As a seasoned cryptocurrency investor and observer with over five years of experience in the dynamic digital asset market, I find the Q2 2024 report from CoinGecko particularly intriguing. The crypto landscape has always been an exciting yet volatile space, and this quarter was no exception.

Over the past few years, the crypto industry has experienced a succession of significant events, from steep declines and collapses to scandals, milestones like Bitcoin halving and Ethereum‘s Merge, and regulatory approvals for Bitcoin and Ethereum ETFs. Each occurrence left its mark on the market in various ways.

Despite the ongoing market recovery and consolidation following the Bitcoin halving in early 2024, the crypto market finished Q2 of that year with a total capitalization of approximately $2.43 trillion. This figure represents a decrease of around 14.4% compared to the first quarter of 2024. However, the market is making efforts to expand or at least stabilize its value.

In Q2 2024, we witnessed a multitude of noteworthy occurrences and transformations. CoinGecko meticulously compiled and analyzed this data, producing an exhaustive report generously supported by BingX.

As a crypto investor, I can relate to Bobby Ong’s analysis of the 2nd quarter of 2024. The market experienced consolidation after Bitcoin’s halving, with various developments taking place. Airdrops were a topic of debate during this period. Looking ahead, the second half of 2024 may bring uncertainty, but there are positive signs: improving economic conditions and teams persisting in their efforts to build despite price fluctuations.

Thus, let’s discuss the Q2 2024 crypto industry report by CoinGecko.

Top Insights

-

Bitcoin experienced a new halving and a 21.6% fall in trading volume

The total crypto market cap dropped by 14.4%

The Bitcoin mining hash rate hit a new ATH

CEX spot trading volume was down by 12.2%

DEX spot trading volume increased by 15.7%

Meme coins were the top crypto narrative

Ethereum became inflationary, adding 120,000 ETH to the circulating supply

1. Bitcoin, the ATH, and the Halving

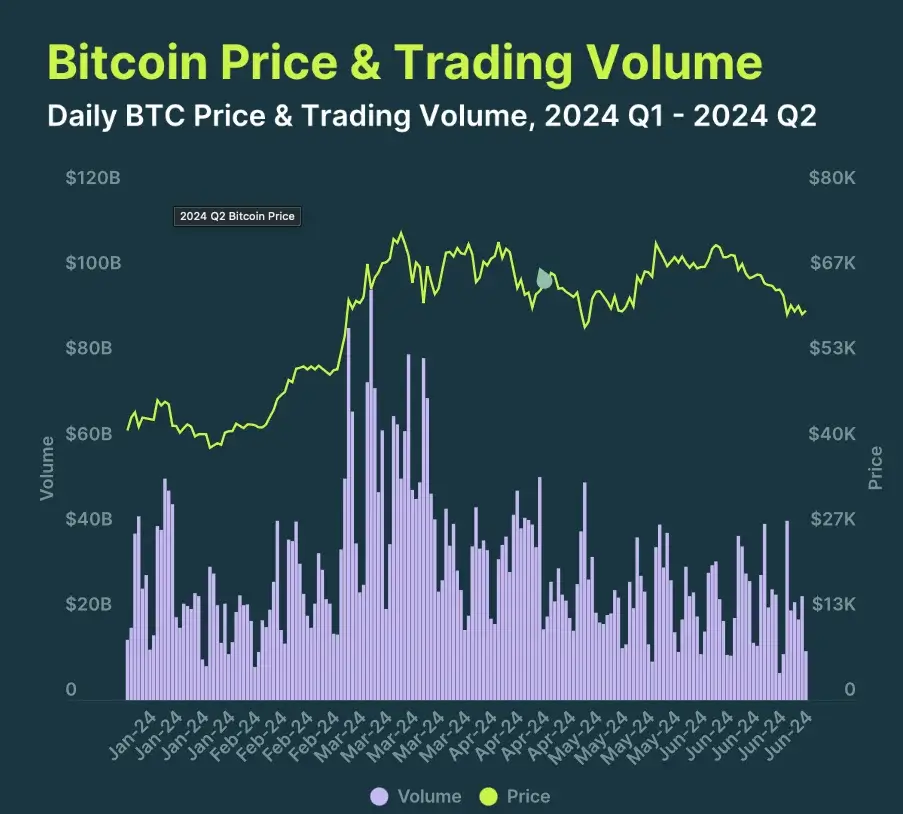

In the first quarter of 2024, Bitcoin set a new record high, peaking at $73,098 around mid-March. Subsequently, its price fluctuated around the $58,000 to $72,000 range.

The price of Bitcoin underwent significant influence from an anticipated development within the cryptocurrency sector: the Bitcoin halving. Specifically, this was the fourth instance of such an event, resulting in a reduction of 50% for the block reward. Presently, the reward is valued at 3.125 BTC.

After hitting a fresh all-time high in cryptocurrency markets around March, following the halving on April 20, 2024, its price took a downturn, settling around $58,000. This price drop was anticipated given Bitcoin’s historical trend of consolidation following a new halving event. It remains plausible that this phase of market stabilization is still ongoing.

In the second quarter of 2024, Bitcoin’s daily trading volume noticeably decreased, dropping down to an average of $26.6 billion per day. This represents a 21.6% decline in comparison to the preceding quarter.

One notable occurrence that had an impact was the recent action taken by Mt Gox, a well-known Bitcoin exchange, transferring approximately 140,000 BTC from its reserves, amounting to around $9 billion. The exchange moved these funds to cold storage and some undisclosed wallets. In addition, the German government announced its decision to dispose of a substantial portion of its Bitcoins held in their reserves.

2. The Evolution of the Total Crypto Market Cap

As a researcher studying the cryptocurrency market, I’ve observed significant shifts in the market cap during the second quarter of 2024. These alterations were partly driven by new introductions and regulatory approvals for crypto trading products, including Bitcoin and Ethereum exchange-traded funds (ETFs).

From my perspective as a market analyst, the total cryptocurrency market capitalization underwent significant shifts due to several factors. The Bitcoin halving and subsequent consolidation period played a pivotal role in influencing the market’s behavior. Additionally, various events within the crypto industry and specific project developments contributed to these fluctuations.

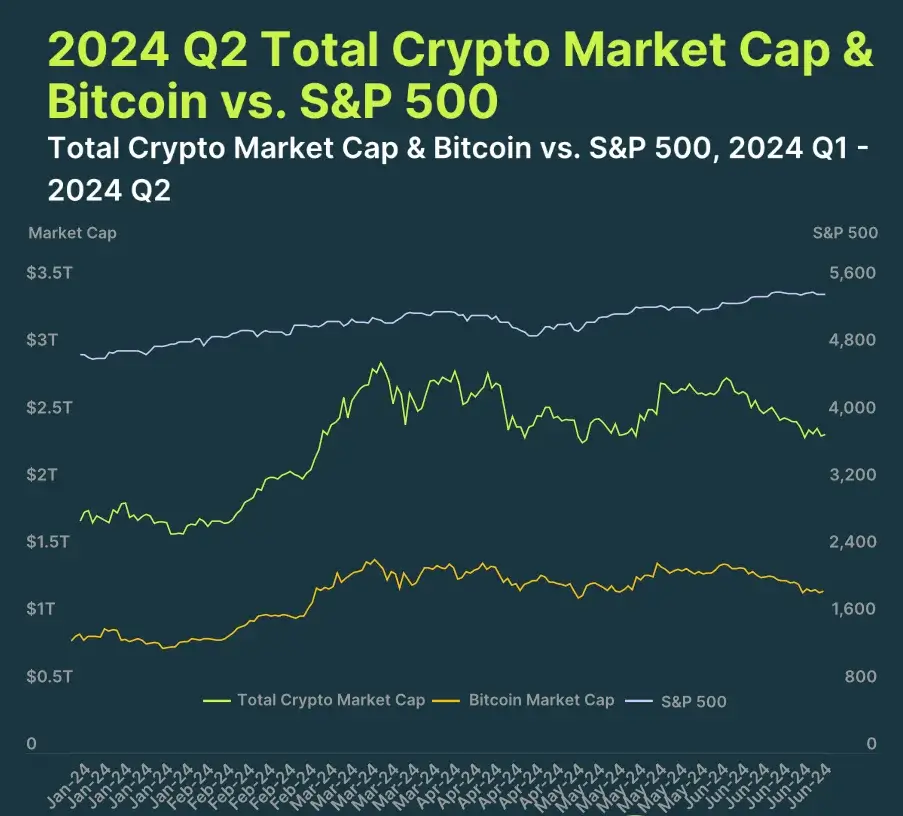

Based on CoinGecko’s findings, the total cryptocurrency market capitalization decreased by 14.4% or $408.8 billion compared to Q1 2024, and stood at $2.43 trillion by June’s end in Q2 2024. Throughout this quarter, the market cap ranged from $2.30 trillion to $2.90 trillion but failed to establish new record highs.

During that time, the S&P 500 made good use of Q2 2024 by gaining a 3.9% return on investment. Consequently, the connection between the overall crypto market capitalization and the S&P 500 became weaker, with a correlation coefficient of 0.16 in contrast to the stronger correlation of 0.84 seen in Q1 2024.

3. A New All-Time High for Bitcoin Mining Hash Rate

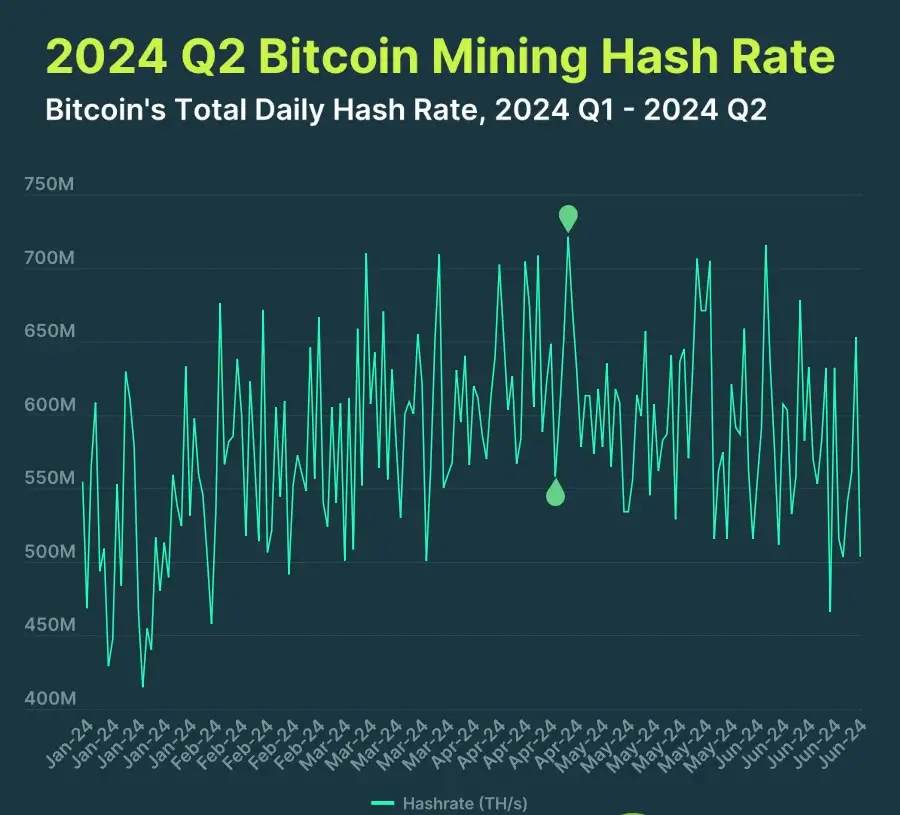

I’ve analyzed the Bitcoin mining landscape, and as anticipated, the mining hash rate attained a new record high of 721 million TH/s on April 23, 2024. However, contrary to expectations, the second quarter of 2024 witnessed a significant decline of 18.8% in the Bitcoin mining hash rate. This marks the first downward trend for Bitcoin’s hash rate since Q2 2022.

Despite a substantial decrease in Bitcoin’s mining hash rate, companies like BitDigital, Terawulf, Core Scientific, Hive, and Hut 8 remained unfazed. In response, these industry giants have either initiated forays into artificial intelligence (AI) or at least began exploring this field by initiating the development of relevant products or features.

As a seasoned observer of the cryptocurrency market, I have witnessed the meteoric rise of Tether, one of the most prominent players in this space. And now, they have made headlines once again with their recent $500 million investment into the mining sector. This move signifies a bold step forward and underscores their commitment to driving innovation in the industry.

4. Spot Trading Volume on CEXs Was Down by 12.2%

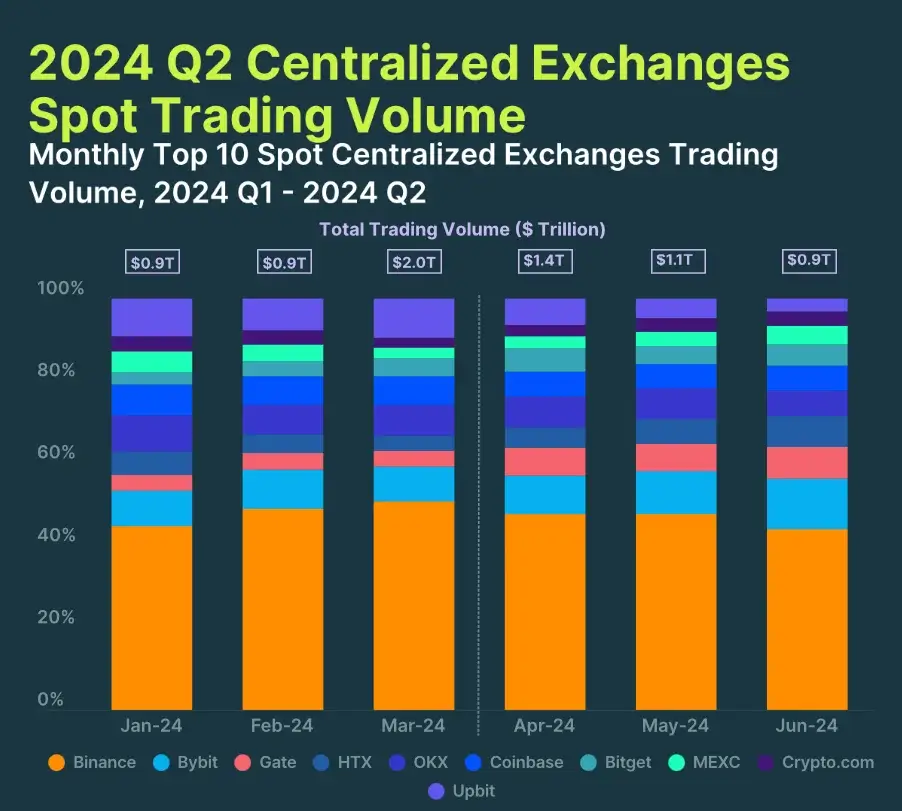

In the world of cryptocurrency trading, both spot markets on centralized exchanges and centralized exchanges themselves remain preferred choices due to their accessibility. Nevertheless, it’s important to note that the trading volume for spot markets on these exchanges amounted to $3.4 trillion in Q2 2024, marking a decline of 12.2% compared to the previous quarter (Q1 2024).

The examination was conducted on the ten major centralized trading platforms currently operating, specifically Binance, Bybit, Gate.io, Huobi Global renamed HTX, OKX, Coinbase, Bitgate, MEXC, Crypto.com, and Upbit.

Based on CoinGecko’s data, Binance held the top spot among cryptocurrency exchanges with a 45% market share as of Q2 2024’s close. Despite some company-related and executive issues, Binance managed to maintain its position. Bybit emerged as the second largest exchange, boosting its market share to 12.6% in June 2024.

5. Decentralized Exchanges Were Up by 15.7%

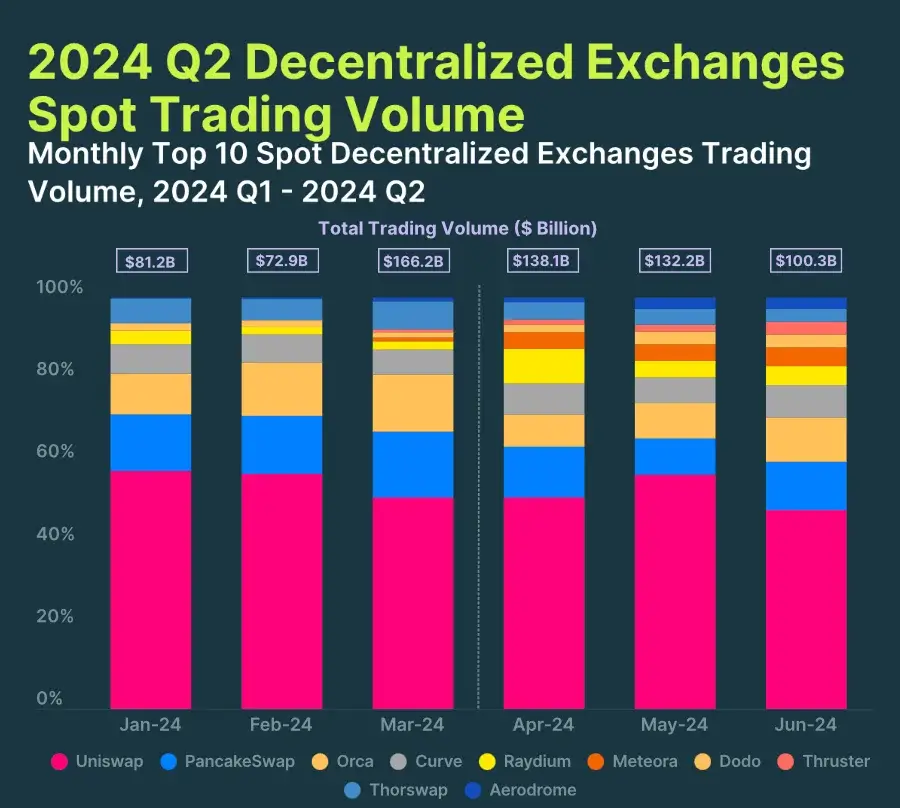

Although Decentralized Exchanges (DEXs) had relatively smaller quarterly trading volumes compared to their centralized counterparts, they registered a significant 15.7% growth in QoQ volume. The leading DEXs were Uniswap, PancakeSwap, Orca, Curve, Raydium, Meteora, Dodo, Thruster, Thorswap, and Aerodrome. Collectively, these top 10 platforms recorded a substantial trading volume of $370.7 billion in spot transactions.

Uniswap, as anticipated, held the number one spot amongst decentralized exchanges with a market share of 48% by the close of June 2024. Notably, Thruster exhibited an unexpected growth trajectory, recording a substantial 464.4% ($6 billion) surge in volume quarter-over-quarter. Consequently, Thruster claimed the title for the most significant growth in Q2 2024.

But what factor led to such an increase in DEX spot trading volume?

6. Meme Coins’ Popularity Reached New Heights

If you’ve been involved in the crypto world for the past six months, you’ve likely observed the significant growth and transformation of meme coins. Numerous new meme-inspired tokens have emerged, while established ones have seen a surge in market value. As a result, meme coins have remained a popular and significant discussion point since the start of 2024.

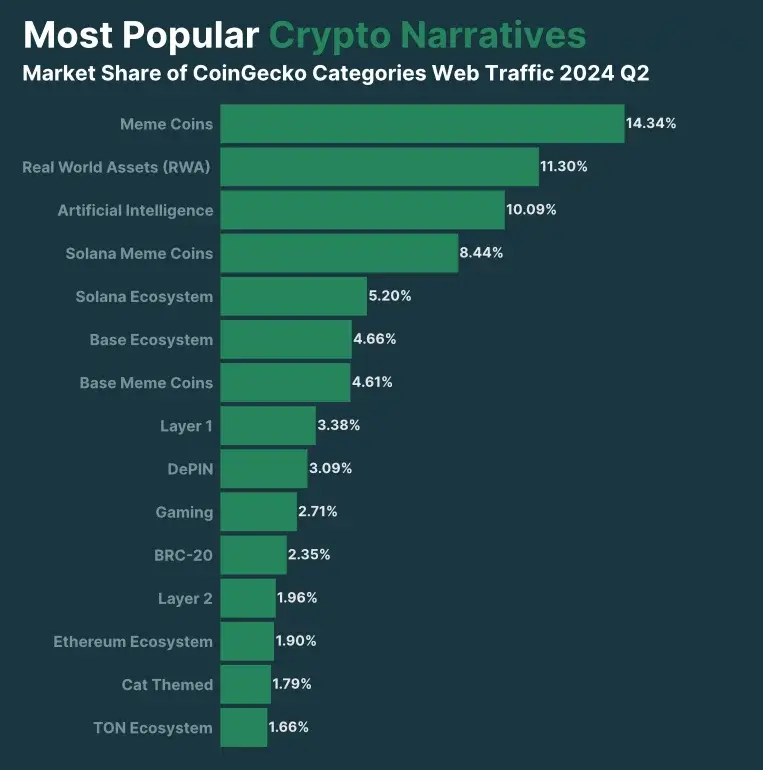

In the second quarter of 2024, meme coins dominated the crypto conversation, accounting for around one-third (29.18%) of the total market share, with four out of the fifteen most prevalent crypto narratives revolving around this trend.

In simpler terms, Memecoins held the first and second largest market shares among Real World Assets (RWA) and Artificial Intelligence (AI) in the crypto market, accounting for 11.30% and 10.09% respectively.

7. Ethereum Became Inflationary

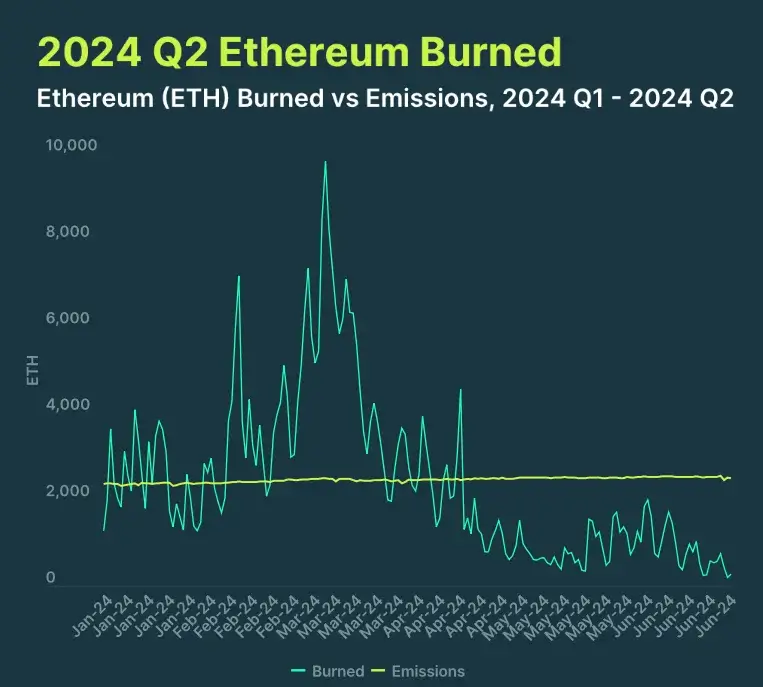

In Q2 2024, Ethereum (ETH), the second largest cryptocurrency by market cap, saw the destruction of 107,725 tokens through a process called “burning.” Concurrently, the network produced 228,543 new ETH. As a result, the total supply of ETH in circulation grew by approximately 120,818 tokens due to the difference between the burned and emitted amounts. In simpler terms, Ethereum experienced a net inflation rate during Q2 2024.

In Q1 2025, the ETH burn rate dropped by approximately two-thirds compared to the same period in the previous year, due mainly to decreased network activity and lower gas fees.

During the second quarter, there were just 7 days when Ethereum’s burn rate surpassed its emission rate. In contrast, this occurrence took place on 66 days in the first quarter.

8. The DeFi Market Cap Decreased by 20.7%

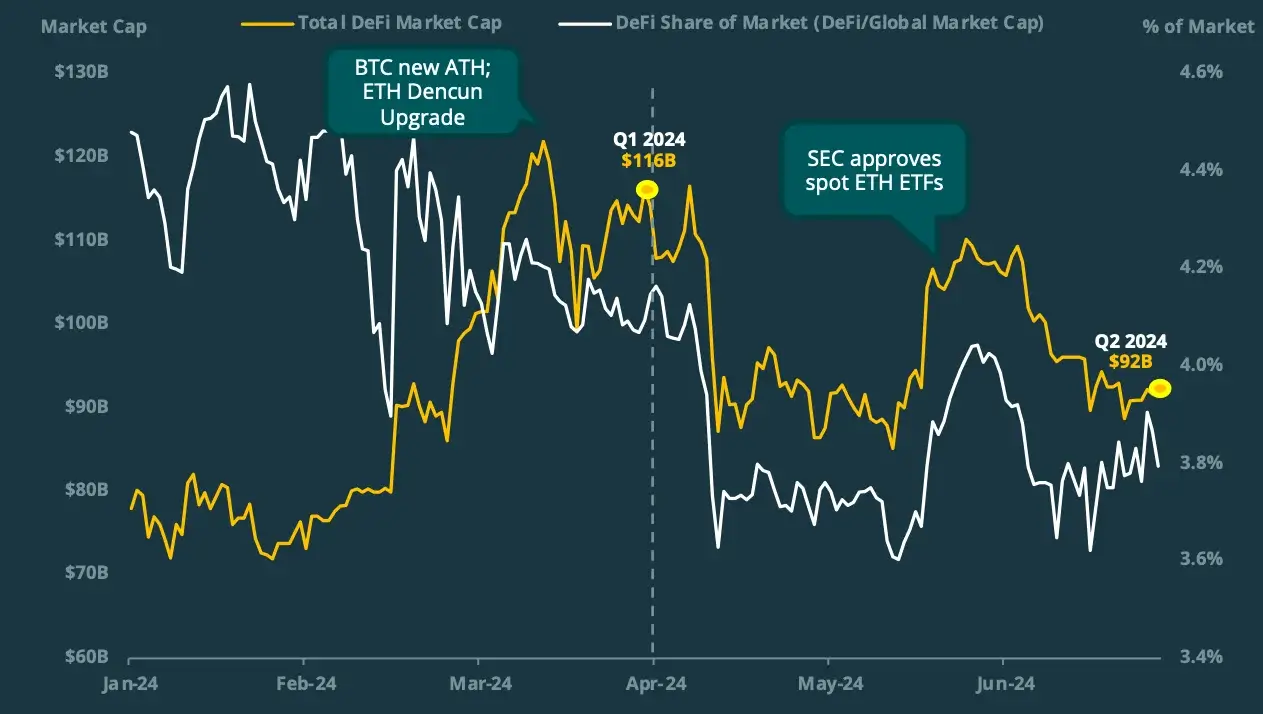

During the second quarter of 2024, the Decentralized Finance (DeFi) sector underwent alterations, though not to the same extent as other sectors. Notable occurrences, including the approval of Ethereum spot ETFs, instigated these changes.

Following the Bitcoin halving, the Decentralized Finance (DeFi) market endured a minor dip in total value, but subsequently bounced back. However, once Bitcoin’s price dipped below $70,000, the DeFi market value saw a significant decrease of approximately 25%, dropping from $116 billion to $87 billion.

Luckily, the Securities and Exchange Commission (SEC) in the United States gave its green light to Ethereum-based exchange-traded funds (ETFs) focusing on spot Ethereum. Consequently, the Decentralized Finance (DeFi) sector surpassed $100 billion in value once again, with this development serving as a significant trigger for Ethereum’s revaluation.

9. NFTs Were the Most Affected Digital Assets

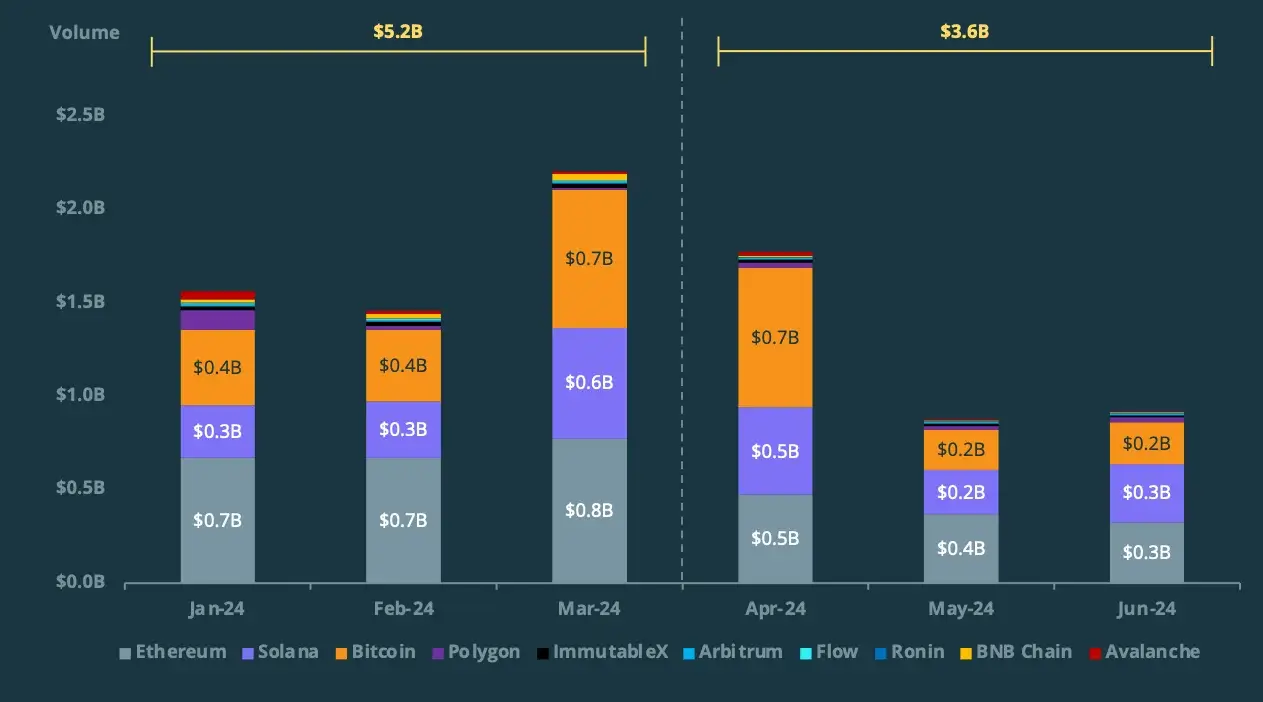

I’ve taken a close look at the recent trend in Non-Fungible Tokens (NFTs) based on Q2 2024 data from CoinGecko’s crypto report. The NFT trading volume saw a considerable drop of 31.8% quarter over quarter, decreasing from $5.2 billion to $3.6 billion. To gain a better understanding of this shift, I analyzed the performance of the top 10 NFT networks: Ethereum, Solana, Bitcoin, Polygon, ImmutableX, Arbitrum, Flow, Ronin, BNB Chain, and Avalanche.

Ethereum continues to lead the way in non-fungible token (NFT) trading with a volume of 32.7%, making it the most favored blockchain for this type of transaction. However, Solana is rapidly gaining traction, particularly towards the end of Q1 and the beginning of Q2, reporting over $1 billion in NFT trading within the last quarter alone.

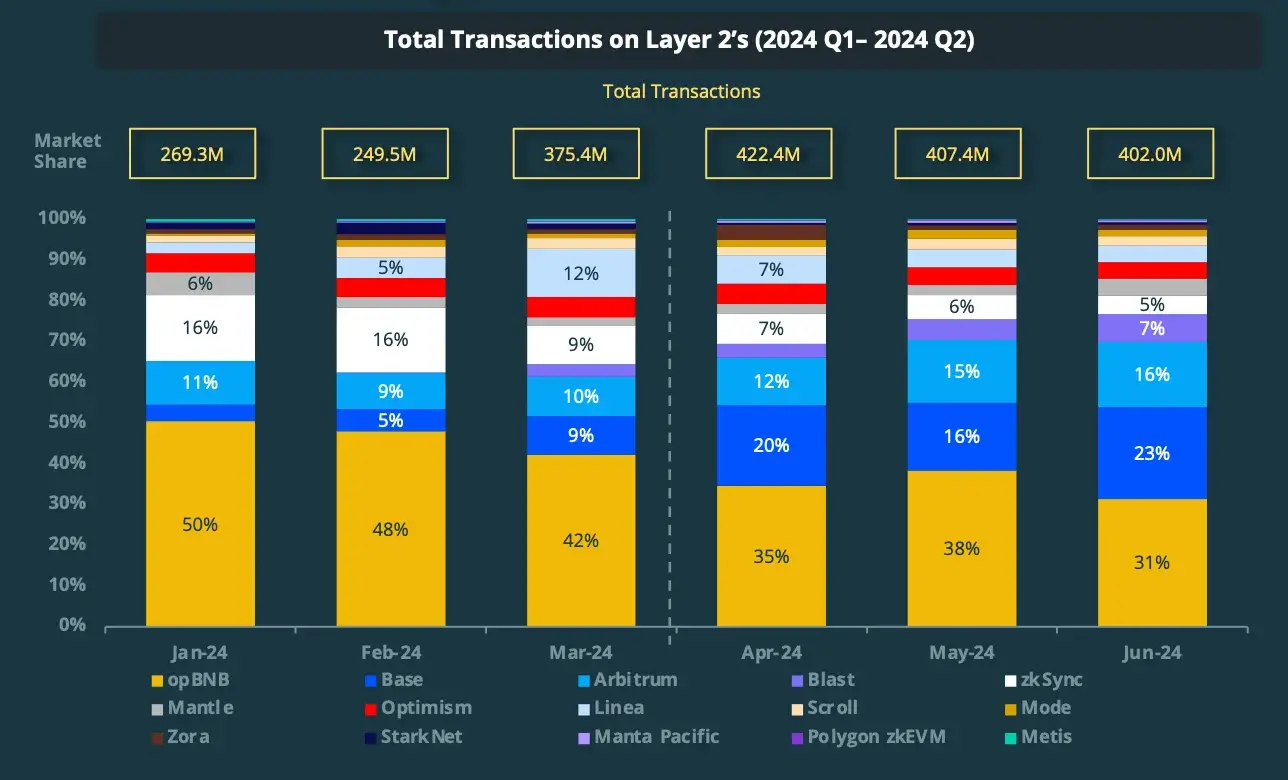

10. Layer 2 Adoption Increased by 37.7% QoQ

In Q2 2024, as per CoinGecko’s data, a total of 1.23 billion Layer 2 (L2) transactions occurred. The leading platforms in this category were opBNB, Base, Arbitrum, Blast, and zkSync. Among these, opBNB accounted for the largest share, handling approximately 34.8% of all L2 transactions.

In terms of on-chain activity, Base surpassed Arbitrum; however, both networks experienced substantial growth in the number of transactions. On the other hand, zkSync saw a 37.8% decrease quarter over quarter, following the distribution of its airdrop on June 17.

Final Thoughts

In the second quarter of 2024, the crypto industry experienced several notable developments. The Bitcoin halving and the unexpected green light for Ethereum ETFs stood out as the most significant among these events.

After going through a phase of stabilization following Bitcoin’s halving event, the crypto market has seen a mild decrease in both cryptocurrency prices and trading volumes. However, recent signs suggest that market circumstances are gradually returning to their usual state, which in turn is boosting optimism within the digital currency sector.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-07-19 09:19