- Head and Shoulders pattern flashed bullish momentum ahead for the AI coin

- Fetch.Ai has saw a gradual hike in midterm cruisers in 2024

As a seasoned crypto investor who has weathered numerous market cycles, I find myself intrigued by the current state of Fetch.AI (FET). With 10 years of investing under my belt, I’ve learned to read between the lines when it comes to chart patterns and on-chain data analysis.

At the moment, the price of Fetch.AI [FET] was at $1.26, and the trading volume within the last 24 hours was around $383.56 million. Over the past week, there’s been a drop of 10% for FET, which might be attributed to market instability. Despite this minor setback, its performance over the past year has generally been quite impressive.

Given the impressive 198.8% increase over the last year, the token’s robust expansion underscores the ongoing fascination with Fetch.AI’s groundbreaking contributions to artificial intelligence and blockchain networks.

Charts show ‘Head and Shoulders ‘pattern

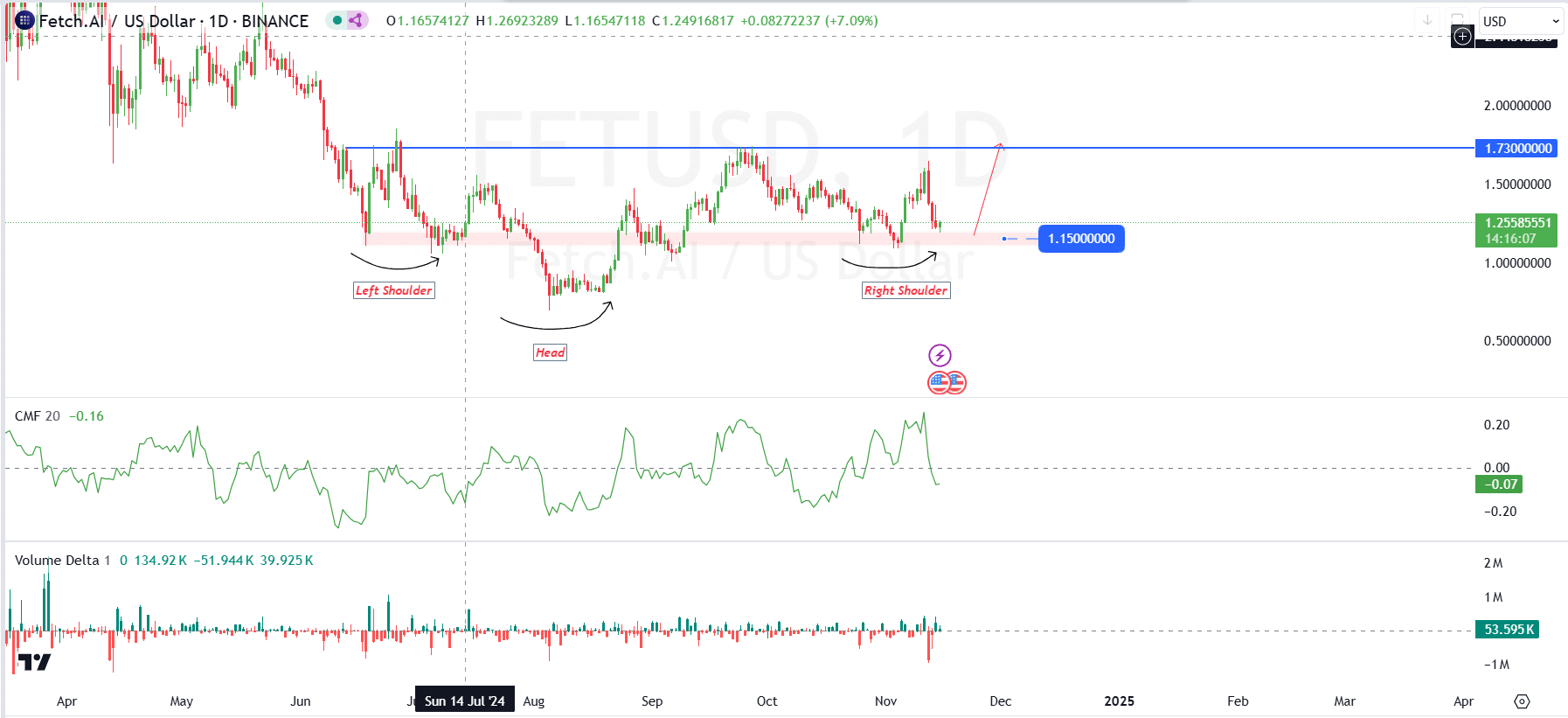

According to AMBCrypto’s examination, a bullish reversal formation called an Inverse Head and Shoulders has been identified in Fetch.AI’s daily chart.

Frequently, this pattern indicates that a decline might be ending and a surge in positive movement may follow. The $1.73 resistance level appears to have acted as a significant hurdle. Once we surpass this barrier, it could trigger additional growth. This breakout would likely suggest that the buyers are in command.

Furthermore, analysis of the volume revealed significant peaks at crucial stages within the chart, most notably near the peak (head) and the right shoulder formation.

An increase in volumes suggests strong buying activity, which is essential for a lasting bullish trend. Conversely, if there’s a breakout with reduced volume, it hints at weaker demand from buyers.

Currently, as I’m typing this, the Chaikin Money Flow Indicator (CMF) stands at -0.07, suggesting a moderately active selling phase in the market. However, there are also hints of slow and steady accumulation. If the CMF shifts into positive numbers together with a price surge, it would serve as additional evidence supporting strong buying activity.

Market sentiment & on-chain data analysis

Regarding the core aspects, the ASI Alliance has announced their intention to deploy an “Earn and Retire” strategy for FET tokens, with the goal of decreasing the available token count.

This action is anticipated to establish a deflationary condition, typically leading to an increase in token value as long as demand stays constant or rises. By striking a balance between token incentives for users and regulated inflation, the project aims to foster a lasting ecosystem that motivates holding and utilization of FET.

The news has ignited enthusiasm among members of the Fetch.AI group, hinting that it might mark the beginning of further strategic moves aimed at boosting the worth of FET.

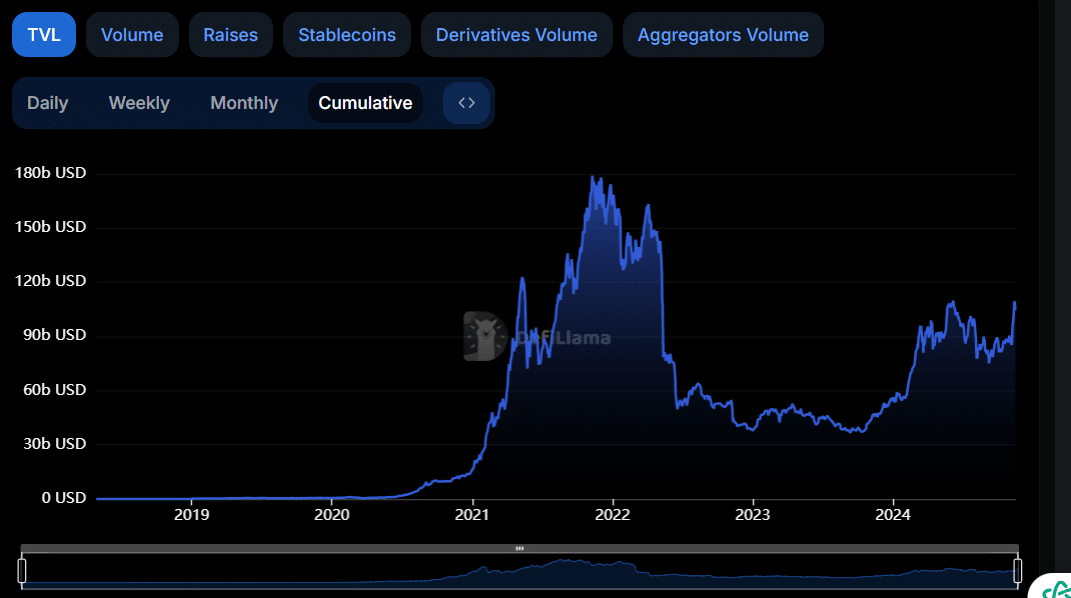

In the wider cryptocurrency sector, there have been indications of a market recovery as Total Value Locked (TVL) has shown an upward trend in the year 2024. After experiencing a significant decrease in 2022 due to tightening economic conditions, TVL levels remained steady throughout 2023.

2024 has seen a steady increase in Total Value Locked (TVL), indicating a growing curiosity and careful re-engagement in Decentralized Finance (DeFi) and blockchain initiatives, signaling a positive trend.

It seems that this trend could be indicative of a more positive outlook within the market, particularly since recent collaborations and advancements are enticing investors to reinvest in the system.

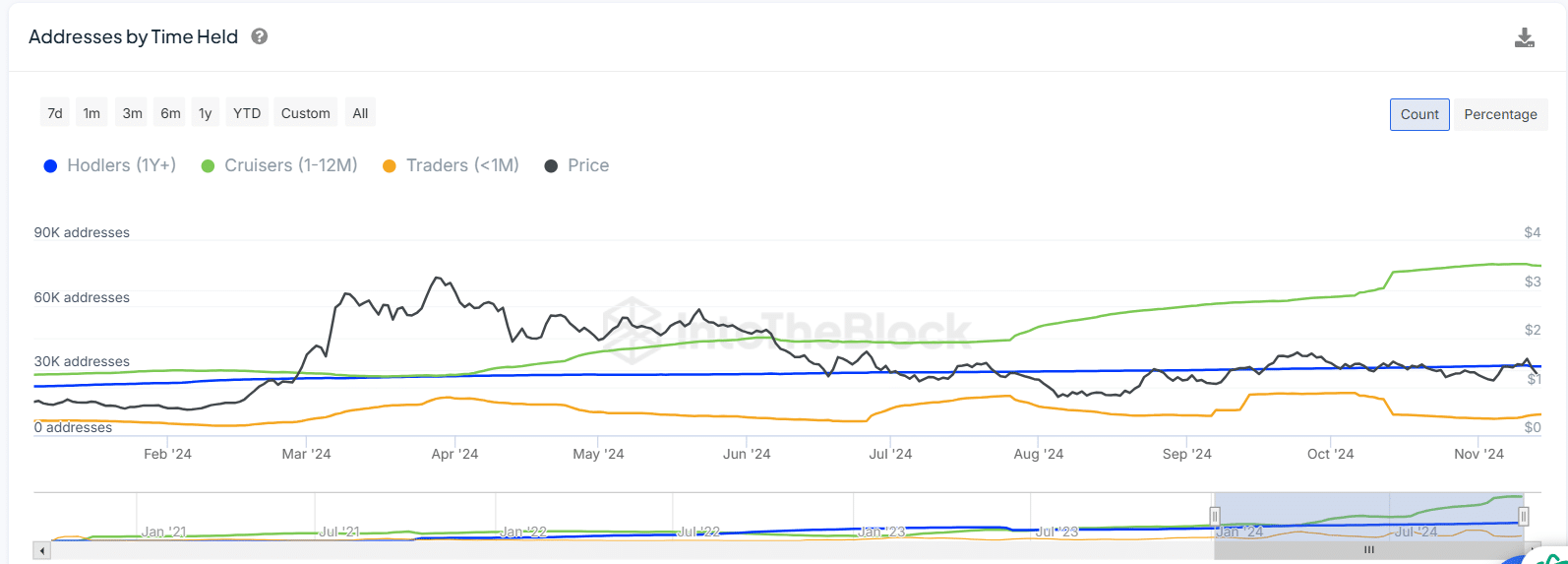

2024 saw a consistent perspective from long-term Fetch.AI token holders, as those who had held onto their tokens for over a year displayed little variation in their holdings, suggesting strong faith among the initial adopters of this platform.

As time goes by, it appears that an increasing number of mid-term investors are choosing to stay with FET, implying a tendency among newcomers to keep their investments in FET for longer durations.

Read FET Price Prediction 2024- 2025

Instead, we saw a decrease in the number of short-term traders over the course of the year, suggesting less speculative trading was taking place.

Over time, this change might lower the fluctuation of FET (First Electricity Trader), making prices more consistent and suggesting that the investor group is growing more mature.

Read More

2024-11-16 08:08