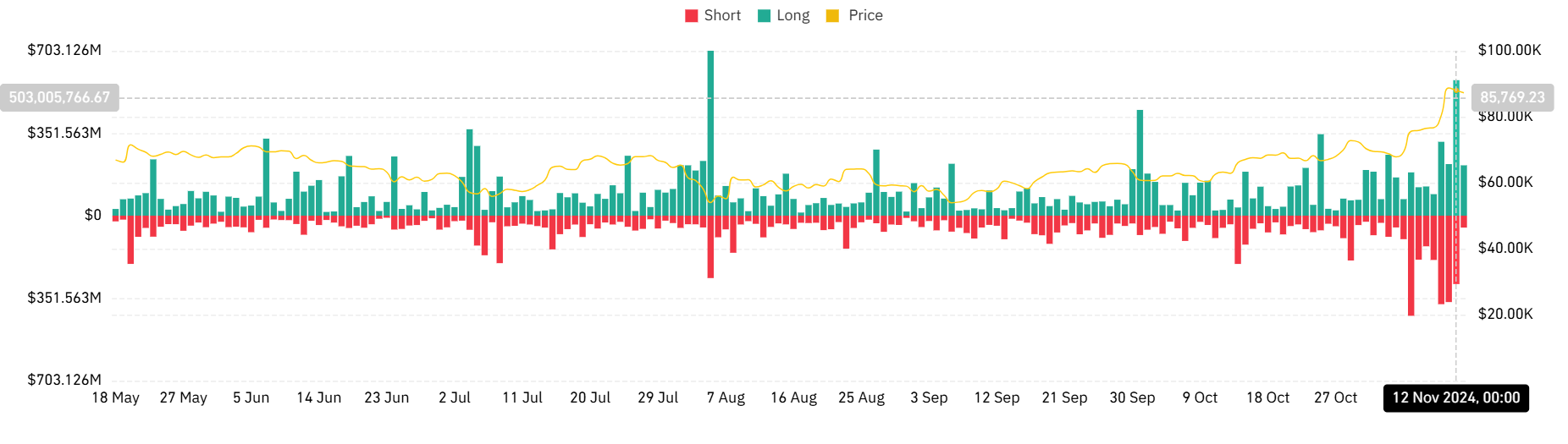

- Long and short positions saw a spike in liquidation volume in the last trading session.

- Bitcoin contributed over $500 million to the liquidation.

As an experienced crypto investor with battle scars from numerous market cycles, I’ve seen my fair share of liquidations – some painful and others exhilarating. The recent spike in liquidation volumes, particularly the $503 million+ wiped out by Bitcoin’s price movements, serves as a stark reminder that the cryptocurrency market is anything but predictable.

Lately, there’s been a lot of selling off (liquidation) in the cryptocurrency market, and Bitcoin [BTC] is leading these price fluctuations.

In turbulent market conditions, selling off both long and short positions provides valuable information about the current market situation. Recent findings shed light on the level of borrowing and potential risks within the cryptocurrency market.

Longs, shorts hit notable levels

As per the liquidation report on Coinglass, approximately $503 million worth of positions have been closed out due to recent Bitcoin price fluctuations, underscoring the effect of its swift market swings.

Moreover, during the recent trading session, the total liquidation amount on AMBCrypto’s assessment reached approximately $870 million.

This pattern shows that the market’s leverage is fragile, with investors who predicted continuous price increases being surprised by unexpected price drops.

Instead, the increase in short liquidations implies that Bitcoin’s latest surge compelled bearish traders to close their positions since the asset breached crucial resistance thresholds.

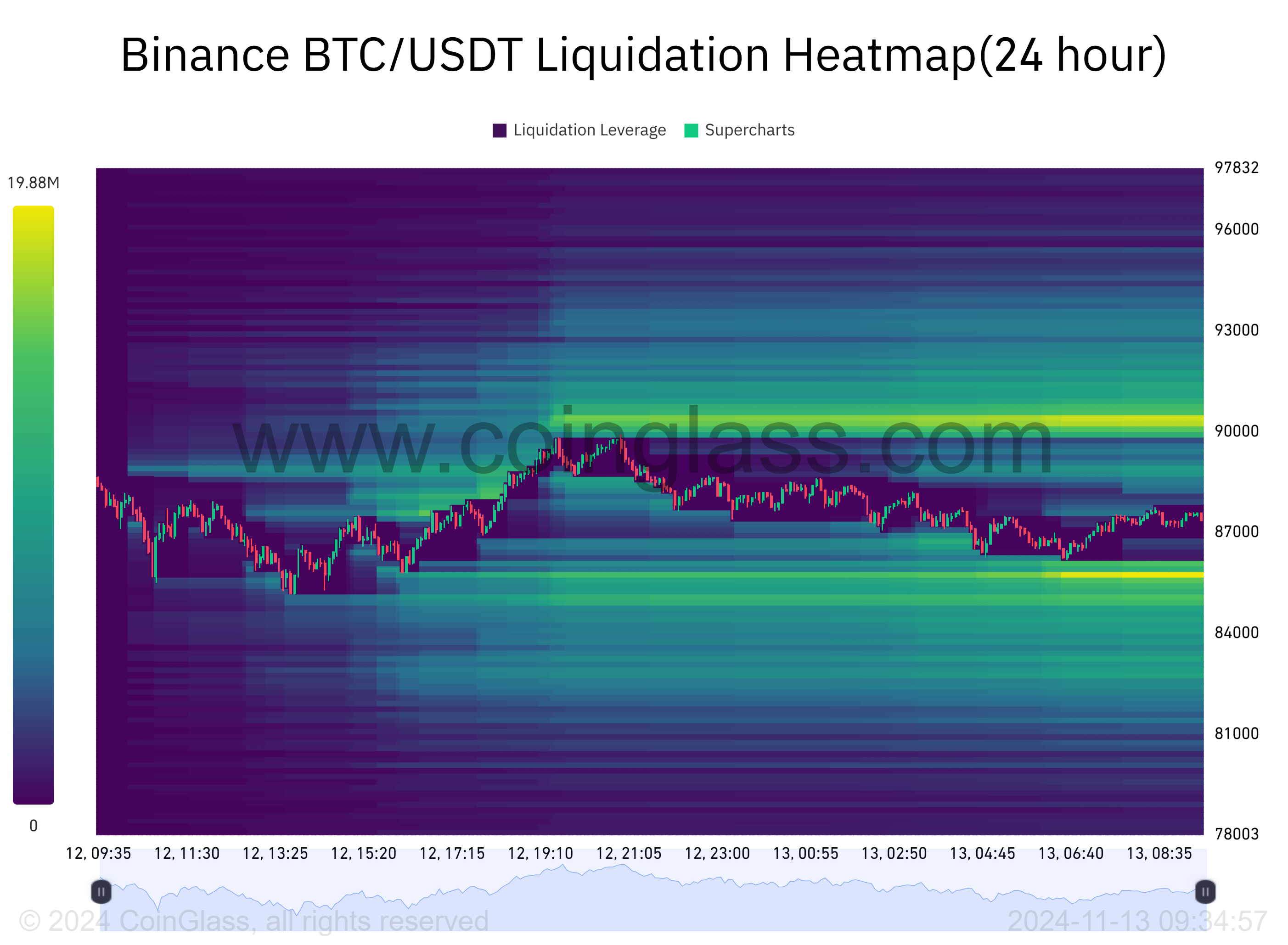

High leverage concentrations

The Binance BTC/USDT Liquidation Heatmap provided additional context, showcasing areas of concentrated liquidation activity.

The heatmap highlighted liquidation clusters between $84,000 and $88,000, with darker zones representing higher leverage and more significant liquidations.

The focus on Bitcoin’s psychological resistance points highlights the high level of speculative activity in this market.

On the graph, the bright yellow line pointed towards Bitcoin’s price approaching nearly $85,769, coinciding with a significant increase in both long and short liquidations.

Significantly, sell-offs became prevalent in the market as Bitcoin’s value fell from its latest peaks, causing stop-loss trades and margin demands.

It’s intriguing to note that the liquidation map shows a high concentration of leveraged trades around the present price points. This situation offers potential benefits as well as potential dangers.

In simple terms, these areas can help drive price movements by functioning as temporary reserves of liquidity. However, if the process of sell-offs continues, these zones could indicate a weakness in the market that might lead to further instability.

Market implications

The sharp increase in cryptocurrency withdrawals, notably on significant platforms such as Binance, mirrors the increased turbulence across the overall market.

As Bitcoin trades close to its record peaks, data on liquidations reveals a blend of investor excitement and potential risks among traders.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Traders keep a close eye on important price points and liquidation details to predict the market’s future trend changes.

Liquidations may amplify temporary price fluctuations, but they also offer chances for market balance restoration and the emergence of fresh trends.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-14 02:15