-

XRP was seeing a somewhat sustained yet tentative bullish trend.

Despite bearish attempts to reverse gains, XRP maintains higher lows after each bull flag.

As a seasoned crypto investor with a keen eye on market trends, I’ve seen my fair share of bullish and bearish cycles. Lately, XRP has been an intriguing play with its somewhat sustained yet tentative bullish trend. Despite bearish attempts to reverse gains, XRP maintains higher lows after each bull flag, indicating a potential consolidation phase before the next leg up.

As an analyst, I’ve noticed an unexpected surge in Ripple (XRP) over the past few weeks, causing a stir among investors and me included. But the million-dollar question is: how long will this bullish trend last for XRP?

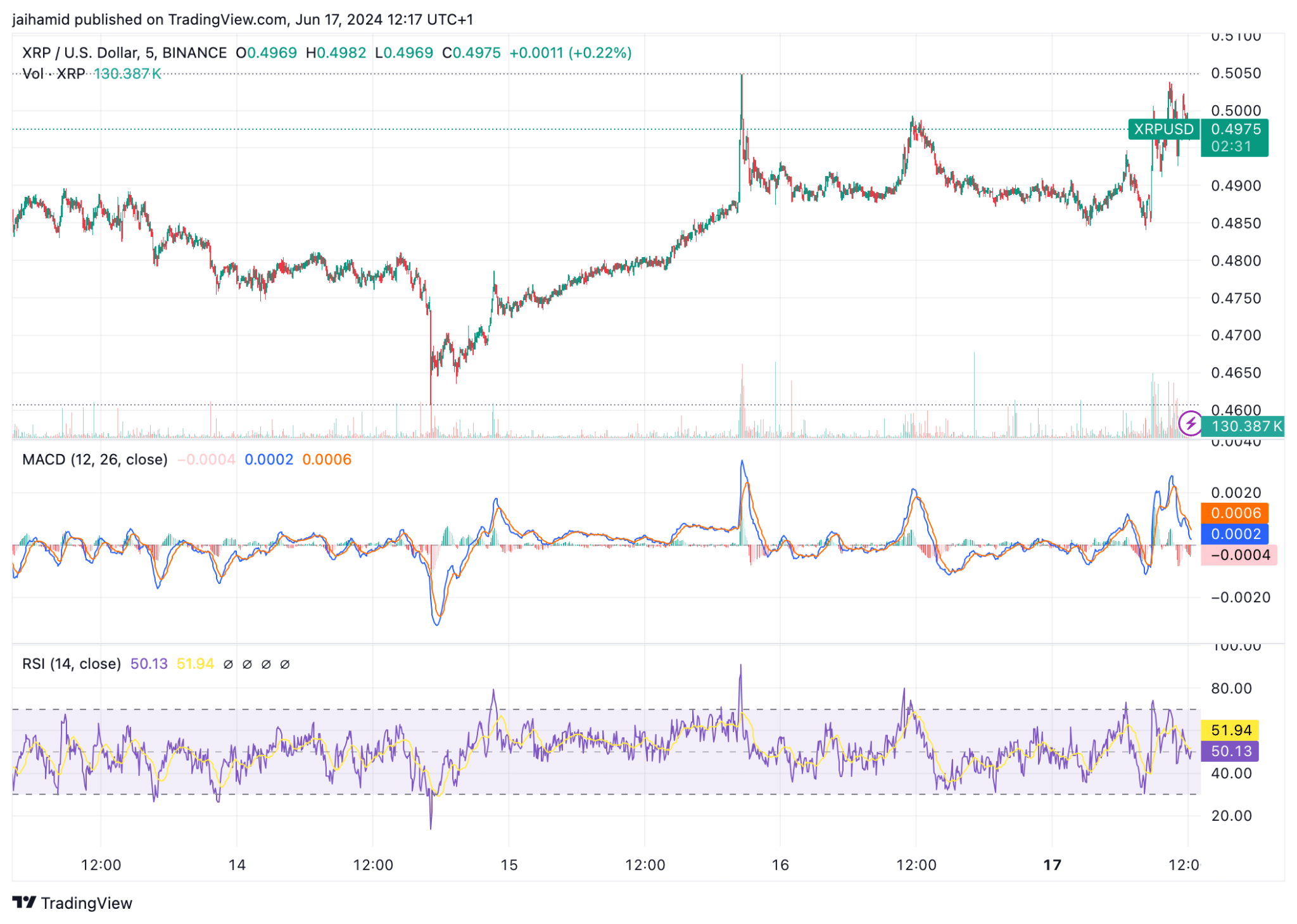

The daily price fluctuations of XRP exhibit a predominant downward trend interspersed by minor rebounds, as depicted in the following chart. Meanwhile, XRP’s MACD line hovers near the zero line, suggesting that the market is evenly divided between bullish and bearish forces.

Blue peaks appearing above the signal line momentarily indicate a bullish trend, but this optimistic outlook is soon countered by following red valleys beneath the signal line.

Bullish momentum to halt or…?

Periodic surges in the Relative Strength Index (RSI) suggest fleeting instances of heightened buying activity. However, these spikes do not endure, implying that any upward market tendencies are uncertain and insufficiently fueled by consistent purchasing power.

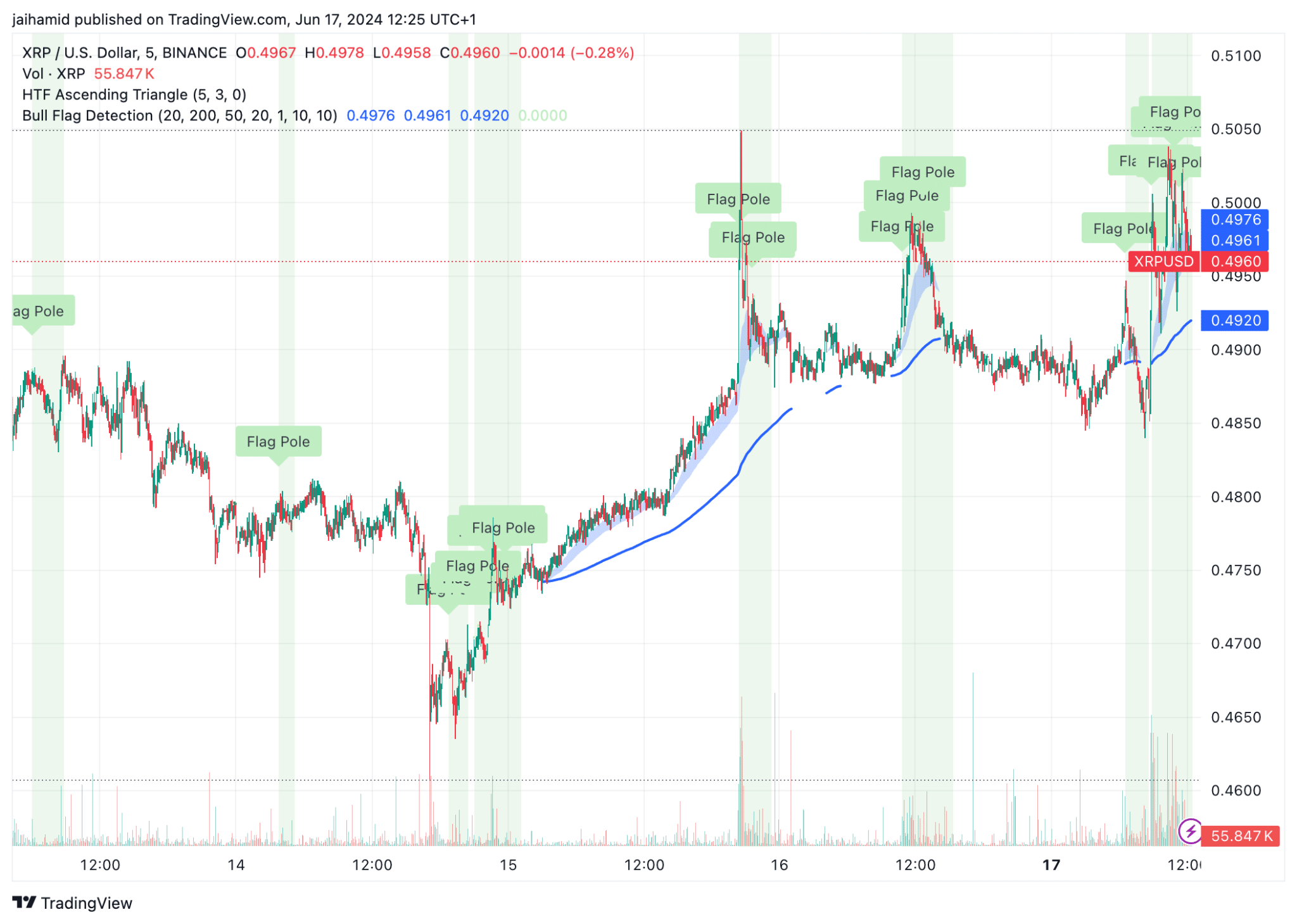

Multiple bullish flag formations appearing on the chart signify that the uptrend is likely to persist further.

Instead of “These poles are followed by horizontal or minor retracement movements forming the ‘flags,’ as shown in the chart above. This pattern typically indicates a consolidation phase,” you could say: The chart above illustrates a common pattern whereafter pole formations, there are brief horizontally moving or minor corrections, referred to as “flags.” These flags suggest a period of consolidation for the price action.

The price has demonstrated strength by remaining above previously identified resistance levels, which have now become new areas of support.

Every bull flag represents a new high point, subtly indicating a persistent optimistic attitude among investors.

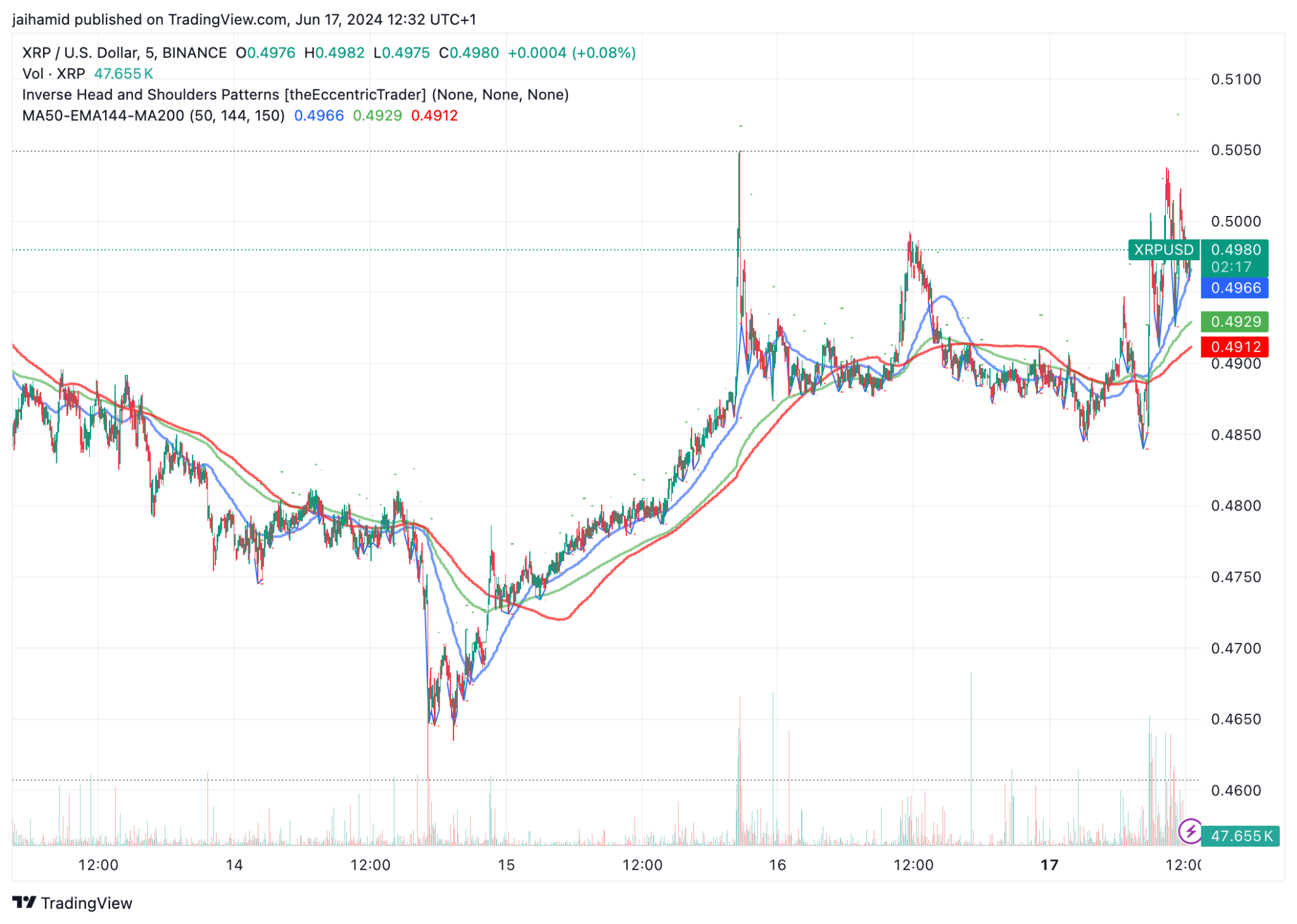

As a market analyst, I’ve observed some potential inverse head-and-shoulders patterns in XRP‘s price action over the last five trading days. However, these patterns appear congested and overlapping due to numerous bearish attempts to reclaim control of the market and reverse the bullish trend.

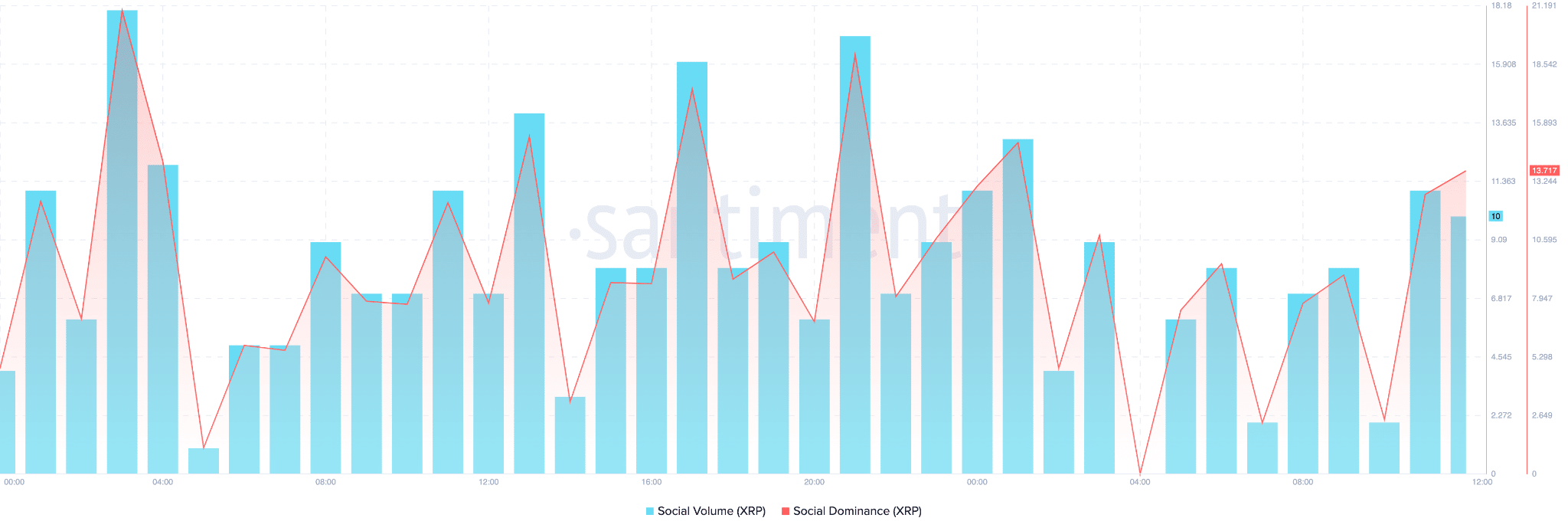

As a researcher observing market trends, I notice that the recent price fluctuations around designated points indicate recurring challenges to resistance levels for XRP. In terms of social activity, my analysis reveals a decrease in volume since the beginning of the year. However, compared to a month ago, XRP’s social performance shows some improvement.

Realistic or not, here’s XRP’s market cap in BTC terms

Social dominance is currently increasing, but hasn’t reached the high points seen in late December and early January yet.

In summary, the bearish forces are vigorously challenging the bullish trend in XRP. For this upward trend to continue, there needs to be a substantial surge in buying activity.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-18 01:11