- Bitcoin’s price appreciated by 9.06% over the past week

- Bitcoin’s whale activity hiked over the past week, driving its most-recent rally

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have witnessed the ebb and flow of various digital assets, but none quite like Bitcoin. Over the past week, I’ve been intrigued by the surge in BTC‘s price and the role that whales seem to be playing in this rally.

For the last seven days, Bitcoin [BTC] has continued its upward trend seen over the past month, as indicated by its price graphs. Currently, it is being traded at approximately $68,300, thanks to a 10% increase in value over the past month and an additional 9% rise during the previous week.

As a crypto investor, I’ve seen some impressive returns recently. However, it’s important to acknowledge that the cryptocurrency I’m invested in is currently 7.27% short of its All-Time High (ATH) that it reached earlier this year.

As a researcher, I’ve observed an interesting trend: While Bitcoin (BTC) saw substantial growth, it was primarily fueled by the actions of large-scale investors, often referred to as ‘whales’.

Are Bitcoin whales driving the surge?

Based on data from Santiment, there was a significant increase in the number of large Bitcoin holders (often referred to as “whales”) when the price of Bitcoin fell to approximately $59,000 as shown on the price graphs.

Between October 10th and 13th, an additional 268 wallets started holding between 100 to 1,000 Bitcoins. This analysis implies that large Bitcoin holders, or “whales,” may have contributed significantly to the current rally by injecting capital into the market. In other words, without these substantial investments from whales, it’s likely that the recent upward price trend we’ve observed might not have materialized.

During the downturn, whales started to buy more cryptocurrency, suggesting they have faith in its potential increase in value.

Typically, an increase in whale investments can indicate a possible upward market trend. Consequently, the recent market fluctuations could be attributed to a significant rise in whale activity.

What does Bitcoin’s chart say?

Whales play a vital role in any crypto’s price movements.

From my perspective as a researcher, an increase in the number of whales (large-scale investors) in a cryptocurrency market indicates a favorable market outlook. These seasoned investors are predicting that the value of the crypto will escalate even more.

Therefore, these prevailing market sentiments could set BTC for more gains on the charts.

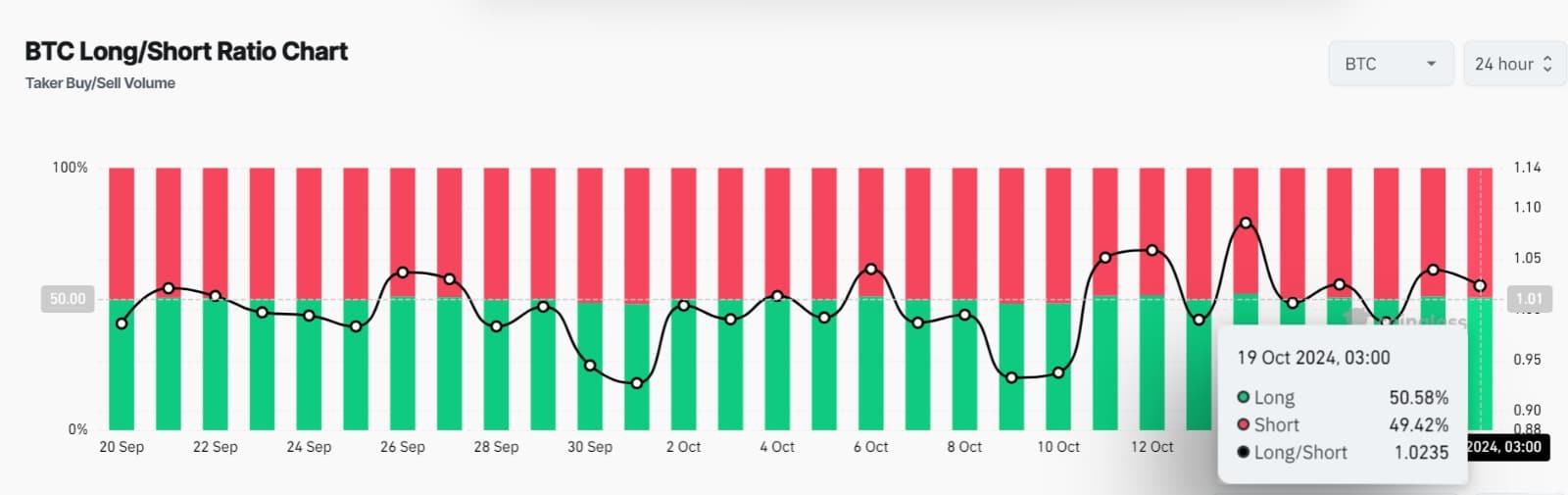

Over the last 24 hours, I’ve noticed that the Long/Short Ratio for Bitcoin has consistently been above 1. As we speak, this ratio stands at an impressive 1.023.

This implied that long-position holders have been dominating the market.

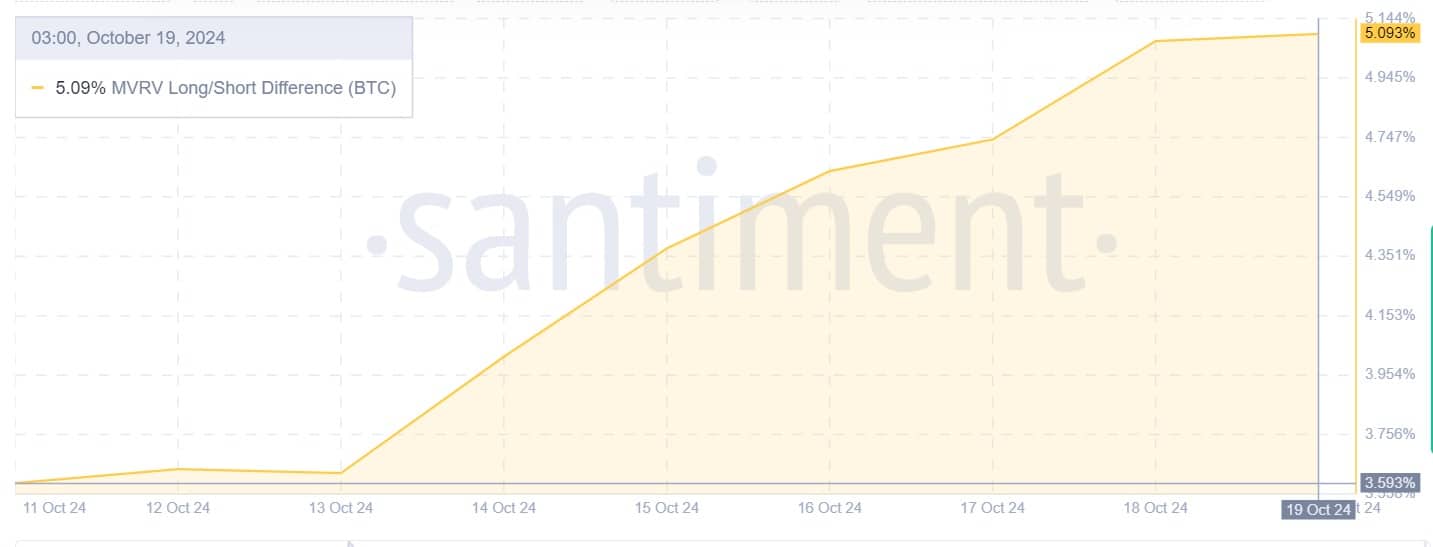

Over the last week, Bitcoin’s MVRV Long/Short gap expanded significantly, rising from a minimal 3.59% to an impressive 5093%. This suggests that long-term holders are currently experiencing profits.

When the MVRV (Maker’s Value Realized to Purchase Price ratio) for long-term investors surpassed that of short-term ones, it signaled a strong belief among investors in the market’s lasting potential.

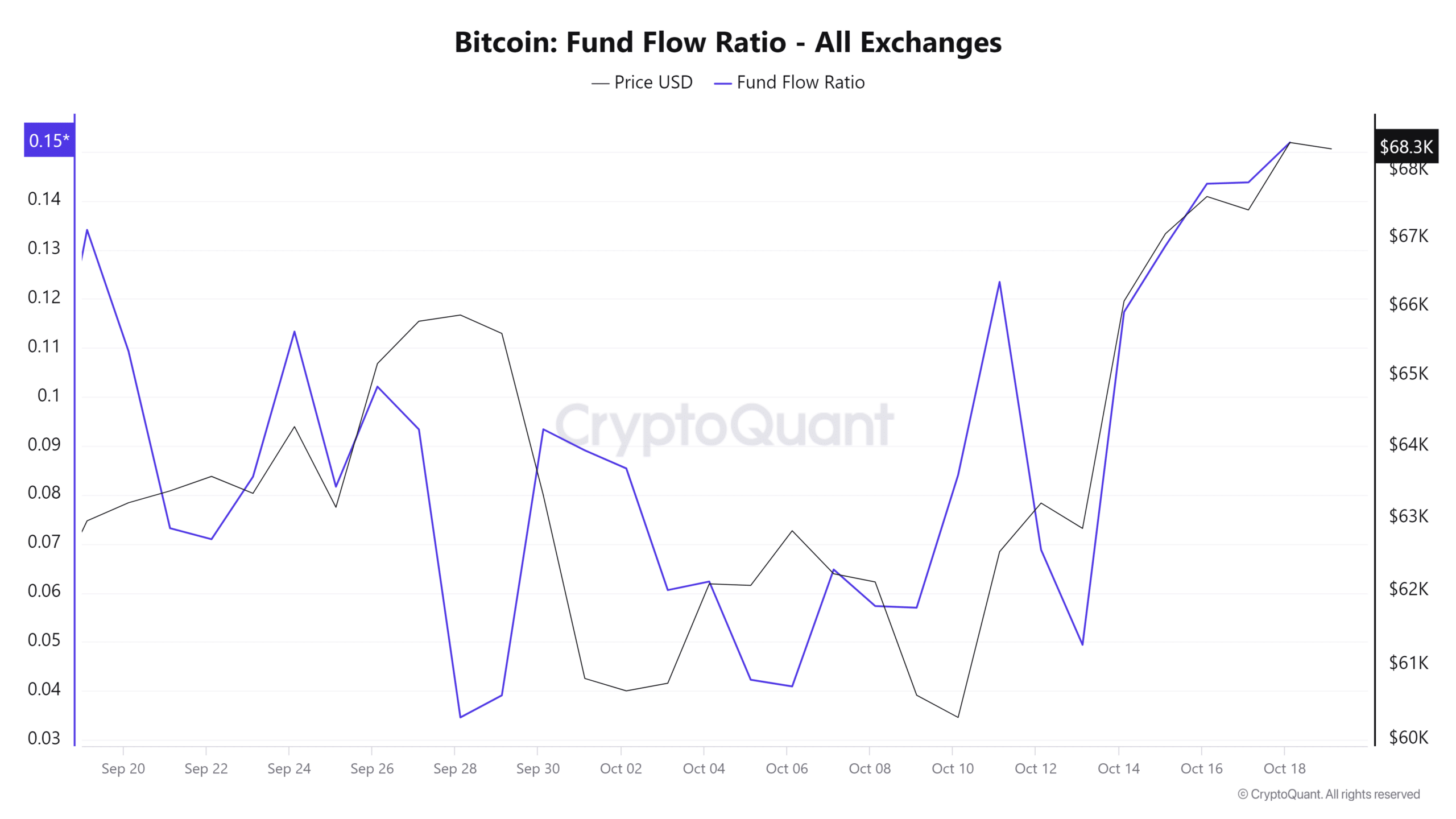

To put it simply, the Fund Flow Ratio for Bitcoin reached a peak this month at 0.15, indicating an increased demand for purchasing Bitcoins over selling them, suggesting stronger buying pressure compared to selling pressure.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Therefore, investors are accumulating BTC and expressing their confidence in the market.

Currently, due to investor enthusiasm and positive market opinion, Bitcoin seems to be in a strong position. If this trend continues, it’s possible that Bitcoin could regain its $70k value in the near future.

Read More

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2024-10-19 19:04