-

MicroStrategy’s stock MSTR led the market with triple-digit gains in H1

Solid H1 rally, increased regulatory clarity, upcoming ETH ETF, and expected Fed rate cuts are key catalysts for H2 2024

As a researcher with a background in financial markets and crypto assets, I find the first half of 2024 to be an incredibly exciting period for the crypto industry. The impressive performance of MicroStrategy’s stock (MSTR), which led the market with triple-digit gains, is a clear testament to the potential of Bitcoin (BTC) and related equities.

In the initial part of the year, shares of companies connected to cryptocurrencies, such as those dealing with crypto equities and Bitcoin miners like MicroStrategy (MSTR), experienced significant growth, recording triple-digit percentage increases.

According to CCData’s latest report, titled “2024 H2 Outlook,” Mastercard (MSTR) saw an impressive increase of 380% in certain aspects. This substantial growth is attributed to the company’s significant holding of Bitcoin (BTC), as mentioned in the report.

MicroStrategy saw a remarkable 380% increase in its stock value, primarily due to its significant Bitcoin investment. Currently valued at around $13.3 billion, this investment consists of 214,000 Bitcoins purchased at an average price of approximately $35,158 each. Since the beginning of 2020, these holdings have generated a substantial profit for the company, amounting to roughly $6.54 billion.

BTC miner stocks and overall market performance

The cryptocurrency sector saw significant gains from stocks such as Coinbase (COIN) and Robinhood (HOOD). According to recent reports, their shares experienced substantial growth, increasing by 329% for Coinbase and 122% for Robinhood respectively.

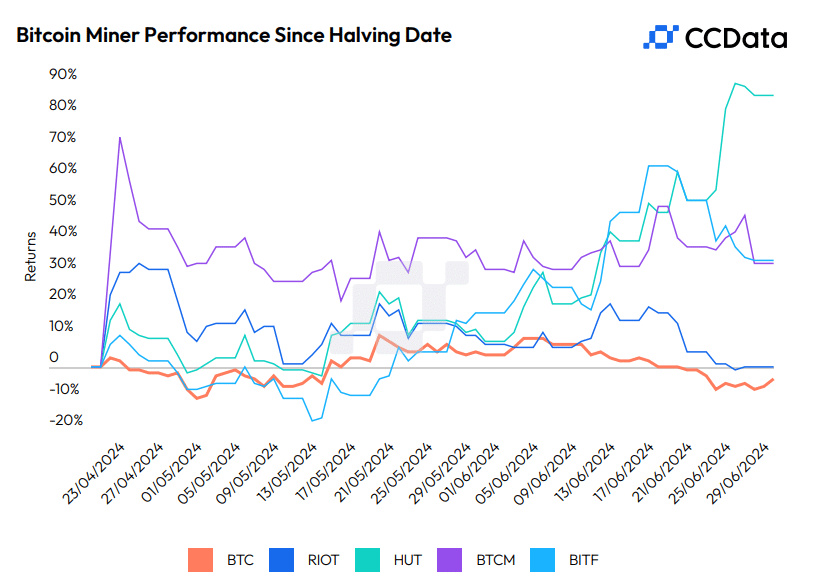

As a crypto investor, I’ve noticed an impressive rebound in the mining stock sector following April’s halving event. Specifically, companies like Hut 8 Corp (HUT) and Bitfarms Ltd (BITF) have surged by 86% and 34%, respectively. In comparison, Bitcoin itself only saw a decline of 3.2% during the same timeframe.

From my perspective as an analyst, the report highlighted that institutional investors have shown increased interest in Bitcoin ETFs at location B. These financial entities have been actively investing in these products.

Approximately $14.41 billion has been added to these ETFs, bringing the overall asset value to an impressive $53.56 billion. These ETFs now account for approximately 4.4% of Bitcoin’s total market capitalization. Notably, the IBIT ETF has attracted a significant inflow of around $17.64 billion, representing over 1.5% of Bitcoin’s current market value.

CEX markets share dynamics

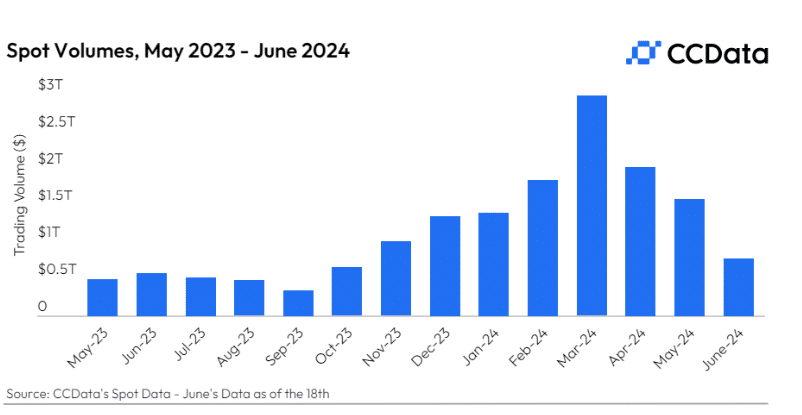

The centralized exchange (CEX) sector experienced significant expansion in the first half (H1) of the year, recording a total spot trading volume of $10.6 trillion – marking a substantial increase of 145% compared to H2 2023.

On the market share front, the report added,

As an analyst, I’ve observed significant growth in the trading volumes of Bitget, Crypto.com, and Bybit, with increases of approximately 38.4%, 24.6%, and 22.2% respectively. Conversely, Coinbase experienced a decline of roughly 6.0%.

Bitcoin and crypto markets: H2 2024 outlook

The report highlighted that H1’s strong performance could serve as a robust base for improved results in H2. It specifically identified potential Fed interest rate reductions towards the end of 2024 and the upcoming Ethereum [ETH] ETF debut as significant drivers for market growth.

As a crypto investor, I firmly believe that the clearer regulatory landscape in the U.S and EU, with initiatives like the Digital Asset Market Strategy (DAMS) in the U.S and MiCA in the EU, significantly boosts confidence and paves the way for more investments in the second half of this year. This optimistic outlook is also shared by AMBCrypto’s July report, which highlights the potential growth opportunities for major cryptocurrencies like Bitcoin, as well as memecoins.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Is Trump’s Presidency a Game Changer for the US Dollar and Bitcoin?

2024-07-04 11:04