-

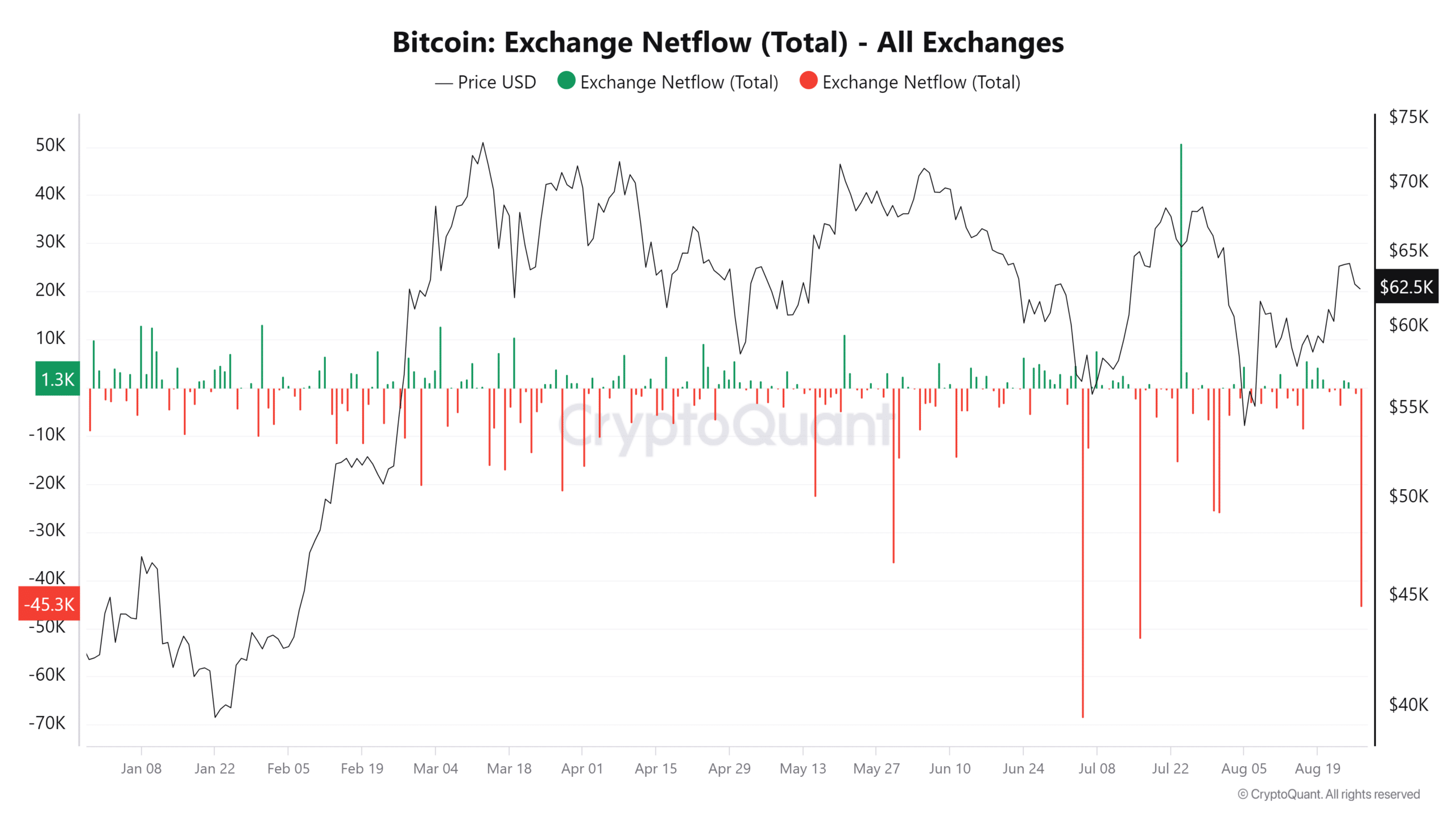

BTC saw an outflow of over 45,000.

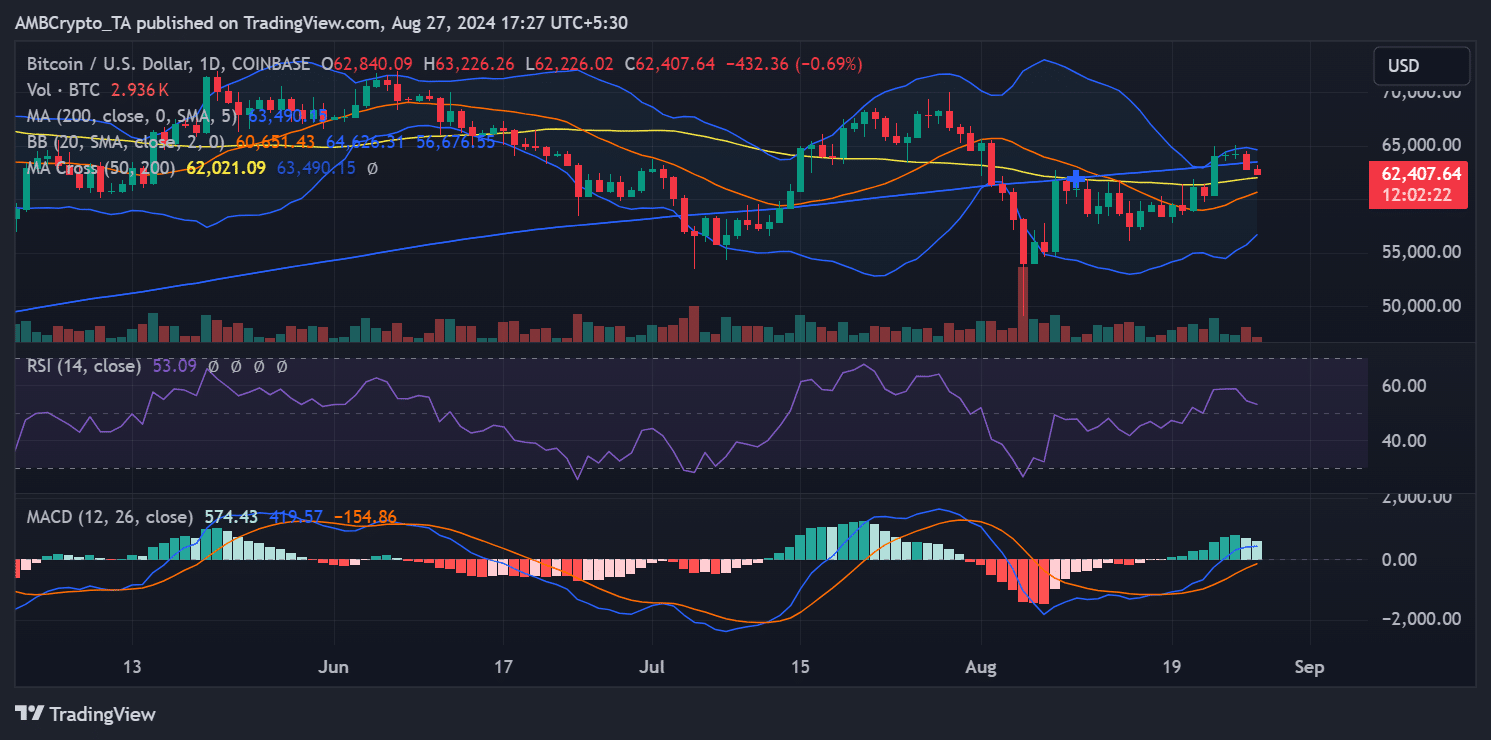

BTC has declined in the last 24 hours but remained around $62,000.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market cycles and their subsequent ebbs and flows. The recent fluctuations in Bitcoin’s price are no exception to this pattern, but they do serve as a reminder that volatility is an inherent part of investing in cryptocurrencies.

The recent volatility in Bitcoin’s [BTC] price has led to increased activity among traders and holders.

As a researcher observing the Bitcoin market, I’ve noticed that despite holding steady near the $60,000 mark, recent price swings have given some investors pause, resulting in a wave of selling activity.

Bitcoin sees sell-offs from short-term holders

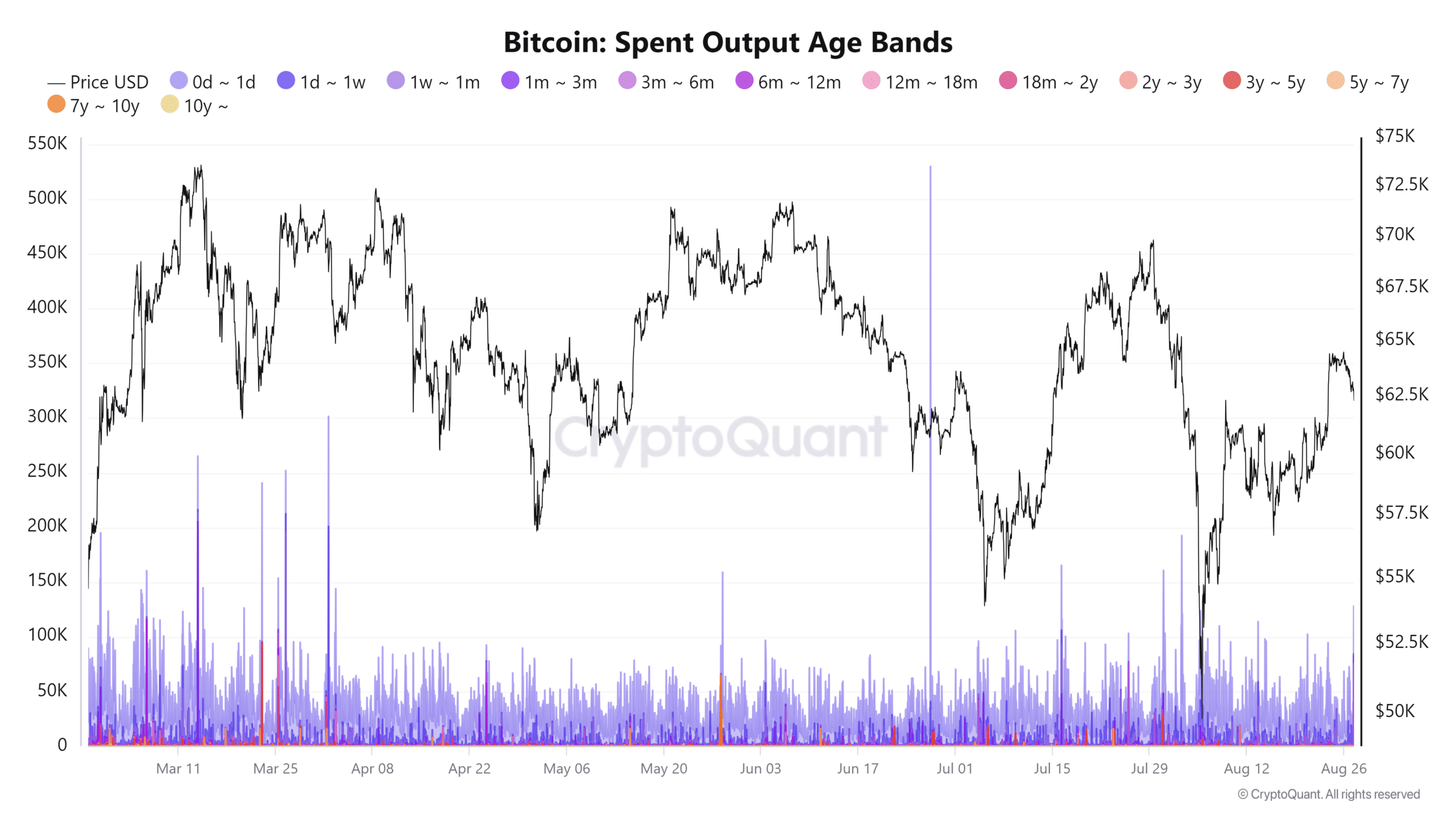

As per the latest information from CryptoQuant, it seems that certain Bitcoin wallets which were previously inactive have recently exhibited signs of increased usage.

Analyzing the 1 week – 1 month spending age groups, it was found that short-term Bitcoin holders moved approximately 33,155 Bitcoins in total.

This uptick in short-term holders’ activity could signal immediate market selling pressure.

It seems reasonable that the unpredictability and fluctuations in the market right now could be influencing the choice to move and cash out these assets.

Investors might aim to secure their gains following the latest changes in Bitcoin’s value, or they could try to minimize possible losses if they expect further drops in its price.

Additionally, some may be rebalancing their portfolios in response to the changing market dynamics.

An uptick in transactions by short-term investors might put a bearish influence on Bitcoin’s value. This is especially likely if these trades result in substantial sell-offs on cryptocurrency exchanges.

Bitcoin records its biggest outflow of the month

Although short-term traders have been offloading their Bitcoin recently, the 26th of August saw the highest withdrawal rate, suggesting a notable change in market trends.

As a crypto investor, I’ve been keeping an eye on the exchange netflow analysis by CryptoQuant, and I must say, the recent figure of -45,432 BTC is quite concerning. It’s been almost two months since we last saw such a significant negative outflow, which occurred in June. This suggests that a large amount of Bitcoin might be moving off exchanges, possibly indicating accumulation by whales or increased demand elsewhere. It’s crucial to stay informed and adapt strategies accordingly.

A negative exchange outflow suggests that more Bitcoin was taken out of exchanges than put into them.

Based on my years of investing and observing market trends, I find that when Bitcoin holders are moving their coins off exchanges, it often indicates a bullish sentiment. From my perspective, this action usually signals confidence in the cryptocurrency’s value and a belief in its future growth potential. This is an experience I have noticed throughout various market cycles, and it aligns with my understanding that investors tend to withdraw assets from exchanges when they feel secure enough to hold them long-term.

Also, this movement contrasts with the selling pressure seen from some short-term holders.

This suggests that as some market players are securing gains or minimizing potential losses, a significant number of Bitcoin investors are opting to keep their BTC away from exchanges instead.

BTC’s volatility stretches

According to AMBCrypto’s examination, Bitcoin’s day-to-day fluctuations showcase its persistent price swings.

Examining the Bollinger Bands, a tool for gauging market volatility based on price movement, reveals they’ve expanded over the past few days, mirroring the heightened price instability.

Read Bitcoin’s [BTC] Price Prediction 2024-25

During the most recent trading day, Bitcoin experienced a drop exceeding 2%, and it’s currently losing nearly 1% more in this ongoing session.

At the moment, Bitcoin is being exchanged for around $62,401. The expansion of the Bollinger Bands suggests increased market volatility, meaning that price fluctuations are growing more noticeable.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

2024-08-28 04:08