-

BONK momentum was barely bullish and buying pressure was indecisive.

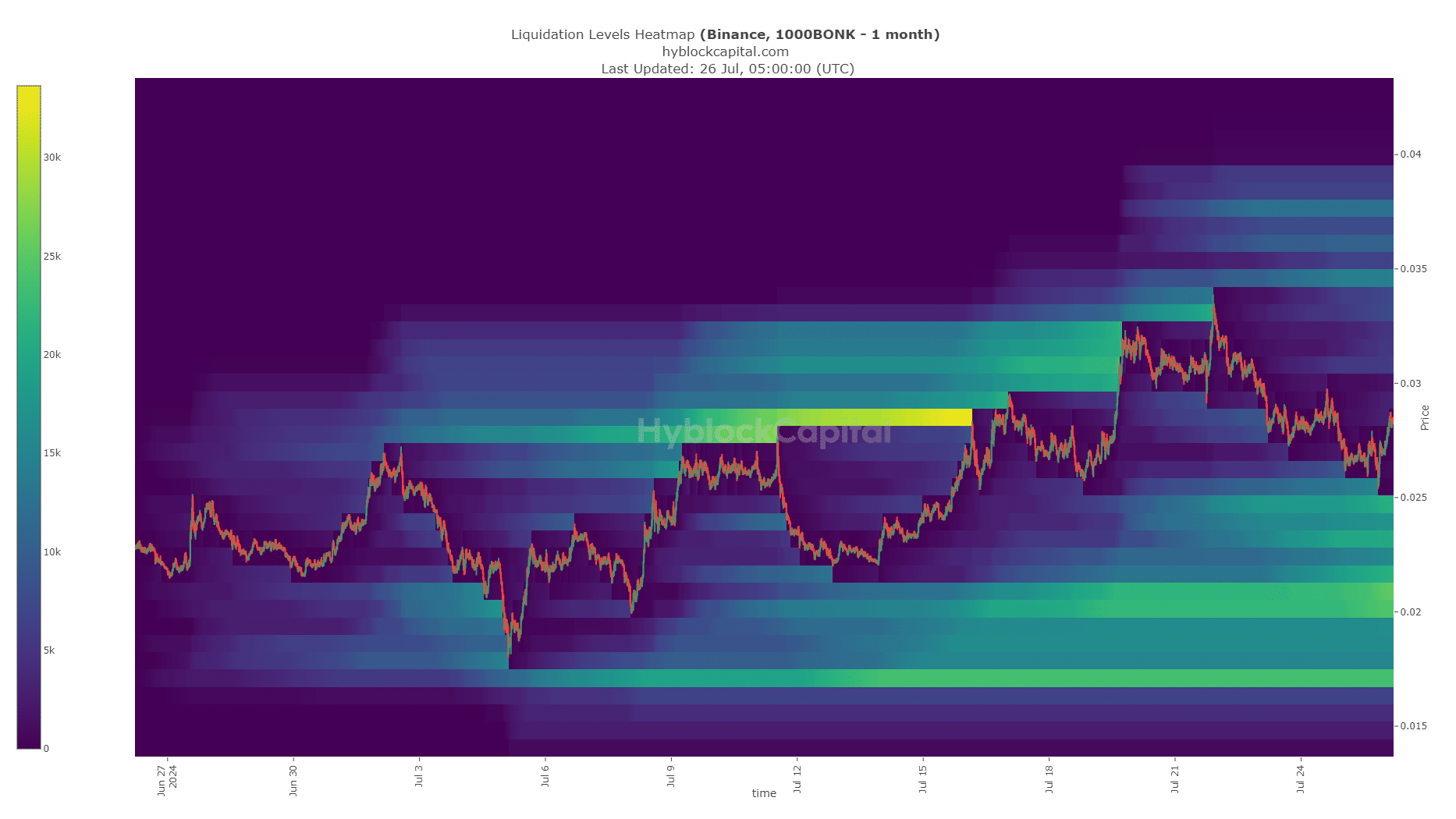

The liquidation levels showed that prices could be pulled lower in the coming weeks.

As a seasoned researcher with extensive experience in cryptocurrency markets, I have witnessed the volatile nature of memecoins like Bonk (BONK). Last week’s 22% decline from the July 22nd high was concerning, but the bullish market structure remains intact.

Last week was turbulent for Bonk (BONK), with a significant decline of 22% from its peak on July 22nd. However, there are signs that it may be regaining its footing and continuing its bullish trend, in line with Bitcoin‘s (BTC) momentum.

Last weekend, a significant resistance level was breached, indicating potential for further growth. However, this didn’t materialize as Bitcoin and the Bullish Coin (BONK) failed to gain sufficient momentum. With the current trend, could we expect the previous week’s losses to be regained this weekend?

BONK prices likely to rebound

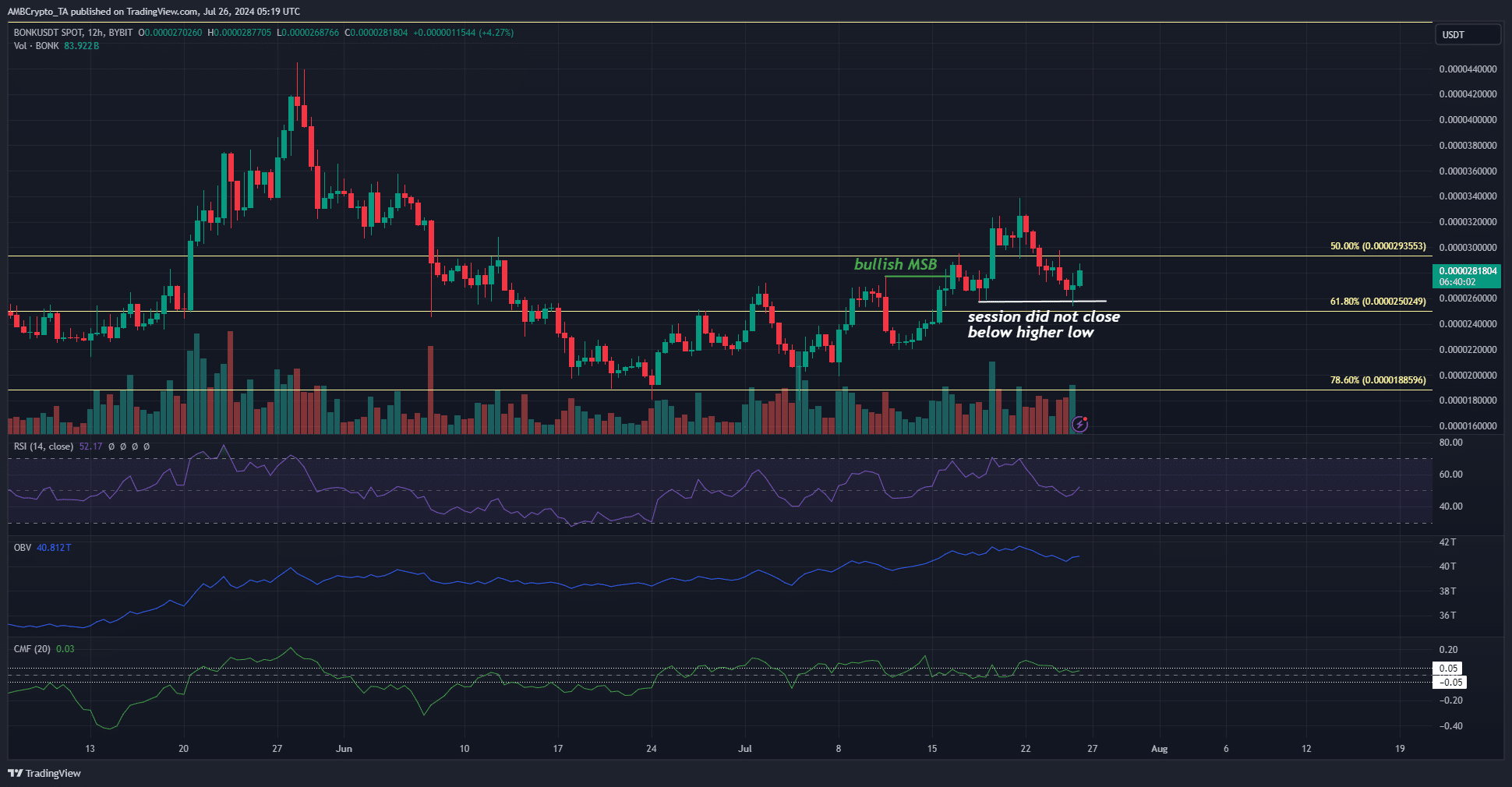

In simpler terms, the 12-hour price chart indicated that the market’s overall trend remained positive. The price surpassing the $0.0000277 mark represented a significant bullish shift in the market structure. Moreover, the new low at $0.0000282 had not been breached as of yet, suggesting continued buying pressure.

As a crypto investor, I would describe it this way: A downturn would be marked by a 12-hour trading session that ends below the current support level. However, prices have instead surged higher from this level. This uptick could potentially be attributed to Bitcoin’s rebound from $64k to $67.1k at the time of reporting, representing a 4.7% increase.

The Capitel Market Farce (CMF) registered a small surplus of 0.03%, indicating insignificant incoming capital. The Relative Strength Index (RSI) stood at 52, yet the momentum was unclear. On the other hand, the On-Balance Volume (OBV) experienced a dip during the previous week, but it has been on an uptrend in July.

Liquidation heatmap warns of a potential downturn

The small $0.000025 pool of liquidity was drained, causing prices to rebound. Yet, there were more substantial amounts of liquidity available at the prices of $0.00002 and $0.000017.

Realistic or not, here’s BONK’s market cap in BTC’s terms

If the market structure turns bearish, these would be the next price targets.

In summary, BONK maintains a optimistic perspective. Following recent setbacks causing losses for the past four consecutive days, the indicators have been brought back to their neutral state. Should Bitcoin undergo a change in direction around $69k, it’s expected that BONK will experience a loss and give up its previous gains.

Read More

2024-07-26 16:07