-

Some holders of the coin have been hit by one of the worst losses since 2022

Long-term holders remain profitable than short-term counterparts, indicating that BTC is still in a bull phase

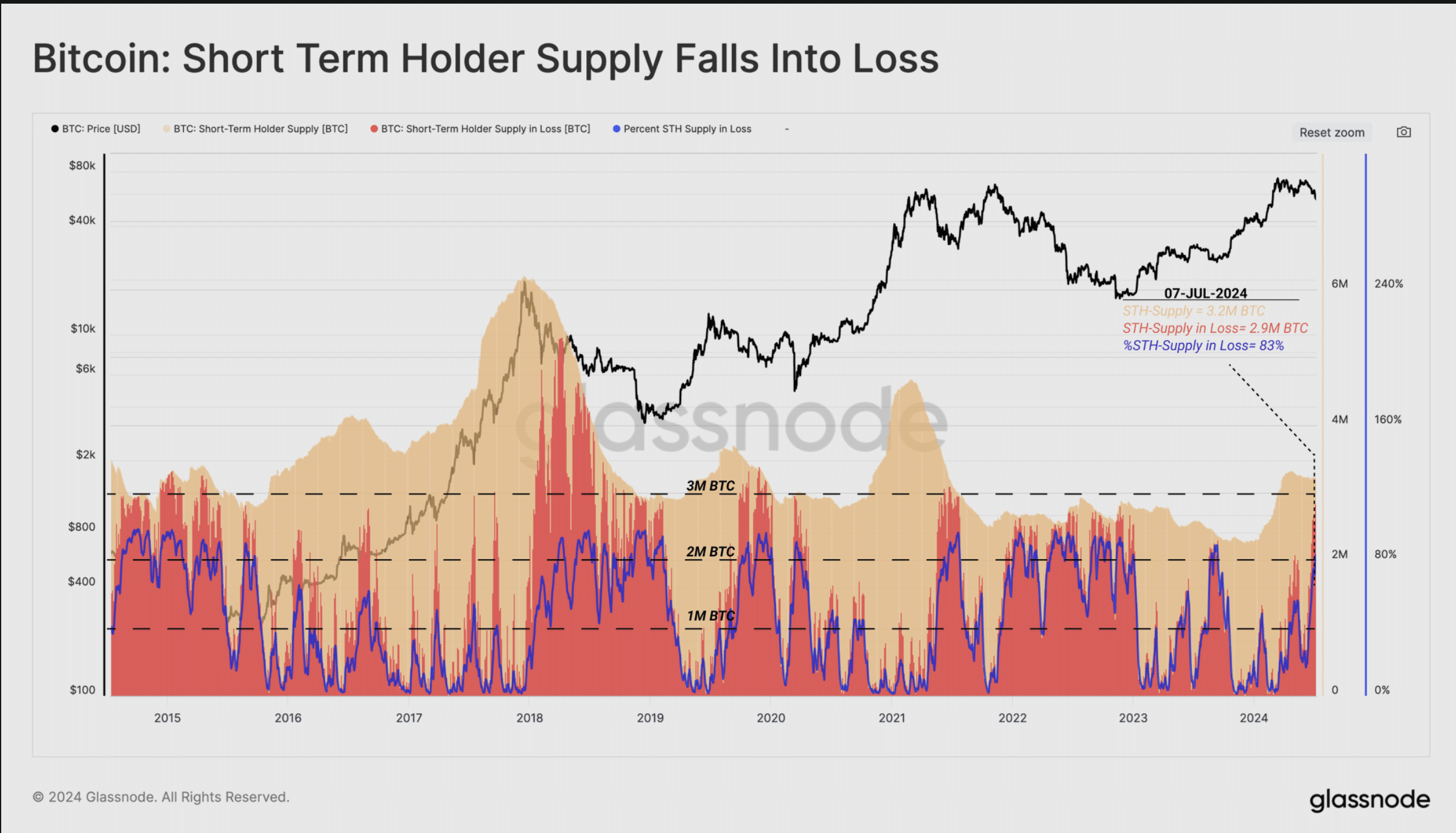

As a researcher with extensive experience in cryptocurrency markets, I believe that recent market developments indicate both challenges and opportunities for Bitcoin (BTC) investors. According to Glassnode’s latest report, the last 30 days have seen BTC’s price decline by approximately 14.5%, causing significant financial losses for many Short Term Holders (STHs). These are individuals who have held Bitcoin for less than 155 days.

Based on a recent analysis by Glassnode, Bitcoin‘s [BTC] price drop over the past month has contributed significantly to one of the most substantial losses since the 2022 bear market. Specifically, BTC’s value has decreased by approximately 14.45% within the previous 30-day period.

In the report, the focus was on Short-Term Holders (STHs) of Bitcoin, defined as individuals who have owned the cryptocurrency for under 155 days. Notably, a significant number of these STHs experienced losses for approximately 90 days following a Bitcoin price downturn.

Are weak hands in trouble?

Among the past three years, this financial loss ranks as one of the most substantial for holders. According to Glassnode’s analysis.

As a crypto investor looking back at the market conditions, I’ve noticed that the situation we faced during Q2-Q3 2021 bore some striking similarities to what we’re experiencing now. However, the stress experienced by short-term holders during that period was much more pronounced and prolonged, lasting for a significant 70 consecutive days. This extended duration of financial distress managed to shatter investor confidence, paving the way for the devastating crypto bear market that unfolded in 2022.

Although the Bitcoin price drop does not automatically mean that it has entered a bear market.

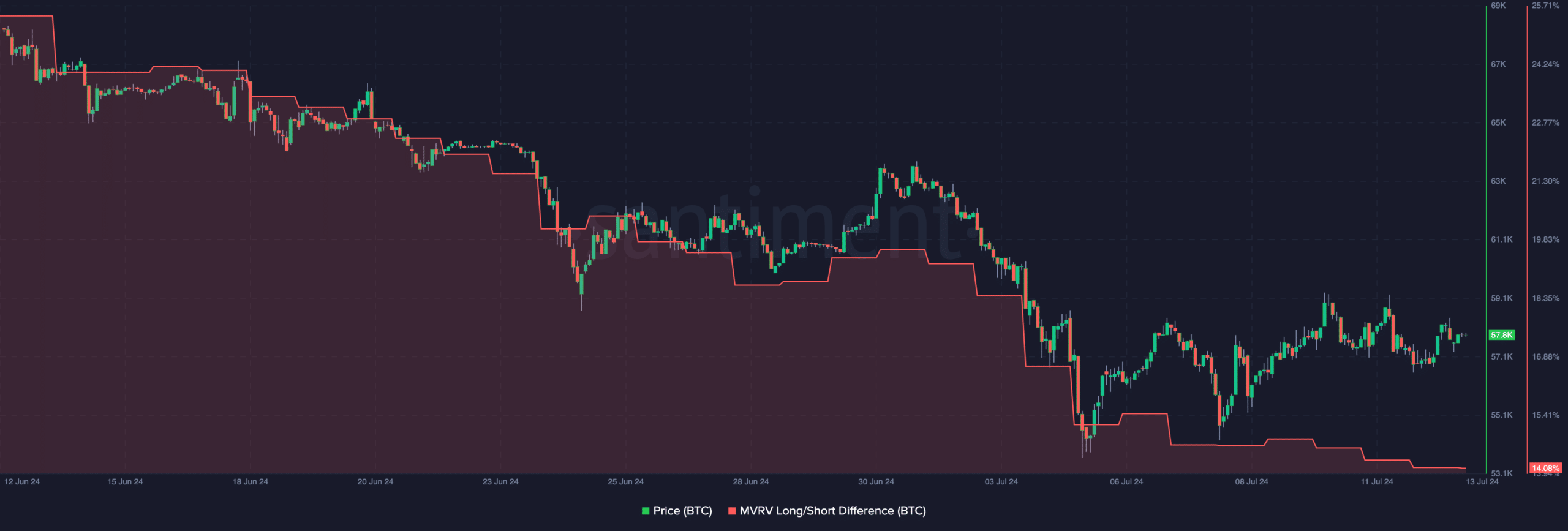

The gap between the profitability of long-term investors and short-term traders can be illustrated through the MVRV Long/Short Difference. In this context, MVRV represents Market Value to Realized Value, a metric that assesses the profitability disparity between those holding assets for extended periods versus those trading frequently.

Bulls stressed by Bitcoin’s shenanigans

As an analyst, I would interpret negative values in the context of Bitcoin’s price movement to mean that short-term investors are poised to reap greater gains than their long-term counterparts. If indeed this situation holds true, it’s a clear sign that we’ve entered a bear market for Bitcoin.

As an analyst, I would put it this way: Should the difference be favorable, it implies that investors who have held onto their assets for a longer duration stand to gain more significant returns upon selling, compared to those who have traded more frequently.

At press time, the MVRV Long/Short Difference was 14.08%.

Despite its decrease in value compared to past months, Bitcoin’s price drop doesn’t necessarily signal a shift into a bear market. Rather, it appears that the cryptocurrency is experiencing an anticipated correction within the ongoing bull market cycle.

Furthermore, hammering on the losses incurred, the report stated,

Focusing on losses incurred by short-term investors this past week, we observe a significant realization of approximately $595 million in losses. This marks the most substantial loss event since the nadir of the 2022 market cycle.

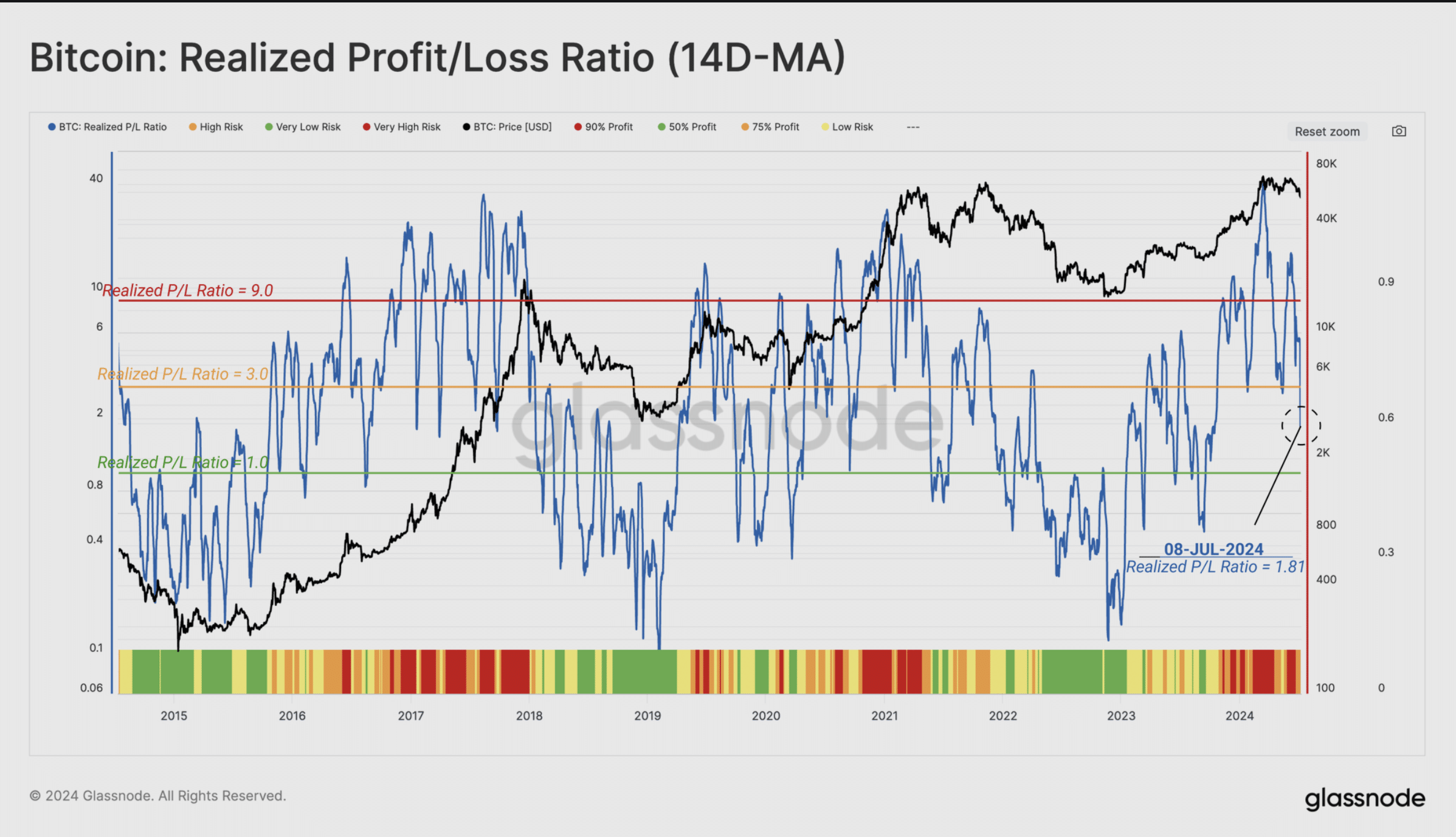

Furthermore, acknowledging the stress on bulls, the Realized Profit/Loss Ratio indicated scant profitability for Bitcoin. Generally, when this ratio falls within the range of 0.50 to 0.75, it signifies that Bitcoin is experiencing a correction in its bull market cycle.

Sadly, starting from July 8, the metric dropped to 1.81. This indicates that investors have generally expressed doubt about Bitcoin’s prospects. If the trend continues or if the price does not recover, it may push Bitcoin into a bear market.

As of now, the value of Bitcoin stood at $57,848, marking a minimal increase during the previous 24-hour period.

Is your portfolio green? Check the Bitcoin Profit Calculator

If the price experiences a significant increase, the Bitcoin crash may be a mere memory. Conversely, if the price doesn’t surge, BTC investors could face diminishing returns.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-13 10:15