- AIOZ’s Netflow was a rollercoaster, with dramatic sell-offs during downturns and massive inflows during price rallies. 🎢

- AIOZ rocketed 40% in just one hour, thanks to a significant whale buying spree. 🚀

At the time of writing, AIOZ Network’s [AIOZ] was on a wild ride, surging 40% in a single hour. 🚀

This meteoric rise was fueled by a massive whale, specifically Whale 0xc7c0 (convexking.eth), who snapped up 8.9 million AIOZ tokens worth $4.12 million. 🐳💰

This purchase bumped their total holdings to 20.29 million AIOZ tokens, valued at $8.58M, at the coin’s current price of $0.43, as of press time. 📈

Decoding the Momentum Behind AIOZ’s Rapid Surge

AMBCrypto’s analysis delves into the EMA cross and MACD indicators, showing that AIOZ broke above the 9-period EMA, signaling a bullish trend. 📊

Simultaneously, the MACD line crossed above the signal line, reinforcing the upward momentum. The histogram’s shift to positive territory further solidified the bullish sentiment. 📈

This price action was perfectly timed with the whale’s substantial purchase, highlighting the significant impact of institutional activity on price movements. Large investors were the key to this price spike, showing how market sentiment can shift with a single, well-timed buy. 🐳🚀

The Role of Large Holders in Market Movements

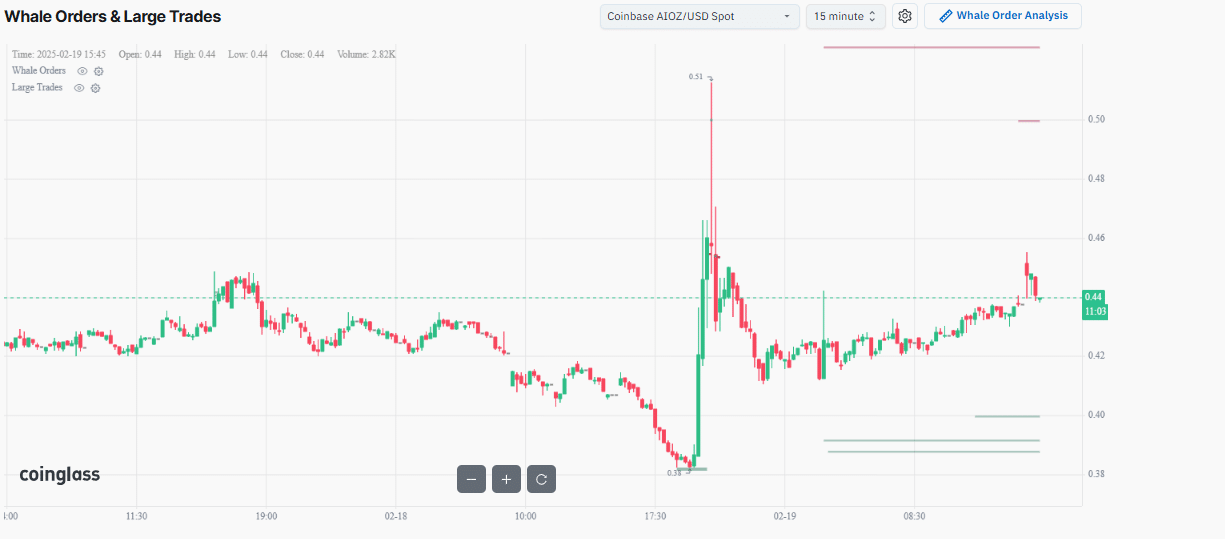

The whale order indicator revealed that Whale 0xc7c0’s buy order appeared as a thick, dark line, indicating a large filled order. 📈

The size and duration of this order suggested a prolonged influence on AIOZ’s price action. This accumulation likely catalyzed the surge, demonstrating that substantial whale activity can be a precursor to strong price movements. 🐳🚀

Large orders often predict future trends, making whale monitoring essential for traders. 📊

How Institutional Behavior Shapes Price Trends

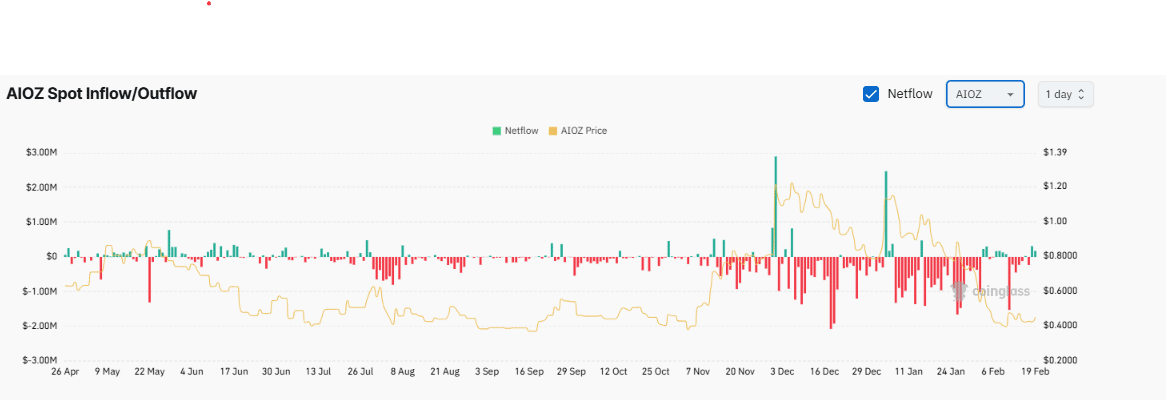

Further analysis showed a significant spike in net inflow, aligning with the price surge. 📈

Over the past months, AIOZ’s Netflow has been a rollercoaster, with notable sell-offs during downturns and strong inflows during price recoveries. 🎢

Large inflows in early December and mid-January corresponded with temporary price rebounds, reinforcing the correlation between whale accumulation and price movements. 📈

Recently, inflows have stabilized after a period of strong outflows, suggesting potential price consolidation or gradual recovery. 📊

If this pattern continues, AIOZ may experience further upward pressure or stabilization at current levels, depending on subsequent whale activities. 📈

Understanding Market Psychology During Volatile Phases

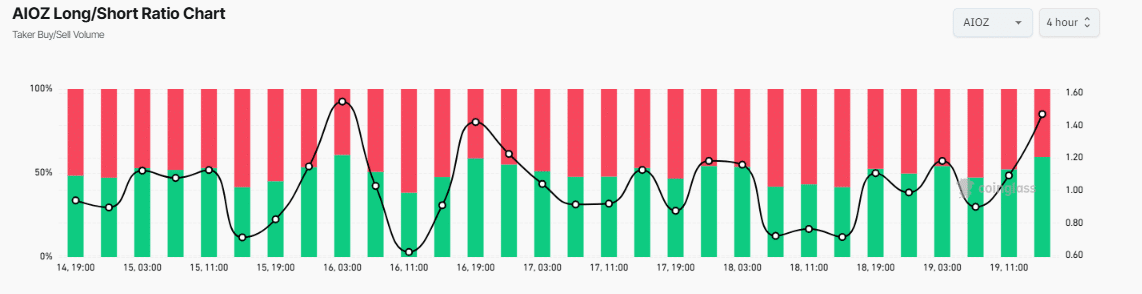

Finally, at press time, the Long/Short Ratio over four hours indicated that short positions dominated the market. However, as the price surged, the ratio shifted towards long positions. 📊

This transition reflects a broader market sentiment shift from bearish to bullish, aligning with whale-driven buying pressure. 📈

If long positions continue to gain dominance, further price appreciation could occur as traders anticipate extended bullish momentum. 📈

The recent price surge in AIOZ was heavily influenced by whale accumulation. Moving forward, sustained whale interest and bullish market sentiment could drive further price increases or stabilization. 📈

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2025-02-20 10:42