- Resistance at $98,279-$100,080 remains key for Bitcoin’s push toward $100,000.

- More wallets have bought BTC around this price range.

As a seasoned researcher with years of experience navigating the crypto markets, I find myself intrigued by Bitcoin’s current position at the cusp of a potential breakout. The support zone at $94,800-$97,700 has shown remarkable resilience, underpinned by the collective interest of both institutional and retail investors.

The path that Bitcoin’s (BTC) value is taking remains a focal point for both traders and investors, as significant support and resistance points will influence its future direction.

As more data points emerge, it’s becoming easier to see the direction ahead. Major clusters where assets tend to accumulate and various technical signals are giving us insights into investor attitudes.

Bitcoin shows strong demand zone

An examination by IntoTheBlock reveals a significant area of interest for Bitcoin holders, as approximately 1.3 million wallets have amassed Bitcoin within the range of $94,800 to $97,700. This region has emerged as a crucial demand zone.

In simpler terms, this group of prices acts as a strong base for the market, with the present value at around $97,860 holding steadily within these boundaries.

If Bitcoin drops beneath that area, there might be increased selling, possibly causing a shift towards a downtrend. Conversely, the resistance between $98,279 and $100,080 indicates that surpassing this threshold is crucial for continued bullish strength.

Technical indicators signal stability amid volatility

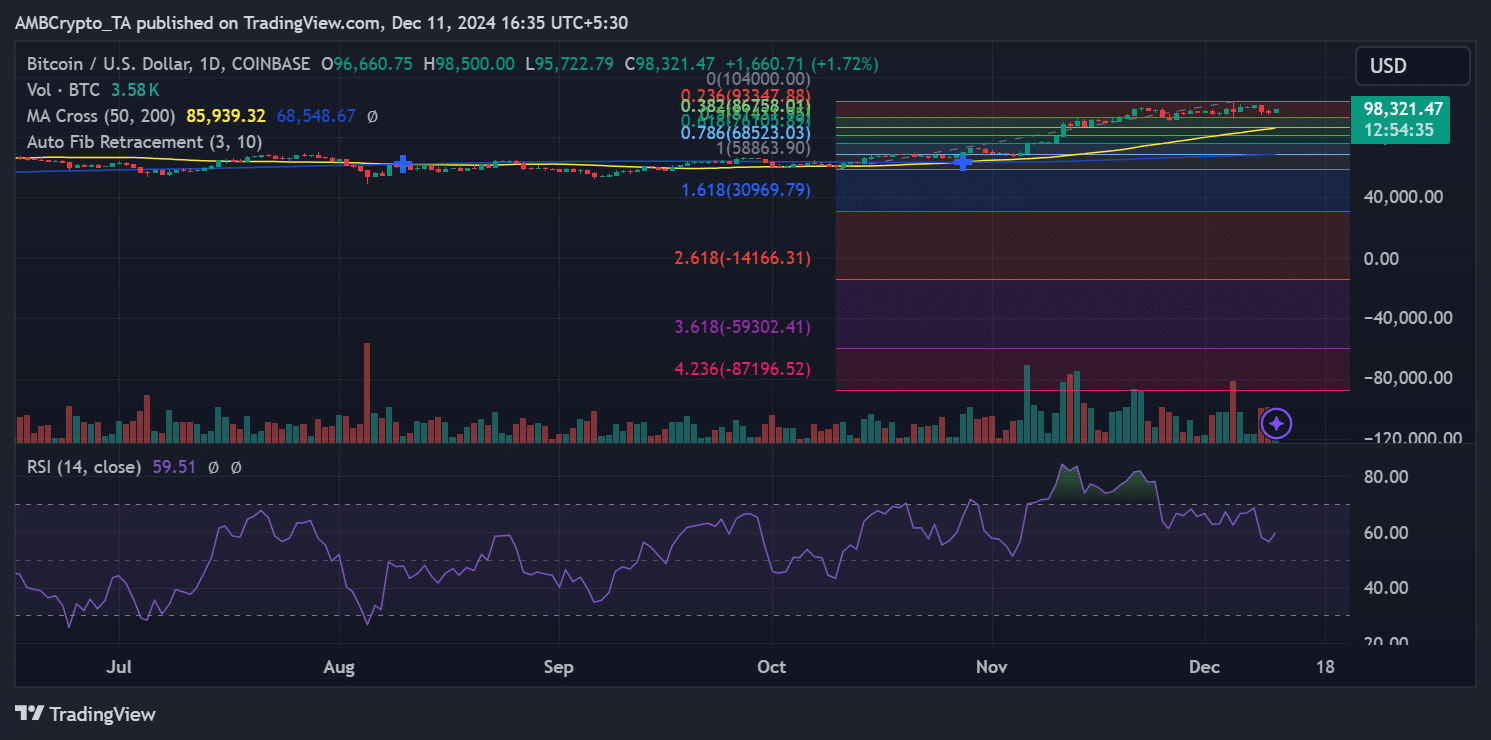

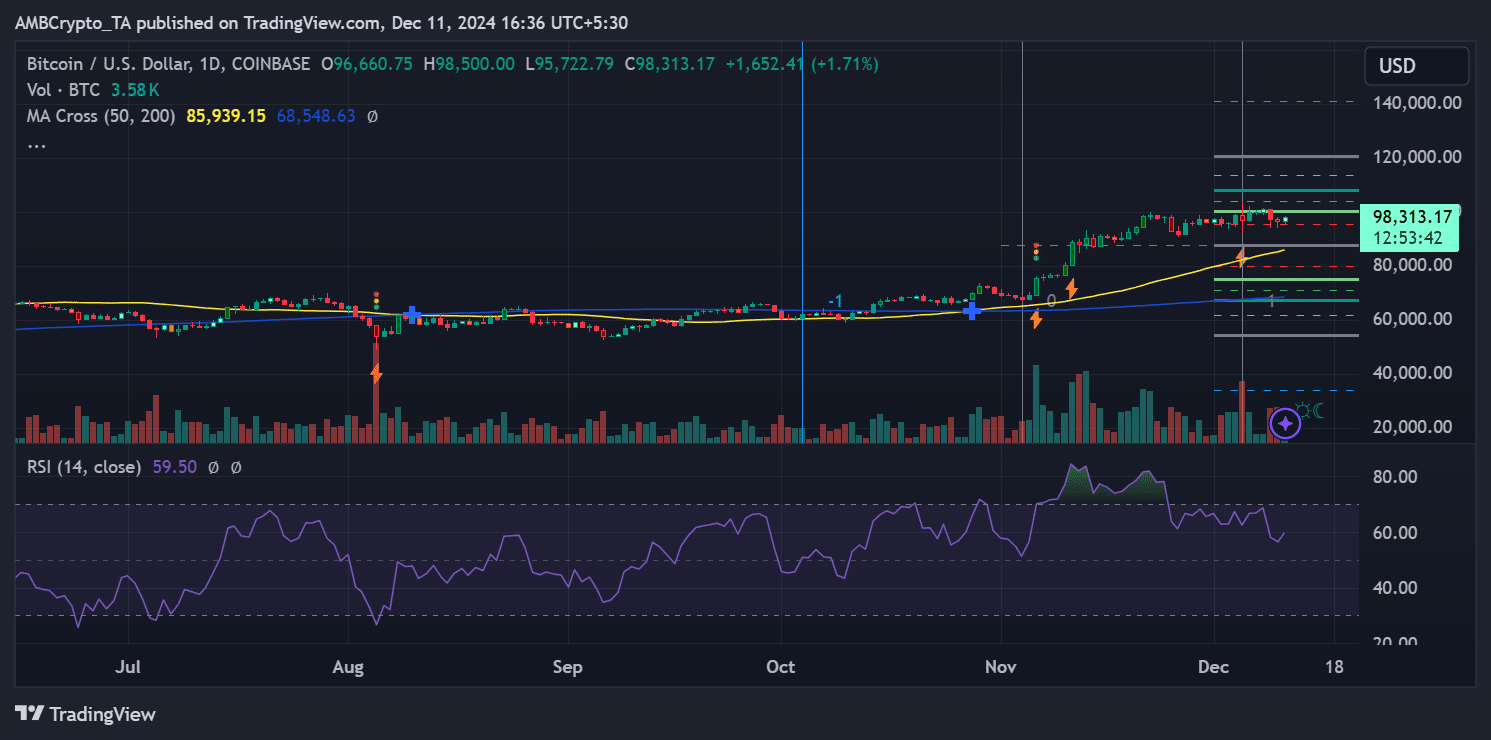

Right now, Bitcoin’s value is at approximately $98,313, which is an upward trend bolstered by the 50-day moving average of around $85,939. Important levels for potential reversals, as suggested by Fibonacci analysis, place $94,876 as a critical junction point, where it overlaps with the demand zone.

In addition, the RSI (14) is at 59.51, showing no clear direction in momentum, but steady volume levels imply high market activity. If Bitcoin continues to stay above $97,700, reaching $100,000 becomes more likely.

Accumulation patterns above $100K show BTC’s long-term potential

It appears that approximately 482,000 different investors have purchased Bitcoin when its price was within the range from the current level to $100,000. This suggests a high degree of optimism among these investors about potential future gains for Bitcoin.

Nonetheless, the significant intersection point for both institutional and retail interest continues to be within the range of approximately $94,800 to $97,700.

The repeated buildup suggests a positive long-term perspective for Bitcoin, as long as it maintains its present pace and successfully surpasses the significant obstacles at upcoming resistance points.

Read Bitcoin (BTC) Price Prediction 2024-25

Currently, Bitcoin stands at a crucial juncture. It finds strong backing at the levels of $94,800 to $97,700, offering a sturdy base for potential advancement. However, an immediate obstacle lies at $98,279 to $100,080, making it difficult to move forward. Overcoming this barrier could push Bitcoin towards unprecedented heights.

From my analysis, the alignment of on-chain data and technical indicators suggests that Bitcoin’s immediate action could shape its course in the coming weeks.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-12-12 02:16