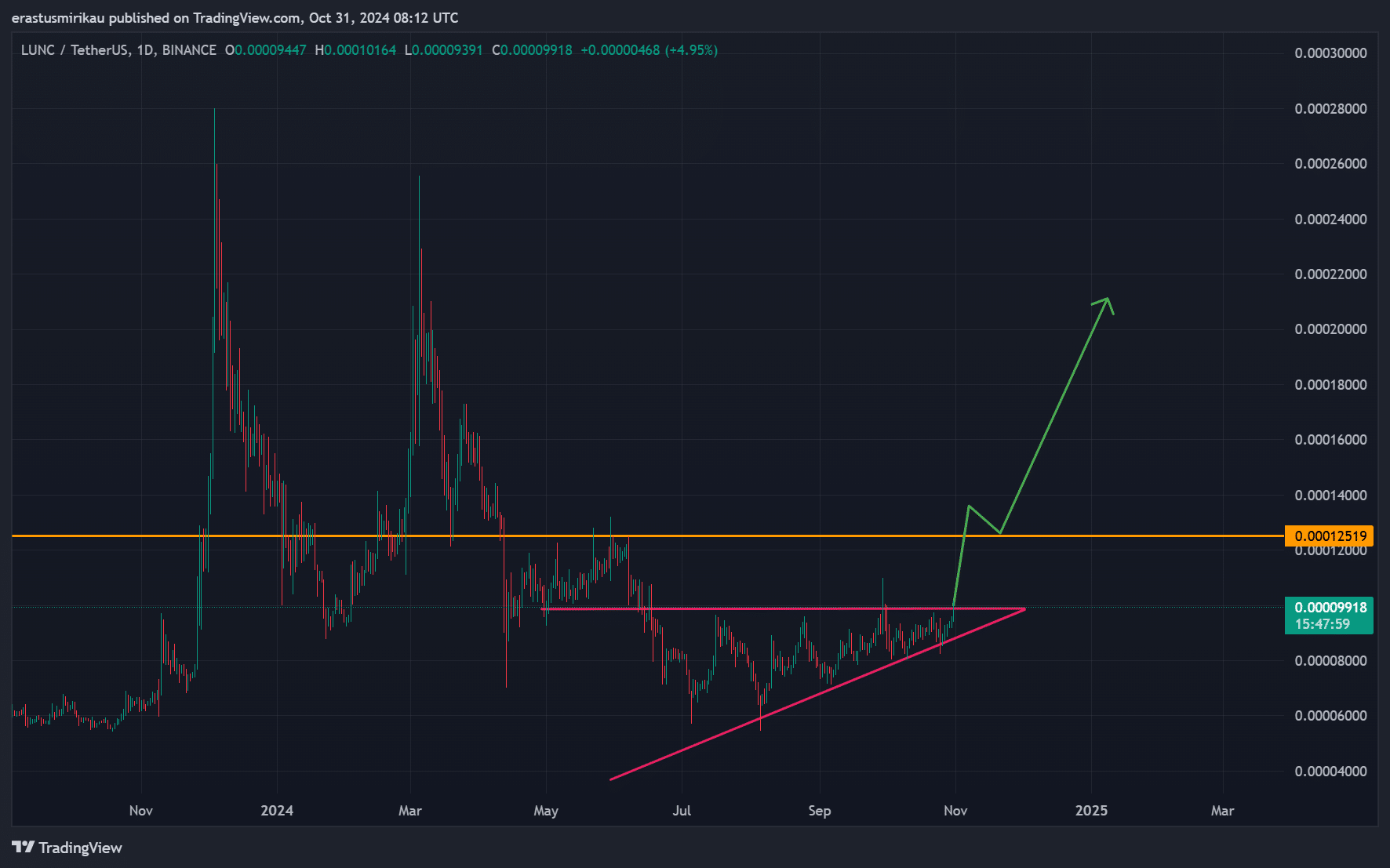

- LUNC’s ascending triangle pattern and technical indicators suggest a possible bullish rally if it breaks resistance at $0.00012519.

- High volume surge and short interest imbalance could drive a strong price movement post-burn.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of bullish and bearish trends. The recent developments surrounding Terra Classic [LUNC] have piqued my interest, given its current ascending triangle pattern and technical indicators.

There’s been a lot of buzz within the cryptocurrency world as Terra Classic [LUNC] experiences a strong surge following its escape from a rising triangle formation, hinting at a possible upward trend.

The upcoming burn of approximately 270 billion LUNC tokens on October 31st has sparked great interest and discussions in the market.

Currently priced at $0.00009937 and showing a 5.15% increase at the moment of checking, LUNC encounters crucial resistance levels which may influence its upcoming direction. However, will it maintain this energy?

Ascending triangle pattern signals bullish potential

Formed by LUNC, the upward-slanting triangle shape signals a growing interest among buyers who are eager to drive prices upwards, with every effort at the resistance level showing their persistent attempts to break through and continue the bullish trend.

As a crypto investor, I’ve noticed that when a coin like LUNC forms such a structure, it often indicates a strong upward trend potential. If LUNC manages to break through the resistance level at $0.00012519, it could lead to substantial gains for me and other investors in the market.

As a result, traders are keeping an eye on this significant price point. If it’s broken through decisively, it might spark a surge of purchases. But if it can’t be maintained, we could see the market moving sideways or even experiencing a correction, which may dampen recent enthusiasm.

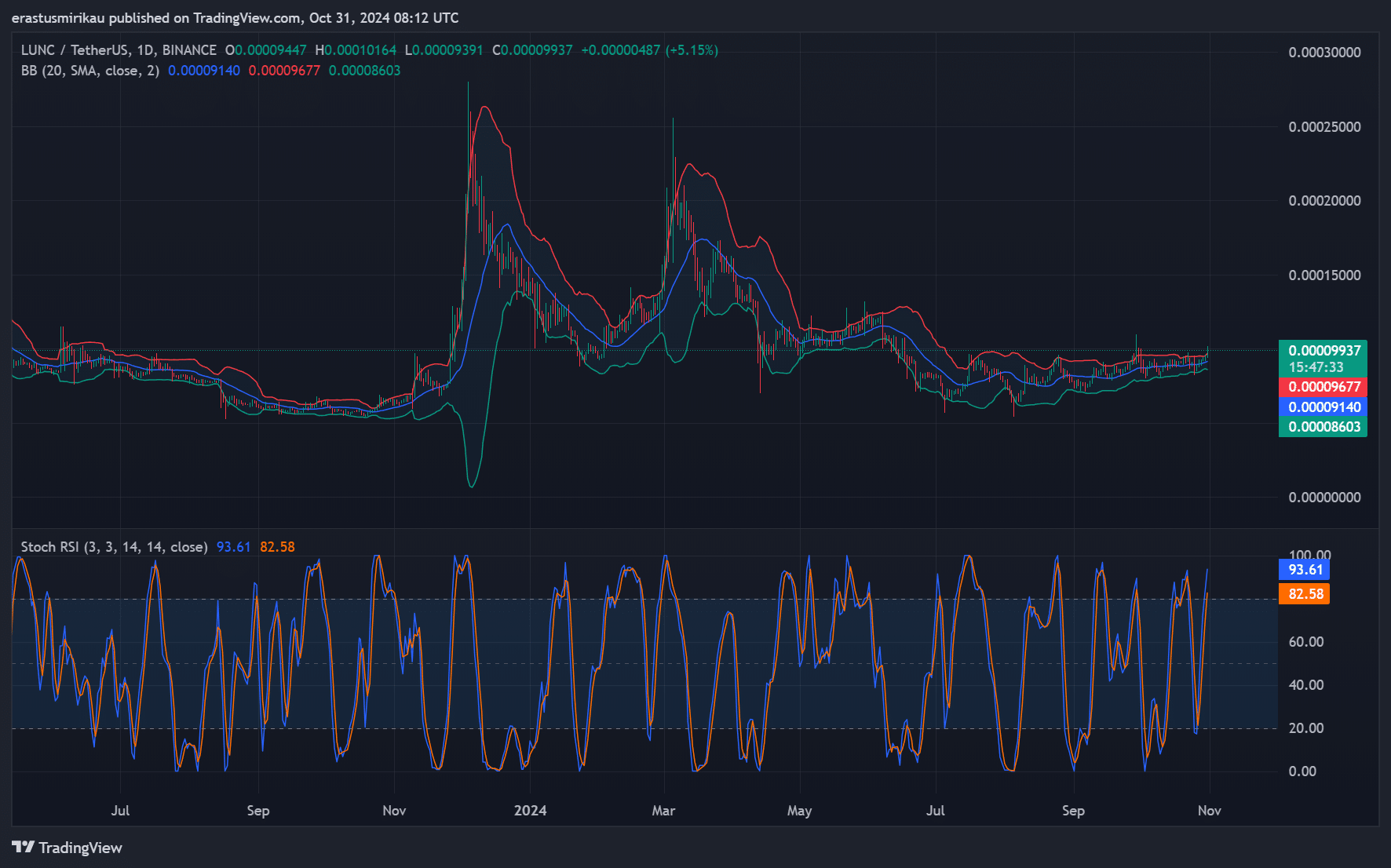

What do the Bollinger Bands and STOCH RSI reveal?

Looking at technical indicators gives us additional insights into LUNC’s current standing. The Bollinger Bands (BB) are becoming narrower, suggesting decreased volatility, which may be followed by a potential breakout in the near future.

If LUNC manages to surpass its resistance level, it might trigger a significant upward trend due to the expanded bands. Furthermore, the Stochastic RSI indicates that the market is overbought as values have reached 93.61 and 82.58. This could mean some traders might decide to cash out soon.

As a researcher, I find that so long as the price of LUNC remains above its critical support thresholds, an ongoing uptrend could be sustained, providing a robust base for potential future growth.

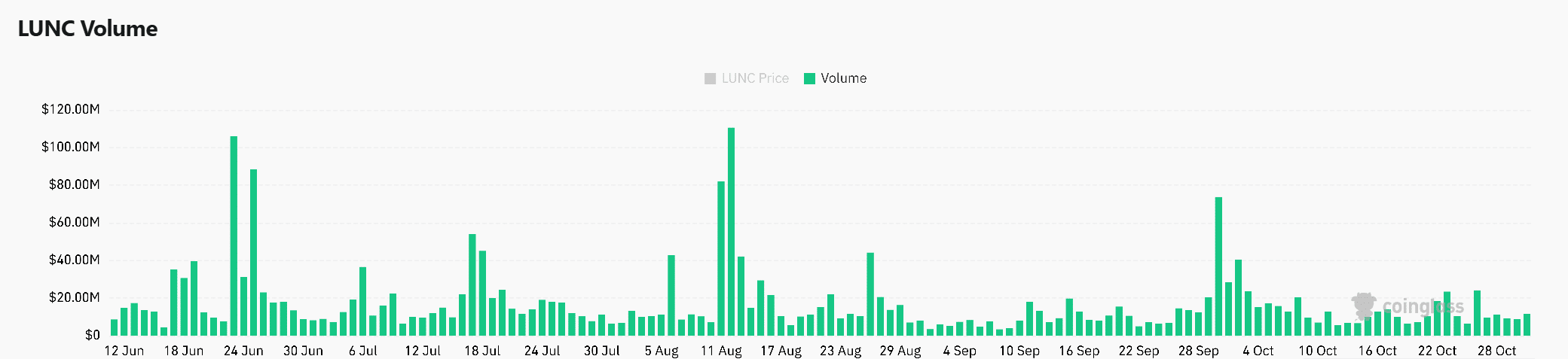

Volume surges over 200%: A sign of interest?

The incredible trading volume for LUNC has soared by a staggering 222.09%, amounting to $34.02 million. This significant increase suggests that more investors are taking notice and showing greater interest, which is vital for maintaining market movements.

A significant increase in trading volume for LUNC frequently indicates the robustness of its breakout, suggesting that investors expect a bullish trend following the burn event.

As a result, this increase in volume functions as a strengthening of optimistic feelings, implying that the recent breakout might be well-supported.

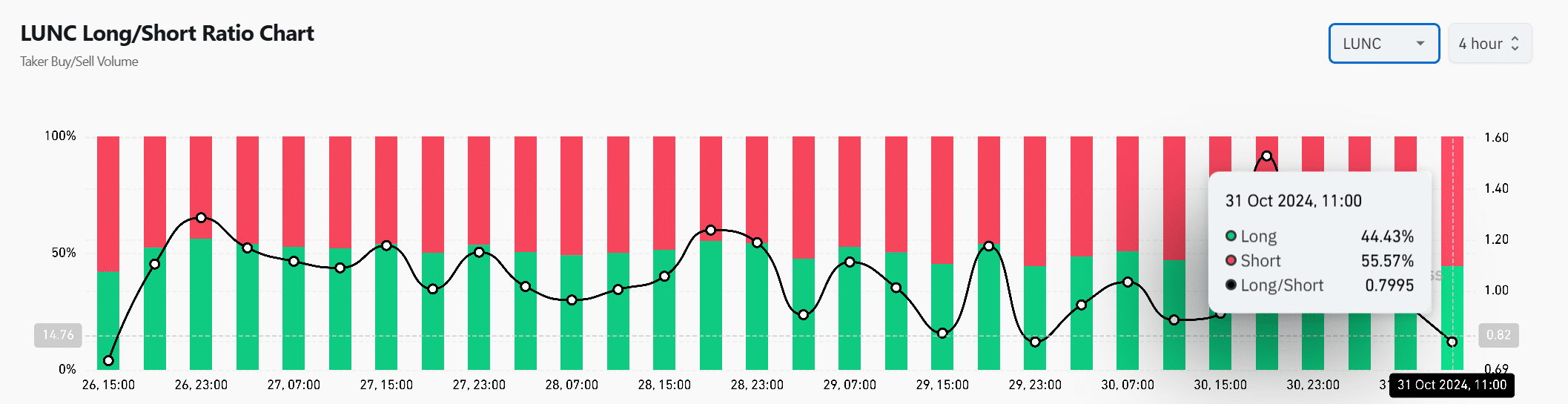

Are shorts overpowering longs?

The long/short ratio provides valuable insight into market sentiment. Currently, 55.57% of trades are short positions, with only 44.43% long.

If LUNC’s price increases due to this imbalance, it might trigger a situation where short sellers are compelled to buy back the shares they had sold earlier (to ‘cover their positions’), which could further drive up the price.

On the other hand, a large number of traders holding short positions might reflect their cautious stance, potentially causing LUNC to encounter resistance as it moves upwards. As a result, the balance between long and short trades will play a significant role in deciding if LUNC’s upward trend can be maintained.

Is your portfolio green? Check the LUNC Profit Calculator

Will LUNC continue its upward journey?

Looking at its robust momentum, LUNC’s chart suggests a possible surge might be on the horizon due to its bullish pattern and approaching burn event. Yet, some concerns arise as the market shows signs of being overbought, and there is a substantial amount of short positions. This could potentially impact the longevity of this upward trend.

Should the price of LUNC surpass the significant barrier at 0.00012519 USD, it may spark the next phase of the cryptocurrency market’s upward trend. However, in the absence of a firm breakthrough, the current momentum could potentially slow down.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-11-01 06:16