-

Hong Kong HashKey exchange received approval for Avalanche and Chainlink trading.

AVAX and LINK pairs saw a surge in trading activities.

As a seasoned crypto investor with roots in Asia, this recent development by HashKey in Hong Kong has piqued my interest. Being born and raised in the bustling financial hub of the region, I’ve witnessed its transformation into a significant player in the global crypto market. The inclusion of Avalanche [AVAX] and Chainlink [LINK] for retail trading is a testament to this evolution.

HashKey, a compliance-focused exchange based in Hong Kong, has just been given the green light to facilitate the trading of Avalanche (AVAX) and Chainlink (LINK) for individual investors.

Initially, only Bitcoin [BTC] and Ethereum [ETH] were available for retail trading in Hong Kong.

Including AVAX and LINK in its platform, HashKey broadened the range of cryptocurrencies available for trading in the region, providing retail investors with an opportunity to invest in these promising digital assets.

Both markets responded positively to this development, showing promising price movements.

How AVAX and LINK reacted

As a researcher delving into the realm of cryptocurrency, I observed that the AVAX/USDT pair exhibited a notable consolidation pattern near the $27 mark, reminiscent of a head and shoulders formation. Subsequently, there was a significant drop in its value to approximately $23.

This decline met an order block that provided support, allowing the price to stabilize.

After hearing about AVAX being allowed for trading in Hong Kong, its price dipped to $23, formed a double dip, and surpassed a recent peak in the short term.

As a researcher observing the market trends, I haven’t seen a definitive uptrend just yet. To confirm this double bottom pattern, a successful retest is essential, especially during the upcoming Asian trading sessions. If this happens, it could potentially drive up the price of AVAX in the coming months.

Additionally, LINK saw considerable price fluctuations following the HashKey Hong Kong announcement. Escaping a 14-day period of stability, LINK rapidly increased, however, it encountered resistance around the $12 mark.

Prior to the announcement, LINK’s price swiftly declined but found support around $10.91.

Similar to AVAX, LINK has developed a double bottom formation on its hourly chart and subsequently breached this structure. However, it also requires a subsequent test for confirmation that an uptrend is indeed underway.

Based on HashKey’s endorsement, it would be wise to keep a close eye on LINK, as further examination indicates.

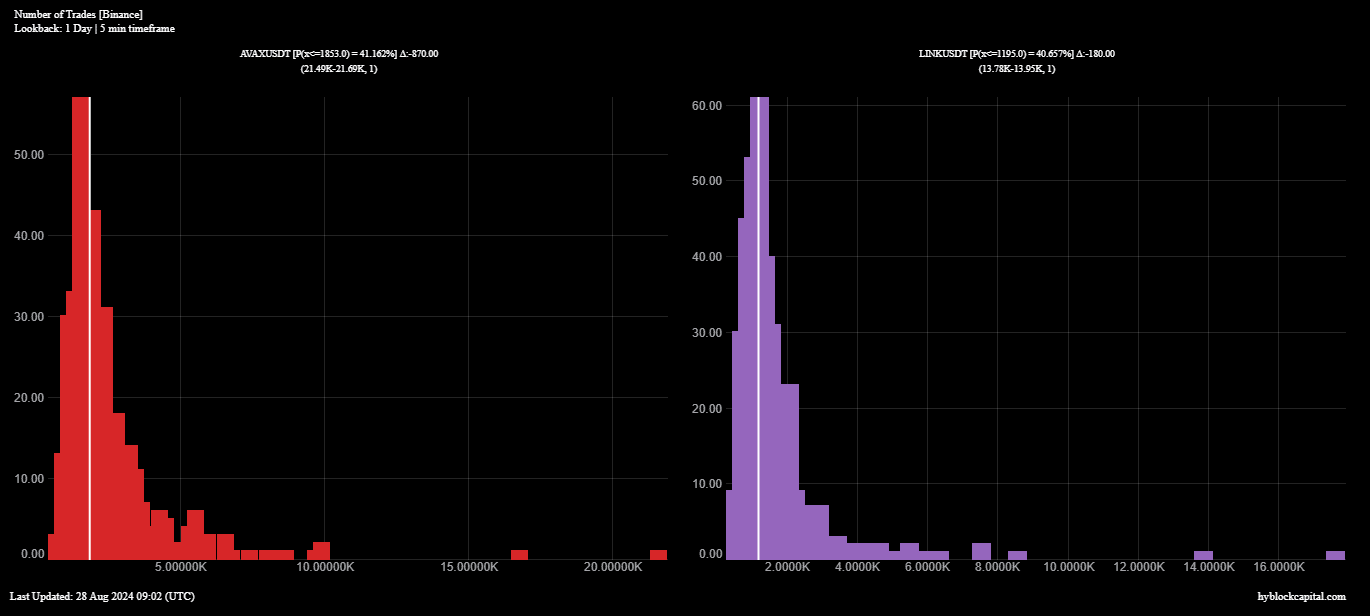

Number of trades increase

The announcement from the HashKey Hong Kong exchange triggered an increase in trading for AVAX and LINK resources as well.

As a crypto investor, I noticed that the AVAX/USDT pair on Avalanche had a staggering 21,490 trades, while the LINK/USDT pair on Chainlink clocked in at 17,540 trades. This suggests robust liquidity and heightened interest from investors, signaling potential growth opportunities.

Building on our current achievements, expanding the positive impact to additional markets and trading platforms could significantly boost liquidity even more, drawing in a greater number of traders and investors.

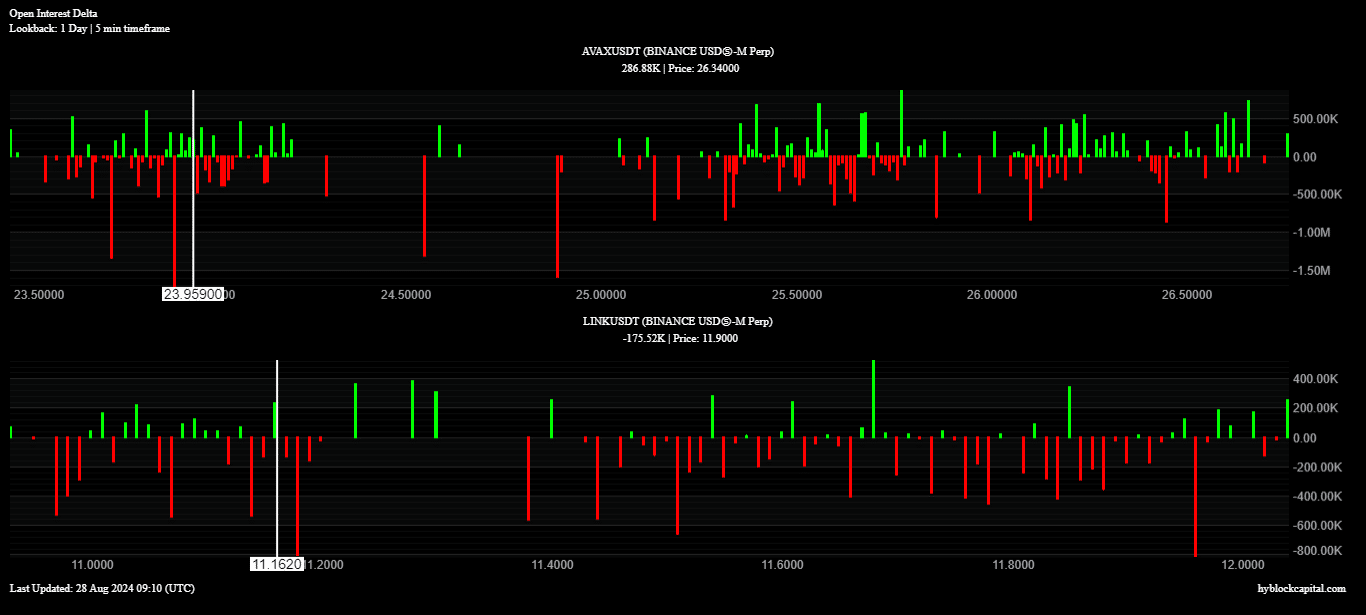

Open Interest on the rise

Ultimately, the Open Interest for both AVAX and LINK increased after HashKey’s approval, with AVAX showing better performance compared to LINK in this particular aspect.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

It’s possible that Avalanche could present a more promising long-term investment due to the increasing global acceptance of cryptocurrencies.

With these assets growing in popularity not only in Hong Kong but also worldwide, it’s possible that their prices may continue to rise, offering attractive opportunities for potential investors.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-08-28 23:36