As a seasoned cryptocurrency enthusiast who has navigated the complex world of digital assets for years, I find Revolut’s staking service to be a breath of fresh air. It simplifies the process of earning rewards from staking, making it accessible even for beginners.

In 2023, Revolut, one of the leading digital banks globally, launched staking on its platform.

In this piece, let’s delve into the mechanisms behind Revolut staking, its advantages, potential pitfalls, as well as the prerequisites, restrictions, and charges linked to it.

What is Revolut Staking?

Similar to the initial concept of staking, Revolut’s staking involves setting aside some funds to support a cryptocurrency’s network and earning rewards in return for doing so. Notably, the entire staking procedure is carried out solely within the Revolut platform.

Participating in staking is ideal for Proof of Stake blockchains as it significantly boosts network security and aids in the validation process. While there are some resemblances to mining, staking generally necessitates less hardware and energy consumption, making it easier to get involved and more environmentally friendly.

In 2023, Revolut introduced their staking service as an extension of their growing cryptocurrency offerings. As stated on their official site, this feature allows investors to earn passive income, or “rewards,” with minimal effort.

How Does Revolut Staking Work?

Sometimes, staking can seem quite complex, particularly for users who engage in it infrequently or are newcomers to this field.

On the other hand, Revolut’s staking process is remarkably simple. Given that the entire Revolut application is known for its ease of use and intuitiveness, this should come as no shock.

In essence, when it comes to earning rewards through staking on Revolut, users need to acquire some cryptocurrency first (provided they don’t already possess any on their Revolut account). Afterward, they simply secure their cryptocurrency for a predefined duration, and the rewards they receive will be proportional to the amount of crypto they have staked.

What Cryptocurrencies Can You Stake on Revolut?

Currently, Revolut enables staking for six digital currencies: Ethereum, Solana, Polkadot, Cardano, Tezos, and Polygon, formerly known as Matic.

Depending on the cryptocurrency you choose for staking, you can earn various rewards. The rewards strongly depend on the amount of crypto staked, too. For instance, if you stake 1 ETH, you will not be rewarded as much as you would be if you stake 1,000 ETH. However, those temporarily locking their funds will receive a staking reward after a set period.

Revolut Staking APY and Rewards

Revolut clearly lays out the estimated benefits users may gain by staking various cryptocurrencies, with the precise return rate differing based on the selected digital currency. Some choices provide attractive Annual Percentage Rates (APRs).

As a researcher delving into the realm of staking, I’d like to highlight an essential term: Annual Percentage Yield (APY). This figure signifies your yearly compounded return as a percentage. For example, if I stake 1 DOT and the APY is 12.30%, my annual reward would amount to approximately 0.123 DOT for each DOT staked. Given the current DOT price of $5.93, this equates to roughly $0.73 in value.

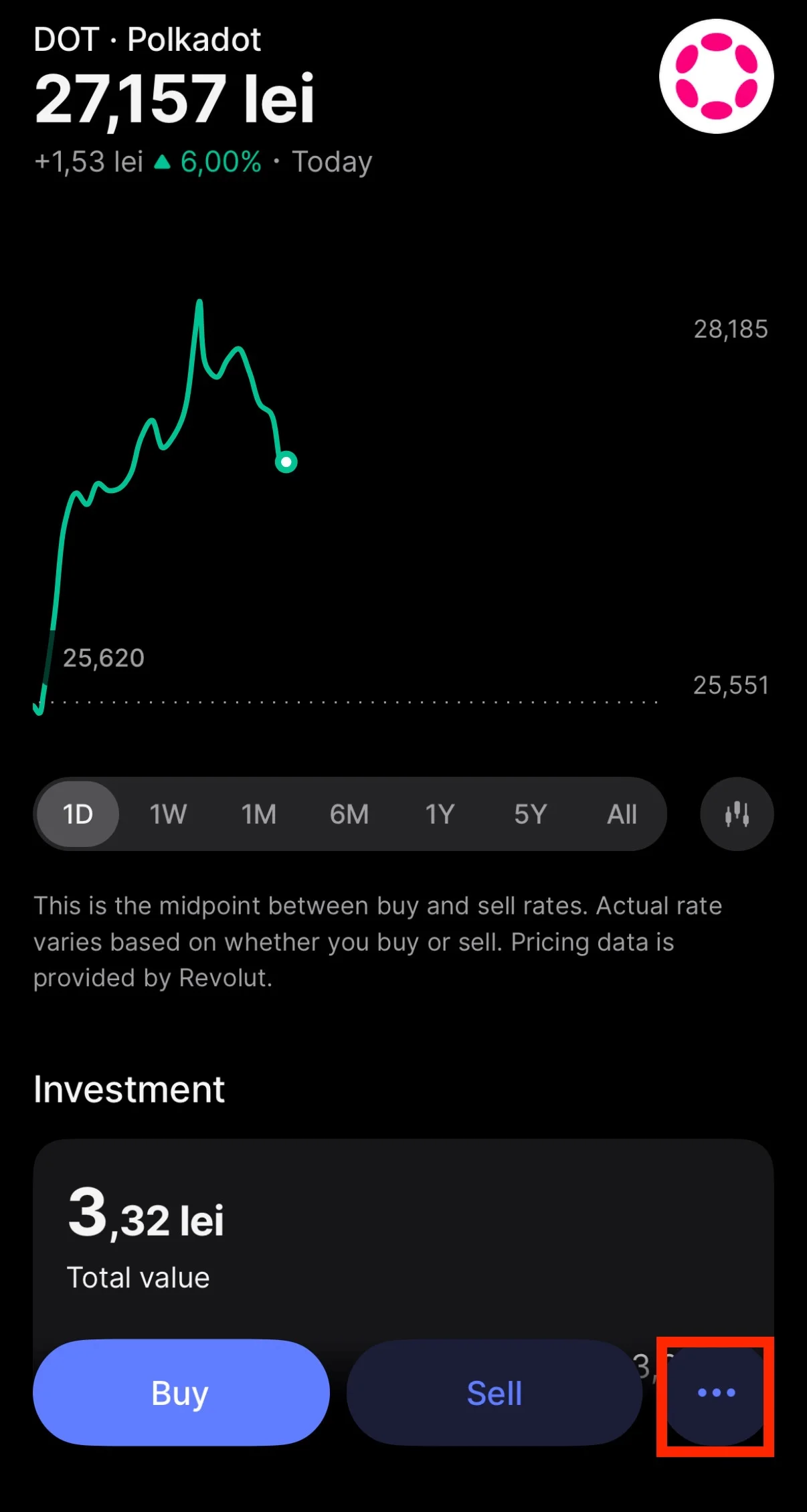

Polkadot (DOT)

At the moment, to earn interest on your staked DOT, you’ll need to collaborate with Revolut, offering an annual percentage yield (APY) as high as 12.30%. The rewards for staking Polkadot are distributed weekly, following a delay of approximately 2 days.

Keep in mind that if you’ve staked DOT on Revolut, there’s a holding period of 30 days. This means after you unstake DOT, you must wait for 30 days before you can withdraw your balance. During this time, you won’t be able to sell the temporarily locked DOT tokens.

Tezos (XTZ)

As a crypto investor on Revolut, I’ve found a promising opportunity with Tezos staking that offers an Annual Percentage Yield of 5.76%. However, it’s important to note that the reward can change based on network conditions. When I initiate the staking process, I get an estimated reward, but the actual amount could be more or less due to market fluctuations.

Individuals who hold Tezos can expect to receive their rewards around 24 days following their initial stake, but the exact timing may fluctuate depending on the conditions within the network.

Cardano (ADA)

Should you choose to invest your Cardano on Revolut, keep in mind that the Annual Percentage Yield (APY) currently sits at 2.09%. Please note that the returns may fluctuate according to network conditions.

In the same manner as with Tezos, the duration for which you wait could vary depending on the current network’s conditions. Your rewards will be automatically reinvested to boost your returns.

Ethereum (ETH)

Staking Ethereum currently offers an annual percentage yield (APY) of about 2.95%. If you choose to stake ETH through Revolut, your earnings will be distributed to you every day, with a typical delay of around 2 days.

In Ethereum’s case, once unstaked, you must wait 10 days before accessing the balance.

Solana (SOL)

On Revolut, staking Solana provides a return of 5.25% annually, and the earnings are distributed every three days following a three-day waiting period to begin accumulating returns. After undoing the stake, there’s another waiting period of three days before you can use your balance again.

Polygon (POL, ex-MATIC)

Currently, you have the opportunity to deposit Polygon (POL) in Revolut, which can yield an Annual Percentage Yield of up to 3.74%. Your returns will be distributed daily, but there’s a one-day waiting period before they start. It’s important to note that once you decide to withdraw your staked amount, you’ll have to wait for another 4 days before you can access your balance again.

Revolut Staking Step-by-Step

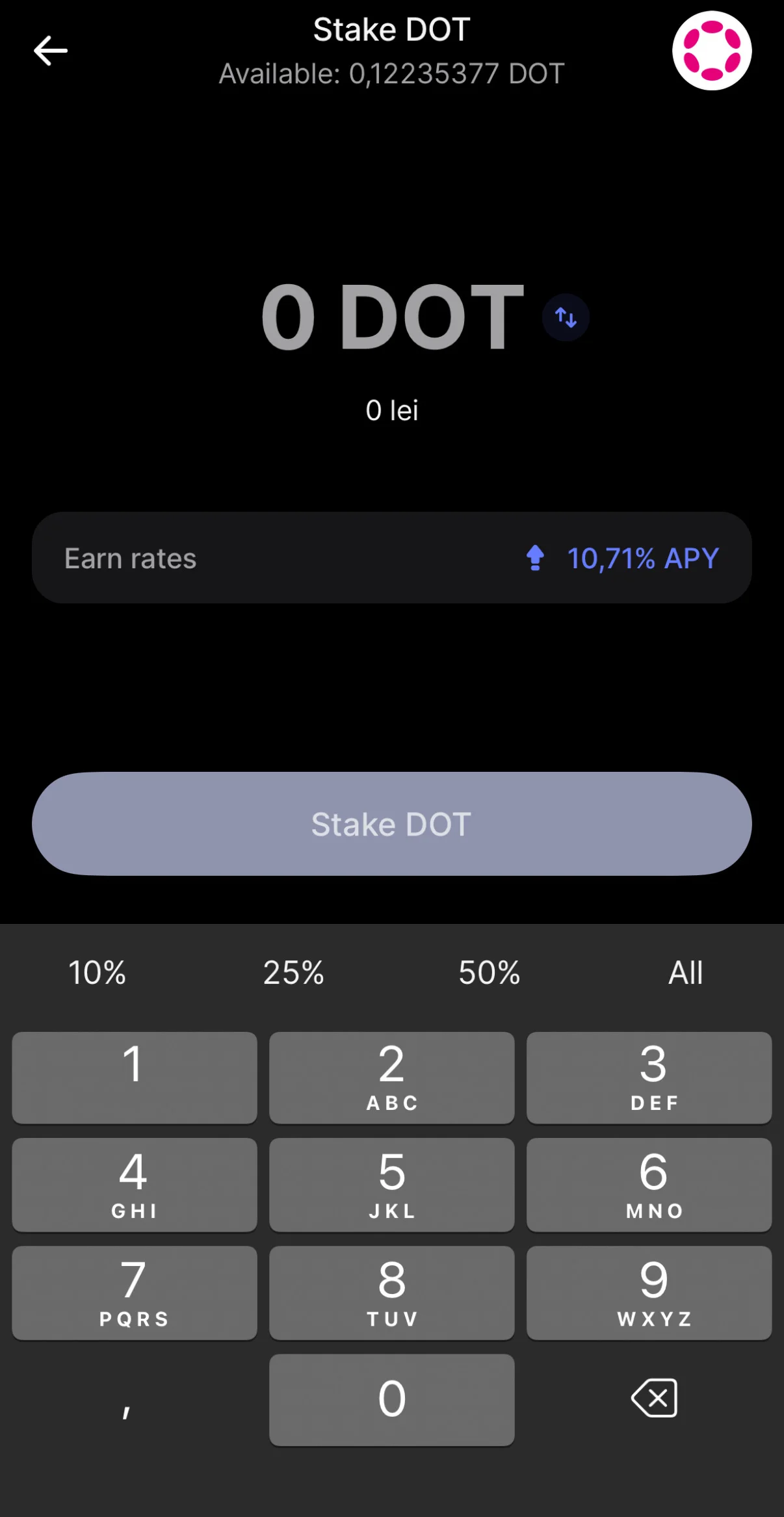

- Open the Revolut app and make sure it’s up to date.

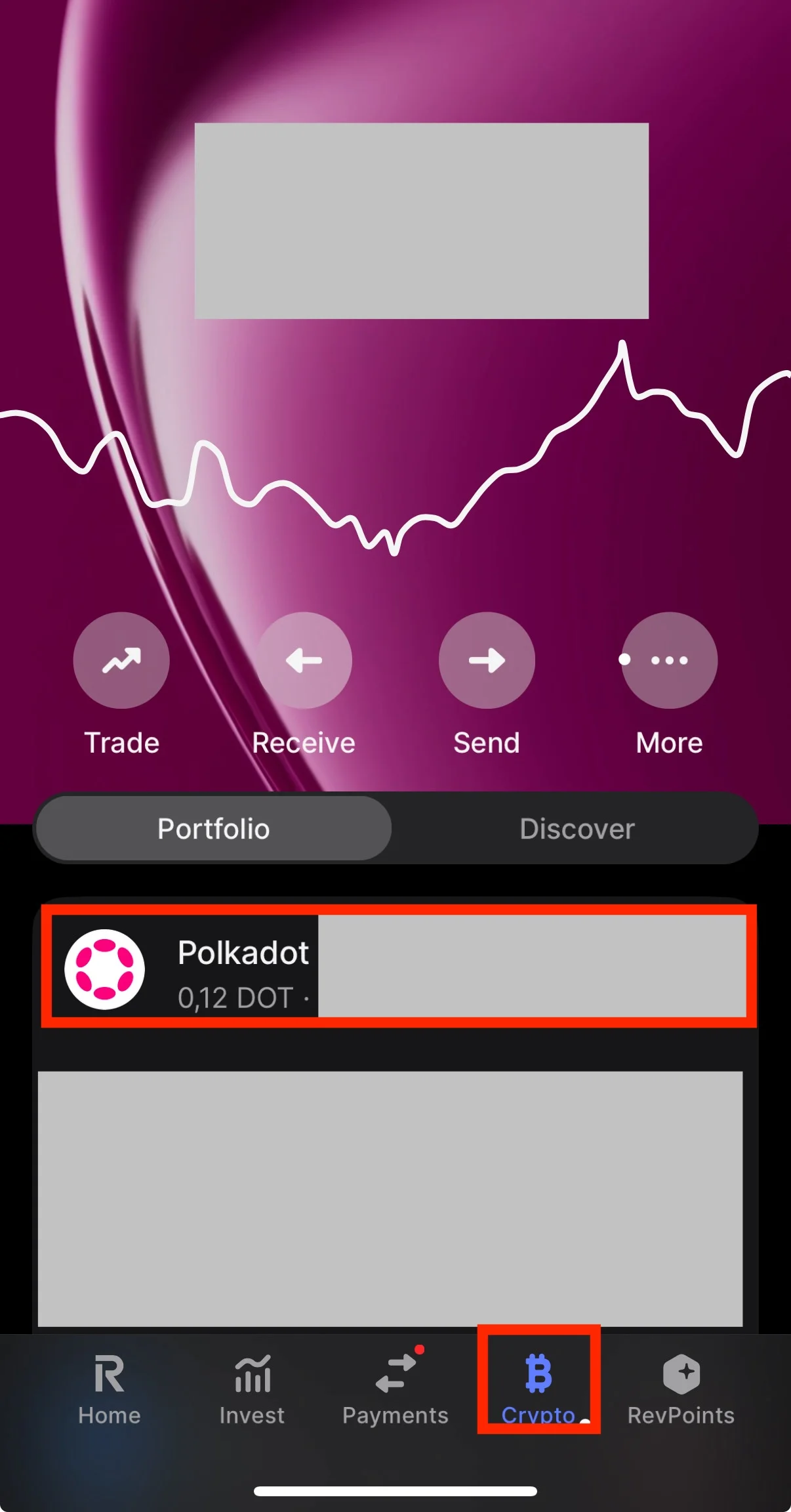

- Go to the “Crypto” section and choose the cryptocurrency you want to stake (e.g., Polkadot).

- If you haven’t purchased that crypto you want to stake yet, you’ll need to buy some first. Remember that you’ll pay a transaction fee when purchasing it.

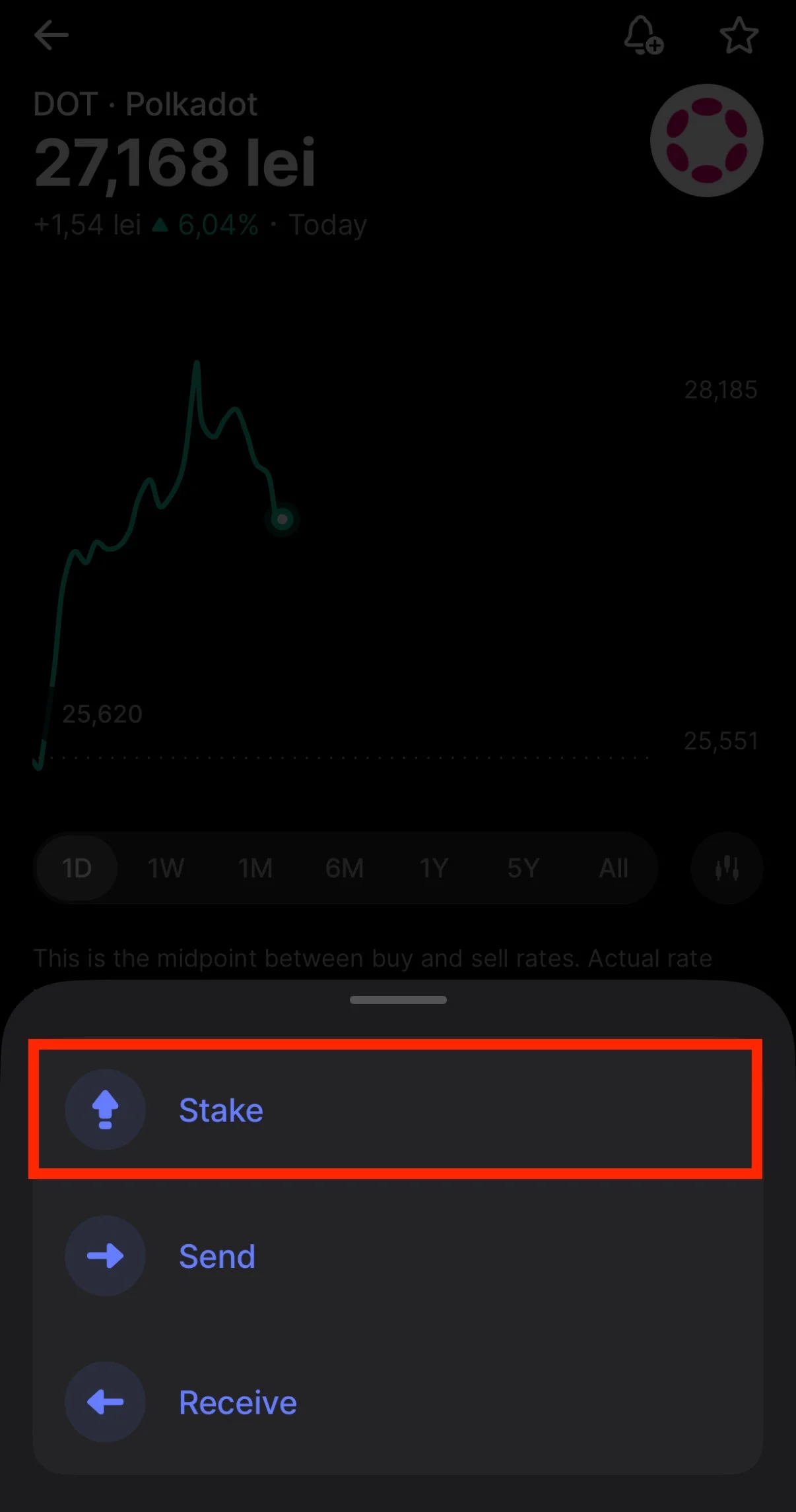

- After purchasing it, go to your portfolio and tap on it. Then, tap the 3-dot menu and select “Stake.” Make sure to read the details carefully before proceeding.

- Tap “Continue” to move forward.

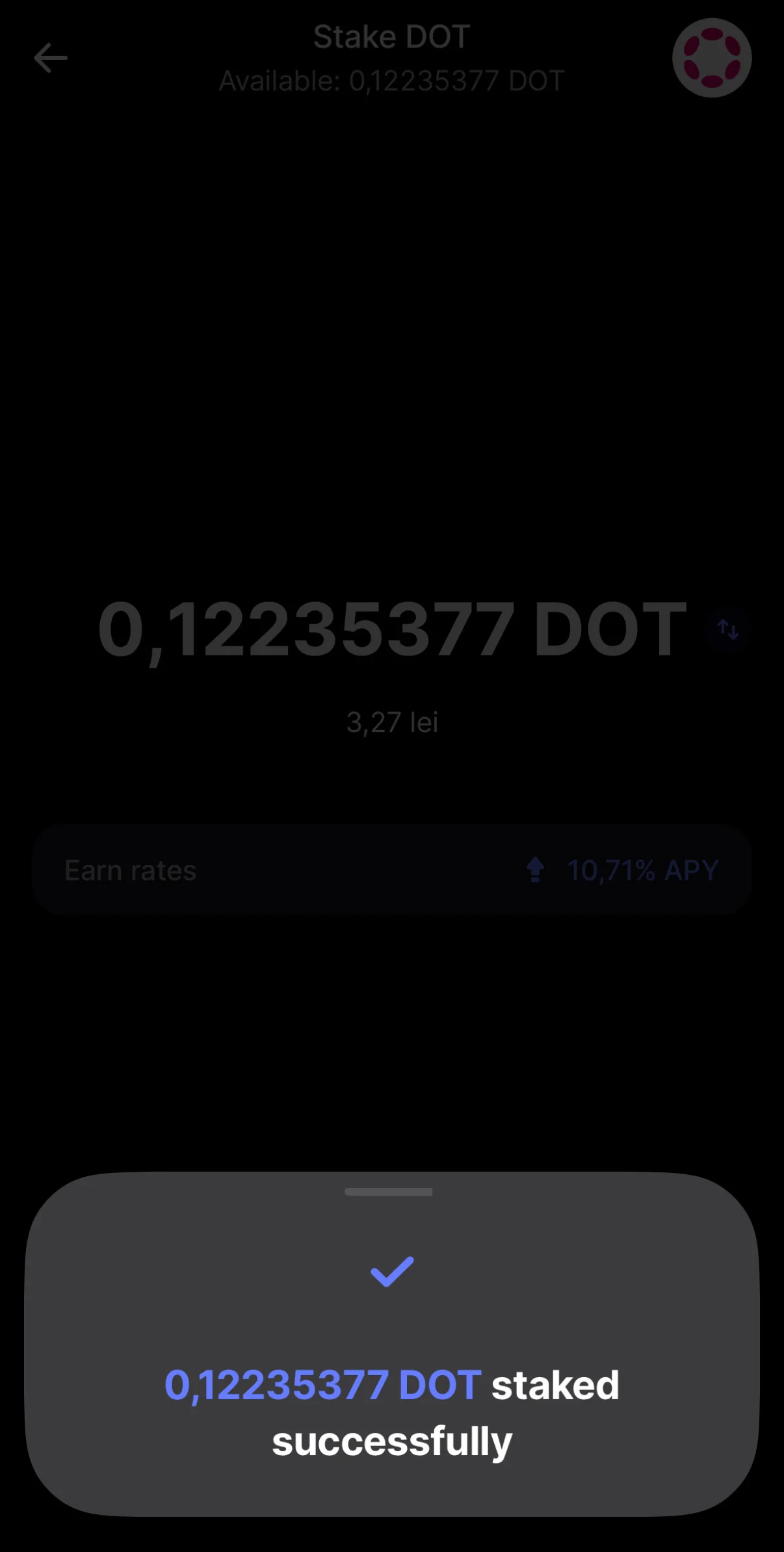

- Choose the amount of crypto you want to stake. You’ll see details about your estimated annual rewards. Once you’ve decided, click “Confirm”.

- You can view more information about your staked coins in your portfolio, such as when you’ll receive your first reward, the staked value in fiat, and the estimated rewards rate.

Risks, Conditions, Requirements, and Fees

On Revolut, it’s straightforward to make your cryptocurrency work for you by staking it, which means you can earn rewards while keeping your assets locked on the platform. This feature offers users a chance to capitalize on their crypto holdings.

However, staking still involves certain risks. One of the primary risks is market volatility. Even though you are provided with an estimated annual reward when you stake your crypto, the actual reward may be smaller due to market fluctuations. In the worst case, you may end up with no reward at all.

Furthermore, investing in cryptocurrency staking involves certain risks, including the possibility of losing your staked funds due to slashing or downtime penalties.

Even with the associated risks, opting for Revolut’s staking service is still an appealing choice for individuals seeking immediate and effortless cryptocurrency engagement, as it requires minimal technical expertise.

Revolut’s token staking feature is accessible only in certain European Economic Area (EEA) countries. As for the United Kingdom, the staking service is being discontinued. Users can now only withdraw their staked tokens, but they are no longer able to stake new ones.

Fees for staking vary by region and token. In the EEA, fees range from 15% to 35%, depending on the token and the amount staked. In the UK, the fees are flat and range from 15% to 30%. It’s important to check the specific fees before staking, as they can significantly affect your rewards.

In Conclusion

With Revolut’s staking service, you can effortlessly generate rewards simply by securing your cryptocurrencies, making it an ideal choice for newcomers as well as experienced users who prefer a straightforward approach to investing in digital currencies.

Users can invest their tokens in well-known cryptocurrencies such as Ethereum, Solana, and Polkadot, earning returns by staking them. The exact reward amount depends on the specific token being staked and the quantity invested.

Even though the procedure seems simple, it’s crucial for users to understand the potential risks involved, such as market fluctuations and possible penalties.

Furthermore, keep in mind that the cost of staking can differ based on location and the type of cryptocurrency, so always take these expenses into account prior to staking.

Regardless of the various elements at play, Revolut’s staking continues to be an attractive option for individuals looking to generate passive income from cryptocurrencies.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-11-18 16:49