- U.S. Presidential elections, among other bullish drivers, have bolstered the crypto market this month.

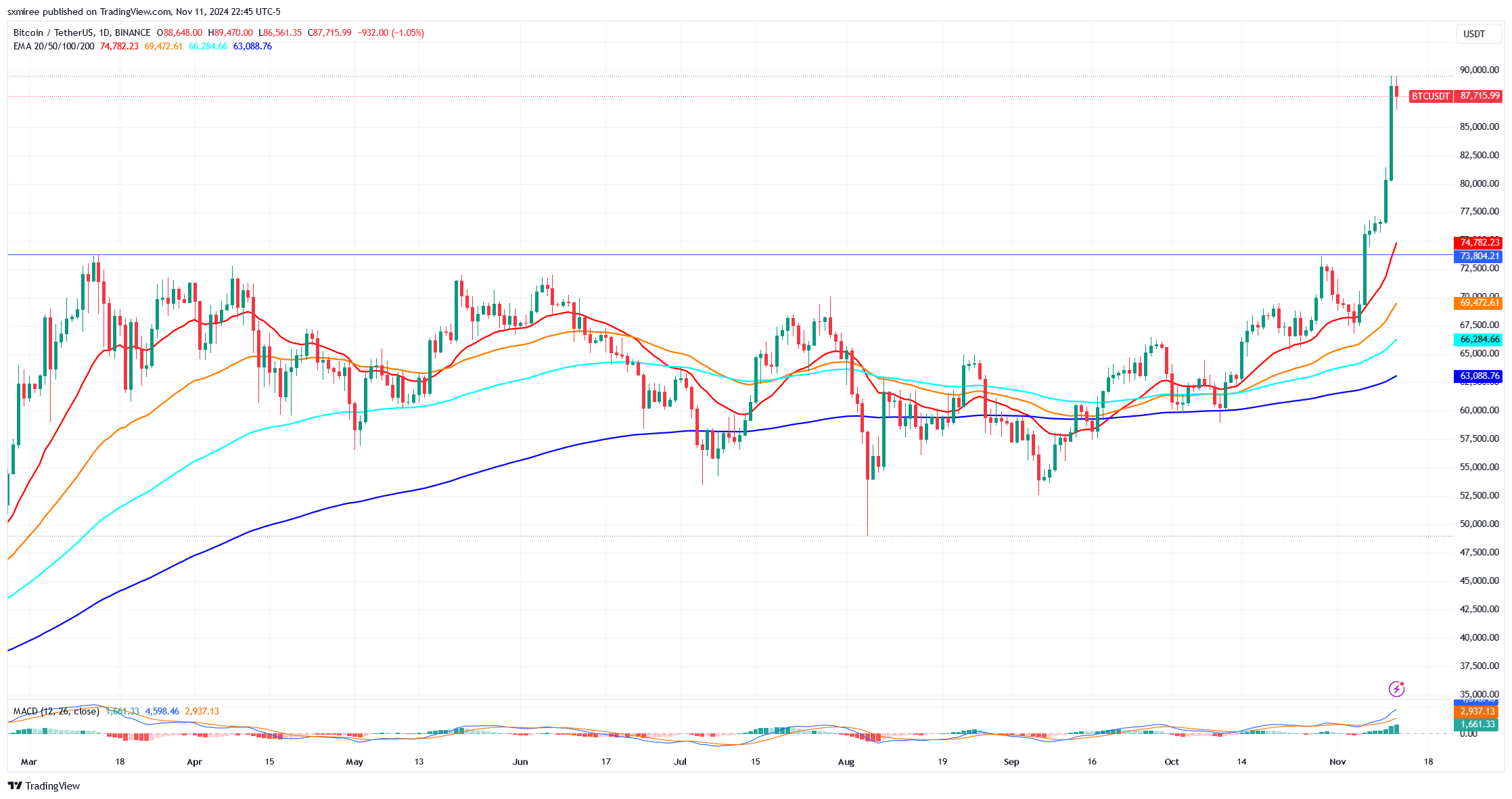

- Bitcoin surpassed its March price high last week, on course to track its best weekly returns since February.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed numerous market cycles and their intricacies. The current surge in Bitcoin and other cryptocurrencies is indeed an exciting development, but it’s important to delve deeper into the performance of decentralized exchange (DEX) tokens like Uniswap [UNI], Raydium [RAY], PancakeSwap [CAKE], and Synthetix [SNX].

Bitcoin (BTC) and other cryptocurrencies continued their winning trend this week, boosted by the positive impact of President-elect Donald Trump’s election success.

In the aftermath of the U.S. election results, Bitcoin experienced a significant surge, reaching new heights beyond its prior peak in March of last year. This week, the digital currency demonstrated yet another remarkable jump in value.

Today, Bitcoin surged past $82,000 around 8 am and continued to climb, reaching an unprecedented peak of nearly $90,000 by the time news was published.

The surge in Bitcoin’s price has given a boost to the entire cryptocurrency market, causing the prices of many alternative coins to increase following a phase of relative stability between August and September.

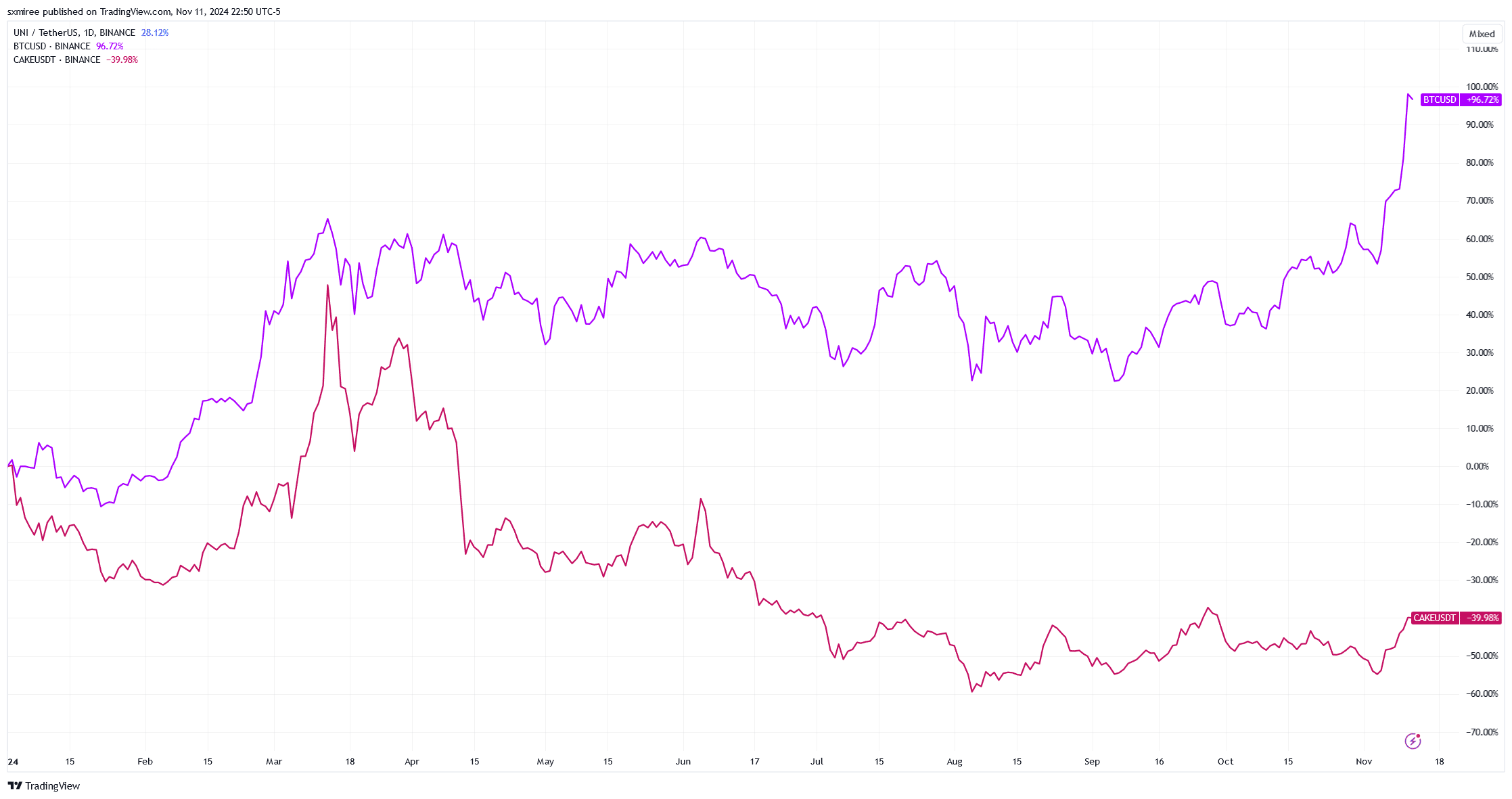

Nevertheless, the native tokens linked to DEX platforms such as Uniswap and PancakeSwap have generally not seen significant growth, even though they’ve followed a path of modest increases.

DEX tokens’ underperformance

As a researcher delving into cryptocurrency market trends, I’ve observed that both Uniswap [UNI] and Raydium [RAY] are currently trading at approximately 70% less than their record peak prices.

Currently, PancakeSwap [CAKE] and Synthetix [SNX] are significantly underperforming. They’ve each dropped over 40% since the start of the year, and they’re now sitting about 95% beneath their previous record highs.

Instead of showing significant growth like DEX tokens, Bitcoin’s price has more than doubled, while Ethereum has recently been trading 45% above its year-to-date (YTD) value.

market analysts believe that the decreased performance is due to the intensifying competition between decentralized exchange platforms and traditional centralized exchanges, as the latter have been incorporating features similar to DeFi.

Many well-known centralized trading platforms such as Binance, KuCoin, and OKX have launched their own token initiatives, providing perks like reduced transaction fees.

The popularity of user trends, particularly the Decentralized Finance (DeFi) story, played a significant role in the underperformance we’ve seen. This narrative gained traction during the market surge from 2020 to 2021.

In the latest market trends, retail investors have been influenced by new stories such as RWA and AI, causing a decline in excitement for Decentralized Exchange (DEX) tokens due to these alternative narratives.

Read Uniswap’s [UNI] Price Prediction 2024–2025

Despite some reservations, market experts believe that Decentralized Exchange (DEX) tokens could potentially be underpriced, particularly since the Decentralized Finance (DeFi) sector is still progressing. This period of underperformance offers potential investment opportunities for speculators, as decentralized exchanges continue to play a crucial role within the DeFi environment.

Platforms for decentralized exchanges (DEX) that are particularly robust could see significant advantages when it comes to a long-term strategy in the world of DeFi, which emphasizes enhancing user experience and adopting a straightforward regulatory framework.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-11-12 12:43