-

BTC has a silver lining; the sharper pullback may have flushed out weak hands.

Meanwhile, PEPE could still steal the spotlight.

As a seasoned crypto investor with battle-scars from multiple market cycles etched into my trading journal, I’ve learned to appreciate the unpredictable dance between BTC and its altcoin siblings. The latest BTC pullback has me reminiscing about the rollercoaster rides of yesteryears – a wild ride that’s both exhilarating and exhausting!

This month, two attempts have been made for Bitcoin [BTC] to surpass the $65K barrier, but each attempt was met with significant reversals afterwards.

The recent decline that brought Bitcoin down to $58K (its lowest point in more than two weeks) has sparked worries about a potential larger adjustment or pullback in price.

Currently priced at $62,662, as reported now, AMBCrypto cautions that should a similar trend continue, Bitcoin might experience additional pressure going downwards.

On the downside, we might be experiencing a sharper correction. But, this could also mean that speculative investors are leaving the market, paving the way for more robust investors to step in and increase their buying activity.

As a crypto investor, I’ve noticed that periods of market correction, or what I call “cleansing,” often pave the way for new growth and accumulation, creating a solid foundation for a comeback. Interestingly, while Bitcoin has faced some challenges, memecoins like PEPE have shown remarkable resilience. In fact, over the past week, PEPE has surged by more than 5%, suggesting an exciting revival in this niche sector of cryptocurrencies.

Generally, memecoins tend to flourish during times when the market is uncertain, attracting traders who are looking for potentially large profits despite the high level of risk involved.

But PEPE’s performance may still be tied to Bitcoin’s price action.

BTC is showing short-term potential

At the moment, Bitcoin appears to be trending towards a brief downturn, as buyers seem to be reasserting their dominance over the market.

In this situation, we’re creating a perfect setup for a ‘short-squeeze event’. This means that those who have sold Bitcoin (BTC) without owning it (the short sellers) may find themselves in a position where they must purchase BTC to cover their positions. As more of these individuals buy BTC, the value of each token tends to increase.

However, this doesn’t guarantee a rebound strong enough to position BTC for a bull run to $70K.

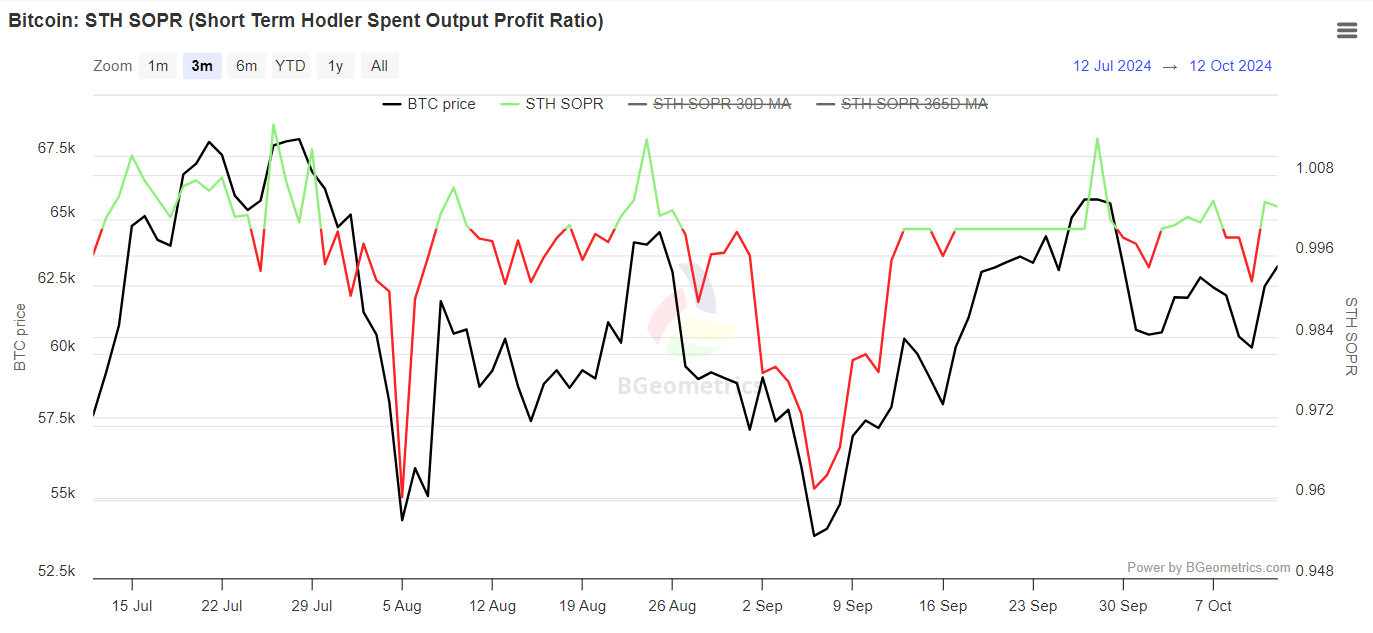

Over the last seven days, investors who’ve held Bitcoin for a prolonged period haven’t been very active, whereas those who bought within the last 155 days have been selling, which is suggested by the green downward trend or “wig.

In a thriving stock market environment (bull market), excessive selling can indicate an approaching peak in the market. With more investors cashing out their gains, there’s growing unease about a possible larger correction that might drive Bitcoin prices down below $60K again.

If the $62K level is confirmed as the market’s lowest point, marked by a majority of traders going long, large holders holding firm, and many seeing this as a buying opportunity rather than a downturn, it could indicate the beginning of an accumulation period.

Keeping a close eye on these actions is essential. Even minor deviations from these patterns might reduce the chance of recovery, which appears probable at this moment.

PEPE might stay in the green

As a researcher, I’ve observed an intriguing pattern historically – memecoins tend to experience significant surges when the value of Bitcoin corrects. This phenomenon arises due to traders seeking out high-risk, high-reward opportunities amidst a volatile and uncertain market.

However, they are also highly sensitive to Bitcoin’s broader market direction.

If Bitcoin maintains its present position and begins to surge, it’s possible that PEPE might temporarily drop due to traders redirecting their attention towards Bitcoin and other prominent cryptocurrencies.

From my perspective as an analyst, should Bitcoin experience a downturn, there’s a possibility that PEPE could gain traction during another memecoin surge. This momentum might propel PEPE to reach new peak levels.

Despite numerous recently introduced meme coins experiencing high double-digit increases, it’s possible that PEPE will maintain its upward trend too.

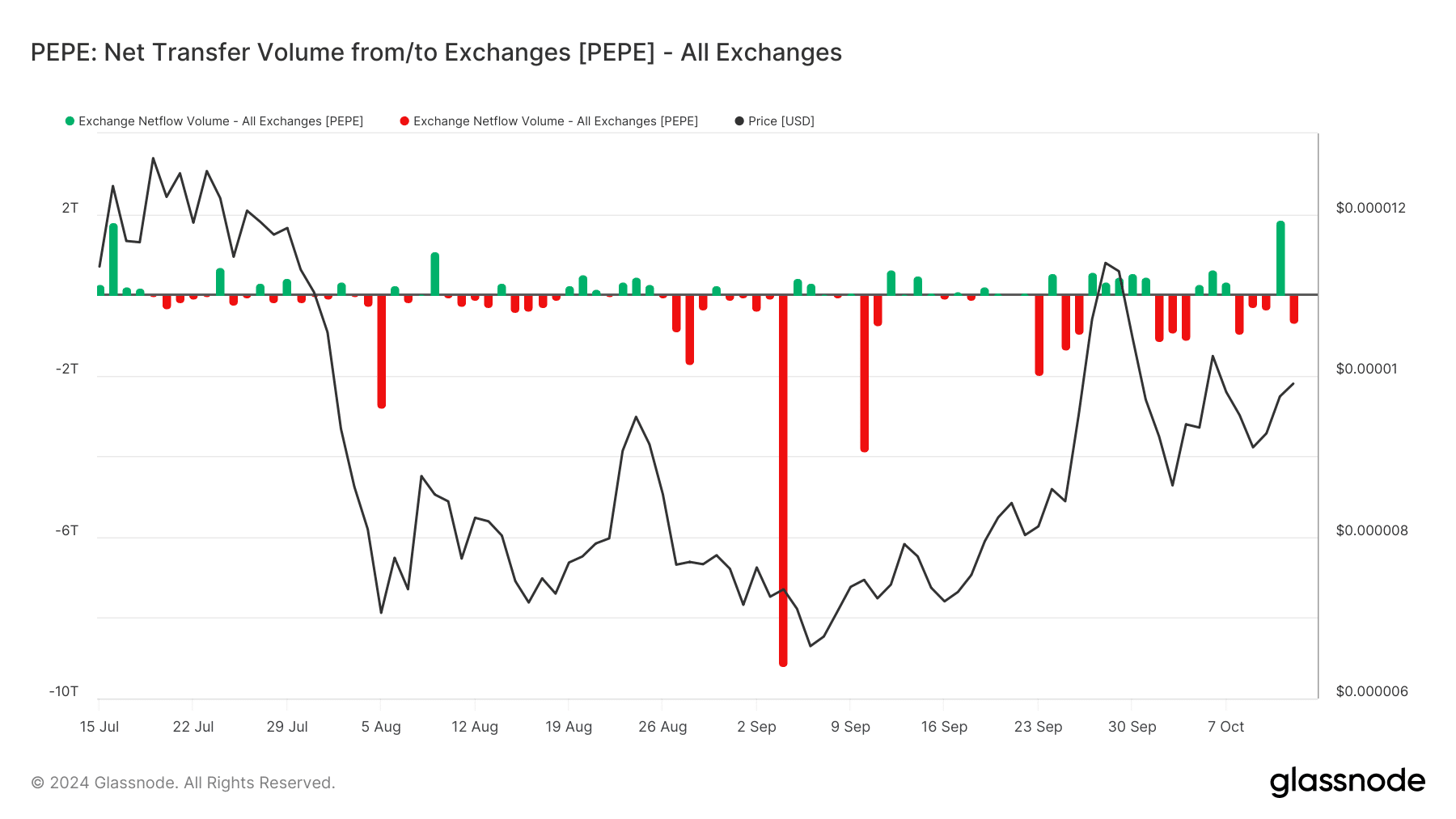

Source : Glassnode

In the last three days, PEPE surged above $0.000010 but struggled to hold that level.

Over the past three months, a massive deposit of approximately 1.8 trillion PEPE tokens onto exchanges – the largest amount in that time frame – has created challenges for the ‘bulls’ (those who expect prices to rise) in sustaining their upward trend.

This highlights just how volatile memecoins can be. Interestingly, as BTC pulls back, PEPE is again experiencing an increase in net withdrawals, which historically signals a market bottom.

As a crypto investor, I’ve noticed that for a strong bull market, it’s essential to maintain consistent net outflows from cryptocurrency exchanges. This pattern is crucial because it reflects a healthy demand for digital assets. However, if this trend of outflows were to reverse as Bitcoin regains its dominance, it might dampen the renewed optimism that’s currently surrounding PEPE, potentially affecting its market performance.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

All signs point towards meme coins being preferred at the moment. The upcoming days are significant as they may indicate whether Bitcoin can recover its power, or if PEPE will persist in stealing the limelight instead.

If it does, PEPE might soon break past the $0.000010 resistance.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-10-13 17:12