- EigenLayer’s latest partnership has brought the liquid BTC restaking feature.

- Its TVL was over $10 billion, at press time.

As a researcher with years of experience in the crypto space, I’ve seen my fair share of partnerships and platform updates, but EigenLayer’s latest move to bring liquid BTC restaking features is truly noteworthy. With TVL over $10 billion at press time, it’s clear that Bitcoin holders are eagerly embracing yield-generating alternatives within the DeFi ecosystem.

EigenLayer, the most extensive re-staking platform on Ethereum (ETH), has unveiled its newest Bitcoin (BTC) re-staking features.

The option provides yield opportunities for wrapped Bitcoin (WBTC) holders.

The platform unveiled fresh functionalities, such as earnings derived from peer-to-peer node operator P2P.org and the ability to stake uniBTC – a version of Bitcoin wrapped in a different format.

This evolution follows a growing interest in Bitcoin investments offering returns, such as staking, since Bitcoin owners are looking to expand their portfolios by diversifying their holdings.

Demand for Bitcoin restaking on EigenLayer rises

4th November saw EigenLayer unveiling plans for ARPA Network to commence rewarding those who deposit uniBTC in their system.

The development allows BTC holders to earn yields while contributing to Ethereum’s decentralized ecosystem.

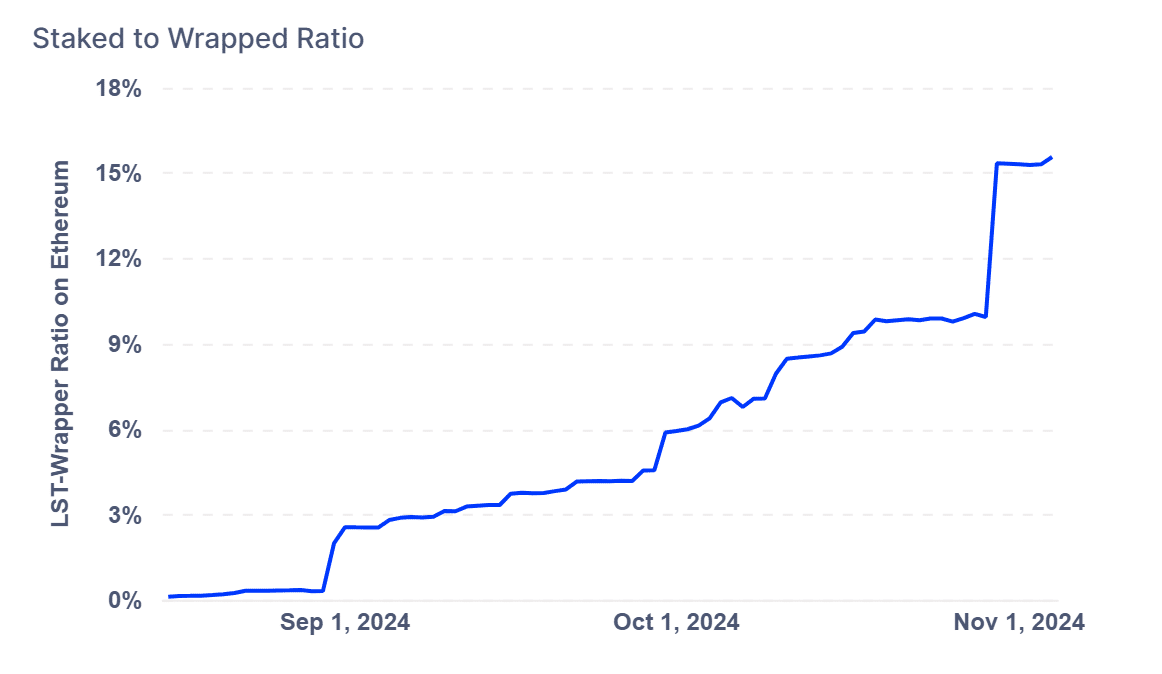

As someone who has been closely following the world of cryptocurrency for years, I can confidently say that the recent surge in WBTC staking across various platforms is a significant development. Having witnessed the rise and fall of numerous digital currencies, I have learned to recognize trends that indicate long-term growth potential. This latest movement towards WBTC staking, with over 15% of all WBTC now actively being staked, suggests that we are seeing the beginnings of a broader trend that may well reshape the crypto landscape in the coming years.

As a researcher, I’ve noticed an escalating interest in Bitcoin staking opportunities, as the decentralized finance (DeFi) sector expands. It seems that BTC owners are increasingly keen on utilizing decentralized protocols to optimize their assets, aiming to capitalize on the growing potential of these financial systems.

More recent data highlights this trend, showing a significant surge in Bitcoin transactions that have been resubmitted since early August.

The rising weekly transaction figures for WBTC and other wrapped Bitcoin assets reflect the growing appeal of yield-generating opportunities for BTC. This pointed out that staking and yield alternatives are increasingly viewed as viable options for Bitcoin holders.

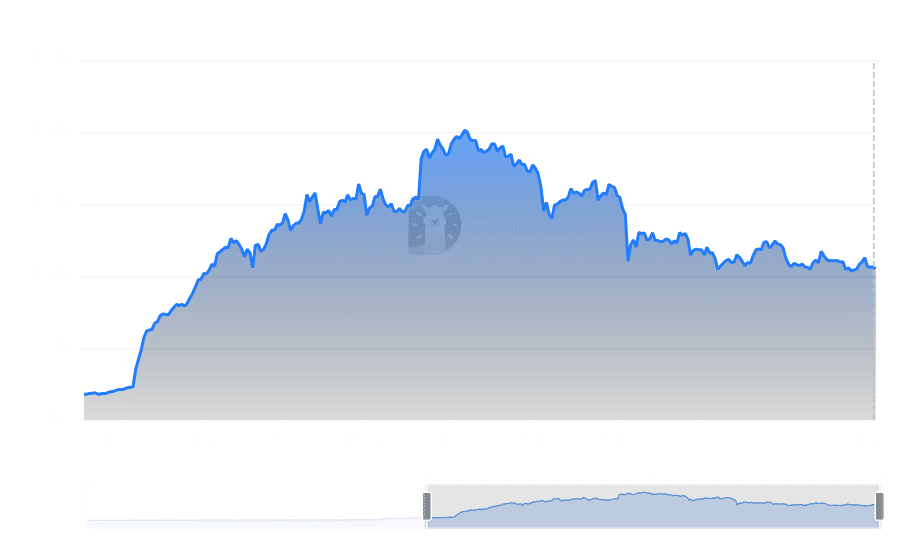

EigenLayer’s TVL maintains decent momentum

EigenLayer’s Total Value Locked (TVL) has shown steady growth, as reported by DefiLlama.

This climb mirrors the heightened adoption of Bitcoin staking solutions, enabling BTC holders to engage in staking activities without liquidating their assets.

EigenLayer serves as a link for individuals aiming to generate income from their Bitcoin investments. This approach contributes to the growth of the platform’s value, as it increases the total funds secured within it.

Price analysis: EIGEN token outlook

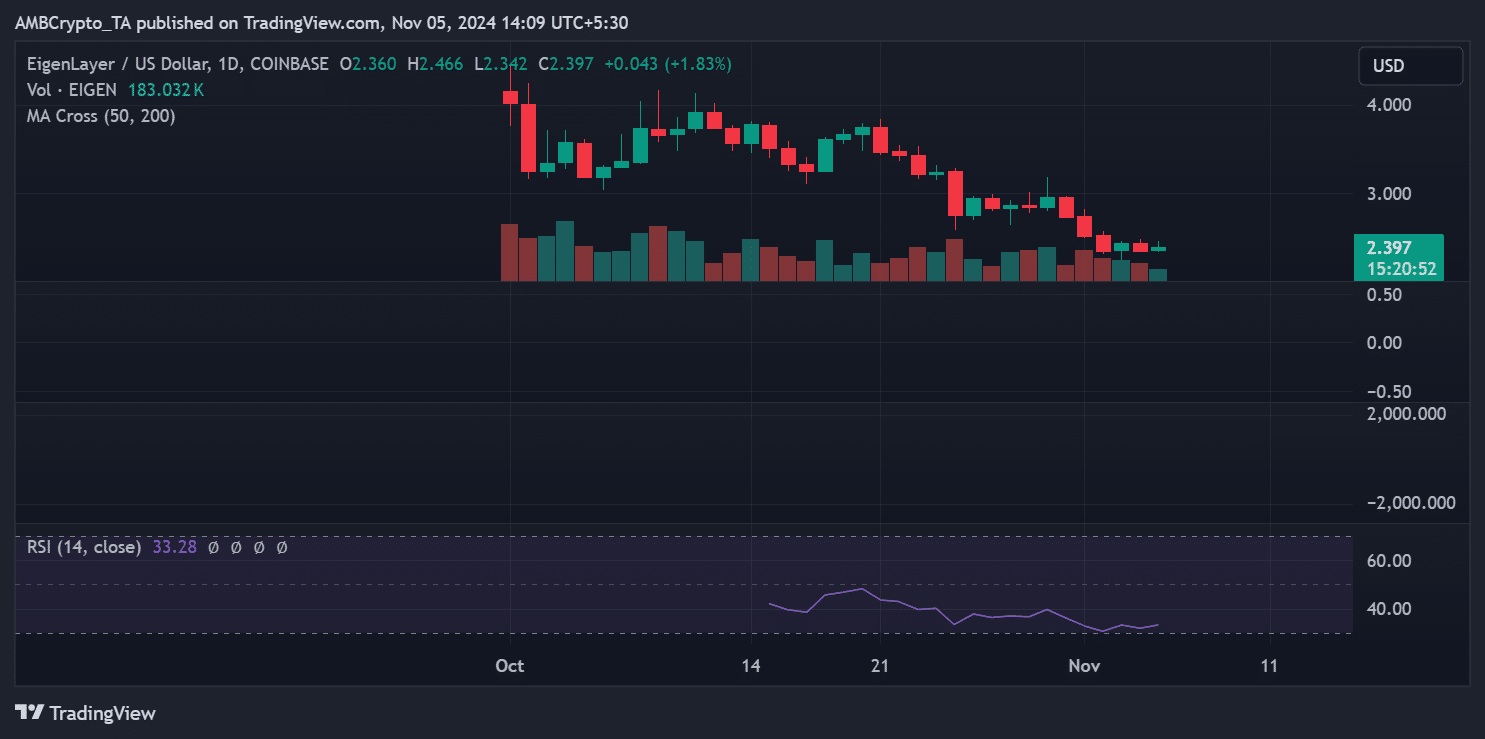

Regarding EigenLayer’s native token, EIGEN, recent activity has indicated price consolidation.

Currently, the coin is being exchanged at approximately $2.39. The fluctuations in EIGEN’s value mirror not only general market trends but also the unique expansion of its own platform.

Currently, when this is being penned down, the Relative Strength Index (RSI) for EIGEN stands around 33, indicating that it may be approaching overbought territory.

This could potentially present a buying opportunity if the downward pressure stabilizes.

The trading volume for EIGEN has seen modest fluctuations but remains stable overall.

If the extended re-staking features offered by EigenLayer draw in more Bitcoin owners, it could potentially increase the value of EIGEN due to increased demand.

This could potentially surpass its resistance level near the $2.50 mark.

The platform’s recent updates offer Bitcoin holders new ways to explore yield-generating options without parting with their holdings. With potential further adoption, the coming months could determine if these enhancements will translate into sustained growth for EIGEN.

This could solidify EigenLayer’s role as a key player in Bitcoin staking within the DeFi ecosystem.

Read More

2024-11-06 03:36