-

DOT’s price surged by 9.73% in 24 hours following weeks of decline

Surge came on the back of high whale activities, with large transactions and staking

As a seasoned crypto investor with years of experience in the market, I’ve seen my fair share of price surges and declines in various altcoins. The recent surge in Polkadot (DOT) has certainly piqued my interest.

The cryptocurrency community has been drawn to the significant transactions on the Polkadot (DOT) network recently. Surprisingly, this altcoin has experienced a 33% increase in transactions, an uptick that comes despite its relatively low price. Furthermore, according to Polkadot Watch’s latest tweet, there have been other notable developments.

“50,000 $DOT ($291,500 USD) was transferred from unknown wallet to unknown wallet.”

In addition, there has been a significant increase in staking activity for DOT, with whales being among the key contributors. As per Toni’s recent update on X (previously known as Twitter), approximately $2.6 million has been allocated for DOT staking.

“Approximately 2.6 million dollars worth of DOT tokens, equal to around $14.38 million, have been deposited for staking in Polkadot. Whales are still actively purchasing DOT and choosing to stake it.”

What’s driving whale activity?

As a dedicated researcher exploring the dynamic world of decentralized finance, I’ve come across intriguing patterns in the investment landscape of the DOT ecosystem. One particularly captivating aspect that has piqued my curiosity is the surge in whale activities and increased staking for DOT. A significant factor fueling this trend is the rumor mill buzzing with anticipation surrounding a potential DOT Exchange-Traded Fund (ETF).

Based on Voice Lark’s report, there’s a favorable outlook among investors due to the rumored DOT Exchange-Traded Fund (ETF) proposal from Coinbase.

” Coinbase Plans Polkadot ETF, Signaling Potential Boost for DOT Price and Popular Altcoins.”

Prevailing market sentiment

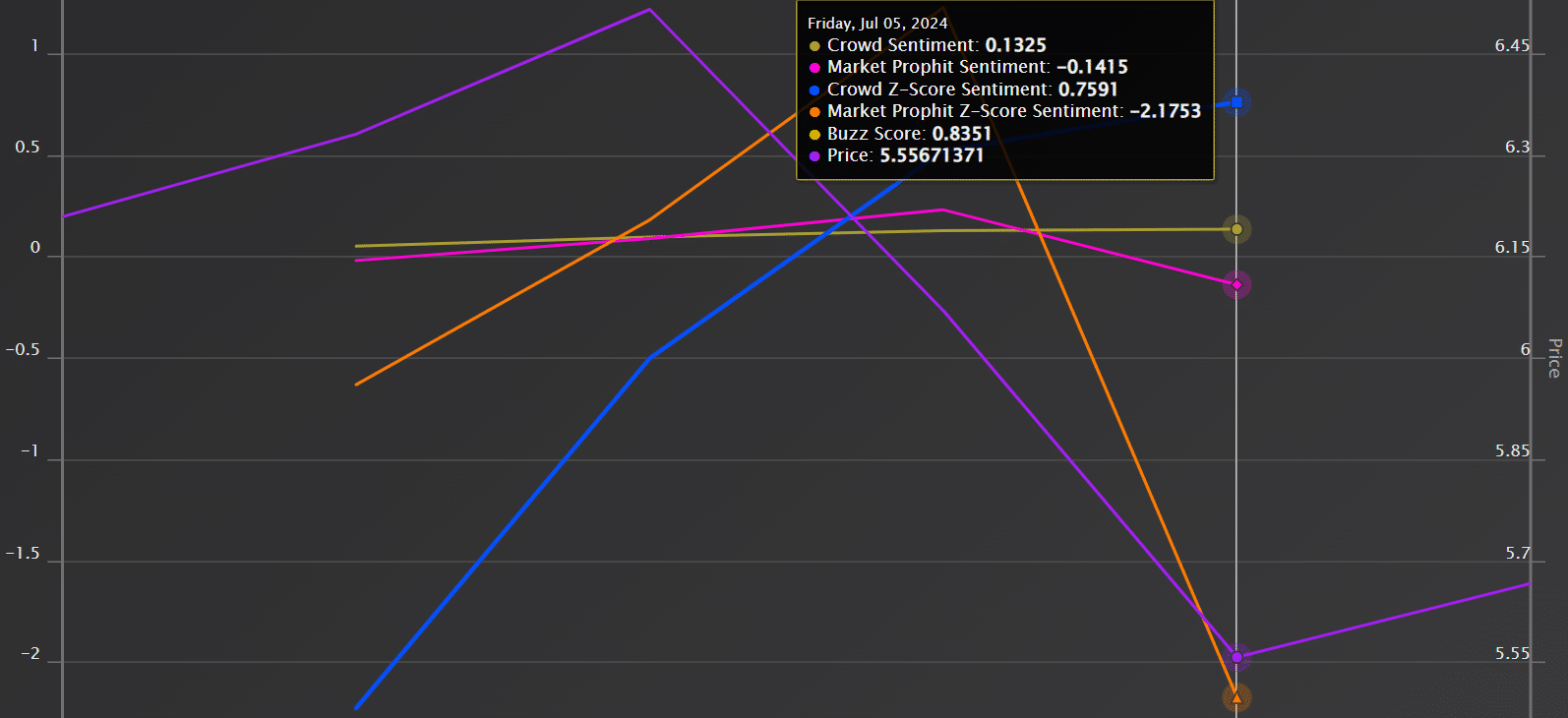

AMBCrypto ‘s analysis of DOT’s market sentiment indicated that it has been largely positive lately.

As a crypto investor, I would interpret those figures this way: The sentiment among the crowd towards DOT was favorable when its price was at 0.1325. The z score of 0.75 indicated that this optimistic feeling was stronger than average. Additionally, the buzz level of 0.83 suggested that there was a high degree of excitement and activity surrounding DOT at that time. In essence, the market mood pointed to a bullish outlook for DOT’s price trend.

Indicators and price charts

As I analyze the current market situation, DOT is currently priced at $5.87, marking a notable increase of 9.73% in the previous 24 hours. Surprisingly, however, the trading volume has declined by 8.20% during this same timeframe.

As a researcher studying the cryptocurrency market, I’ve noticed that Polkadot’s Relative Strength Index (RSI) recently registered a reading of 46 after crossing above its moving average (MA) at 44. This is often seen as a bullish sign in technical analysis, suggesting an uptrend. When the RSI rises, it typically indicates increasing buying pressure and decreasing selling pressure within the market.

As a crypto investor, I’ve noticed an intriguing development in the On Balance Volume (OBV) of a particular cryptocurrency over the past week. The OBV, which measures the flow of money into and out of an asset, has shifted dramatically from a deficit of $2.7 million to a positive $949k at present. This surge indicates that buying pressure might be stronger than selling pressure in the market.

This is a bullish signal as a higher OBV often precedes rising prices.

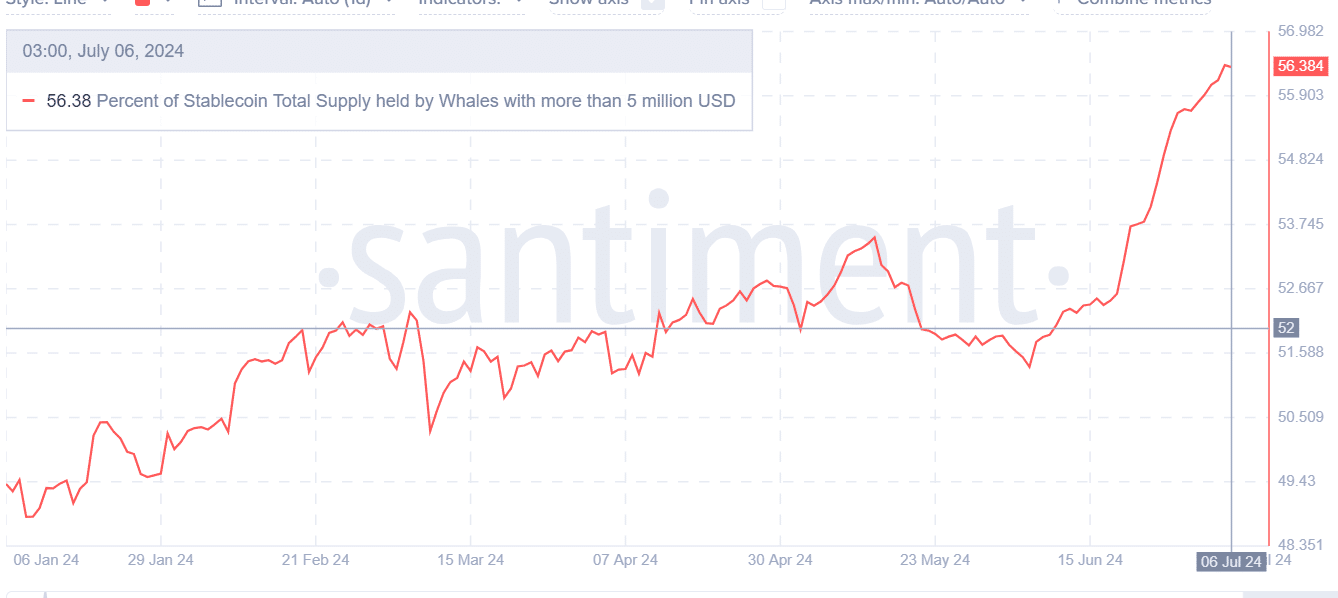

As a researcher studying market trends with Santiment’s data, I’ve observed an intriguing development: within the past week, the total supply held by whales has risen from $48 million to $56.3 million. This accumulation indicates that large investors, or “whales,” are expressing confidence in the altcoin’s direction and future prospects by increasing their holdings.

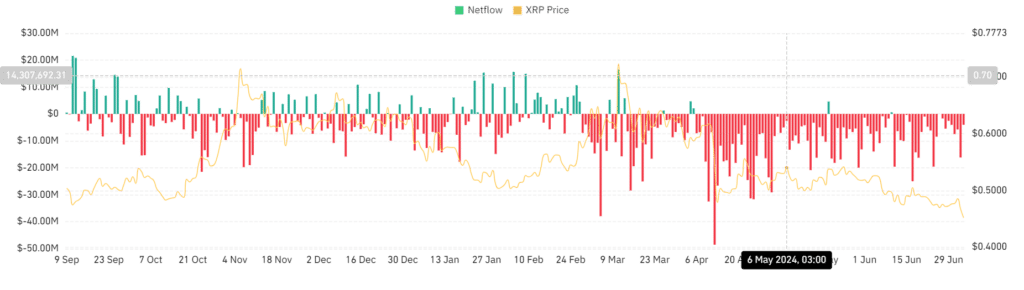

At the current moment, DOT experienced a net loss of approximately $124,760 in value. This comes after a series of consecutive negative outflows lasting for about four days.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-07-06 22:15