- Uniswap’s CEO receives SEC’s Wells notice, similar to Coinbase.

- Ripple’s resilience offers lessons for Uniswap.

In the middle of the ongoing lawsuit between Ripple (XRP) and the Securities and Exchange Commission (SEC), attention has shifted towards Uniswap Labs.

On April 10th, the CEO of Uniswap (UNI) announced on X (previously known as Twitter) that they had been given a warning by the Securities and Exchange Commission (SEC).

Uniswap CEO’s persistent optimism

In a talk with the “Bankless” podcast, Hayden Adams, Uniswap’s CEO, shared his worries.

“The SEC is essentially taking very aggressive stances and basically trying to shut down crypto.”

He provided more insight into the Wells notice concerning Uniswap’s user interfaces. This development came alongside a recent court decision classifying Coinbase as a broker.

He said,

“Two weeks ago, Coinbase suffered a legal setback when their case was dismissed from court before it even went to trial.”

The ruling’s importance is emphasized through this comparison, potentially setting a precedent for Uniswap’s similar situation.

Uniswap to follow Ripple’s footsteps

Additionally, Stuart Alderoty, Ripple’s CLO citing criticism against SEC highlighted,

“The SEC has been unsuccessful in their recent appeal case, Govil, at the Second Circuit Court of Appeals. The court ruled that since the buyer did not sustain any financial harm, the SEC cannot claim disgorgement from the seller.”

Uniswap could learn a thing or two from Ripple’s flexibility in facing regulatory challenges. Ripple managed to maintain a positive trend in trading even before the recent market slump.

In light of the recent cryptocurrency market crash, numerous tokens suffered substantial double-digit drops. Yet, some investors took advantage and bought more XRP during this downturn.

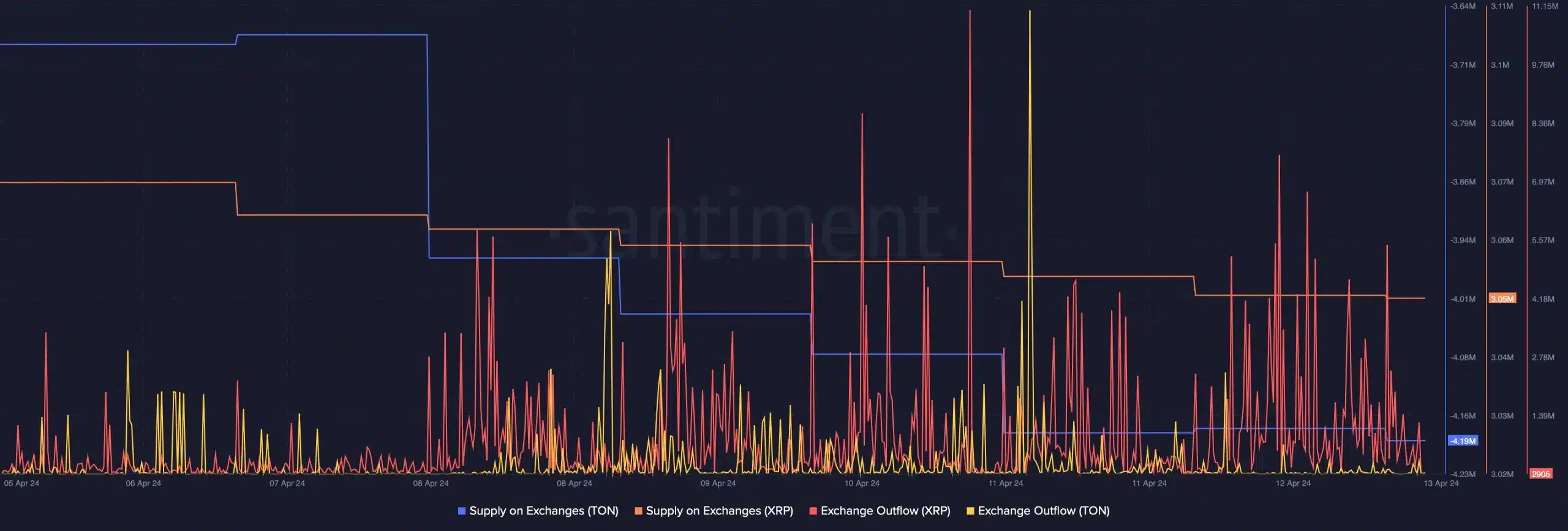

According to AMBCrypto’s examination of Santiment’s statistics, there has been a rise in XRP being transferred from exchanges over the past few days.

Amidst the market downturn, some investors saw the price decrease as a chance to invest.

What’s lies ahead for Uniswap?

Over the last 24 hours, UNI encountered various difficulties that led to a notable decrease of 12.64%. This downturn suggests a period of stabilization for UNI.

The weekly chart revealed a sharp 28.21% decrease, plummeting from $11 to $7 in just three days.

The lengthy legal dispute between Uniswap and the SEC leaves us wondering: How far will the regulatory agency be prepared to push?

Despite facing challenges, UNI tokenholders may anticipate a substantial increase in value if they learn from other altcoins, specifically XRP, and remain persistent.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- LPT PREDICTION. LPT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-04-14 11:03