- Dogecoin’s Open Interest (OI) surged by 15%, indicating traders’ belief and confidence in the memecoin

- Whales’ large transaction volume jumped by 41% too

As a seasoned crypto investor with a knack for spotting trends, I can confidently say that Dogecoin (DOGE) is shaping up to be a promising investment opportunity in the near future. The recent surge in Open Interest (OI) by 15% and the significant increase in whale transactions by 41% indicate a growing belief and confidence among traders and large investors alike.

Dogecoin (DOGE), currently the most prominent meme-based cryptocurrency, could catch the eye of whales and institutions given its potential for a 28% surge in value. This optimistic outlook is due to its robust market behavior, heightened trader and investor interest, and increasing political backing, which contribute to this positive prediction.

Indeed, the broader cryptocurrency sector is showing a positive trend right now, as top coins such as Ethereum (ETH), Solana (SOL), and XRP are on an upward trajectory. This growth in the altcoin market strengthens Dogecoin’s optimistic forecast as well.

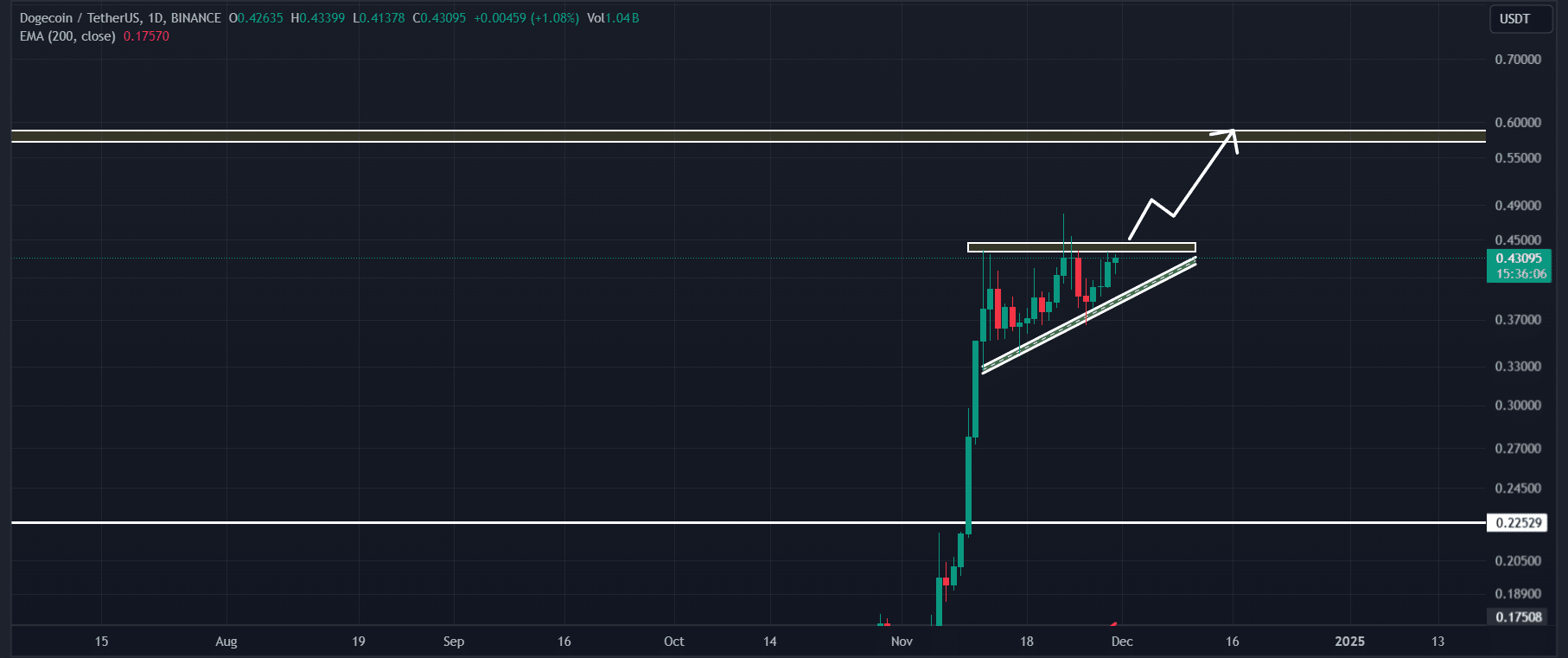

Dogecoin’s technical analysis and key levels

Over the past fortnight, following a remarkable 150% surge, I’ve noticed that DOGE has been treading water in a consolidation phase. Interestingly, this consolidation seems to be shaping up as an ascending triangle on the charts, according to AMBCrypto’s technical analysis.

If Dogecoin (DOGE) manages to break through the upper boundary of its rising triangle formation and end the day trading above $0.45, we might expect a potential increase of around 28%, potentially reaching the price point of $0.58 over the next few days.

From a favorable perspective, it appears that DOGE was transacting above its 200 Exponential Moving Average (EMA) on the daily scale, suggesting a rising trend. The 200 EMA is a technical tool utilized by traders and investors to discern whether an asset is experiencing an uptrend or a downtrend. This information assists them in making educated decisions about their positioning, as it provides insights into the asset’s overall behavior pattern.

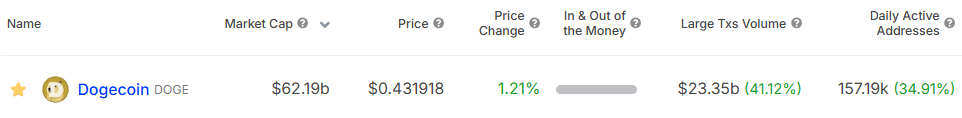

Besides using technical analysis, it seems that large investors (whales) and common traders are quite active in the memecoin market, according to data from companies like IntoTheBlock and Coinglass.

Whales and traders’ participation

By the 30th of November, I observed a substantial 41% rise in the high-value transactions associated with whales in the memecoin market. This surge suggests that these influential players hold strong convictions and faith in the potential success of this digital asset.

In addition to long-term investors, traders have been increasingly drawn to the memecoin, according to Coinglass. For instance, Dogecoin’s Open Interest (OI) increased by 15% over the past day and by 7.8% in just the previous four hours. This significant rise in OI suggests that new positions are being established as Dogecoin’s price nears a potential breakout point.

By blending these blockchain indicators with traditional chart analysis, it appears that the bulls have a firm grip over the memecoin. This could potentially propel Dogecoin towards its projected goal.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-11-30 23:03