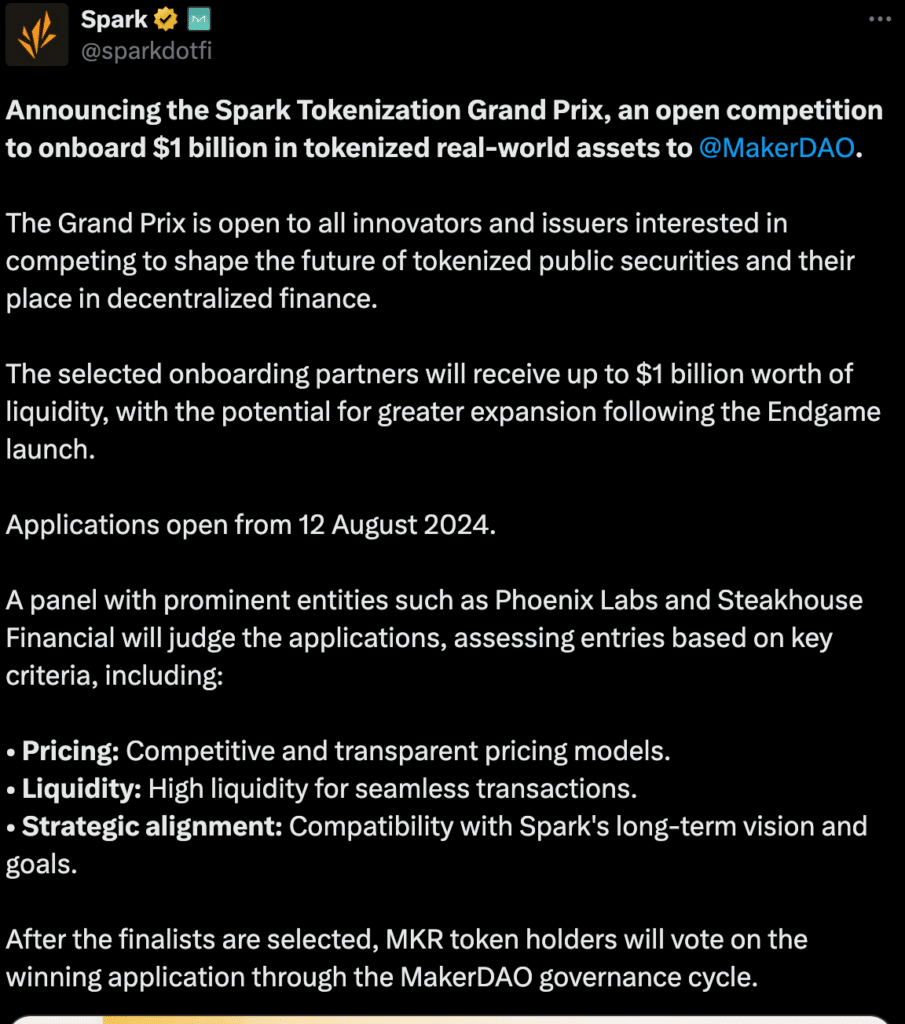

- MakerDAO announced an open competition to invest $1 billion in tokenized U.S Treasury offerings

- MKR’s price registered a significant uptick thanks to this announcement

As an experienced financial analyst, I believe that MakerDAO’s recent announcements at ETHCC have been pivotal in driving the significant price surge of its native token, MKR. The prospect of investing $1 billion in tokenized U.S. Treasury offerings has attracted substantial attention from industry heavyweights and further solidified MakerDAO’s position as a DeFi pioneer.

Over the past 24 hours, MKR experienced a notable surge in price following a prolonged downturn. This price increase can be linked to the exciting developments announced at Ethereum Community Conference (ETHCC) for the MKR protocol.

Making the right moves

MakerDAO’s announcement of a $1 billion investment program for tokenized U.S. Treasury securities has sparked great interest among industry leaders, such as BlackRock, Superstate, and Ondo Finance, who have publicly expressed their intention to join this initiative.

MakerDAO is making U.S government bonds and bills, known as Real-World Assets (RWAs), a priority in its system. By doing so, it aims to tackle a significant issue in the decentralized finance (DeFi) sector and strengthen its reputation as an early innovator in this field. This move aligns with MakerDAO’s long-term vision, as outlined by Founder Rune Christensen, and marks a significant shift in the platform’s approach to managing its reserves.

Ultimately, the goal is to fortify MakerDAO’s dominance within the DeFi ecosystem.

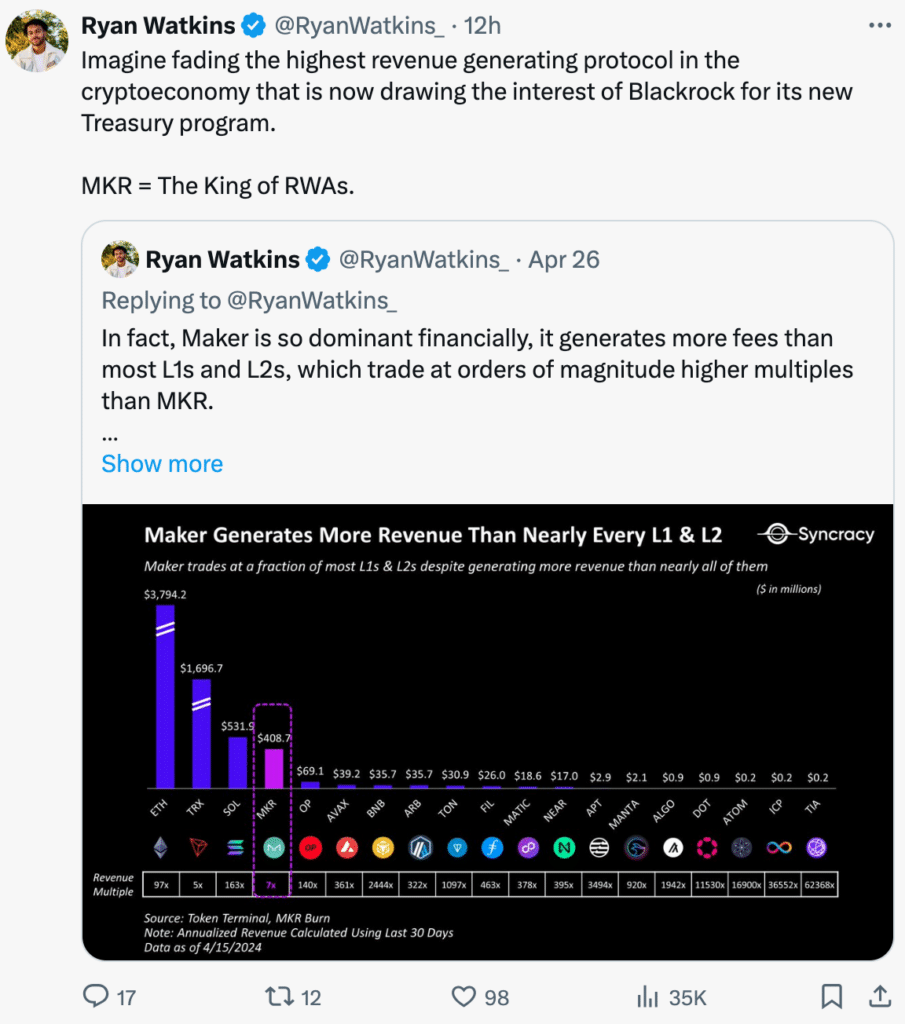

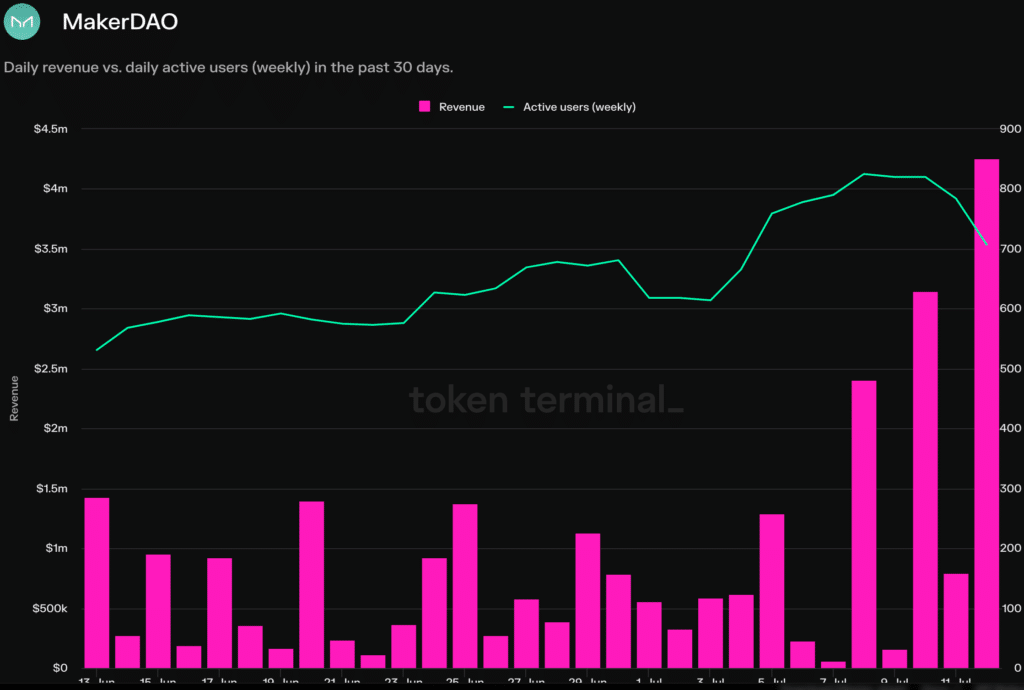

As an analyst, I’ve observed that beyond just institutional interest, MakerDAO’s remarkable ability to generate revenue has been a significant factor fueling its growth.

Ryan Watkins, the Co-founder of Syncrancy Capital, pointed out that MakerDAO generates more fees than most Layer-1 and Layer-2 networks, an achievement despite these networks having much higher market valuations.

It’s noteworthy that AMBCrypto’s examination of Token Terminal’s statistics showed a significant increase of 39.8% in daily active addresses during the last month. Furthermore, MakerDAO’s earnings experienced a growth of approximately 25% over this time frame.

MKR sees green

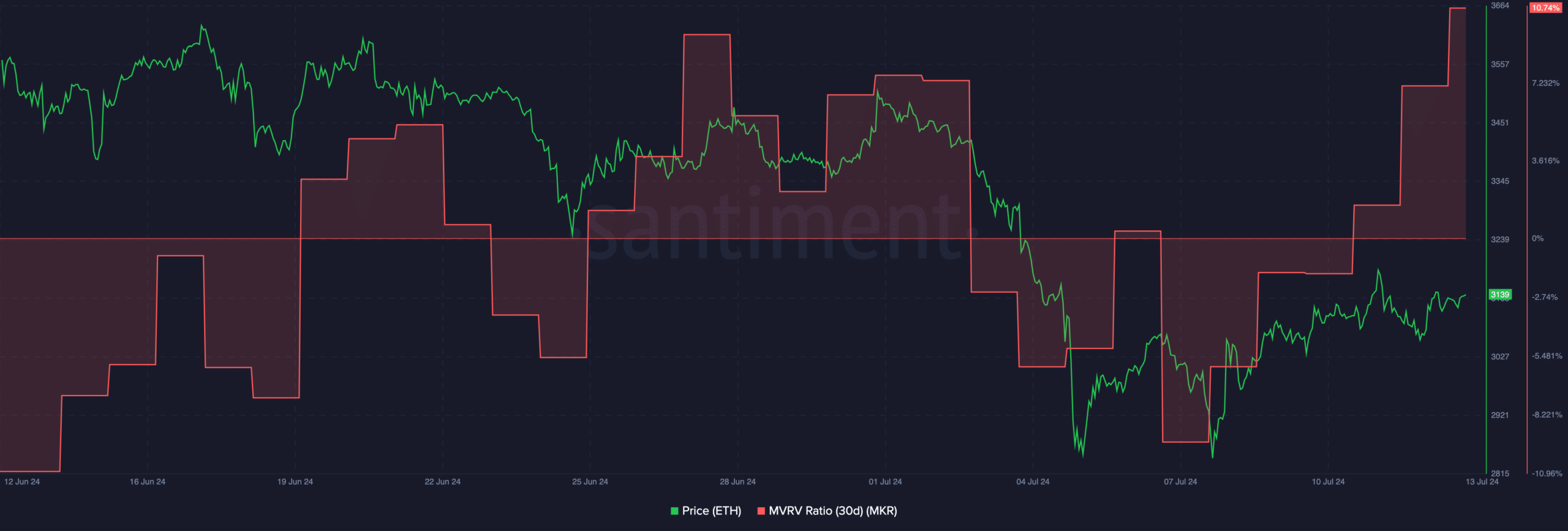

I’ve noticed an impressive increase in MKR’s value at present, as it’s trading at $2,651.82. Over the past 24 hours, this altcoin has experienced a substantial growth of 10.9%. Additionally, its MVRV ratio has risen significantly, suggesting that many crypto users are currently making considerable profits with their MKR holdings.

A large difference between the current market value and the cost basis for an asset (represented by a high MVRV ratio) often signals that some investors may be looking to sell and realize their profits, potentially leading to a decline in the asset’s price.

Realistic or not, here’s MKR’s market cap in BTC’s terms

Due to the MKR token’s role in granting voting privileges, it’s plausible that certain purchasers aren’t primarily motivated by profits but by exercising influence over MakerDAO’s future direction.

Some token holders might decide against selling, resulting in less selling pressure than anticipated for tokens with elevated MVRV ratios compared to others.

Read More

2024-07-14 00:07