-

PEPE’s bearish trend continued as it fell below the 20-day and 50-day EMAs, but near-term volatility could offer some opportunities

Memecoin’s derivates data revealed cautious optimism for buyers

As a seasoned analyst with over a decade of experience navigating through the ever-evolving crypto landscape, I find myself standing at the crossroads of cautious optimism and pragmatic skepticism when it comes to PEPE‘s near-term prospects.

Over the last day, the overall value of meme coins jumped by 10%, reaching approximately $42 billion, which has boosted market optimism. Meanwhile, the Crypto Fear & Greed Index moved from the ‘fear’ region to a ‘neutral’ level, indicating that investors are becoming more cautiously optimistic after spending a considerable period in fearful territory.

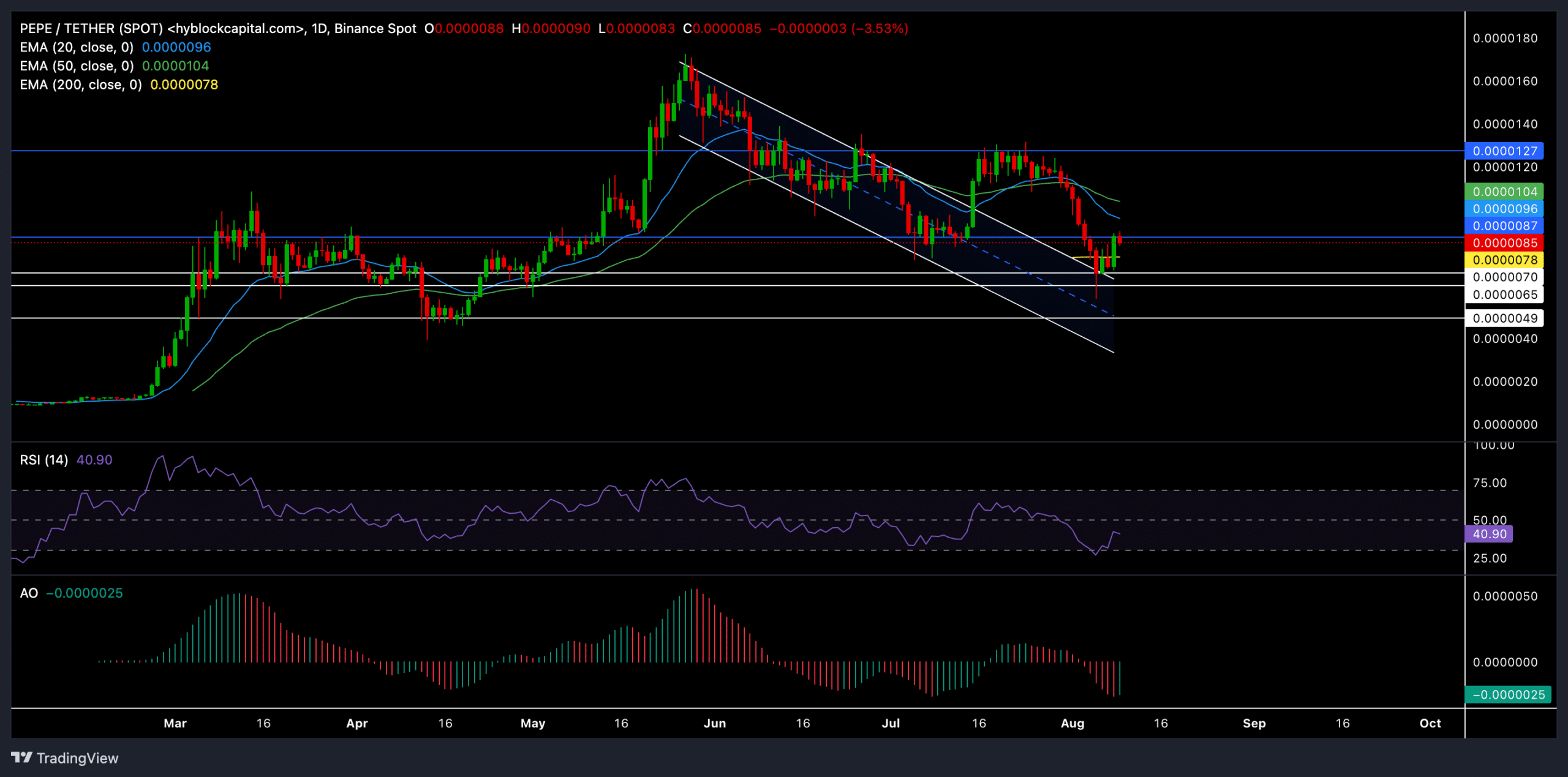

PEPE’s bullish momentum weakened significantly when it dropped below both its 20-day and 50-day moving averages, having initially hit resistance at $0.0000127. But a recent recovery from PEPE‘s immediate support line has created an opportunity for investors to jump back in.

PEPE was trading at $0.0000086, at the time of writing.

Can PEPE bulls reverse the near-term trend?

PEPE’s price movement has been predominantly downward for some time now, with each successive peak being lower than the last, accompanied by dips that also fail to reach previous high points. Additionally, it has lost important points of support along the way.

During this period, PEPE exhibited a downward trend on its daily graph, shaping a descending channel that suggested a strong bearish bias. This downtrend caused PEPE to drop beneath both its 20-day and 50-day moving averages.

Speaking as a crypto investor, I’d like to highlight an exciting development regarding PEPE. In mid-July, we witnessed a predicted breakout from its descending trendline, which gave buyers a chance to challenge the $0.0000127 resistance level that had previously held strong. This event was quite significant and could potentially pave the way for further price action.

Nevertheless, the bears aggressively instigated a sharp drop following the resistance level due to market instability. This decline has now encountered support around the intersection of both horizontal and diagonal lines, approximately at the $0.0000065 – $0.000007 range.

In simpler terms, the buyers are trying to initiate an immediate increase in price. However, the resistance at $0.0000087 could present temporary obstacles. If PEPE manages to close above this point, the bulls will strive to reach $0.0000127 in the upcoming trading periods.

If the overall market’s negative trend persists, there’s a possibility that the memecoin might reach its next significant support point at approximately $0.0000049.

The Relative Strength Index, or RSI, has maintained a bearish lean yet is trending upward following a dip into the oversold region. If the price manages to close above the 50-mark, it would suggest that selling pressure has eased.

Furthermore, the Awesome Oscillator has now displayed a positive (green) line following PEPE‘s recent price increases – an early sign suggesting a potential bullish trend.

Derivates data revealed THIS

The significant increase in Open Interest during the past 24 hours might indicate that additional traders are joining the market, potentially speculating on future price fluctuations related to PEPE.

In this scenario, there’s a slight preference towards taking short positions (with a long to short ratio of approximately 0.9736), suggesting a cautious optimism. Yet, the substantial liquidations, predominantly on the side of shorts, underscore market volatility and indicate the possibility for more price fluctuations ahead.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-08-10 13:11