- Token recently bounced off a major support level and started moving north on the price charts

- Rally seemed likely to continue, as metrics suggested favorable conditions for further upside

As a seasoned crypto investor with a knack for spotting trends and navigating market volatility, I find myself intrigued by the current state of HNT. The recent bounce-back from a major support level and its subsequent northward movement on the price charts are reminiscent of a well-timed pit stop during a marathon race – providing just the boost needed to keep pushing forward.

Over the past day, HNT has experienced a rise of 12.50%, bucking a 16.60% decline from the previous week. Interestingly, its current monthly growth is at 20.14%. As of now, positive trends suggest that it may continue to grow significantly in the near future.

Therefore, AMBCrypto examined crucial aspects shaping the upward trend of HNT and presented potential outcomes regarding its future price movements.

Support acts as a lever for HNT’s push

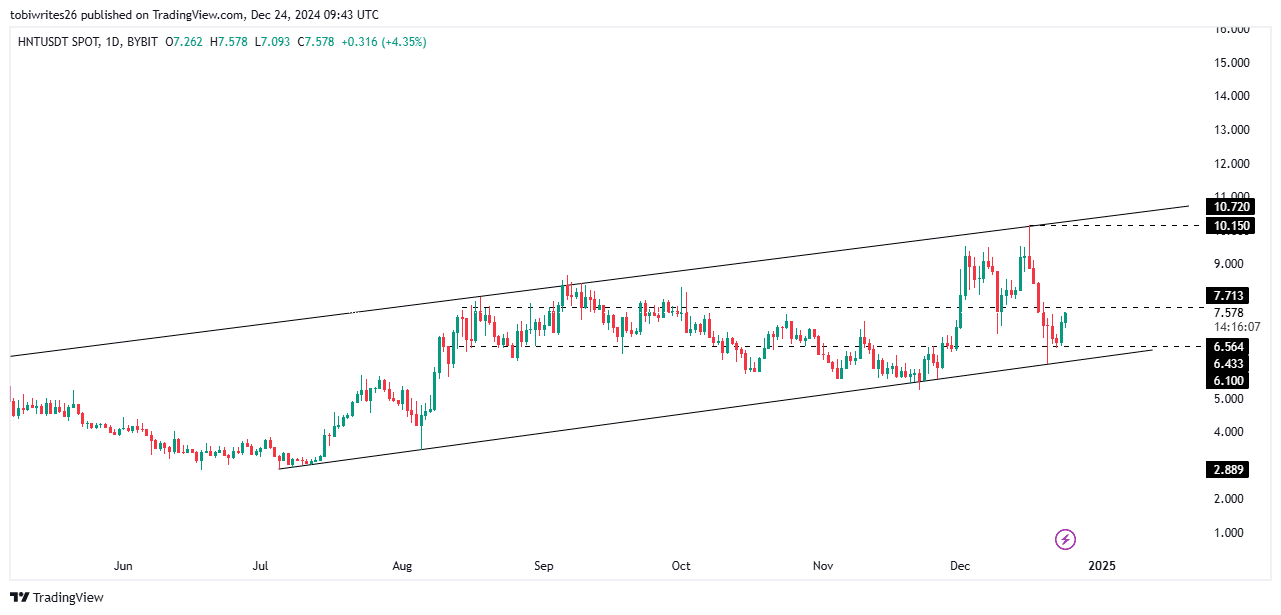

Recently, HNT has rebounded from its lower boundary within an ascending channel, which is a price pattern suggesting a likely continuation of its upward trajectory, confined by specific areas of support and resistance.

More recently, the upward surge from the channel’s backing was strengthened by a crucial point at $6.564 as well. This double reinforcement has given the asset an extra push, causing its value to rise further.

Should the current trend persist robustly, Helium Network Token (HNT) might reach approximately $10.15. Yet, before that can happen, it needs to surmount an essential resistance level at around $7.71, as indicated in the graph.

According to AMBCrypto’s examination of technical indicators, it found a generally optimistic outlook, but there are still some lingering doubts.

HNT remains bullish, despite decline in liquidity flow

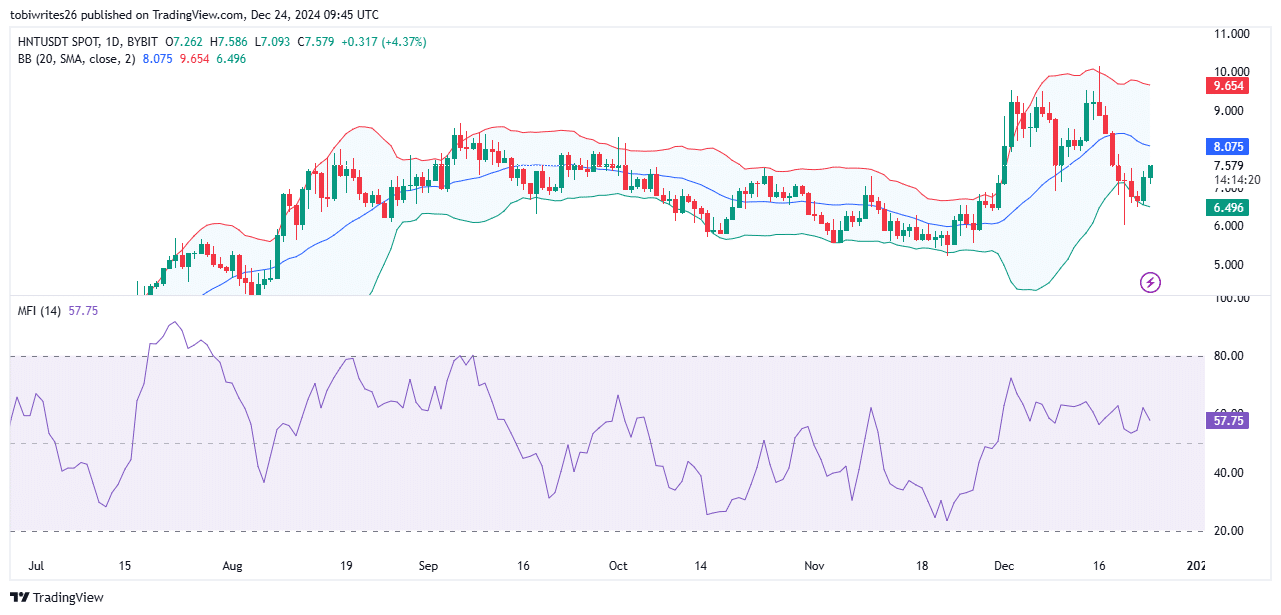

The market sentiment for HNT has remained bullish, with the potential for further upward movement supported by both the Bollinger Bands and the Money Flow Index (MFI).

As a researcher, I employ Bollinger Bands as my tool of choice to gauge market volatility. This versatile instrument is built around three lines: the middle one, which is simply a Simple Moving Average (SMA), and two other lines positioned at two standard deviations from that SMA. These bands serve a dual purpose – they help in recognizing overbought situations when prices touch the upper band, or oversold conditions when they hit the lower band, and they also signal potential price breakouts.

Currently, Helium Network Token (HNT) has bounced back from an oversold region close to its lower boundary and is currently moving upward. It’s likely that this trend will continue, potentially reaching the upper boundary at approximately $9.654—a price point that closely matches the technical chart prediction of $10.

Instead, the Money Flow Index (MFI), a tool that assesses market sentiment based on analyzing both price and trading volume to determine buying and selling activity, showed a decrease.

As long as the Moving Financial Index stayed over 50 (signaling a bullish market), there was still strong buying activity. However, the trend indicated a possible decrease, which might be caused by traders taking profits from their trades.

Traders maintain optimism for HNT’s uptrend

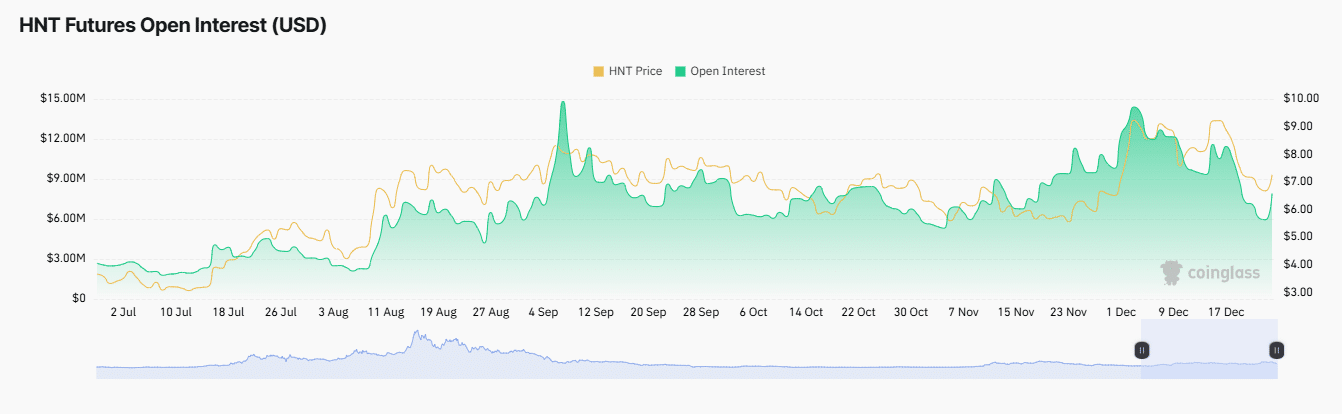

Traders are hopeful that the value of HNT will increase based on signs seen in the Open Interest data provided by Coinglass, suggesting a positive trend.

In the past day, Open Interest, a measure that monitors the number of unresolved derivative agreements within the Futures market, climbed to $7.45 million – marking an increase of 10.98%. This significant rise indicates a rising involvement in HNT’s market, as more contracts are being initiated.

Furthermore, a positive Funding Rate of 0.0152% suggested that the market had more long positions than short ones, indicating a bias towards holding Bitcoin over selling it.

In simpler terms, the Funding Rate indicates which group (long or short positions) is required to pay a recurring fee to maintain equilibrium between the real-world market (spot) and the futures market. When the Funding Rate is positive, it signifies that those who have bought contracts (long positions) are holding more open positions.

Generally speaking, there’s substantial backing for HNT among market players, suggesting that the asset might maintain its upward trajectory starting from its current price point.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-25 10:18