-

SEC approved spot Ethereum ETFs – A sign of increasing crypto acceptance

However, differences in BTC and ETH spot ETF approvals have raised a few questions

As an analyst with extensive experience in the crypto market, I believe the SEC’s approval of Ethereum [ETH] spot exchange-traded funds (ETFs) is a positive sign for the growing acceptance of cryptocurrencies. However, the differences in the approval processes for Bitcoin [BTC] and ETH have raised some intriguing questions.

As a crypto market analyst, I’ve noticed an uptick in cryptocurrency adoption following the SEC’s approval of ETH spot ETFs for trading in the United States.

As a crypto investor, I’m thrilled to share that the long-awaited approval for a Bitcoin [BTC] spot ETF finally came through on May 23rd. This is around five months following the SEC’s initial approval of BTC spot ETFs on January 11th.

As a researcher studying the approval processes of Bitcoin and Ethereum, I’ve discovered some notable differences between the two.

While the SEC’s five-member committee, headed by Chair Gary Gensler, gave the green light to Bitcoin spot ETFs, the approval for Ether spot ETFs came from the SEC’s Trading and Markets Division instead.

A significant query arises – Why did SEC Chair Gary Gensler abstain from voting on the ETH ETF proposal? Could it be that he continues to classify Ether as a security instead of a commodity?

Was ETH ETF approval a political stunt?

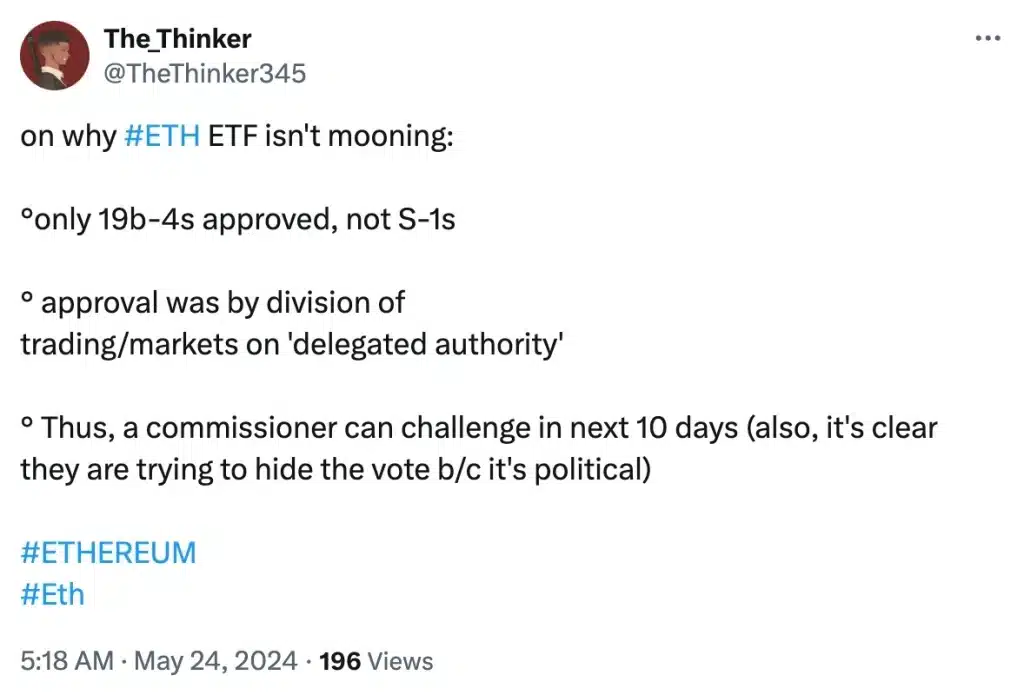

James Seyffart, a research analyst at Bloomberg Intelligence, explained that political considerations and the SEC’s internal workings are the main factors leading to this difference. He made this point in a tweet on May 24th.

In this case, the approval was granted via delegated power, which is a frequent procedure. However, it introduces uncertainty regarding specific roles since there are no publicly recorded commissioner votes for verification.

As a crypto investor, I’d interpret that statement as follows: The SEC commissioner’s decision is currently final, but there’s a possibility that Crenshaw or other commissioners might ask for a reconsideration at a later stage.

As a researcher studying the cryptocurrency market, I couldn’t help but notice the stark contrast between the reaction of various players in the community and Ethereum’s (ETH) muted response on the charts following the approval of its long-anticipated upgrade. One observer even went so far as to remark that ETH’s indifference stood out particularly glaringly against the backdrop of heightened expectations and widespread celebrations among other crypto assets.

Bitcoin vs. Ethereum

The distinctions between the two ETFs were clearly reflected not just in their approval stages, but also in the subsequent price trends of the respective cryptocurrencies. After the BTC ETF gained approval, Bitcoin’s value spiked from approximately $46,000 to around $47,500. Conversely, Ethereum experienced a notable increase of over 11%, reaching above $2,500 for the first time in almost 20 months.

After the approval of the ETH ETF on May 24th, the market response took a turn for the unexpected. Contrary to expectations, Bitcoin, among other cryptocurrencies such as Ethereum, experienced noticeable drops in value on the price charts.

Gensler maintains his anti-crypto position

I’ve been keeping a close eye on the recent developments regarding Gensler’s voting behavior in the BTC and ETH ETF approvals. The speculation surrounding his motives continues to swirl, but considering his past anti-crypto stance, it seems unlikely that he holds a strong bias towards Bitcoin or Ethereum.

The same was evidenced by a recent remark he made,

“Cryptocurrencies represent a limited portion of the total financial markets, yet they disproportionately encompass the prevalence of scams, deceit, and malfeasance within the market landscape.”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-05-25 17:12