- FET fell by over 20% in the last 48 hours

- Metrics flashed mixed signals on the charts

As a researcher with a background in cryptocurrency analysis, I find FET’s recent price drop disconcerting, given its impressive rally prior to this decline. The sudden 20% fall over the last 48 hours has left investors questioning the market sentiment and underlying fundamentals of the project.

As a crypto investor, I’ve noticed that FET experienced a steep decline of more than 20% within just two days. This unexpected price plunge has left me, along with many other investors, pondering over the potential reasons and what the future might hold for FET. Prior to this setback, FET had been making significant strides in the market, showing promising growth on the charts.

The price had increased by around 73% since touching its record low. Yet, the recent price movements have significantly reduced those advances. Unquestionably, this unexpected turnaround sparks curiosity about the current investor attitude and the underlying financials.

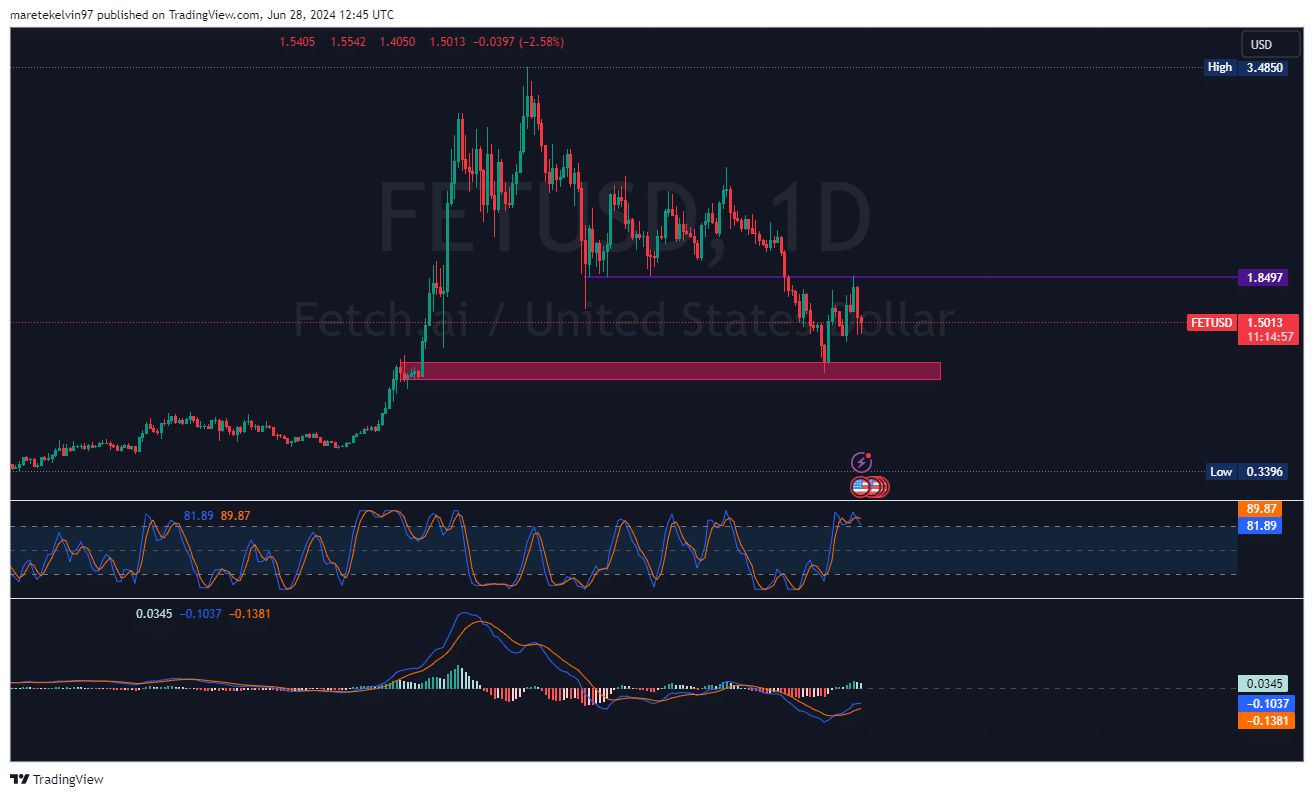

Currently, FET is priced at $1.50 per unit after experiencing a 7.30% decrease in value within the past 24 hours. Consequently, its market capitalization has shrunk by 18.27% during this timeframe.

As a crypto investor, I closely monitor my charts and based on my analysis, both the Stochastic RSI at 89.87 and the MACD are signaling an overbought condition. This implies that a potential price correction could be on the horizon.

Volume spikes amid sell-offs

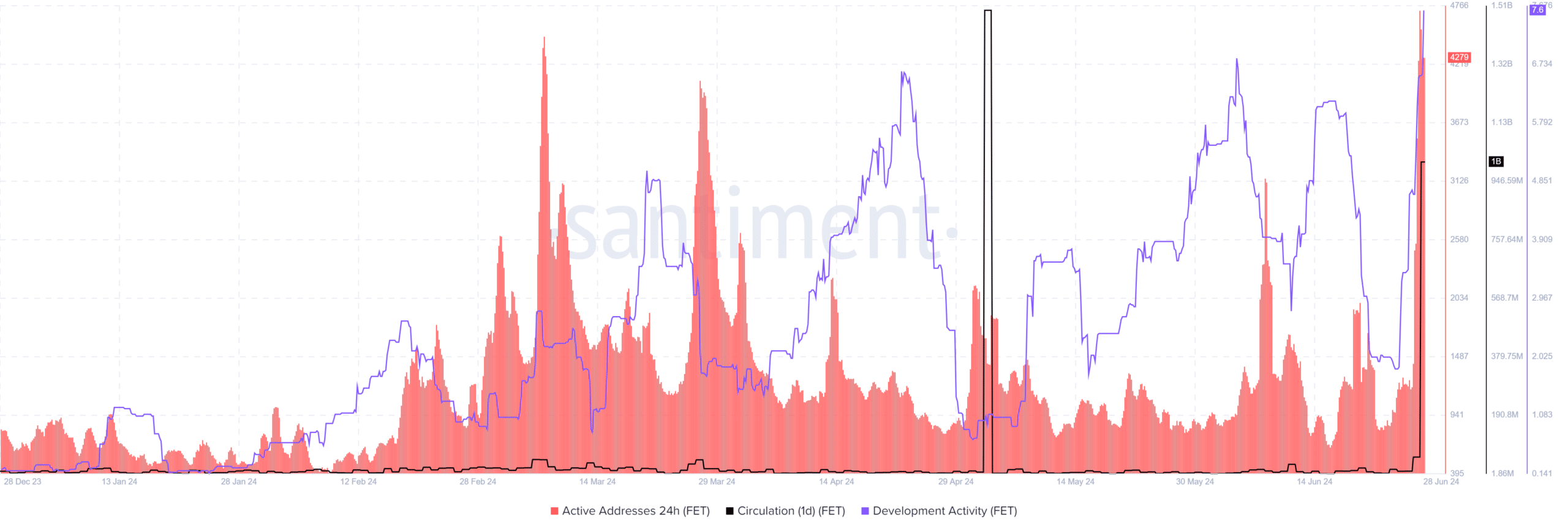

According to AMBCrypto’s examination of data provided by Santiment, there was a significant surge in trading activity observed during the market downturn. This was evidenced by a marked increase in the number of active addresses associated with FET, suggesting heightened network engagement as token prices declined.

It’s intriguing to note that despite the price volatility, the development metrics for FET have shown little variation. This could be an indicator of continuous advancements in the project’s fundamental technology, offering hope for sustained growth to long-term investors.

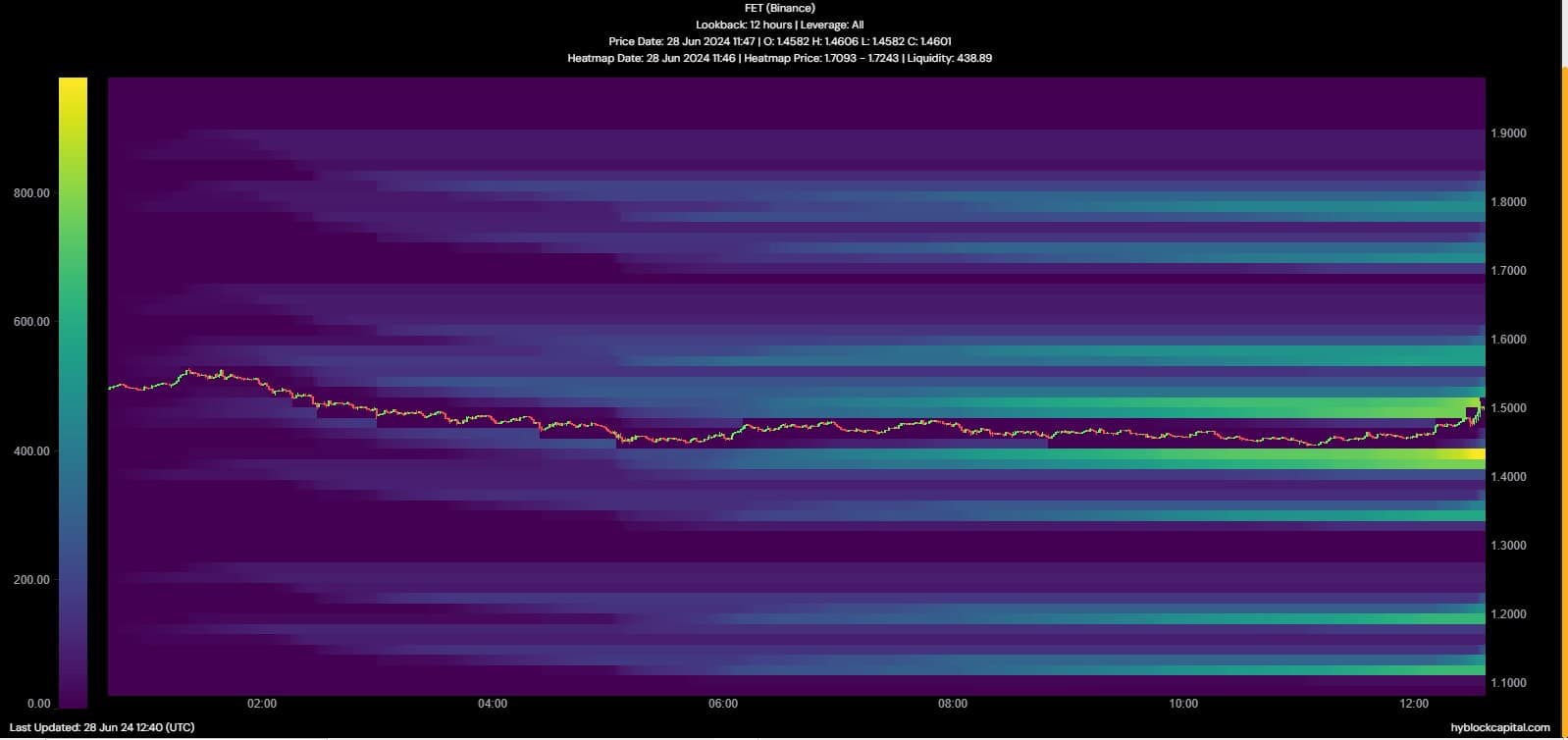

Based on my analysis of the latest Liquidation Heatmap data from Hyblock, I’ve noticed a bearish trend emerging over the past 12 hours. Furthermore, the short-term bias appears to still be bearish, indicating that FET’s price may experience a dip in the near future before potentially rallying once again for the long term.

As a researcher studying market trends, I delved deeper into the analysis of long-to-short ratio data to gain insights into the market’s trajectory. Notably, the data revealed oscillations between long and short positions. This discovery is significant given the recent dominance of short positions in the market dynamics.

Uncertainty around token migration

In recent times, the wider cryptocurrency market has experienced heightened volatility. This trend is evident in FET’s price history as well. It’s important to note that the recent announcement concerning Coinbase’s stance on the ASI token migration might have alarmed some investors.

What is ahead for FET?

For those holding FET tokens, keep an eye on significant levels of both support and resistance in the upcoming days. The region between $1.40 and $1.50 holds importance, serving as a pivotal area. Should selling pressure intensify, it’s possible that FET may revisit its recent low near $1.20.

If the price drops back down to $1.80, this could indicate a shift in trends and stimulate renewed buying enthusiasm among investors.

Read More

2024-06-29 10:15