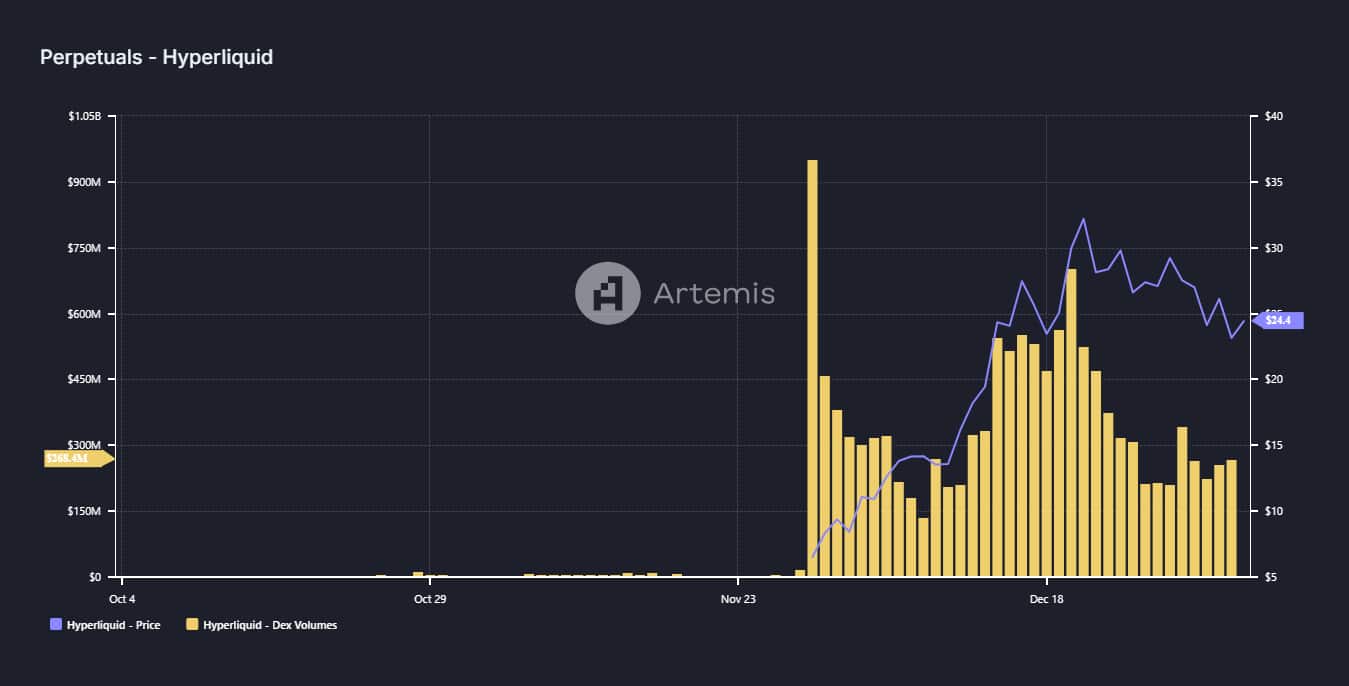

- At the time of writing, HYPE’s trading volume on decentralized exchanges continued to rise, alongside a surge in TVL.

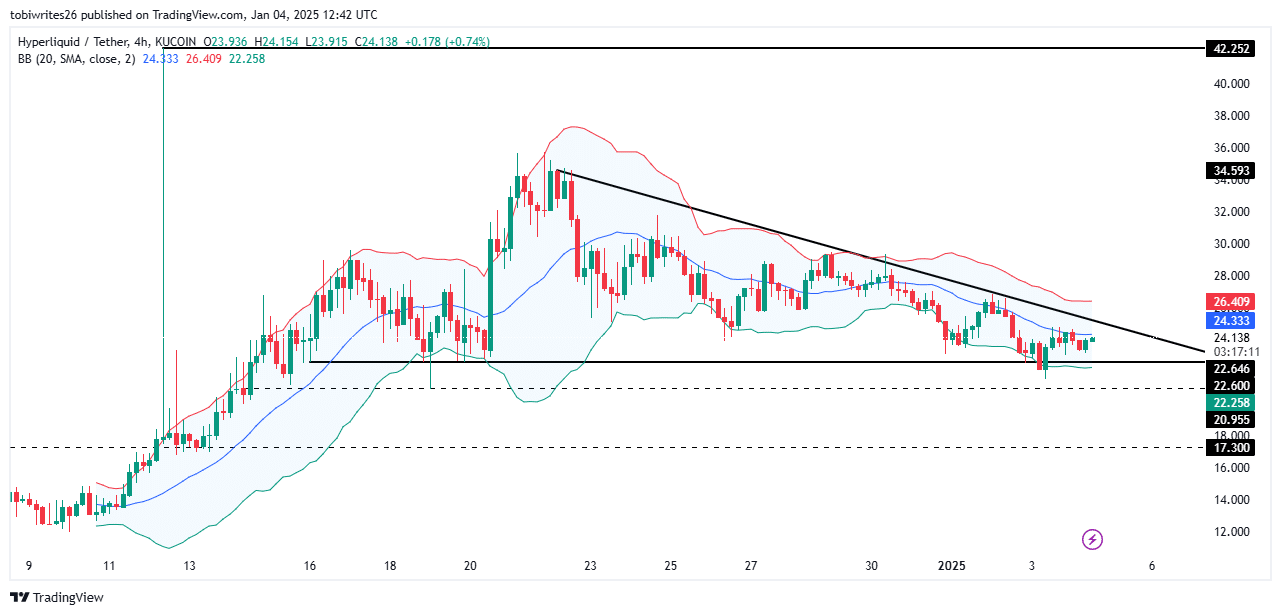

- There was also a confluence between a key support zone and the lower band of the Bollinger Bands.

After a seven-day drop of 12.17%, the digital currency Hyperliquid (HYPE) is showing signs of recovery, increasing by 2.22% over the last 24 hours.

Based on AMBCrypto’s evaluation, there appears to be a positive trend in market feelings, indicating a potential larger surge could occur soon.

Positive momentum for HYPE

Currently, as we speak, the trading volume and Total Value Locked on HYPE’s decentralized exchange (DEX) are demonstrating substantial growth. This upward trend suggests a thriving ecosystem for HYPE.

During the holiday break, there was a temporary decrease in the trading volume for HYPE on DEX platforms. However, this trend seems to have reversed lately, as the volume of HYPE transactions on these platforms is now steadily increasing.

As per the recent figures reported by Artemis, the trading volume stood at approximately $268.4 million when last checked, marking an increase from its previous lowest point of $225.5 million.

A boost in quantity, paired with an uptick in cost, frequently points towards a bullish market behavior. The graph’s blue line, symbolizing the price, mirrors this ascending trajectory.

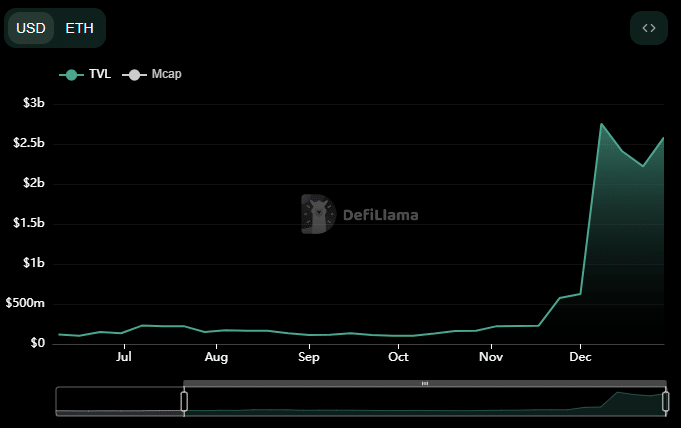

In a similar fashion, the TVL figure, which indicates the movement of funds into and out of HYPE’s protocols, has significantly increased. At the time of this report, the TVL stands at $2.582 billion, bouncing back from a dip to $2.221 billion on December 22nd.

Under the existing circumstances, investing now could be particularly advantageous as it increases the probability of further growth in the market, implying sustained upward trend.

Key chart alignment: A potential surge for HYPE

At the current moment, an important meeting point is seen on the chart. The base of HYPE’s price, which is part of its bullish pattern, coincides with a significant line – the lower boundary of the Bollinger Bands (BB). This alignment could be a crucial point to watch for potential developments in the market.

The graph demonstrated the emergence of a bullish triangle structure, implying a probable increase in price.

The cost of HYPE has now fallen to $22.646, a point considered as a support level within this pattern. Historically, this level has been known to spark upward trends.

This support level coincides with the bottom line of the Bollinger Bands, a technical tool that consists of three parts: the upper band (in red), the lower band (in green), and the middle band (representing a moving average, shown in blue).

A price drop to the lower band often shows oversold conditions and the potential for a rebound.

It seems that HYPE is moving along this pattern, as it has started a surge upward. If the current momentum continues at this point, there’s a good chance it will break through the upper boundary of the bullish triangle, potentially leading to further price increases.

If the purchasing power behind HYPE keeps growing, it might surge even more, possibly attaining its former record peak of $42.

Exchange traders turn bullish

Based on the Buyer-Seller Ratio data from Coinglass, it appears that HYPE’s derivatives market is currently experiencing a surge of bullish investors over sellers, indicating a strong optimistic trend as we speak.

A ratio above 1 indicates a bullish market, while a value below 1 implies bearish conditions.

As a crypto investor, I noticed from Coinglass’s recent report that the sentiment among OKX traders towards HYPE has been predominantly optimistic. The Long/Short Ratio stood at an impressive 7.78, indicating that for every short position, there were almost eight long positions on HYPE. This bullish trend suggests a strong confidence in HYPE’s potential price increase.

This suggests a greater prevalence of lengthy deals over brief ones, signaling robust demand and bolstering the bullish trend for HYPE.

Read Hyperliquid’s [HYPE] Price Prediction 2025–2026

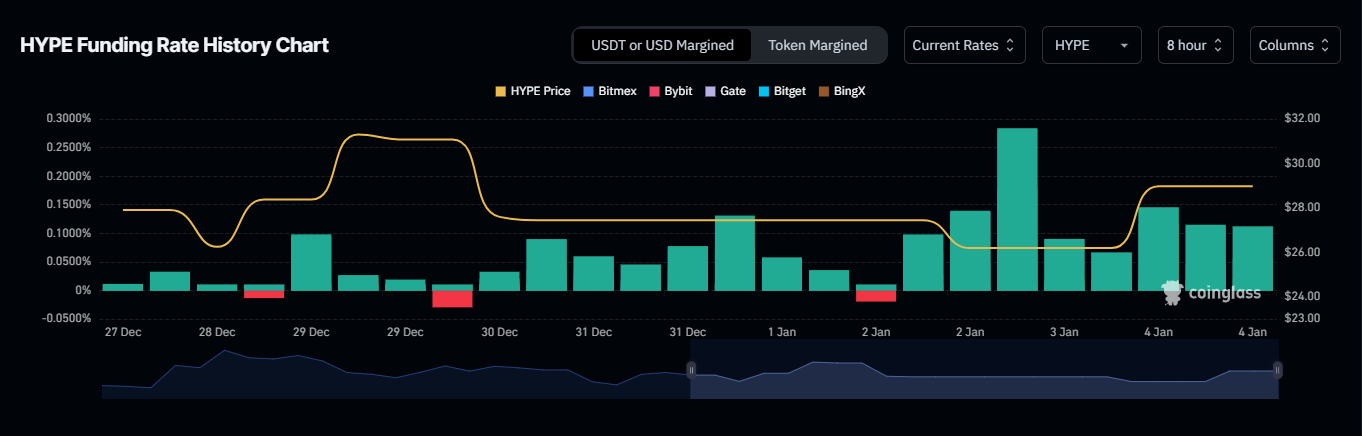

As an analyst, I can confidently affirm that the ongoing bullish trend is reinforced by a healthy Funding Rate, a vital metric that reflects the equilibrium between long and short market positions.

At the given moment, the Funding Rate of 0.0734% indicated that buyers (bulls) had control over the market. This was because they were paying a comparatively higher fee to preserve the difference in price between the immediate (spot) and future contracts of HYPE.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-01-05 11:04