-

AAVE ended the past week as one of the biggest losers.

The protocol’s TVL is around $11.7 billion without an apparent increase

As a seasoned crypto investor with battle-tested nerves, I’ve seen my fair share of market ups and downs. Last week, Aave, my beloved DeFi protocol, ended up as one of the biggest losers in my portfolio. Despite its TVL remaining stagnant at around $11.7 billion and an impressive record-high liquidation event, AAVE‘s token didn’t seem to reap the full benefits.

As a crypto investor, I’ve noticed an impressive surge in liquidations within the Aave protocol lately. Even though this situation worked to my advantage, the price of AAVE token concluded the week on a downward trend.

Aave sees record liquidation volume

According to IntoTheBlock’s data, the Aave protocol experienced its most significant liquidation incident ever, totaling approximately $300 million in assets being liquidated.

The closing down of operations was caused by loans issued in the form of stablecoins, which were secured by wrapped staked Ethereum (wstETH). A 25% decrease in the value of Ethereum initiated it, as this price drop made many borrowers’ collateral insufficient due to its undercollateralization.

Responding to this situation, Aave’s system instantly carried out the necessary liquidations to maintain the platform’s financial health. This action led to a remarkable increase in liquidation activity that had never been seen before.

Additionally, even though the massive liquidation led to some turmoil, the protocol managed to gain some fiscal advantage from the circumstances. It amassed around $6 million in earnings from the liquidation charges that were levied during these occurrences.

Aave ends the week in red

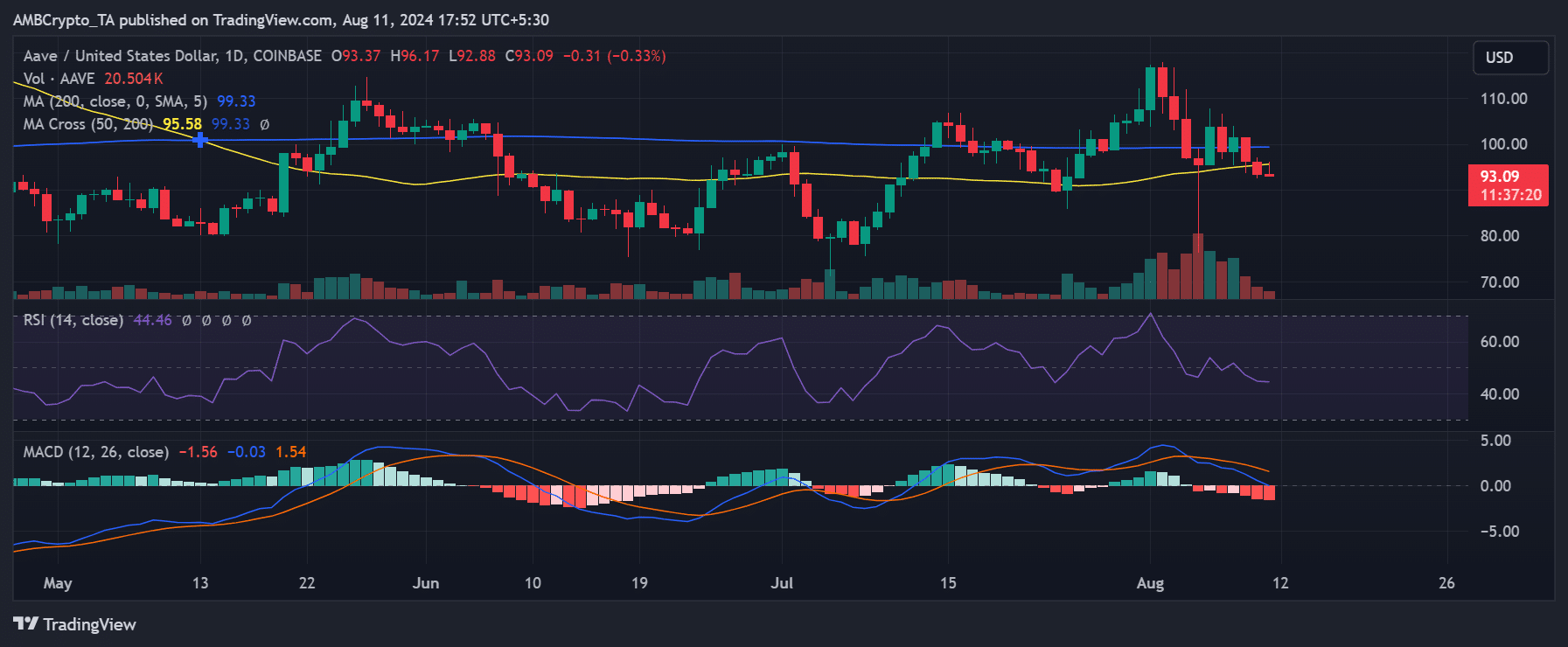

According to AMBCrypto’s latest assessment, there was a significant decrease in Aave (AAVE) towards the end of last week. Specifically, on August 9th, it saw a decline of about 5.17%, causing its price to dip from around $101 to approximately $96.

On the next business day, the price dropped an additional 2.97%, ending approximately at $93. Currently, it is being traded near that same price level, indicating a slight downward trend.

Furthermore, these continuous declines have led to a move towards a downward trend for Aave, which is suggested by its Relative Strength Indicator (RSI).

The RSI, currently at around 45, suggests that the asset is under some selling pressure.

The price trend showed the divergence between protocol performance and token valuation.

Aave Futures throws up mixed signals

1. Lately, the interest rate on Aave has shown a lot of ups and downs, moving back and forth from negative to positive numbers. This fluctuation mirrors shifts in investor feelings and trading patterns.

By the market’s close on the 10th of August, the funding rate had settled around 0.0021%, implying that traders were prepared to pay for the privilege of maintaining long positions. This points towards a generally optimistic outlook, or bullish sentiment, among traders during that timeframe.

Initially, as trading began on August 11th, the funding rate moved into a negative zone, settling approximately at -0.009%.

When the cost of borrowing (funding rate) is negative, it means short sellers are compensating long holders. This situation often reflects a predominant pessimism among traders, as they seem to collectively anticipate a drop in the asset’s price, betting on its decline.

As of the latest update, the funding rate has recovered to a positive 0.004%.

As an analyst, I’ve noticed a rapid swing from a negative to a positive market position over a brief span, which indicates a highly volatile and unpredictable market environment. This swift change in trader attitudes, from bearish to bullish, appears to be driven by the immediate market conditions and sentiment, suggesting that traders are making quick adjustments based on short-term trends and feelings.

Read More

2024-08-12 09:12