- Shiba Inu’s recent price movements affirmed a bullish edge as the bulls now eye the next resistance level.

- Derivates data reaffirmed this edge, but it’s crucial to monitor Bitcoin’s movement to assess the sentiment.

As a seasoned crypto investor with battle-hardened instincts and a portfolio that has weathered numerous market cycles, I find myself intrigued by Shiba Inu’s [SHIB] recent price movements. The bullish edge is palpable, with the symmetrical triangle breakout serving as a clear signal for buyers to step in and push towards the $0.0000182 resistance level.

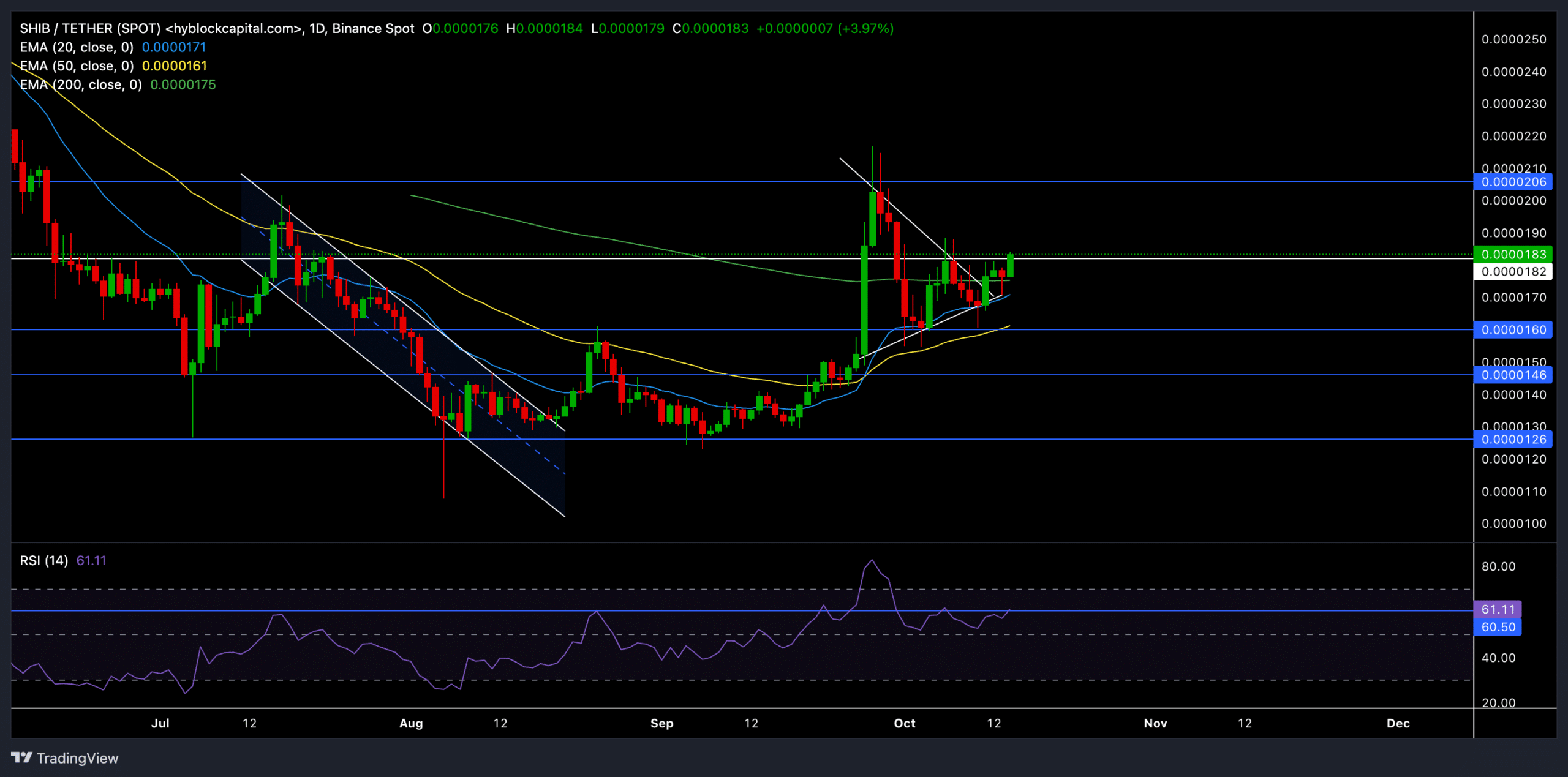

Shiba Inu (SHIB) has recently displayed a robust upward trend as its price surpassed its 20-day, 50-day, and 200-day Moving Average Lines. The recent breakout from a symmetrical triangle formation has favored the bulls, propelling SHIB to challenge significant resistance points.

At press time, SHIB was trading at approximately $0.0000184, up by 4.14% over the past 24 hours.

Can SHIB continue its rally?

Shiba Inu’s latest surge surpassing its 20-day, 50-day, and 200-day Moving Averages suggests a robust increase in positive market pressure, or in other words, a significant strengthening of the bullish trend.

A fresh breakout from the symmetrical triangle formation presents an opportunity for investors to drive prices upward towards the crucial barrier at $0.0000182, a significant resistance point that could potentially halt any further price increases.

If the price breaks above its current point significantly, it might push Shiba Inu (SHIB) towards the resistance level at $0.0000206 in the upcoming trading periods. At this level, sellers could potentially enter the market to initiate a period of sideways movement or consolidation.

In this case, buyers can expect a sideways trajectory between the $0.0000206 and $0.0000182 range.

On the negative side, rapid assistance seemed to be centered around the Exponential Moving Averages (EMAs), offering a robust foundation for Shiba Inu (SHIB) to recover should it face a setback and regain its stability.

In simpler terms, when the Relative Strength Index (RSI) was noticeably above the middle line, it signaled a positive trend for the market. If the value surpassed 60-61, it could lead to further profits, but there might be a reversal once the market becomes overbought. Keep an eye on Bitcoin’s price movement as well, since the overall sentiment of the market may impact Shiba Inu’s direction.

Derivatives data revealed THIS

It’s noteworthy that the 24-hour ratio of the meme coin between long positions and short positions was approximately 1.0462. This figure slightly leans towards a bullish trend. On Binance, this ratio was also 1.0462, while on OKX it stood at 2.43.

This reaffirmed a bullish edge and showed confidence among traders in the ongoing rally.

In much the same way, SHIB‘s trading volume experienced a significant increase of approximately 54.32% to reach an impressive $145.10 million. This upward trend is generally seen as a positive sign due to the daily profits. Moreover, open interest grew by 13.15%, suggesting that more traders are entering new contracts, presumably in expectation of further short-term growth.

Read Shiba Inu’s [SHIB] Price Prediction 2024–2025

As a researcher analyzing market data, I’ve observed an increase in short liquidations. This implies that those betting against the market, or the ‘bears,’ have been compelled to vacate their positions. This trend suggests a growing optimism among investors, often referred to as bullish sentiment. If this sentiment continues, it could potentially boost SHIB‘s immediate price movement.

If SHIB manages to break through its current resistance at $0.0000182, it might indicate further growth potential towards approximately $0.0000206. On the flip side, if the momentum fails to hold above the Exponential Moving Averages (EMAs), SHIB could find itself revisiting the support level at $0.0000171.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Battle Royale That Started It All Has Never Been More Profitable

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- ANKR PREDICTION. ANKR cryptocurrency

- Best Axe Build in Kingdom Come Deliverance 2

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- 10 Must-Read Romance Manhwa on Tapas for Valentine’s Day

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

2024-10-15 09:43