Bitcoin is currently playing peekaboo with $105,814—what a dramatic scene! With a market cap of a jaw-dropping $2.104 trillion and $34.134 billion in 24-hour trading volume, it’s like a wild rollercoaster ride at the crypto amusement park. Yet, despite all this action, the market seems like it’s stuck in a “Should I? Shouldn’t I?” moment, with the price bouncing between $105,871 and $108,785. Someone pass the popcorn! 🍿

Bitcoin

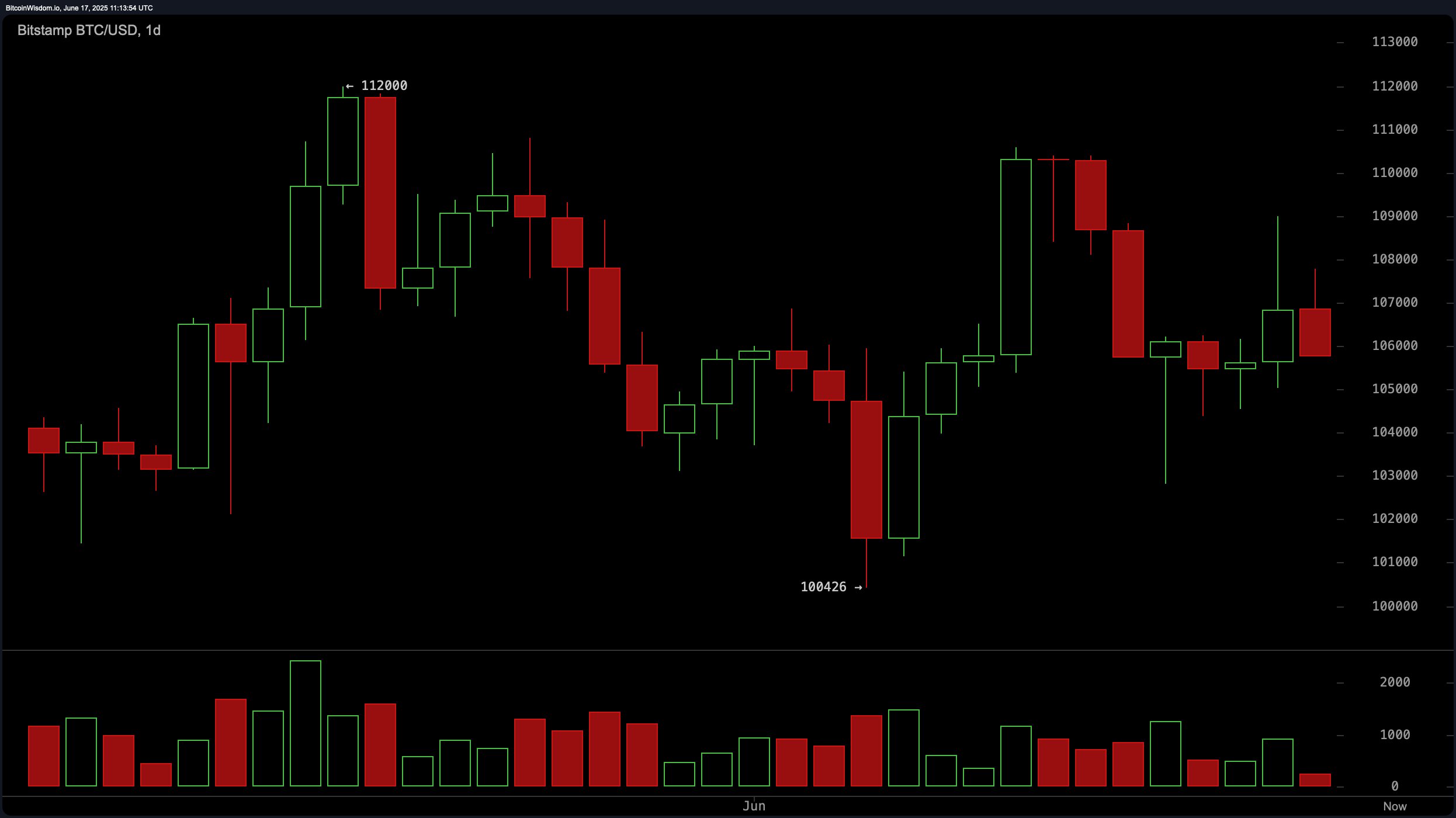

In the world of Bitcoin, the daily chart is looking a bit… gloomy. After a valiant attempt to reach $112,000, the price got a reality check, with a hefty rejection and some serious downward sloping behavior. But don’t despair, there’s still some hope around the $100,426 level, where buyers seem to be hanging on like a life raft. On the flip side, that $110,000–$112,000 resistance is more stubborn than a cat refusing to take a bath. 🛁

Now, the 4-hour chart has a case of the “meh”s. Bitcoin tried a bounce from $102,816, but it couldn’t break past $109,000—awkward! It’s like trying to win a race, but someone keeps tripping you at the starting line. Lower highs are popping up like unwanted party guests, indicating that the bulls might be running out of steam. But hey, if Bitcoin shows a double bottom or some cute bullish divergence between $103,000 and $104,000, it could spark some party vibes again. 🚀

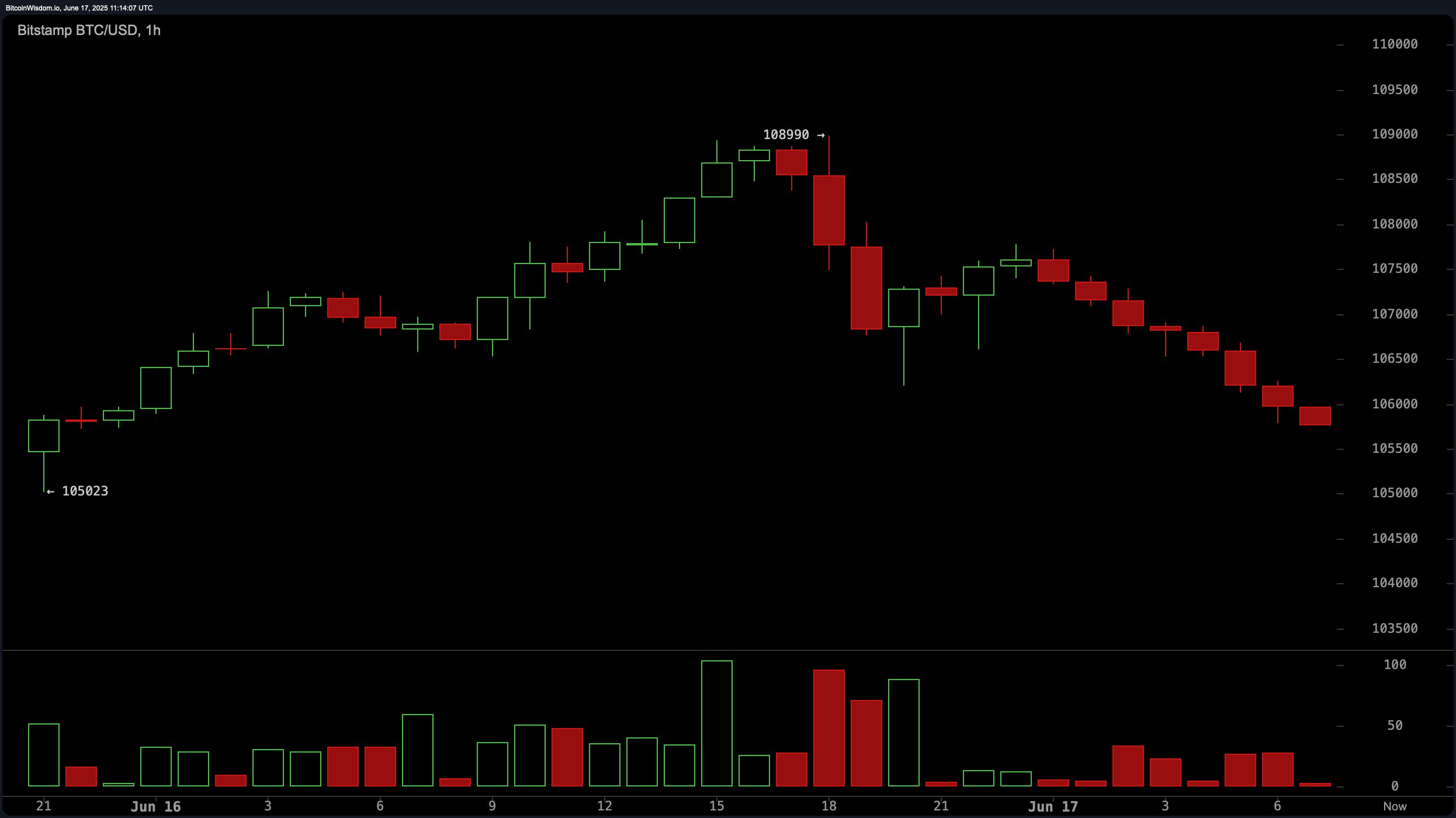

Meanwhile, the hourly chart looks like it needs a nap. A downtrend is clearly taking center stage, with the local high of $108,990 followed by a series of lower highs. It’s a little like watching a suspenseful thriller—just waiting for the next twist. Bitcoin recently tried to test support around $105,000, but the sellers are dominating. If you’re a scalp trader, this is your moment: buy around $105,000–$105,200 if it bounces or short near $107,000–$107,500 if it falls apart like a poorly made pancake. 🥞

Oscillator data has entered the chat, giving a neutral reading, with a slight lean toward bearish vibes. The relative strength index (RSI) is chilling at 50, the stochastic oscillator at 55, and the commodity channel index (CCI) at 29—basically, it’s all “meh, we’re not feeling it.” But the momentum at 154 and the MACD at 626 are dropping hints that things might go south. Someone get these oscillators a pick-me-up. 💔

Moving averages (MAs) are the drama queens here. The short-term averages are flashing red like a stoplight on a Monday morning, signaling bearish tendencies. But the long-term averages (50 to 200-period) are hanging on like loyal fans of the Bitcoin saga, holding the line with bullish support. It’s a classic case of “What do we do now?” – short-term traders are gearing up for a downside, while long-term holders are clutching their popcorn, hoping for a dramatic twist. 🎭

Bull Verdict:

Even though the short-term indicators are being party poopers, the long-term moving averages are giving us hope that Bitcoin can hold its ground. If it stays above $105,000 and gets some new buyers around $103,000–$104,000, a climb toward the $110,000 resistance could be on the cards. Cue the heroic music! 🎶

Bear Verdict:

If Bitcoin can’t hold onto the $105,000–$104,000 support and the negative momentum keeps rolling in like an uninvited guest at a wedding, we might be heading toward a drop to $100,500 or below. Say it with me: “Oh no!” Let’s hope it’s just a phase and not the start of a deeper correction. 😱

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-06-17 16:06