-

At press time, Bitcoin was trading above $60,000 despite declines.

However, the BTC price trend remained bearish.

As a seasoned crypto investor with a few battle scars from past market fluctuations, I can’t help but feel a mix of excitement and cautious optimism when observing Bitcoin’s recent performance. The market dynamics are intriguing, to say the least.

In recent times, Bitcoin [BTC] has shown considerable fluctuation, marked by swift changes in its value.

Even amidst the choppy conditions, there are positive indicators emerging within the market’s behavior, notably with increased trading action and growth in the number of new participants.

Over the past period, I’ve observed an uptick in market activity that seemingly aligned with a BTC price recovery. This recovery propelled Bitcoin back into the $60,000 price range.

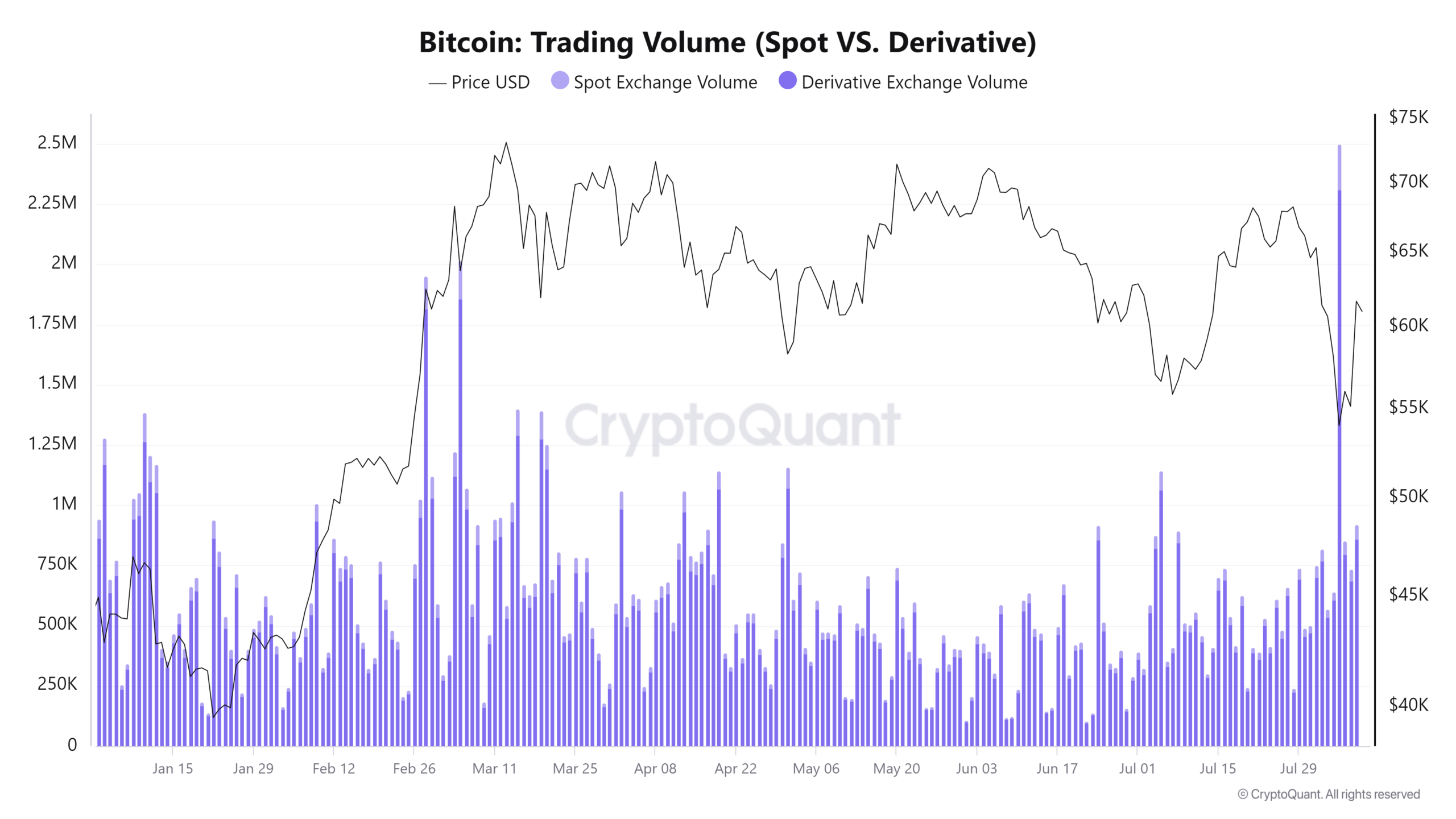

Bitcoin sets record volumes

Amidst a recent dip in Bitcoin’s value that brought its price down to roughly $50,000, there was a notable increase in trading activity across the market.

Data showed that both derivative and spot trading volumes reached near-historic levels.

As a crypto investor, I noticed an intriguing trend: The day when prices plummeted, the trading volume for futures reached an unprecedented peak of $154 billion, according to CryptoQuant’s data.

As a crypto investor, I’ve noticed an increase in Futures trading volume, which typically means more people are actively participating in the market. This surge might be due to savvy traders leveraging the current market volatility to make significant wagers on Bitcoin’s price direction.

At the same time, the amount of direct trades (spot trading) skyrocketed, peaking at a staggering $83 billion. This impressive number was just shy of being the highest ever recorded for Bitcoin’s trading market.

During a steep price drop, a high volume usually indicates both selling activity and buying interest.

Current owners are either aiming to minimize further losses, or both new and current investors are seeking to acquire assets at reduced costs.

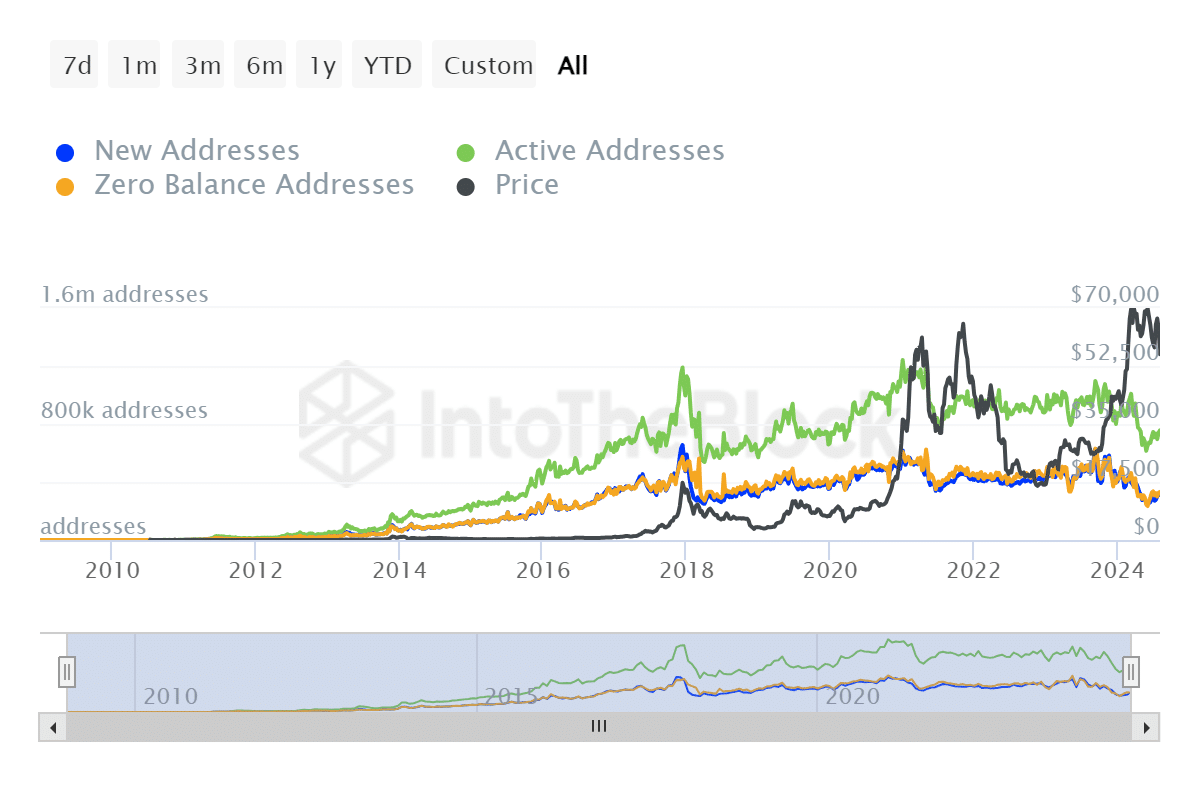

Bitcoin addresses see a slight increase

Lately, data from IntoTheBlock has shown an interesting change in Bitcoin usage, particularly with the creation of new wallets.

Since November 2023, the rate of new daily addresses being created has generally decreased. However, we’ve recently noticed a slight increase in this trend.

Over the last few weeks, the spike in the creation of new accounts seems to indicate a rekindled enthusiasm among retail investors.

As a crypto investor, I find an increase in new addresses to be an encouraging sign, often seen as a bullish marker. This trend implies that more and more individuals are dipping their toes into the market, with a significant number hailing from the retail sector.

Making this adjustment might indicate a wider adoption of Bitcoin, possibly leading to increased market action and financial backing.

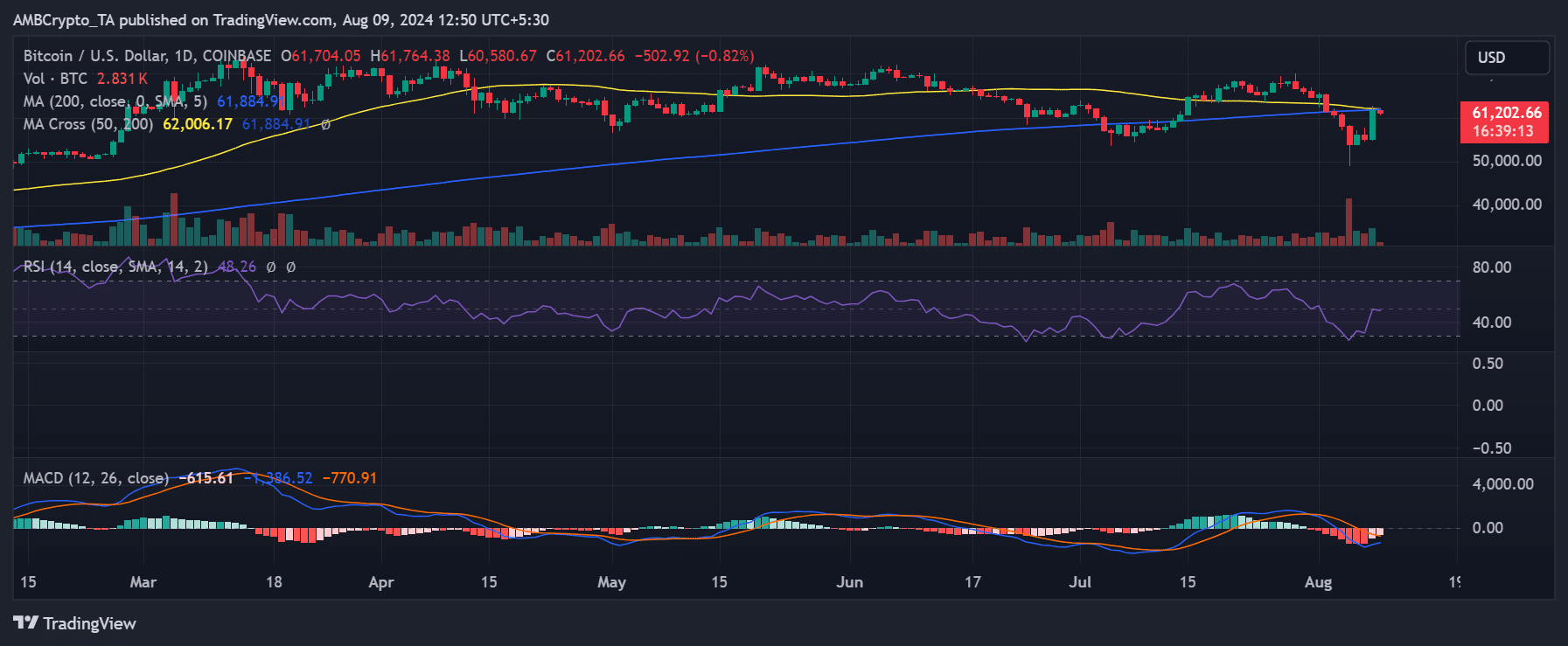

BTC sees a nice rebound

In simpler terms, AMBCrypto’s examination of Bitcoin on a day-by-day basis reveals a notable recovery during yesterday’s trading period.

As an analyst, I observed a significant surge of approximately 11.89% in the value of Bitcoin, propelling its price from roughly $55,000 to a high of around $62,000. At the end of the session, Bitcoin was trading at $61,705 as reported at the time of press.

Although there was a significant rise, the upsurge fell short of pushing Bitcoin into a sustained bull market. The Relative Strength Index (RSI), however, stayed below the neutral level of 50, suggesting it was still in a bearish stance.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Based on my years of observing financial markets and economic trends, I find that while a price spike can signify a significant positive movement, it doesn’t always mean an immediate change in broader market sentiment. As someone who has witnessed numerous market fluctuations over time, I have learned that it takes more than just a single price surge to fundamentally alter the overall sentiment among investors. A sustained period of positive developments or a consistent trend is often required before a shift in market sentiment becomes evident and enduring.

Currently, the price has dropped by about 1% to around $60,900. (or) The current price stands at approximately $60,900, having decreased by a little over 1%.

Read More

2024-08-09 13:12