- Movement token has a bearish technical bias in the short-term, faces sell-pressure at $1

- On-chain metrics suggested bulls can be hopeful of a recovery

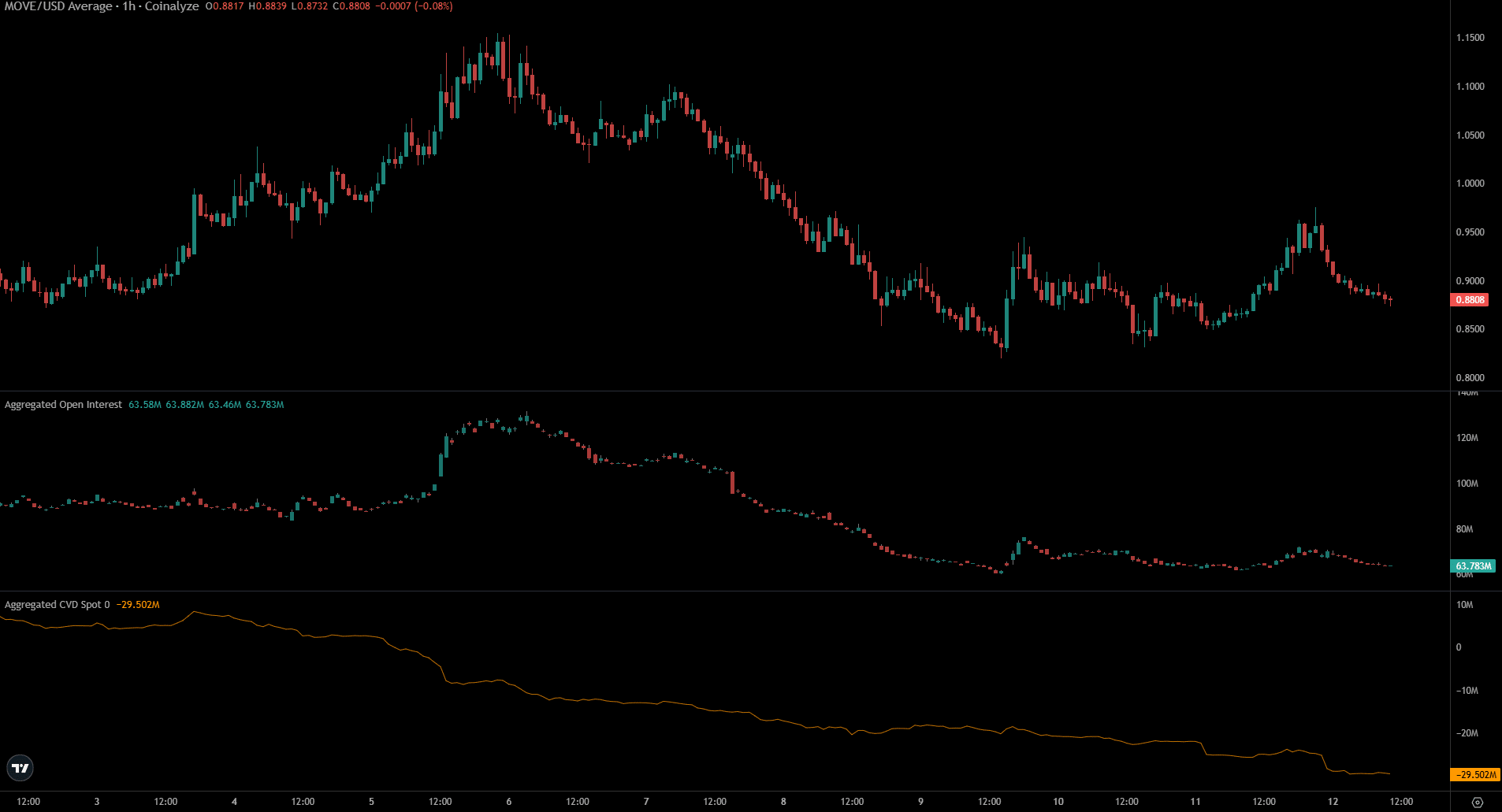

24 hours prior to publication, Open Interest for Movement experienced a 5% increase, which coincided with a 3.3% rise in price. Meanwhile, during the same period, Bitcoin saw a minimal 0.04% growth but also had a slight decrease of 0.09% in its Open Interest.

Regardless of Bitcoin’s current downward trend, the analysis of its realized capitalization and supply distribution suggests that MOVE could potentially be preparing for a rebound.

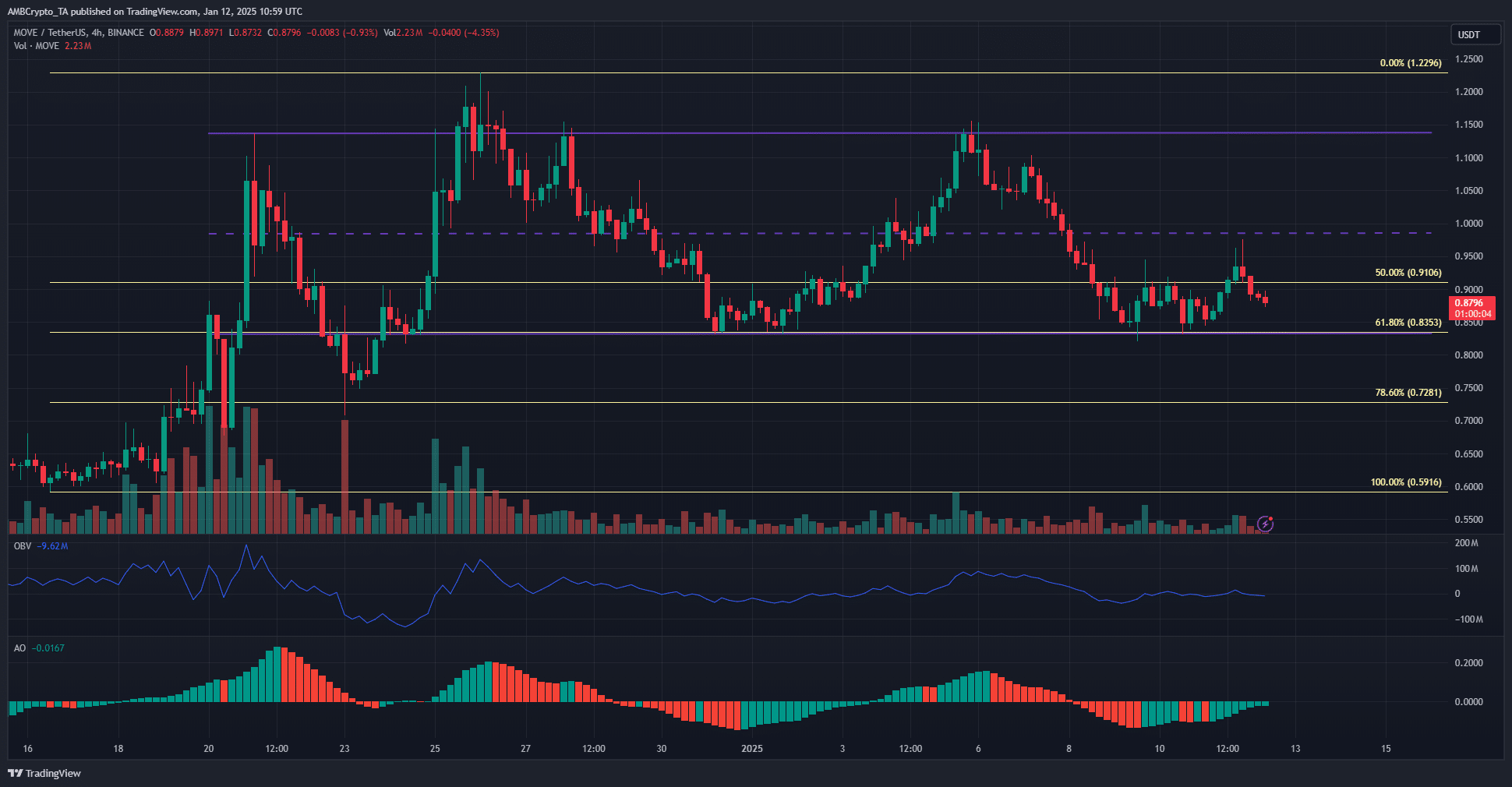

MOVE range formation outlines crucial support and resistance levels

For the past month, Movement token’s price has been fluctuating within a specific range. It increased from $0.83 to $1.13, with the average or midpoint being at $0.98. Over the last five days, this midpoint has acted as an obstacle to the bullish attempts for recovery. Additionally, it aligns with the psychologically significant $1-level, making it more difficult for buyers to push past this resistance.

In this price range between $0.8 and $0.83, there’s a zone that provides support. Over the past fortnight, the On-Balance Volume (OBV) hasn’t reached new lows, which is positive. The selling pressure has not been intense either. While the Awesome Oscillator indicated bearish momentum recently, it appears to be approaching a bullish crossover point as well.

Meanwhile, data from Coinalyze highlighted strong short-term bearish sentiment.

Over the past day, the downward trend in Open Interest has mirrored the decrease in the spot Contract for Value (CVD). Yesterday’s 5% increases were insufficient to reverse the dominant bearish market mood.

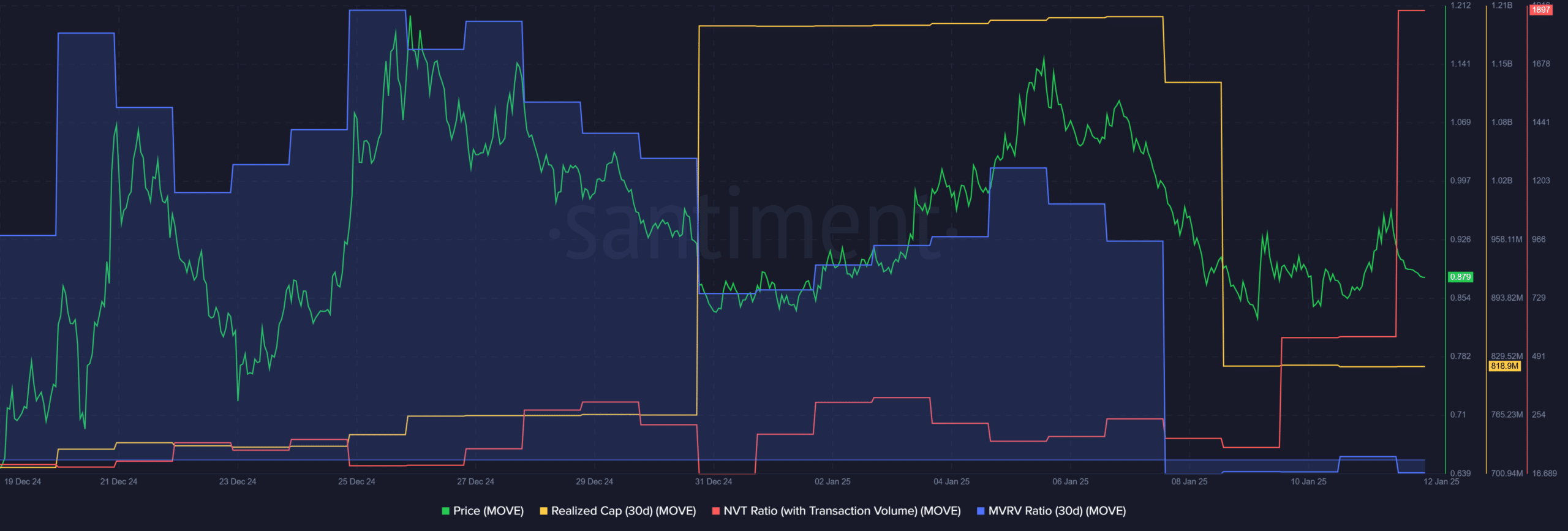

Short-term realized cap underlines distribution trends

As a crypto investor, I’ve noticed an abrupt surge in the NVT ratio lately. This increase suggests that the token might be overvalued compared to its transaction activity. Moreover, the 30-day MVRV ratio for MOVE stands at -4%, implying that MOVE holders are currently experiencing a slight loss.

Over the past seven days, the cumulative price movement within a 30-day timeframe experienced a significant drop, coinciding with a decline in the token’s market price. As the realized cap is determined by the last transaction price of each token, this suggests that participants have been transacting the token at lower prices recently.

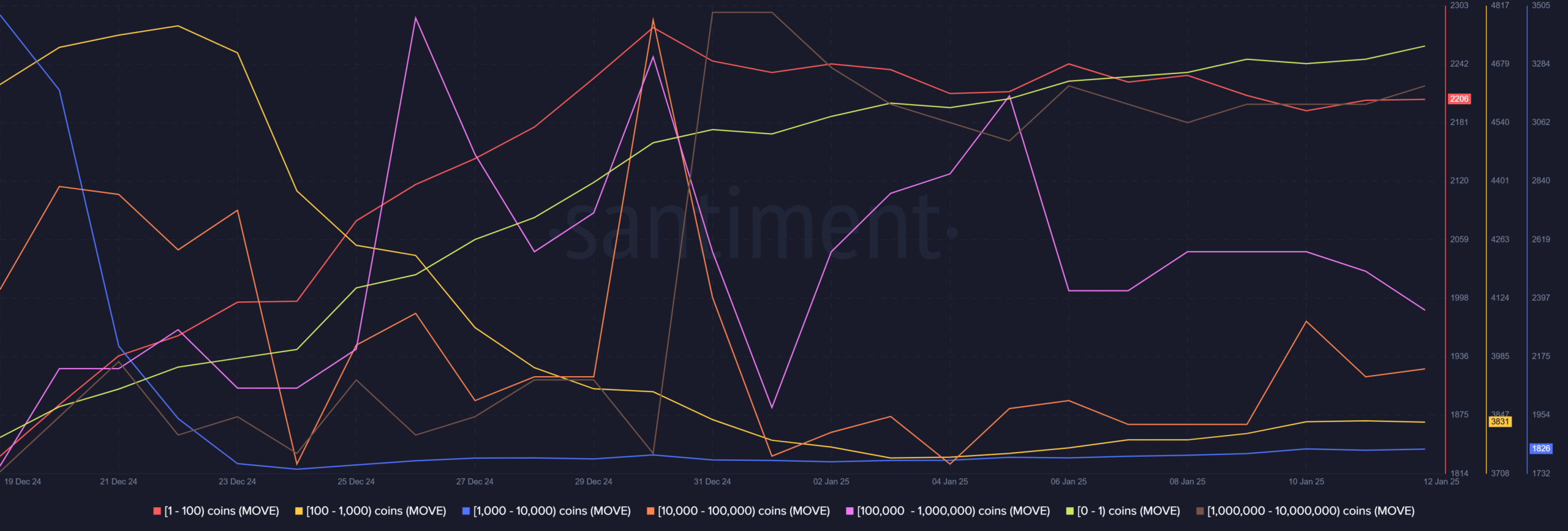

As a researcher, I’ve found that the distribution analysis revealed an interesting trend: while wallets containing 100k to 1 million MOVE tokens constitute a significant portion of the market, the majority of participants have been actively purchasing more. This ‘whale’ group, undeniably crucial in our context, has shown resilience even during the recent market downturn, with their numbers still higher than they were pre-Christmas.

Read Movement’s [MOVE] Price Prediction 2025-26

In summary, there was a predominant short-term negative sentiment (bearish bias), and the Open Interest (OI) adjustments didn’t significantly aid in MOVE’s rebound. Therefore, it would be prudent for traders to monitor the Realized Capriciousness metric closely.

An abrupt increase could serve as a buy indication. At the same time, consistent buildup by certain investor groups suggests strong confidence.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-13 04:07