-

WLD’s price saw a double-digit hike over the course of the last trading session

Futures traders are not convinced about its latest price moves though

As a seasoned crypto investor with a few years under my belt, I’ve seen my fair share of market reactions following token unlocks. The recent Worldcoin (WLD) event was no exception, and it served as a reminder of the unpredictability that comes with investing in this space.

Recently, Worldcoin carried out another token release, a typical event that can trigger considerable market responses. Yet, the impact on the altcoin’s price was underwhelming. In truth, despite this unlock, the price fluctuations did not generate enough momentum to alter traders’ collective sentiment in a favorable way.

This cautious or negative sentiment was particularly evident in the Futures market.

Worldcoin commences unlocks

As a researcher, I’ve come across some intriguing news from Tools for Humanity (TFH), the innovative team behind the Worldcoin (WLD) project. They have recently unveiled an important modification to the unlock schedule of their native token.

In a blog post published on July 16, the initial arrangement called for a three-year lockup period. Yet, this duration has been prolonged: 80% of the WLD tokens owned by team members and investors will now be released over a five-year span, commencing on July 24, 2024.

Based on my extensive experience in the cryptocurrency market and having closely followed the development of this particular token, I believe that the gradual release of tokens over a four-year period is a prudent move by the company. As someone who has witnessed the volatile nature of the crypto market and the impact of sudden influxes of large token volumes on prices, I appreciate the need to manage supply effectively and maintain price stability. This extended schedule demonstrates a thoughtful approach to the release of tokens and is likely to be well-received by investors.

How did Worldcoin react?

Worldcoin has experienced a series of fluctuations in its market performance over the past week.

At first, the value of the Worldcoin token dropped significantly for over a week. But on July 24th, as the unlock event began, there was a slight increase of 1.32%, pushing the price up from around $2.1 to $2.2. The next day, however, the token experienced a significant decrease of over 4%, causing its price to fall back down to approximately $2.1.

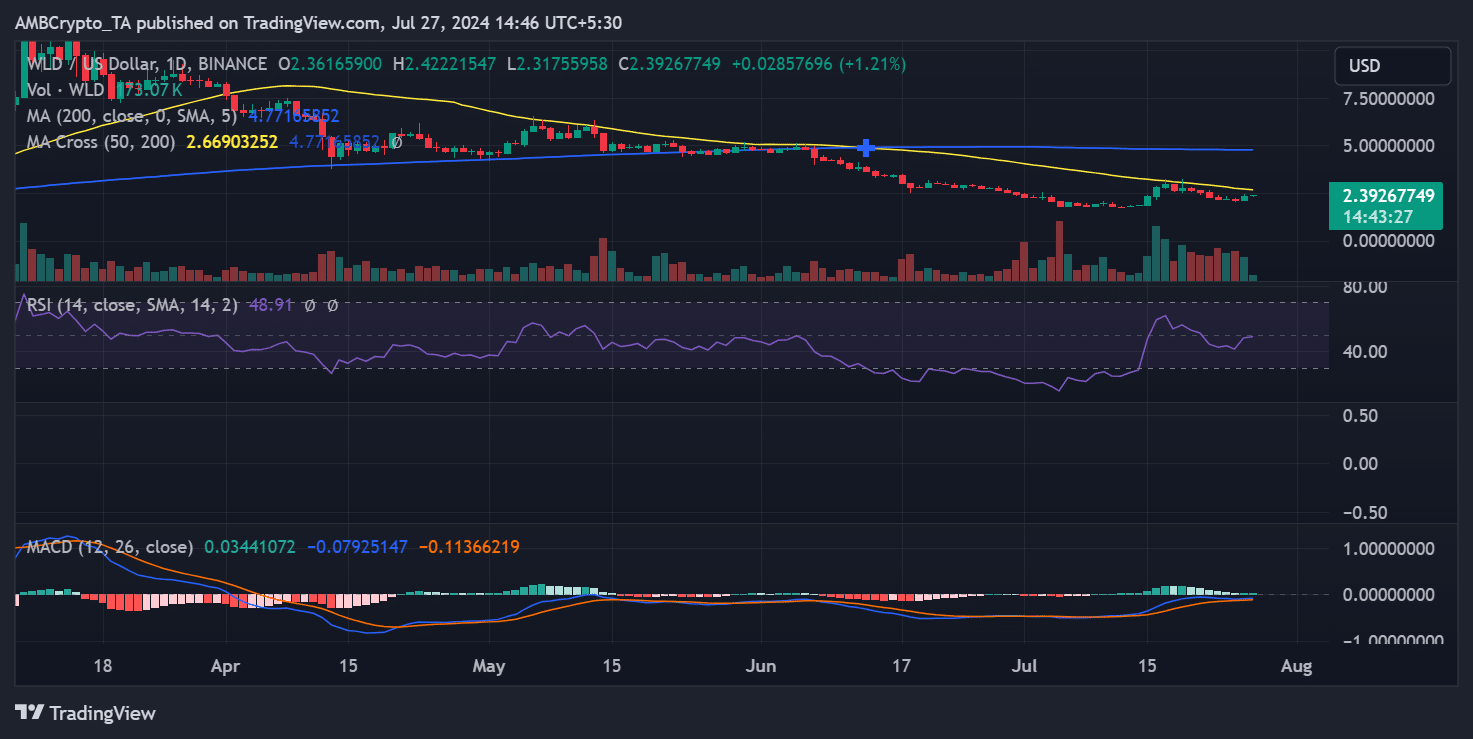

Despite the volatility, there was a noteworthy rise in WLD‘s price on July 26th. As per AMBCrypto’s assessment, this cryptocurrency experienced a surge of 11.74%, touching $2.3. Following this gain, the price climbed further to approximately $2.4, recording an additional increase of over 1%.

Despite these gains, however, the trend has not yet turned bullish.

The technical analysis underscores the significance of the yellow line representing the short-term moving average, acting as a near-term barrier around $2.7 to $3. A successful break above this resistance is essential for the token to strengthen its bullish momentum.

The RSI indicator, currently near the neutral mark, implied that the asset could potentially shift into a bullish phase based on the continuity of recent favorable trends.

WLD traders show negative sentiment

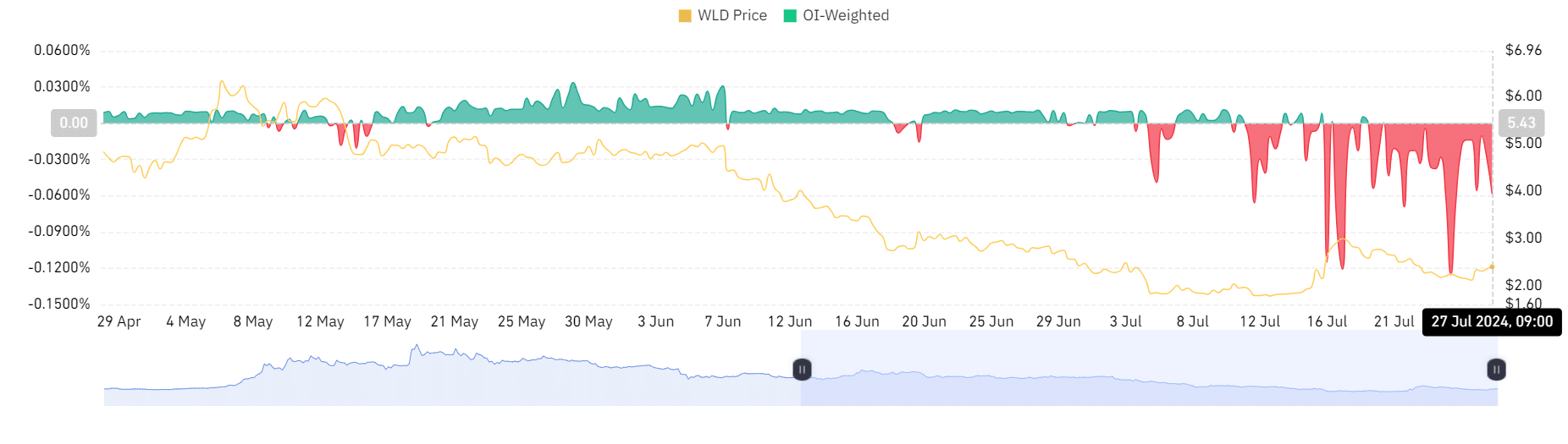

Based on data from Coinglass, there are signs of pessimism among Worldcoin (WLD) traders, as evidenced by the predominantly negative long/short ratio and downward trending funding rates.

The long-to-short ratio indicates that more traders have taken short positions than long positions on Worldcoin. In simpler terms, it means that more traders are wagering on a decrease in the token’s value instead of an increase.

The funding rate for WLD has consistently been beneath zero lately, currently sitting around -0.058% at the present moment.

As a crypto investor, I’d interpret a negative funding rate as meaning that shorts are actually paying longs to hold their positions open. In markets where it’s widely believed that prices will decline, this situation is quite common. It suggests that sellers are currently in control of the market and putting significant downward pressure on the token’s price.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-07-28 07:57