-

Mt. Gox’s BTC distribution raises concerns about potential market volatility

Bitcoin showed some resilience, despite ongoing Mt. Gox asset distributions

As a seasoned researcher who has witnessed the rollercoaster ride that is the cryptocurrency market, I find myself both intrigued and cautious about the latest developments surrounding Mt. Gox’s BTC distribution. The potential for market volatility is undeniably high, given the magnitude of the assets involved and the long-waiting creditors. However, Bitcoin has shown an impressive resilience in the face of such events, a trait that I’ve come to expect from this notoriously unpredictable digital asset.

More recently, Arkham Intelligence, a company specializing in blockchain analysis, disclosed that a digital wallet linked to the bankrupt Mt. Gox exchange’s trustee executed a trial transaction with approximately $2 billion in Bitcoin [BTC] as part of its activity.

What happened?

As a seasoned cryptocurrency investor and observer with over a decade of experience in this rapidly evolving industry, I find myself intrigued by the recent transfer of $3.1 billion worth of Bitcoin (BTC) to BitGo. Given my extensive background in tracking market trends and analyzing blockchain transactions, I cannot help but interpret this move as potential preparations for the long-awaited distribution of funds to creditors.

According to Arkham analysts,

“It’s plausible that the wallet address bc1q26 belongs to Bitgo, one of the five exchanges collaborating with the Mt. Gox Trustee in distributing funds to Mt. Gox creditors.”

For the less informed, BitGo is among the few entities still involved in the distribution process from Mt. Gox. It holds a significant position, being one of the five companies responsible for dispersing digital tokens to claimants.

Last week’s test transaction involving 33,100 BTC worth approximately $2.2 billion highlights continuous work towards readying the anticipated dispensation of funds stemming from the Mt. Gox cold wallet, containing the assets of creditors who have been eagerly waiting for their share.

Why BitGo?

Based on information from Arkham Intelligence, it’s probable that BitGo received these transactions because it serves as one of the main distributors, managing the intricate procedure of returning funds to Mt. Gox creditors.

“We found the location grouped within a significant data cluster, and after analyzing the characteristics such as custody framework and wallet types, we recognized it as belonging to BitGo.”

Indeed, some Reddit users have added credence to these doubts, asserting that they have already been credited with funds in their BitGo wallets.

The story around Mt. Gox

As a researcher delving into the intricacies of the digital currency landscape, I’ve noticed a stir in the market surrounding the distribution of the remaining 140,000 BTC and Bitcoin Cash (BCH) from Mt. Gox. The concern revolves around the possibility of sell-offs by creditors who have been patiently waiting for their share. This potential mass selling could have significant implications for the cryptocurrency market.

The Bitcoin prices dropped below $54,000 following the start of this event in early July, a period that saw a significant impact on their value.

46,000 Bitcoin, stored in Mt. Gox wallets, may be gradually distributed via recognized platforms such as Bitbank, BitGo, and Kraken. The potential impact on the market’s stability could be significant, contingent upon the decisions creditors make regarding their holdings.

Impact on Bitcoin

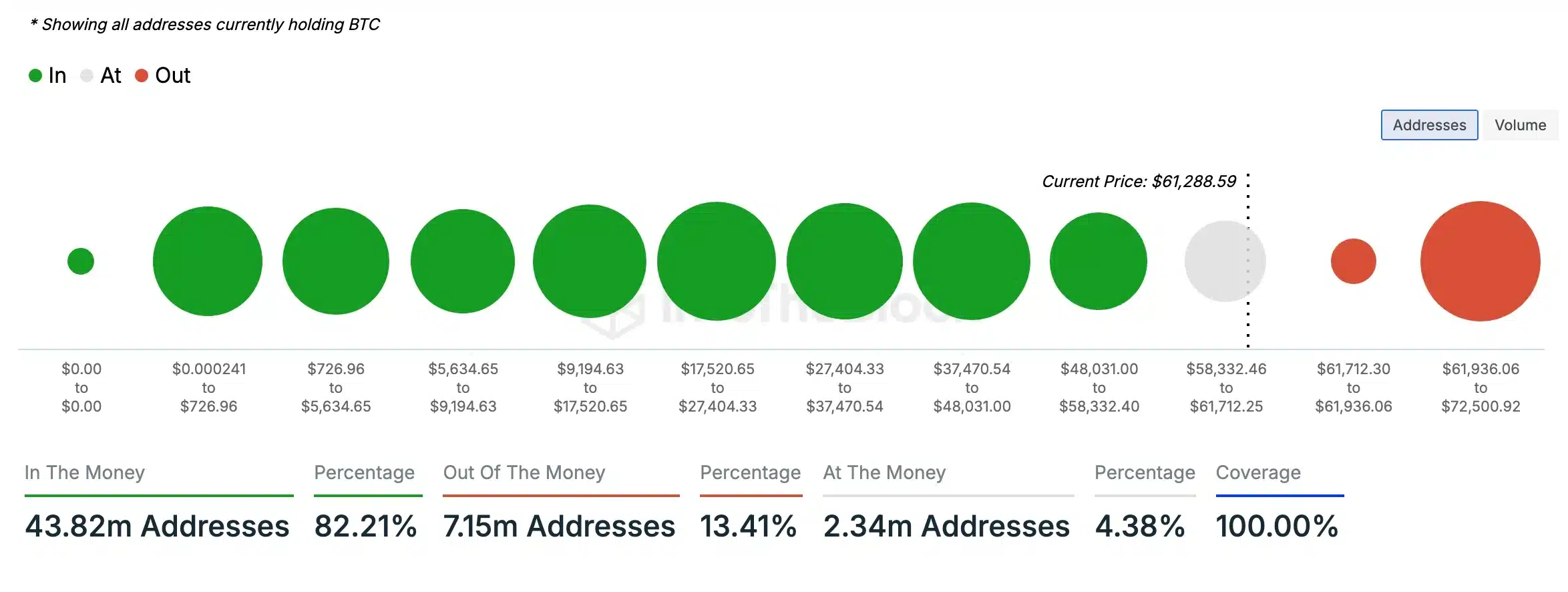

In spite of worries over possible selling activity, Bitcoin continued to show strength in its price graph. Currently, it was being traded at around $61,284, reflecting a 4.61% increase over the past day.

This price stability can be seen as a sign of strong market sentiment. Especially as 82.21% of BTC addresses are currently “in the money,” with their holdings valued above the purchase price.

Contrarily, a sizable majority (86.59%) of these addresses appear to be “in the money,” suggesting minimal upward pressure or risk for significant downturns within the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-14 21:32