-

Bitcoin’s Open Interest surged to over $19 billion after a $2.5 billion Futures liquidation.

BTC faces strong resistance at $63,400, with recent price hovering around $62,700 after a 3% rise.

As a seasoned researcher with years of experience observing and analyzing the cryptocurrency market, especially Bitcoin [BTC], I have witnessed its fair share of ups and downs. The recent events involving Bitcoin Futures Open Interest have been quite intriguing.

As a researcher studying Bitcoin’s [BTC] market dynamics, I’ve observed notable fluctuations in Open Interest after a recent price spike. This volatility led to the liquidation of multiple trading positions.

As an analyst, I’ve observed that, despite certain market fluctuations, the open interest in Bitcoin Futures remains robust, with a significant surge observed recently, suggesting persistent trader engagement.

Bitcoin Futures experience a shake-up

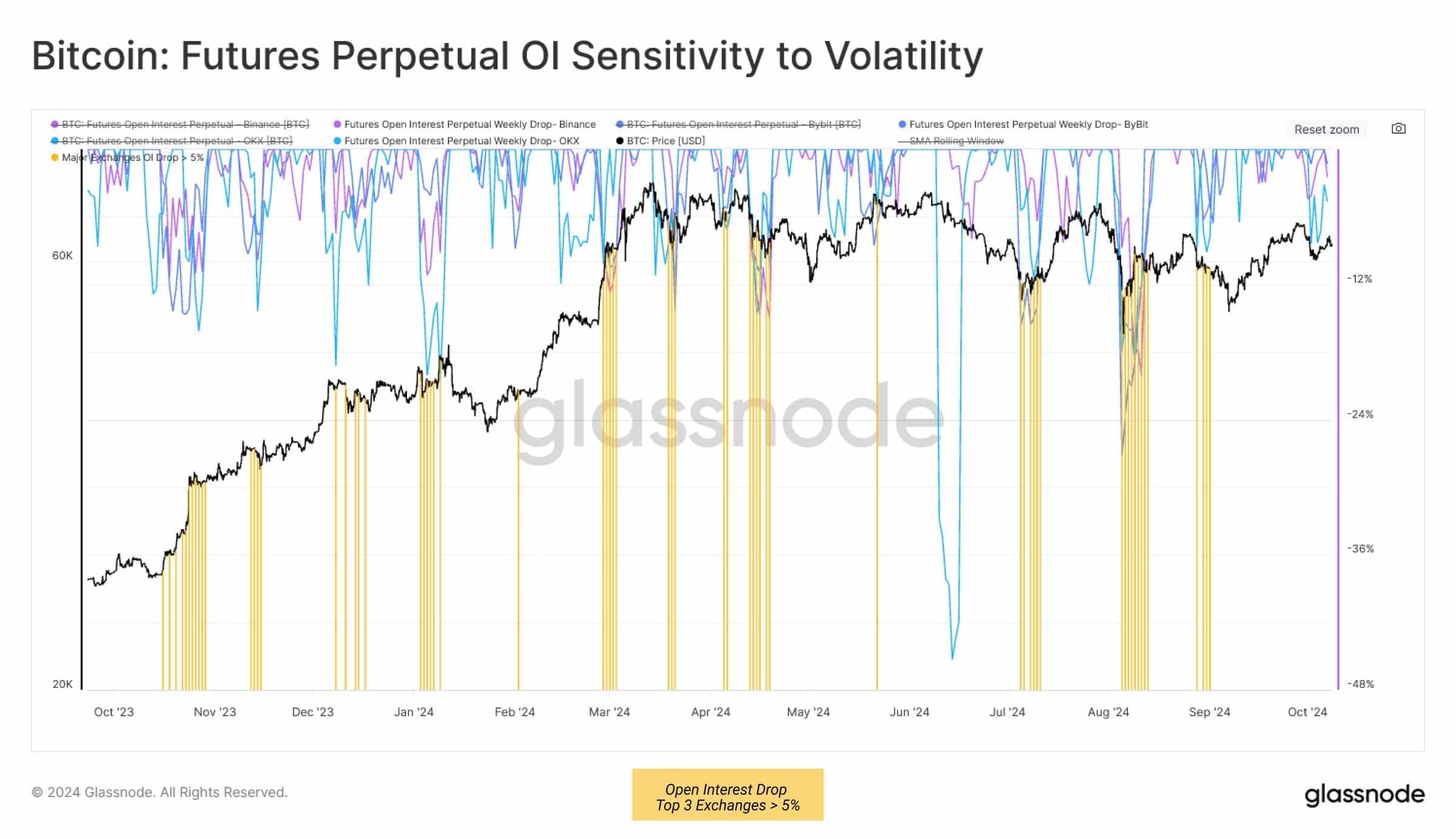

According to data from Glassnode, around $2.5 billion in Bitcoin Futures positions had to be liquidated during the price surge, possibly pushing out numerous individuals who had bet against Bitcoin’s rise, or short-sellers.

On the other hand, despite the significant impact, the decrease in Open Interest among the leading perpetual exchanges was less than 5%. This suggests that it didn’t cause a catastrophic market crash.

As a researcher, I’ve observed that the market has demonstrated remarkable resilience, maintaining its strength even in the face of increased volatility. This could potentially impact leveraged traders significantly.

In the past, the overall expense related to leveraged positions during Bitcoin’s peak weekly value (record high) could go up to a staggering $120 million.

Over the past few weeks, this figure has fallen to approximately $15.3 million weekly, indicating a substantial decrease in high-risk, long-term trades as the market shifted into a period where prices were expected to stay within a specific range.

Increased funds flow into Bitcoin’s Open Interest

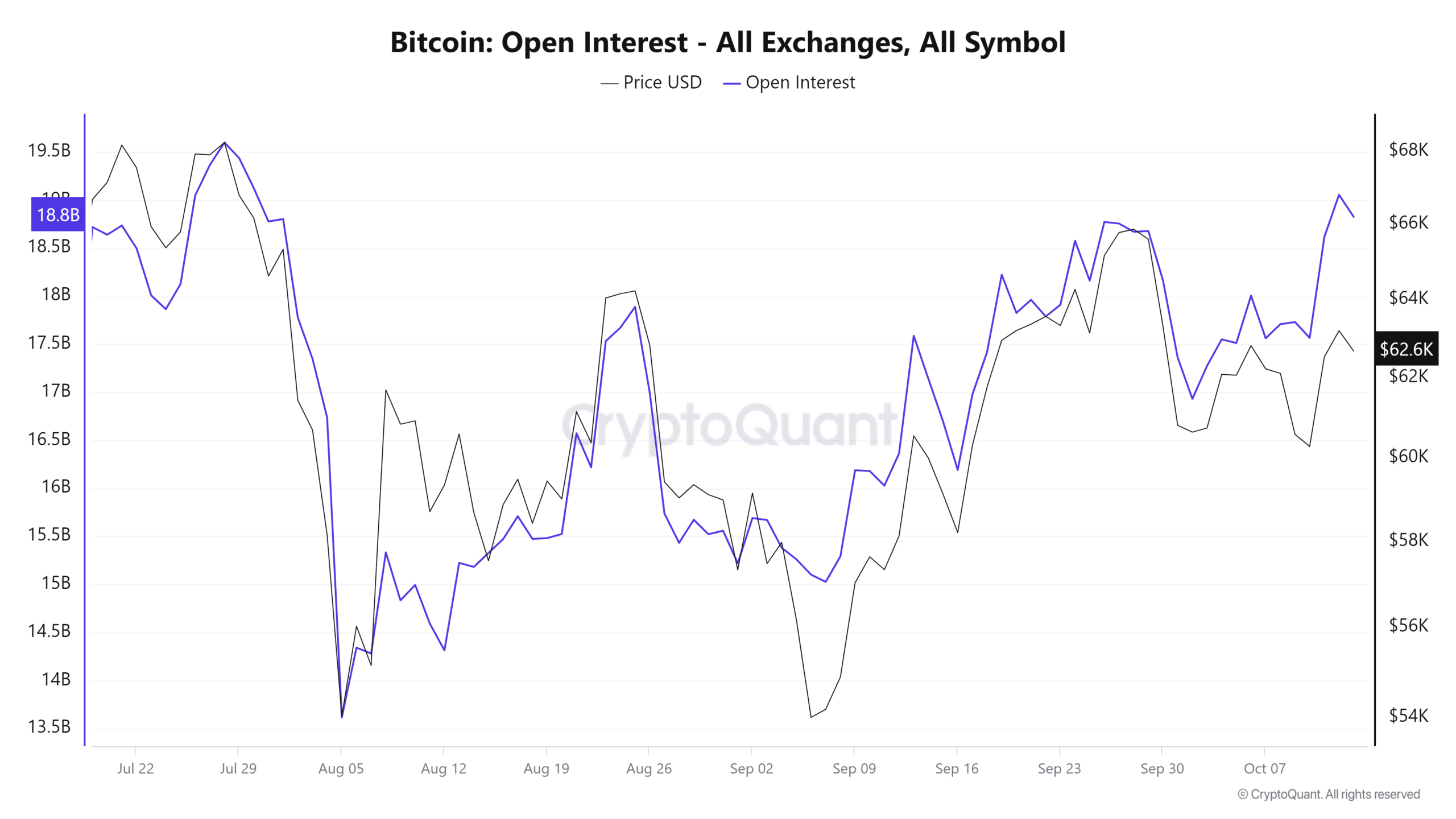

Despite the earlier closures of large positions, traders continue to open new ones.

Based on CryptoQuant’s data, the Open Interest for Bitcoin increased from approximately $17.5 billion on October 10th, to more than $19 billion by October 12th.

Despite a minor drop since that time, the Open Interest continued to be robust, surpassing $18 billion.

The surge in attention from investors is mainly due to Bitcoin’s latest price rise, causing it to surpass the $63,000 threshold.

An increase in Open Interest suggests that traders are proactively arranging their positions, indicating they expect more fluctuations in the market prices ahead.

BTC faces resistance at key price levels

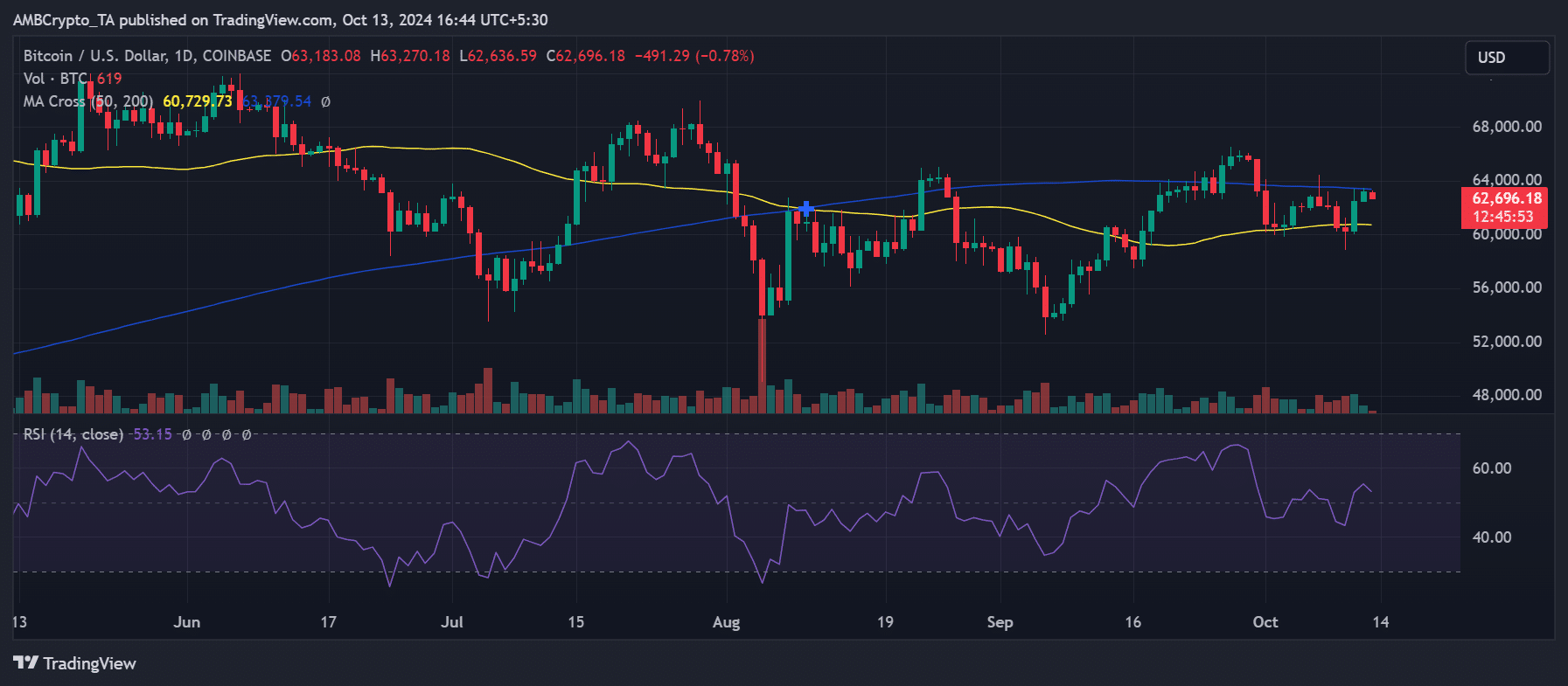

On the 11th of October, I observed a significant 3% surge in Bitcoin’s daily price chart, propelling its value to approximately $62,500.

This rally also pushed the price above the 50-day moving average (yellow line), which had previously served as a significant resistance level.

Currently, Bitcoin encountered stronger obstacles near its 200-day moving average (represented by the blue line) which falls approximately at $63,400.

Despite reaching approximately $63,100 due to a recent price spike, Bitcoin was unable to surpass the significant resistance at that point.

Currently, Bitcoin is experiencing a slight dip, now priced at approximately $62,700. This decrease represents a 1% fall, pushing its value further away from the potential resistance level.

Regardless of temporary market turbulence and the compulsory shutdown of numerous Future Contracts, Bitcoin’s Future Contract volume remains robust.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The recent price surge to $63,000 reflects increasing optimism among traders, although it faces strong resistance around $63,400.

Over the next few days, we’ll find out if Bitcoin can surpass this critical level or if it will encounter further obstacles at this significant pricing threshold.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-14 06:16