- Germany’s Saxony state has been selling seized Bitcoin in recent weeks, exerting pressure on the market

- Bearish sentiment around spot prices has not dispirited institutional investors seeking exposure to Bitcoin.

As a researcher with experience in the crypto market, I’ve been closely following the latest developments. Germany’s Saxony state selling seized Bitcoin has put downward pressure on the market, but this hasn’t deterred institutional investors from seeking exposure to Bitcoin. In fact, they have been buying up Bitcoin funds at an impressive rate, with record inflows in US-listed spot Bitcoin ETFs on July 8th.

On July 10th, Bitcoin’s price bounced back strongly, surpassing $58,000 in a clear sign of recovery within the cryptocurrency market, which exhibited a tranquil atmosphere.

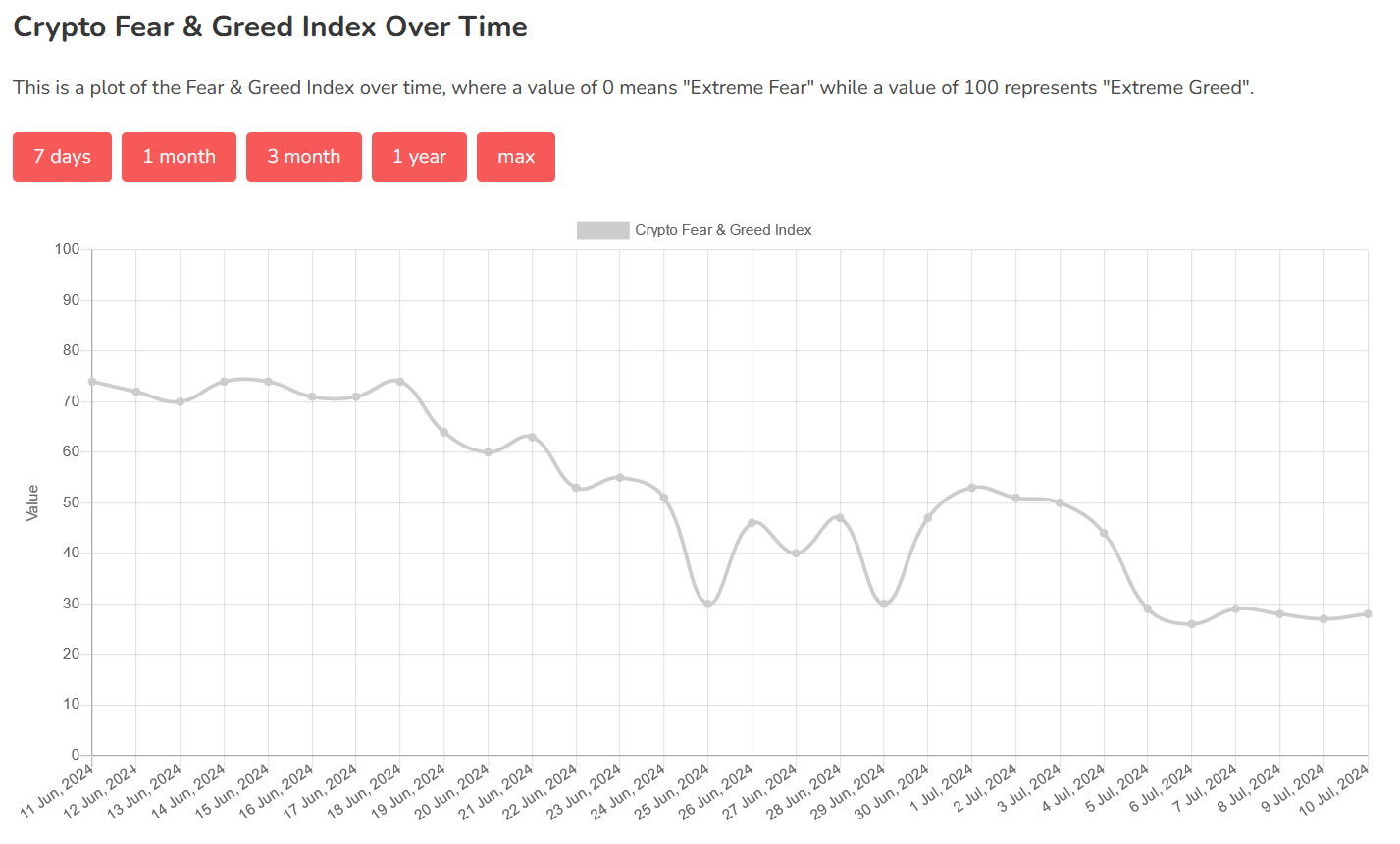

Despite persistent pessimism in the cryptocurrency market, the Fear & Greed Index remains in the “Fear” category as of now.

The “Fear” index currently reflects a significant change in investor attitudes, as it moved from the “Neutral” area just a week ago to the “Greed” region during the previous month.

Germany BTC selloff

In early July, the German state of Saxony disposed of approximately 49,857 bitcoins that were seized by its Criminal Police Office (LKA) from the Movie2k.to platform’s administrator back in January.

The German law enforcement agency has been releasing seized coins into the market, following regulations concerning the disposal of confiscated property from criminal probes.

So far, over half of the German government’s original holdings have been moved to exchanges and market intermediaries.

At the current moment, as reported by Arkham Intelligence, the Bitcoin wallet owned by the German Federal Criminal Police Office (BKA) held a balance of approximately 22,847 Bitcoins.

Bitcoin Funds post strong performance

It’s intriguing that the drop in Bitcoin’s current market value hasn’t lessened investors’ interest in Bitcoin funds.

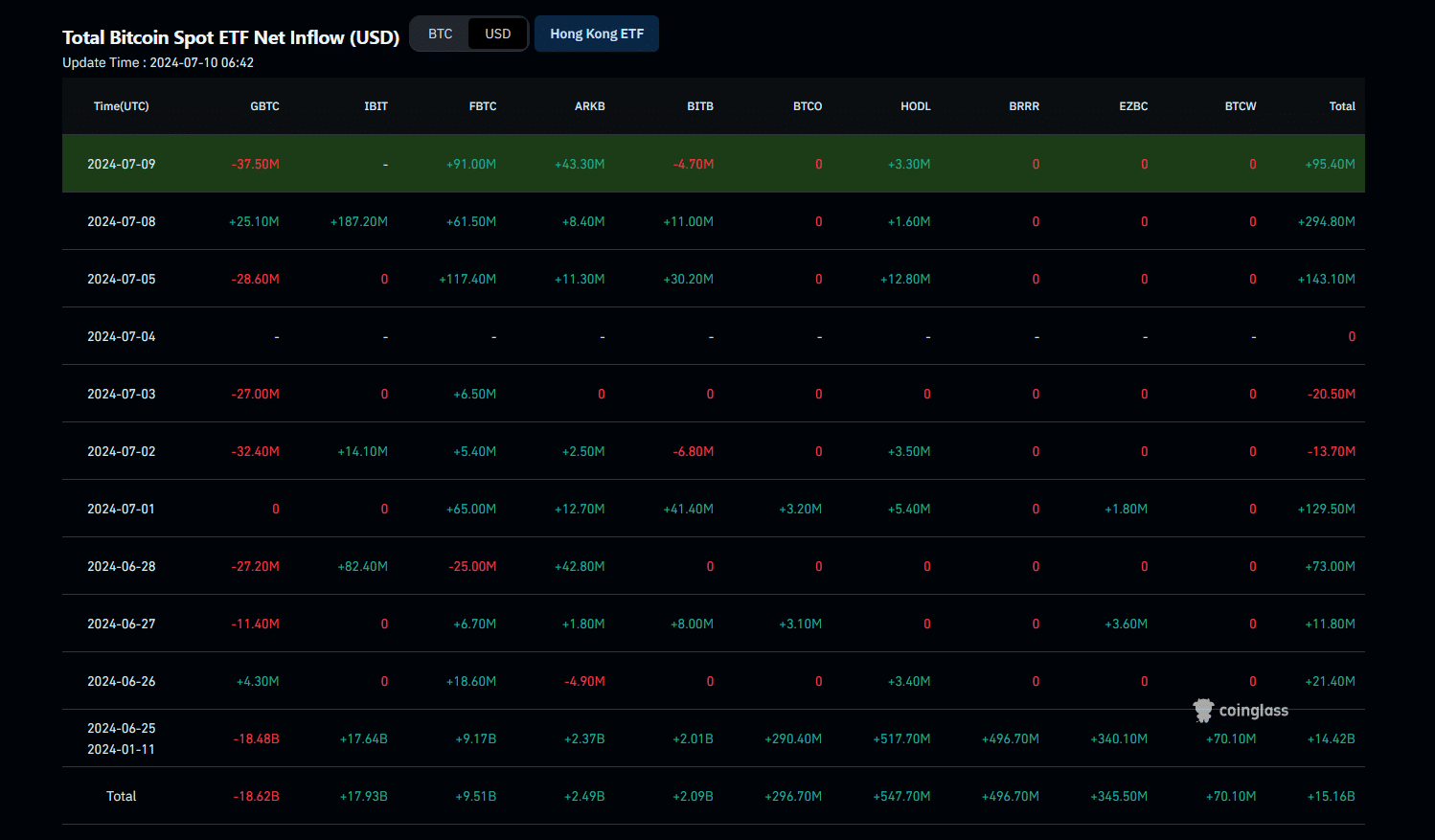

As a researcher studying the trends of Bitcoin Exchange-Traded Funds (ETFs) listed in the US, I’ve discovered that on the 8th of July, these funds experienced a collective inflow of approximately $295 million – marking the largest single-day positive net flow since early June. This significant increase in investments occurred when Bitcoin’s price was above $70,000.

As a crypto investor, I’ve noticed that while no crypto ETFs experienced outflows on that particular day, three funds – Valkyrie Bitcoin Fund, Franklin Bitcoin ETF, and WisdomTree Bitcoin Fund – remained unchanged with no new investments or withdrawals.

Despite investors withdrawing funds from Grayscale Bitcoin Trust and Bitwise Bitcoin ETF on July 9th, the overall inflow still showed a positive balance.

Institutional investors are taking advantage of market volatility by consistently pouring money into ETFs.

Bitcoin ETFs are seeing growing popularity

Crypto investment offerings that concentrate on institutions have gained popularity beyond the US and European markets as well.

In Australia, I’ve discovered that DigitalX has secured approval from the Australian Securities Exchange (ASX) for listing its spot Exchange-Traded Fund (ETF) product on the 8th of July.

In a recent statement posted on X, the investment firm revealed that the DigitalX Bitcoin Exchange-Traded Fund (ETF), identified by the ticker symbol BTXX, is slated to debut in trading on July 12th.

The VanEck Bitcoin ETF, which is comparable to VanEck’s other product, gained regulatory clearance on the 15th of June. Consequently, it started trading on the Australian Securities Exchange five days later, making history as the first spot Bitcoin ETF available there.

Several companies based in Sydney and intending to become exchange-listed entities, such as BetaShares, are anticipated to offer their Bitcoin Exchange-Traded Fund (ETF) products on Australia’s main stock exchange by the year’s end.

BTC/USDT technical analysis

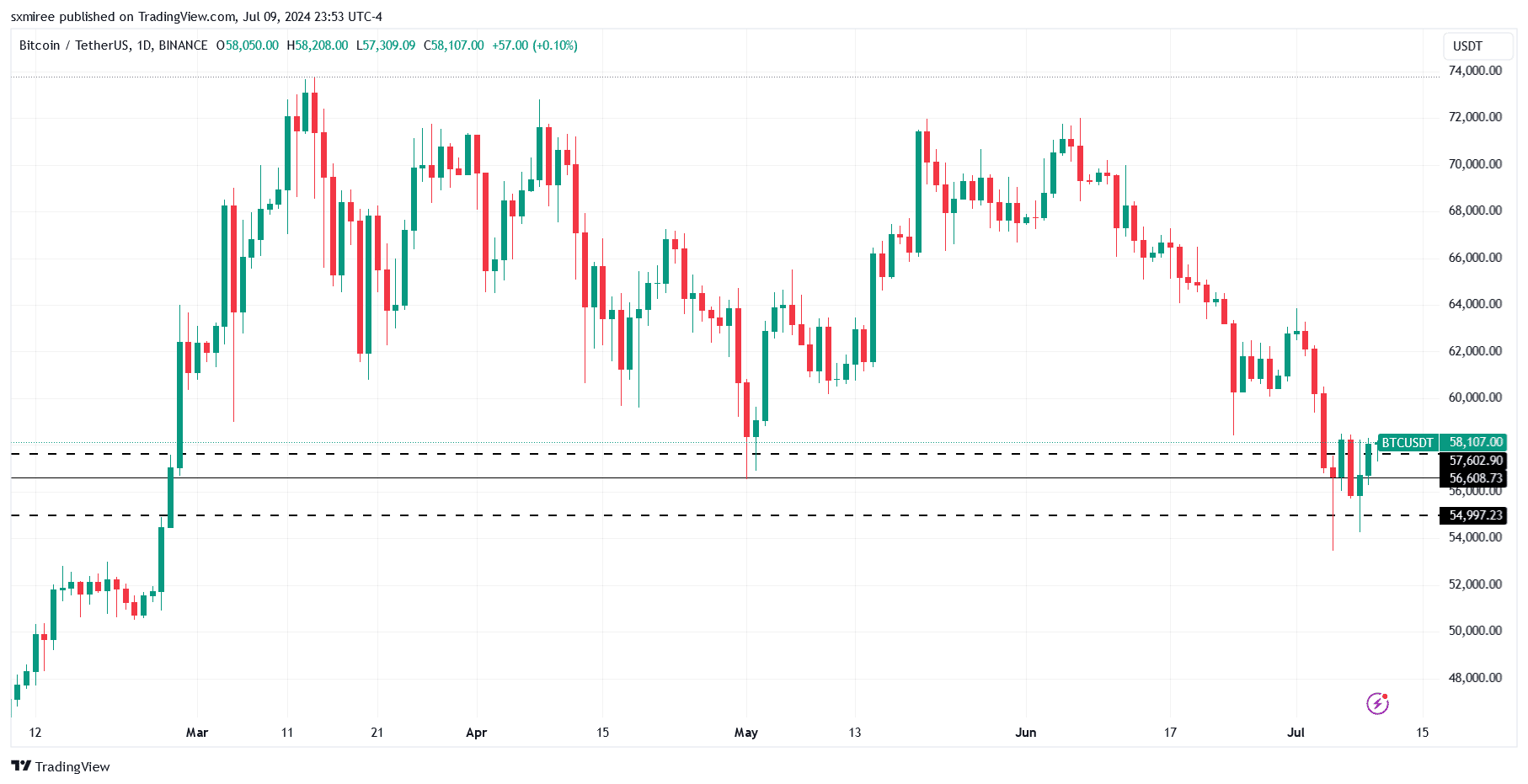

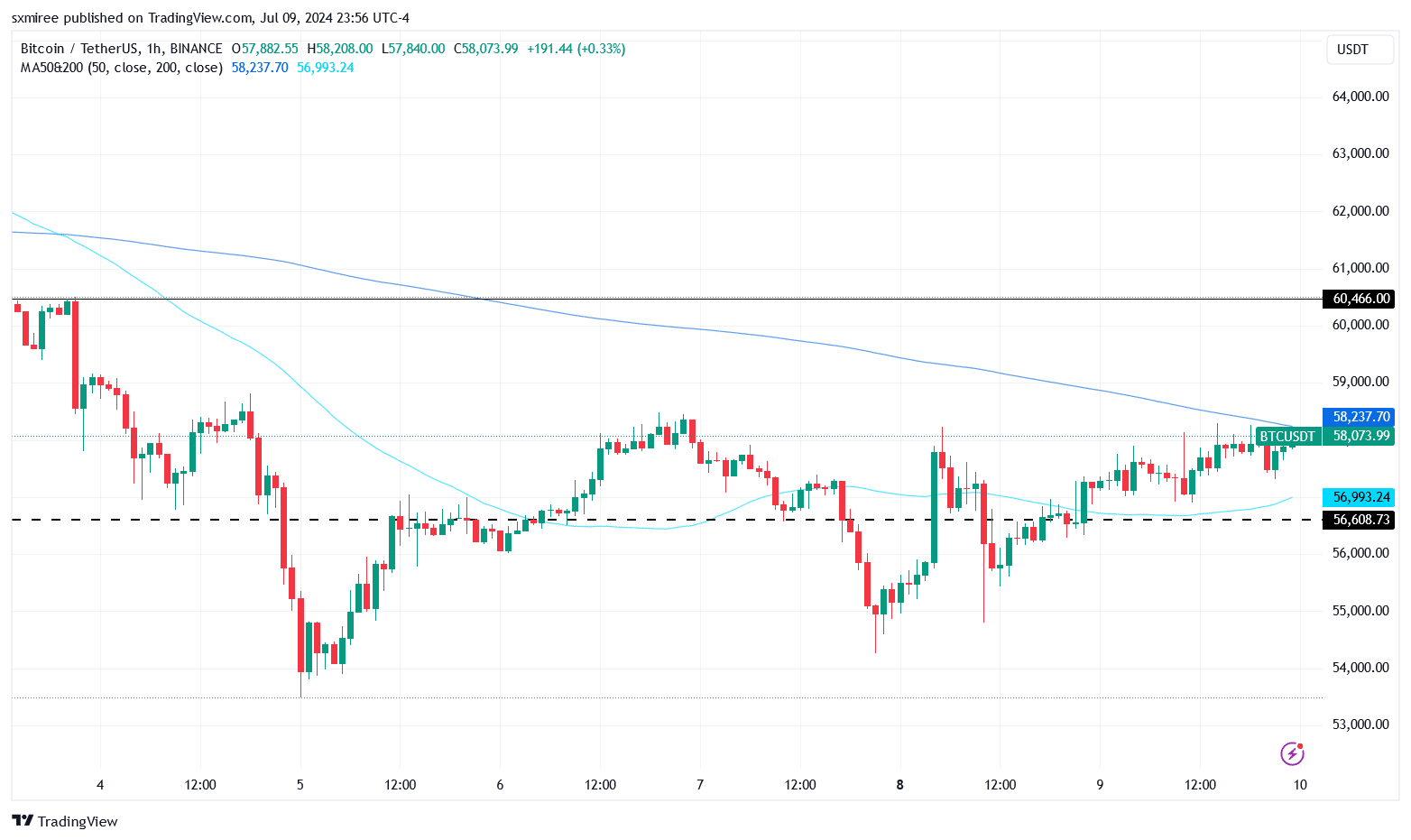

As a market analyst, I observed that Bitcoin spearheaded a modest market-wide recovery on the 9th of July, peaking at a high of $58,239 according to CoinMarketCap data. Now, investors and speculators are focusing their attention on resistance levels situated around the $60,000 mark.

In the past week, the Bitcoin-USD Tether (BTC/USDT) price on the daily chart has established a supportive base between $55,000 and $57,500. Notably, there is a significant support level around $56,600 that aligns with earlier lows recorded towards the beginning of May.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

If we clear out this price range, Bitcoin will be well-positioned to retake some important trendlines that it previously lost last week. Among these trendlines is the 200-day simple moving average, which currently hovers around the $58,240 mark.

As an analyst, I believe there’s a possibility for prices to reach $60K in the future, but any potential gains from this bullish trend could be temporary and brief.

Read More

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Gold Rate Forecast

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- The Heartbreaking Reason Teen Mom’s Tyler and Catelynn Gave Up Their Daughter

2024-07-10 14:16