-

FLOKI’s technical indicators underlined overbought conditions, signaling possible short-term risks

On-chain data and social dominance reflected greater participation too

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself constantly intrigued by emerging projects such as FLOKI. The recent surge in its price and trading volume has caught my attention, but the question remains – will it continue this bullish momentum or face a correction?

In recent cryptocurrency developments, FLOKI [FLOKI] has been creating a stir. Over the past 24 hours, it has experienced a significant rise of approximately 14.19%, currently standing at $0.0001686 per token. This surge has coincided with an impressive increase in trading volume, exceeding 147%. The question on investors’ minds now is whether this bullish trend will persist or if a correction might occur next?

Technical analysis: What do the indicators say?

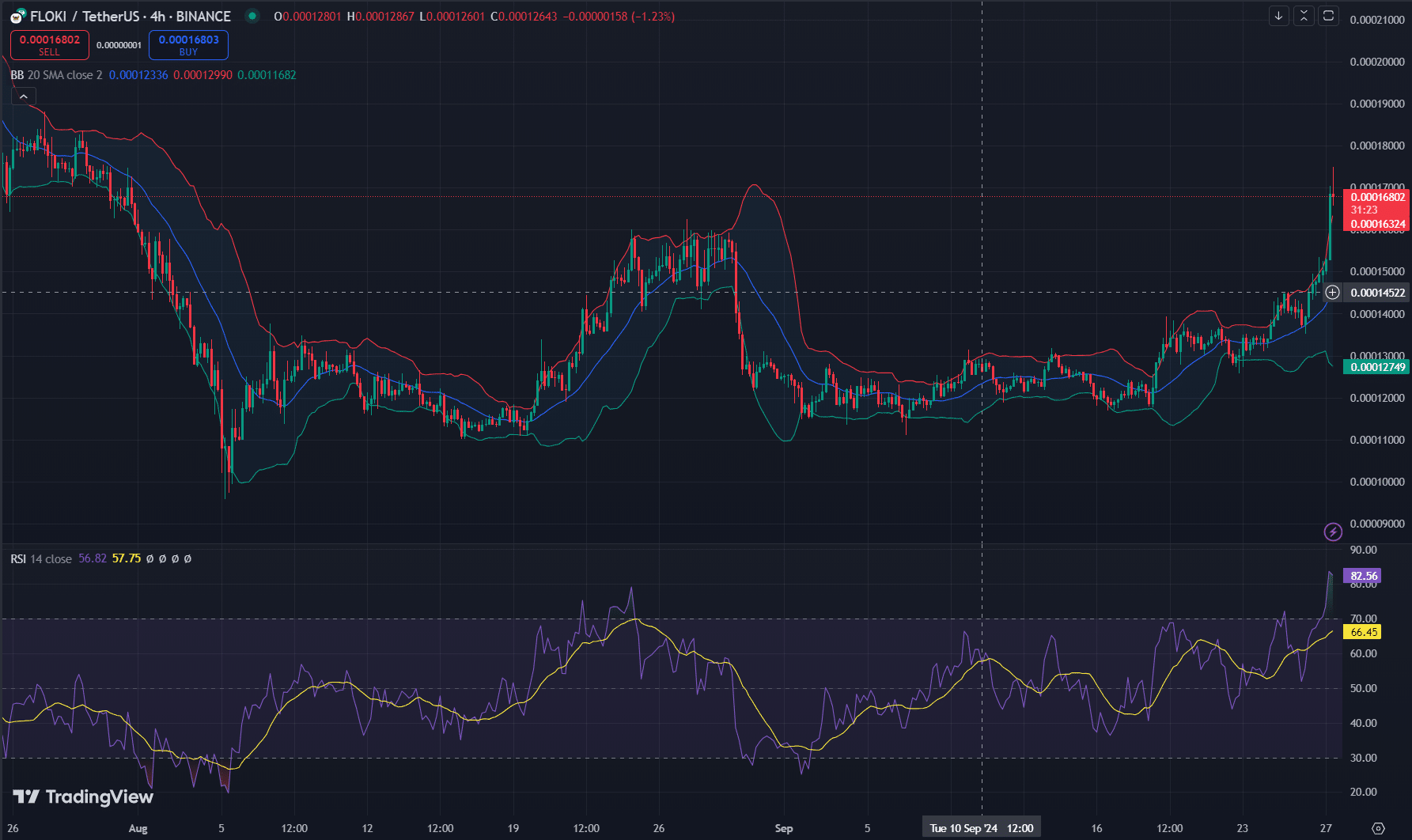

As an analyst, upon scrutinizing the technical indicators, I noticed that the 4-hour Relative Strength Index (RSI) showed a reading of 82.56, suggesting an overbought state. This finding suggests robust buying pressure, a condition that typically precedes market corrections.

Keep in mind that despite fluctuations, FLOKI‘s price has consistently stayed above crucial support points and has been riding along the top of its Bollinger Bands.

From my perspective as an analyst, this prolonged optimistic outlook is evident. Yet, it’s important to note that the price point exceeding the Bollinger Bands suggests increased volatility. As such, I would advise traders to proceed with a degree of cautiousness when navigating these market conditions.

On-chain data: Volume and active addresses spike

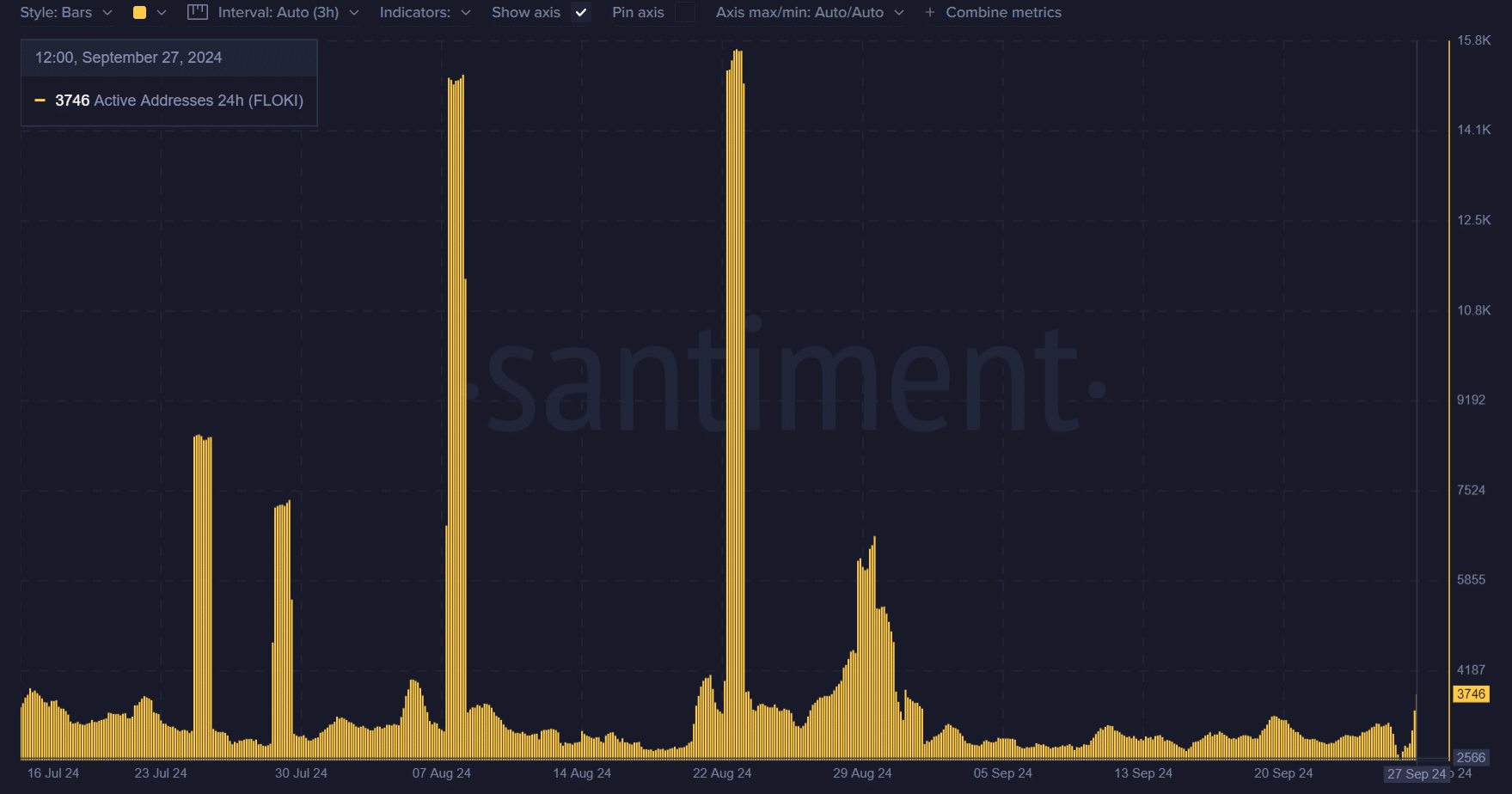

Furthermore, on-chain data indicated a marked increase in activity. Specifically, the number of daily active addresses increased from 2,796 to 3,746, indicating increased curiosity towards the token. Moreover, the trading volume jumped by 147% to reach $143.67 million, as reported by Coinglass, suggesting strong involvement in FLOKI‘s market fluctuations.

Consequently, it appears that these indicators are evidence of robust fundamentals and high user participation supporting FLOKI‘s price surge. The surge in activity implies that there might be further potential for growth in FLOKI.

Social dominance: FLOKI’s growing community presence

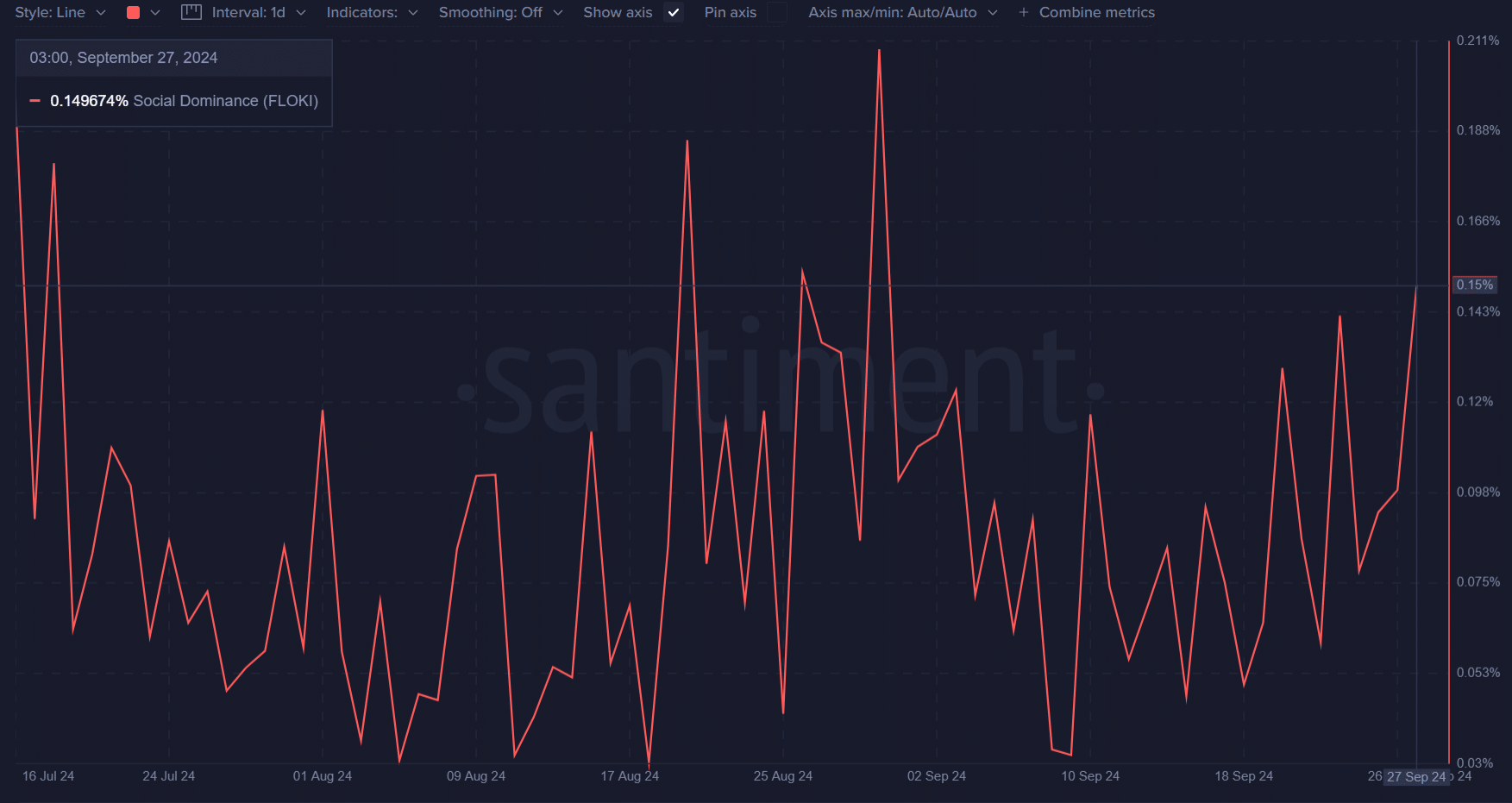

As a researcher examining the dynamics of FLOKI‘s performance, it’s clear that social dominance is significantly impacting its current standing. The token’s share in social conversations has surged to 0.149%, indicating a growing buzz within the community, which is often a strong indicator of increased retail interest. This surge in social sentiment, as seen throughout FLOKI’s history, has been a key driver for price rallies.

Keeping a close eye on social sentiment is essential because sudden changes can lead to market instability, as traders might decide to cash out their gains more frequently.

Long/short ratio: A potential market sentiment shift?

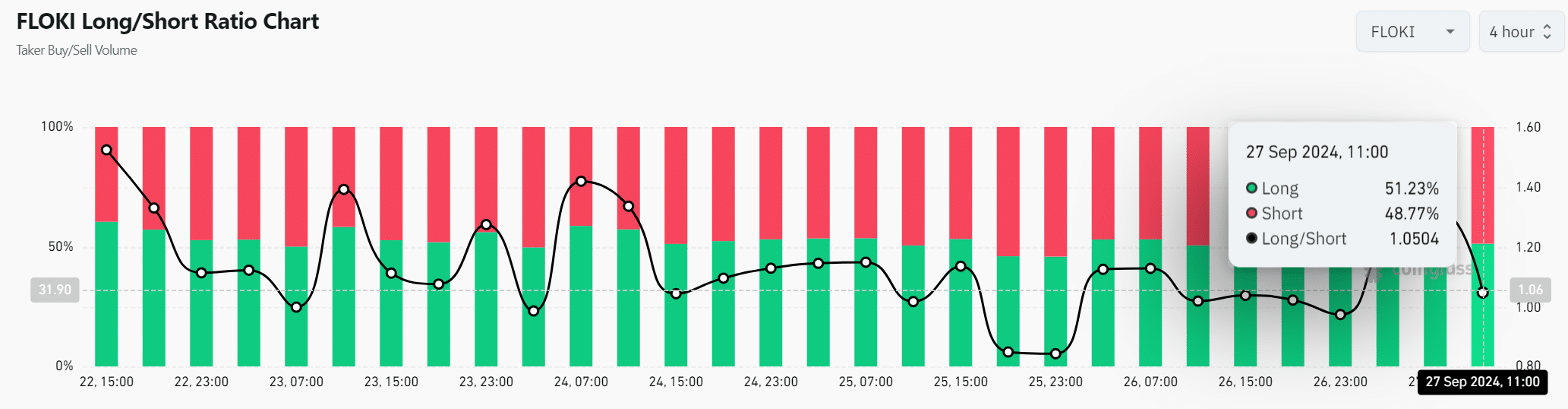

Ultimately, looking at the ratio of long and short positions, it showed a 51.23% preference for buying (long) compared to 48.77% for selling (short). This suggests that traders are generally optimistic about the market, although the close balance indicates a need for careful observation as any sudden changes could occur.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

As I write this, FLOKI seems poised to maintain its upward trend in the near future. Solid on-chain statistics, increasing social influence, and high trading volumes suggest that it will continue to expand.

Yet, it’s advisable for traders to exercise caution since the market appears overbought based on certain technical indicators, potentially leading to temporary price adjustments or pullbacks in the near future.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-28 09:43