) and related project tokens to fund initiatives for the greater good within the Ethereum community and various charities.

This move strengthens Ethereum’s long-term outlook too.

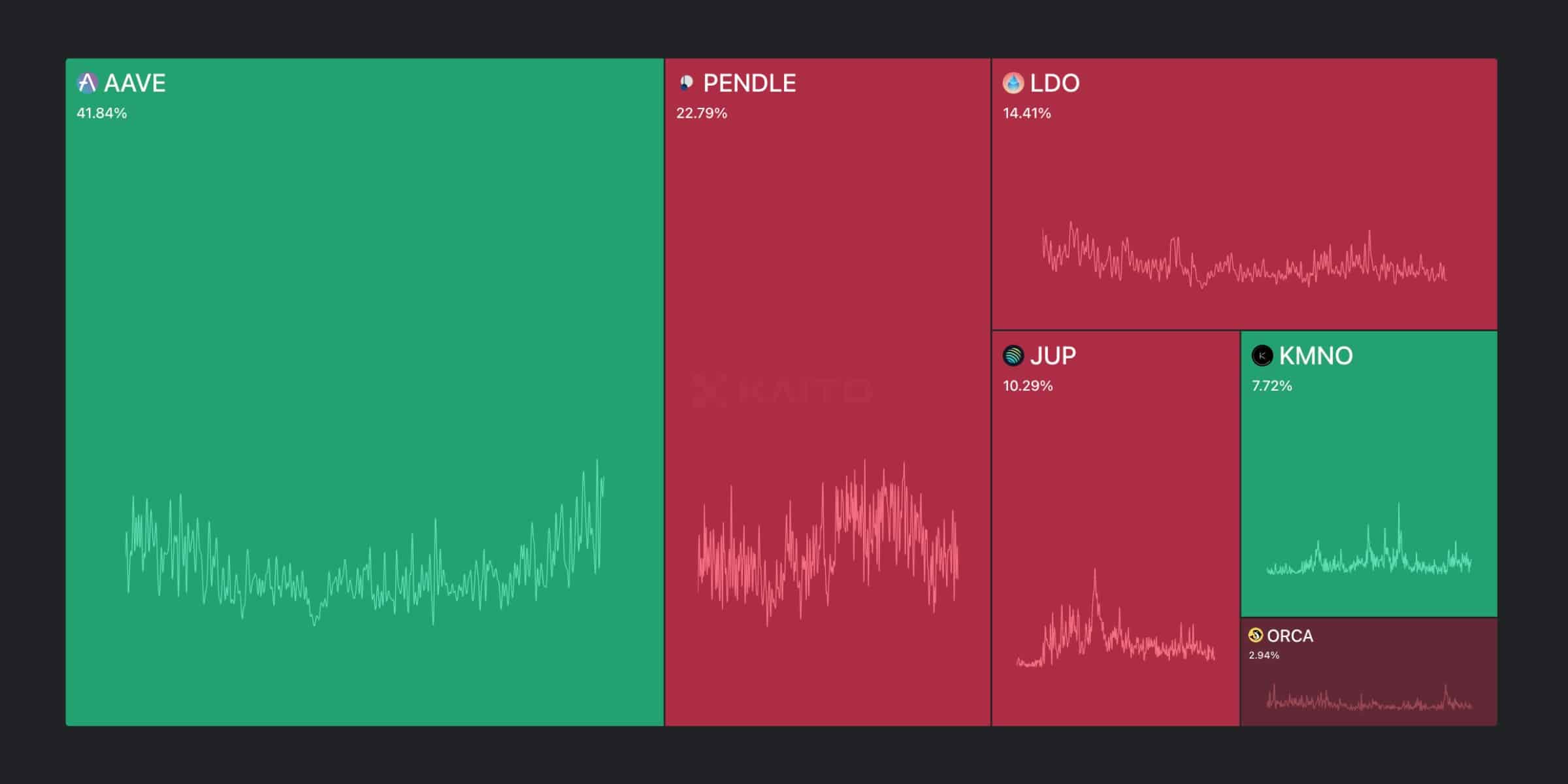

Furthermore, while some speculate that Solana could potentially lead in the Decentralized Finance (DeFi) space, it’s worth noting that Ethereum continues to dominate. In fact, experts at Kaito AI have affirmed that Ethereum still controls a significant portion of attention within DeFi.

One of the major players in the Decentralized Finance (DeFi) sector, Aave, functions primarily on Ethereum, together with important protocols such as Pendle and Lido. It’s expected that these platforms will foster more adoption of Ethereum, potentially boosting its value as prices rise.

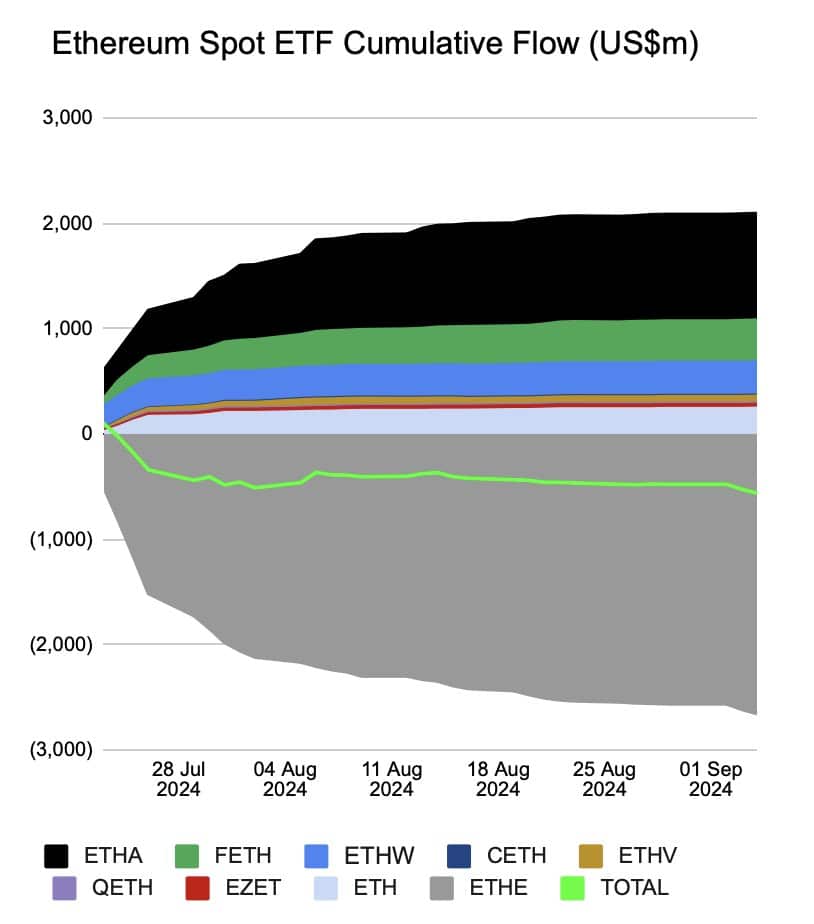

Ethereum ETF cumulative flows

However, there is one area of concern – Cumulative flows for Ethereum-based ETFs have hit an all-time low. The net flows in ETH ETFs are currently negative, with a reading of $562.3 million.

While the existence of an ETF is positive for Ethereum, the lack of demand poses a risk.

If demand does not increase, some ETF issuers may be forced to close their products.

Regardless, since there are continuous advancements within the Ethereum system, it’s possible that a change in price direction might occur soon.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-09-06 23:04