In the wild and wonderful world of crypto, Maple Finance has managed to pull off a feat that would make even the most seasoned squirrel blush: surpassing a billion dollars in total value locked. That’s right, a billion bucks locked up tighter than your grandma’s cookie jar. 🍪

Over the past month, Maple Finance’s token, affectionately known as SYRUP (because who doesn’t want their money sweetened?), jumped a tasty 25%. On April 16, it touched a sweet peak of $0.1419 before settling down like a polite guest at $0.131. Not bad for something that sounds like breakfast condiments, right?

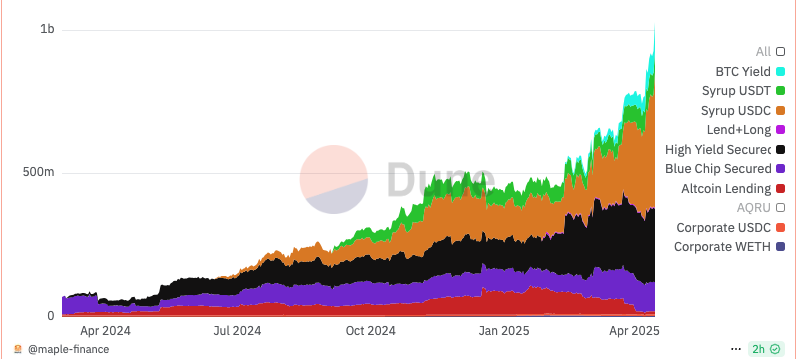

The spark behind this syrupy surge? The platform’s TVL doubled since the chilly days of January, rocketing from a modest $450 million to over a billion. According to the folks at Dune Analytics, it’s a bit like planting a money tree and watching it grow faster than your houseplant under a UV lamp.

Much of this meteoric rise came from the increase in yield-bearing stablecoins—financial instruments that sound about as stable as a toddler on roller skates but apparently work wonders—and a high-yield secured lending product that had investors lining up like it was Black Friday at a maple syrup factory. Case in point: Syrup USDC’s supply surged from $123 million to a hefty $391 million since January, which is almost enough to buy a small country’s worth of pancakes. 🥞

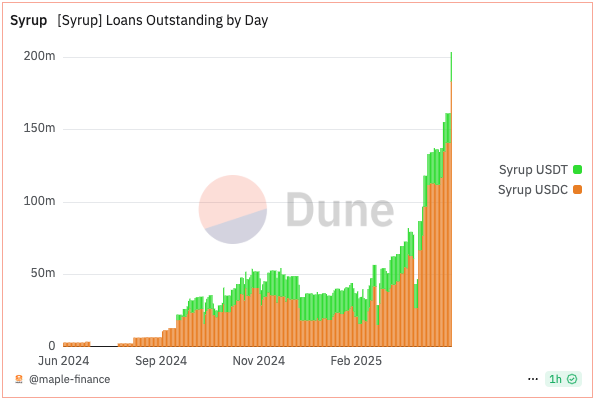

Meanwhile, lending on Syrup USDC skyrocketed like a caffeinated rocket, outperforming its buddy Syrup USDT by leaps and bounds. It pulled in $183 million in outstanding loans, leaving the USDT’s meager $20 million eating its metaphorical dust.

USDC Climbs the Throne Like a True Monarch

Both these stablecoins offer everyday folks a chance to sneak a sip of the platform’s lending yields, which mostly flow to institutional bigwigs known not to ghost on their loans. Maple Finance plays it safe, manually pricing loans to these reputable institutions like a vintage wine auctioneer pricing rare bottles.

They even tossed Bitcoin into the mix with a yield product launched in January, now boasting a $75 million TVL—proof that even the famously capricious crypto king can be turned into a steady income stream if you squint hard enough. 👑

But hey, not everything’s all syrup and sunshine—protocol revenue has taken a bit of a nosedive from $409,628 in January to $370,860 in March 2025. Maybe they spent too much on maple-scented office candles? Who knows!

(SYRUP) (ETH)

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2025-04-16 21:28