- Whales withdraw $3.05M PENGU and $3.29M from Binance and Bybit, respectively

- If PENGU breaks below $0.035, it could turn bearish

The substantial removal of approximately $3.05 million in Pudgy Penguin tokens (PENGU) from Binance might indicate that large investors, or “whales,” are amassing these assets.

😱 Trump's Tariff Bombshell Could Crush EUR/USD!

Markets on edge — read the urgent new forecasts before it’s too late!

View Urgent ForecastCombining this action with a significant transaction from Bybit suggests increasing trust among large-scale investors. Notably, these types of actions frequently occur before price spikes, as the actions of ‘whales’ (large investors) significantly impact market sentiments and can lead to market surges.

If several whales gather vast quantities of PENGU, they might influence the market’s supply patterns, which could lead to an increase in prices due to heightened demand. As more whales participate, the perceived worth and request for PENGU may escalate, creating a positive outlook for its short-term market behavior.

This significant build-up signaled a crucial turning point, potentially boosting the market value of Pudgy Penguins.

PENGU performance and prediction

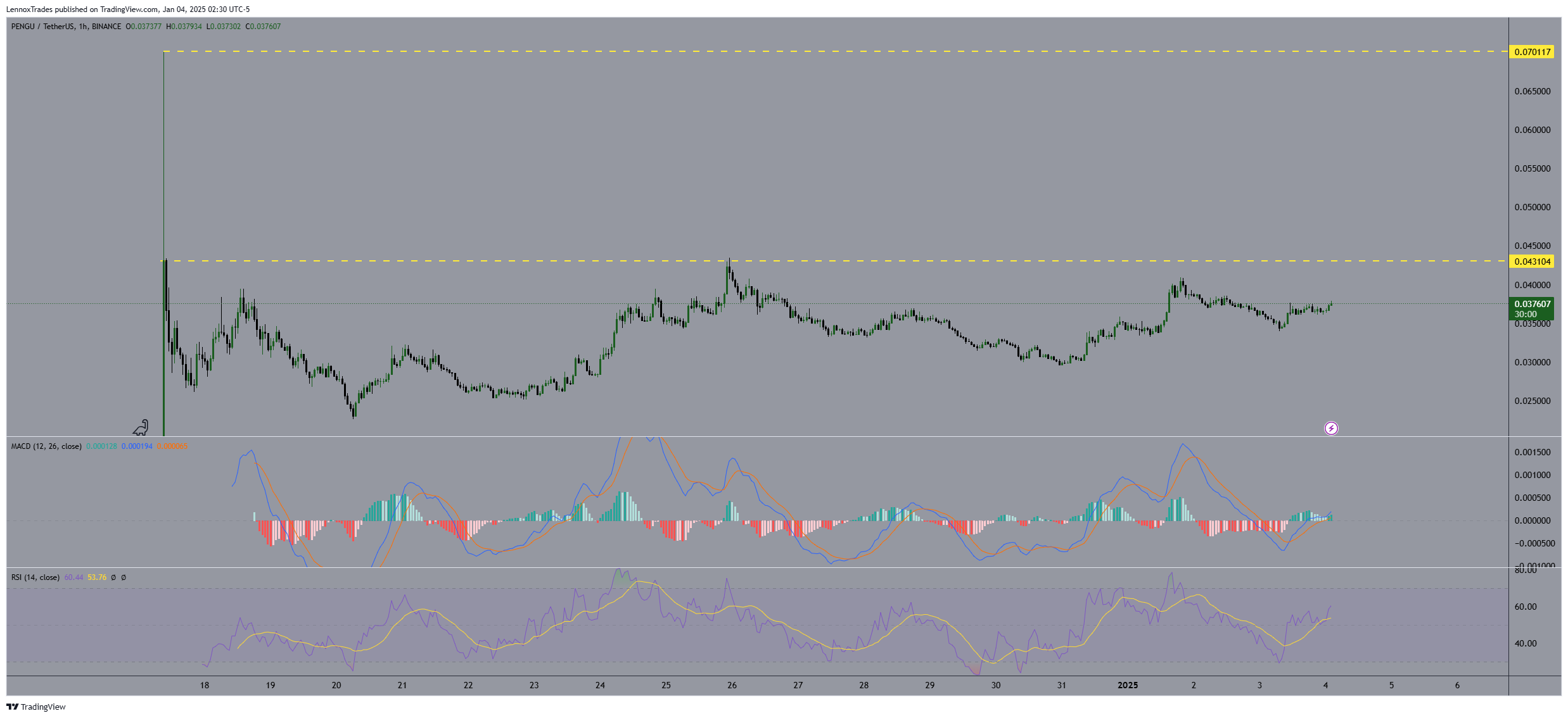

Examining its current performance shows that PENGU has experienced a rise of more than 3% in the last 24 hours, but its daily trading volume has dropped by over 5%. The price trend of PENGU suggests strength as the cryptocurrency made a robust entry into the market, reaching $0.07017 at one point before experiencing a substantial dip.

Later, it found a strong footing at approximately 0.035 dollars, bouncing around this level predominantly. This period of stability could potentially pave the way for upcoming surges, hinting at a stage of consolidation that might foster future growth.

The Relative Strength Index (RSI) surpassed the central point, indicating a rise in buying enthusiasm. Additionally, the Moving Average Convergence Divergence (MACD) supported this optimistic perspective, as it showed an intersection suggesting possible continuous uptrends ahead.

Currently, PENGU is close to a significant support zone priced at approximately $0.035487. Should this level not hold, the price may dip towards the initial target of around $0.043 and potentially reach the secondary goal at $0.070. This implies that PENGU has managed to recover from its initial market turbulence, with a possibility of surpassing its original market value.

If the backing continues to stay firm, it’s possible that Pudgy Penguins could break through the resistance at $0.036921, potentially leading to a significant surge of up to 98%. This could even surpass their all-time high (ATH).

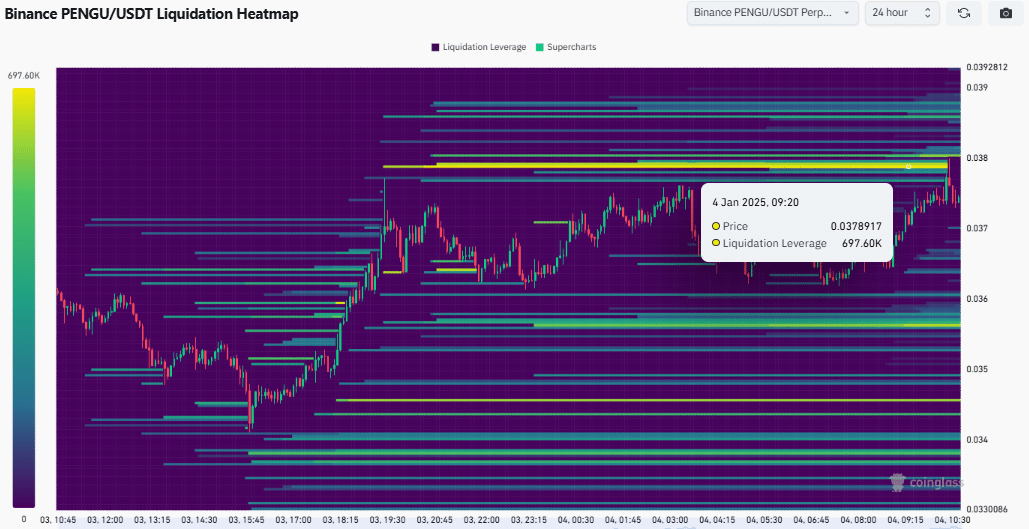

Liquidation heatmap

Furthermore, the PENGU’s liquidation heatmap reveals a significant cluster of highly-leveraged positions susceptible to liquidation at approximately $0.038. This implies that nearly 697,600 units of PENGU might be in jeopardy if the price drops slightly beneath this value.

Should PENGU fail to maintain this level of support, it might initiate a steep drop, potentially causing more sell-offs in a domino effect because of forced liquidations. This chain reaction could intensify the overall price decrease.

On the flip side, maintaining levels higher than this point might help establish a steady market for PENGU and serve as a base for future profits, hinting at a possible recovery should buying support strengthen.

As an analyst, I’ve noticed that the intricate equilibrium between market conditions underscores the crucial impact of liquidation thresholds on the swift fluctuations and overall mood of markets dealing with leveraged assets. In simpler terms, these thresholds significantly shape short-term price changes and the general market spirit.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- The Boys season 4: Release date, cast, trailer and latest news

- Apple Watch Series 10 UK release date, price and when you’ll be able to pre-order

- ANKR PREDICTION. ANKR cryptocurrency

2025-01-05 04:07