- Litecoin and Dogecoin lead in user adoption in altcoins with the highest number of non-empty wallets.

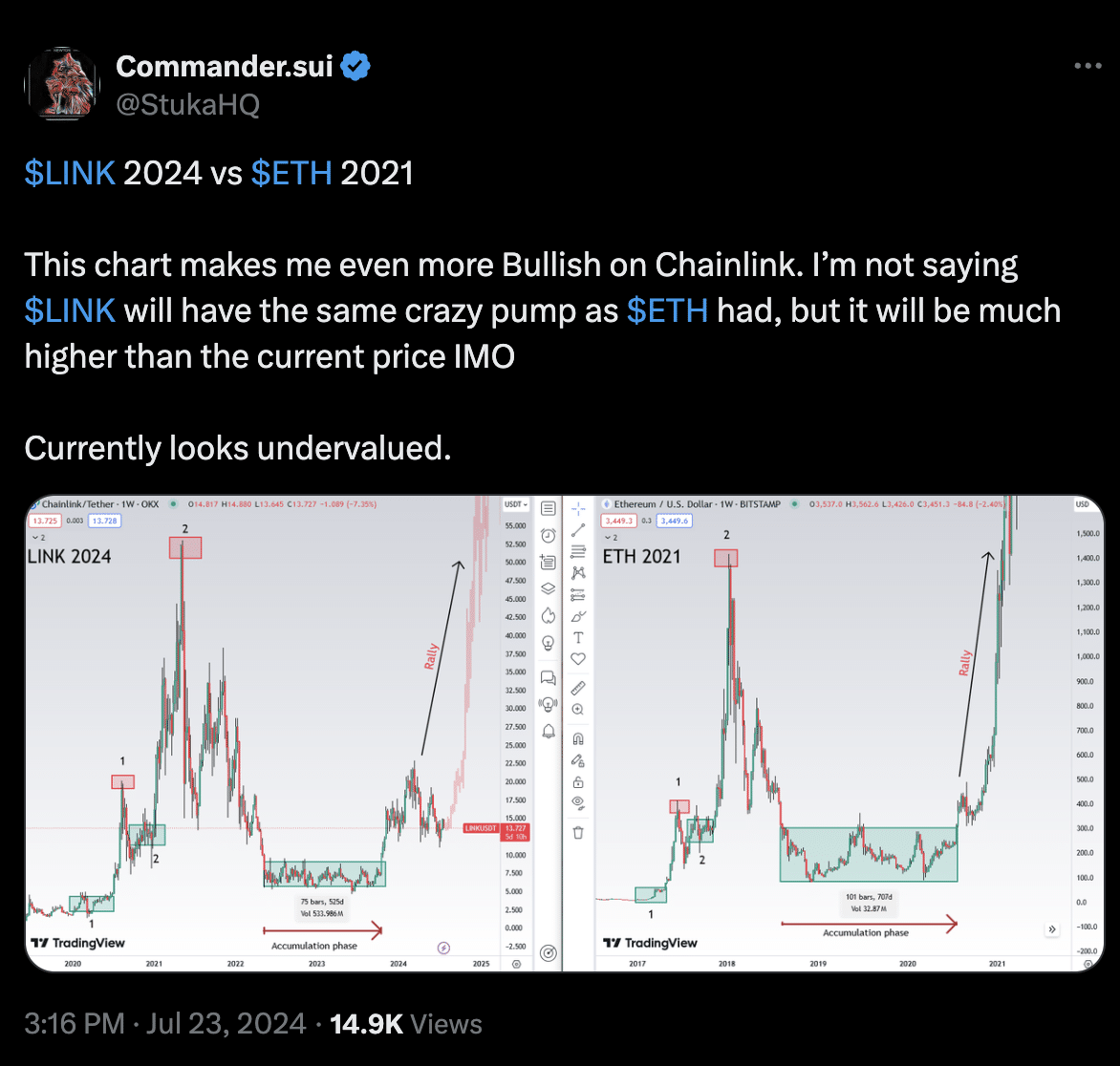

- Chainlink shows potential for growth, mirroring Ethereum’s past price trajectory.

As a seasoned crypto investor with over five years of experience in the market, I have witnessed the ups and downs of various altcoins throughout their existence. Santiment’s latest findings on user adoption and wallet holders across different altcoins have piqued my interest.

The value of the total market capitalization for altcoins has experienced significant fluctuations. Reaching a peak of $1.082 trillion on July 21st, it has since dropped down to a minimum of $1 trillion on July 25th.

Despite a recent minor bounce-back, the market capitalization has resurfaced above the $1 trillion mark.

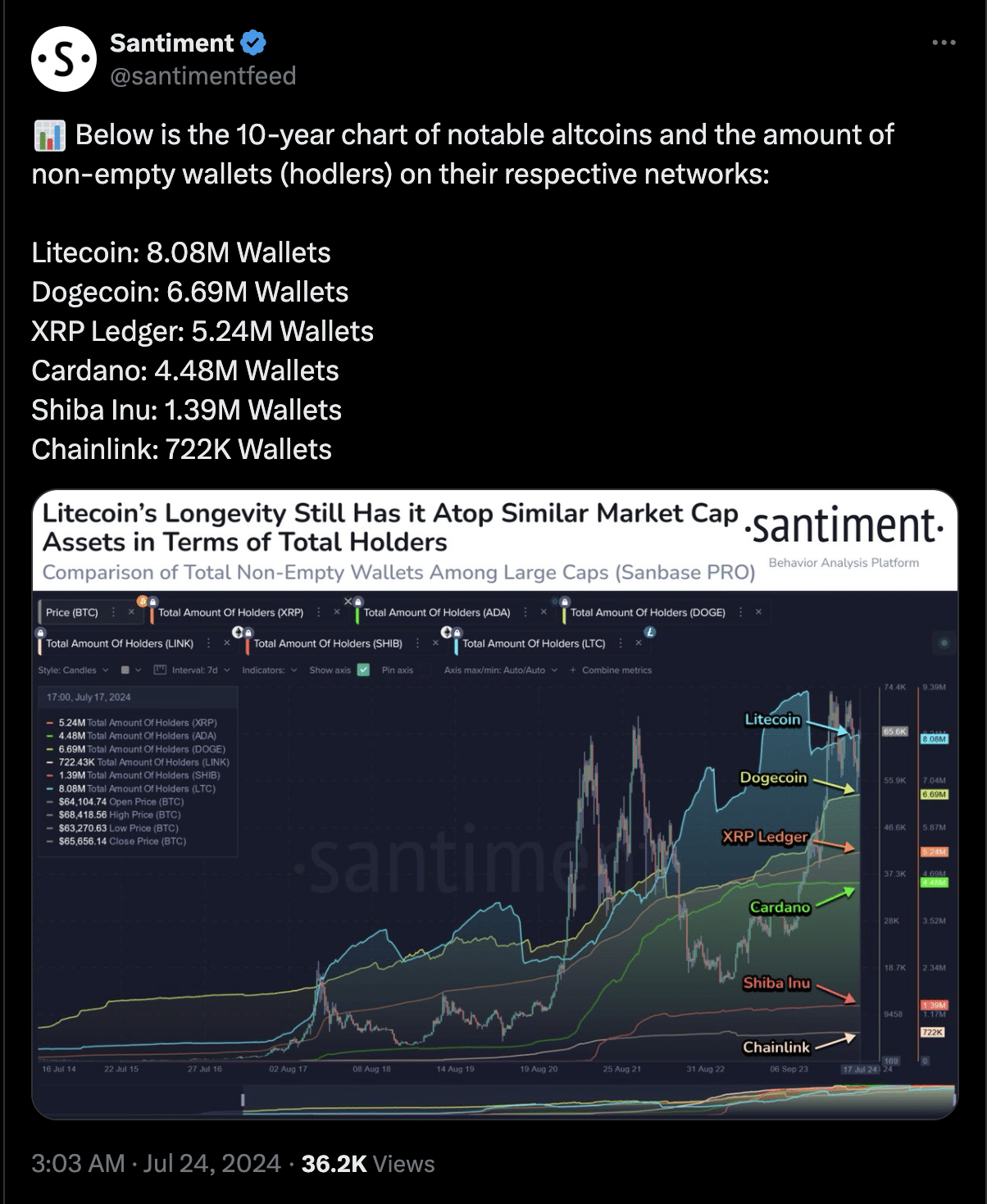

During this period, Santiment, a renowned cryptocurrency market intelligence provider, has disclosed the charts showing the development of significant altcoins over the past decade, alongside the number of active wallets holding these coins.

Altcoin adoption: Who’s leading, who’s not?

Among the prominent alternative cryptocurrencies, Litecoin (LTC) and Dogecoin (DOGE) have gained significant traction with users, showcasing a thriving and expanding base of supporters.

According to Santiment, a renowned cryptocurrency market intelligence provider, the data underscores the persistent allure and growing community of users for these digital currencies.

With around 8.08 million active wallets, Litecoin, referred to as “silver to Bitcoin‘s gold,” demonstrates its popularity among investors.

As a crypto investor, I can tell you that Dogecoin boasts an impressive number of active users, with approximately 6.69 million non-empty wallets in existence. This figure underscores the coin’s enduring appeal and strong user engagement, even given its origins as a meme currency.

Santiment’s ten-year examination uncovers a notable rise in the quantity of active wallets for various altcoins, implying heightened user engagement.

XRP and Cardano are two significant players in the cryptocurrency market, with approximately 5.24 million and 4.48 million wallets, respectively. Shiba Inu (SHIB) is another intriguing meme coin that has gained popularity, as evidenced by its 1.39 million active wallets.

A surge for LINK and DOGE on the horizon?

The conversation frequently revolves around the possible future market trends of altcoins. For example, Chainlink, with approximately 722,000 non-empty wallets, is currently priced at around $13.02, marking a 5.7% decrease over the past day.

Analysts have noticed similarities between Chainlink’s present chart formation and Ethereum’s growth trend during the previous year, which was marked by significant gains.

One analyst is more optimistic about Chainlink after noticing its price chart resembles Ethereum’s, making him more confident in his bullish stance towards Chainlink.

Dogecoin, in contrast, was priced at $0.1249 during the reporting period, representing a 6.4% drop. Crypto expert Ali disclosed his approach, indicating that he hasn’t liquidated any DOGE holdings but has been purchasing more instead. He further mentioned:

Based on my extensive experience in analyzing cryptocurrency markets and observing Dogecoin’s price movements over the past few years, I believe we are witnessing a pattern that has emerged before. Dogecoin will likely consolidate within a descending triangle, which is a common continuation pattern in technical analysis. After this consolidation, we can expect a significant rally of around 140% to 230%. Following the rally, there may be a retracement of roughly 56% to 60% before Dogecoin enters its next bull run. So, given my experience and observation of historical trends, I suggest that we remain patient and wait for these expected price movements to unfold.

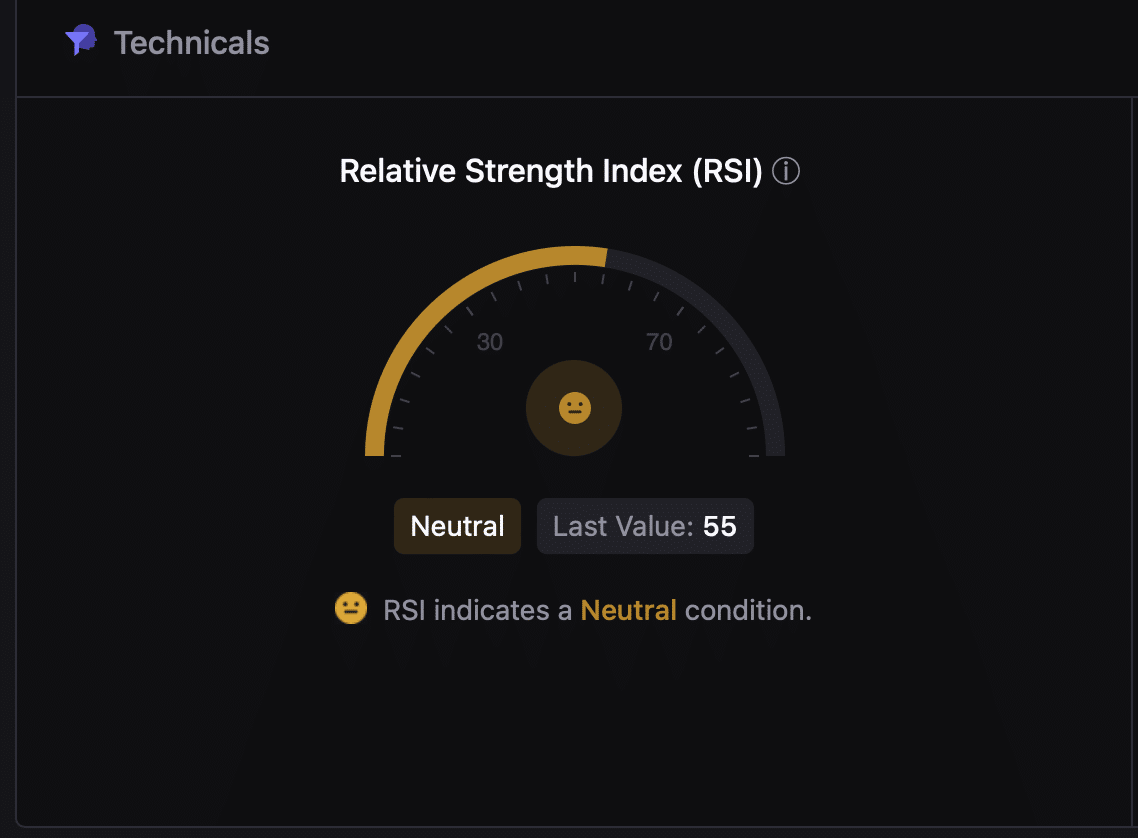

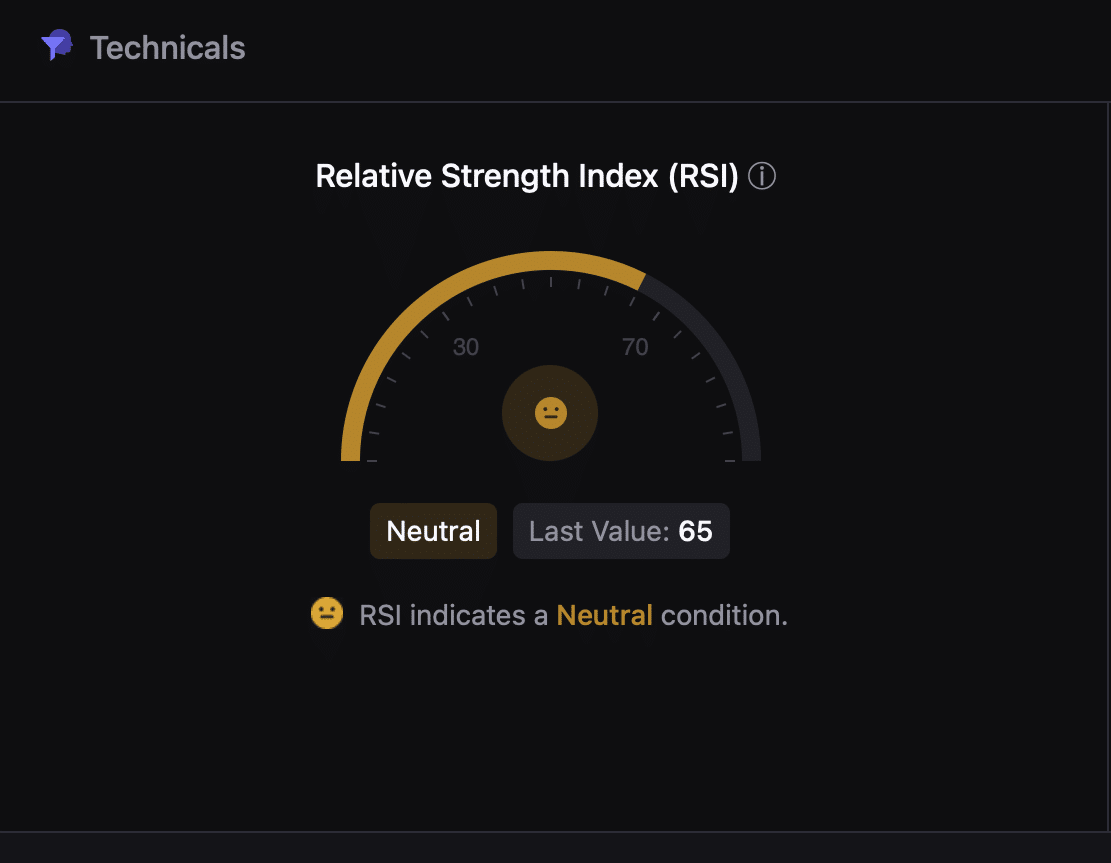

As a crypto investor, I’m keeping an eye on the latest data from CryptoQuant. Based on their analysis, both Chainlink and Dogecoin currently have neutral RSI readings. This suggests that neither asset is significantly overbought or oversold at the moment. However, it’s important to remember that RSI readings don’t provide definitive buy or sell signals on their own, and should be used in conjunction with other technical analysis tools and market conditions.

In simpler terms, the Relative Strength Index (RSI) for Chainlink is currently at 55, indicating an equal balance between investors looking to buy and sell. On the other hand, Dogecoin’s RSI reads 65, suggesting a slightly stronger interest in buying than selling.

In contrast, according to earlier reports by AMBCrypto, more than half of Dogecoin investors have seen profits from their DOGE holdings.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-07-26 06:00