- Solana is playing a critical role in bringing PYUSD into the mainstream.

- $1 billion marketcap on the horizon, recap of how PYUSD’s robust marketcap growth has played out since the Solana integration.

As a seasoned crypto investor who’s seen the rise and fall of numerous digital assets over the past decade, I must admit that the growth trajectory of PayPal’s stablecoin PYUSD is nothing short of impressive. The integration with Solana has undeniably played a pivotal role in this rapid ascent, pushing it towards a $1 billion market cap valuation at an unprecedented pace.

PayPal’s digital currency, PYUSD, was launched over a year ago and is fast approaching a valuation of $1 billion. Since integrating with the Solana network, it has seen significant growth that deserves attention.

Approximately three months have passed since the Solana integration, and PYUSD is rapidly advancing its position among the leading stablecoins.

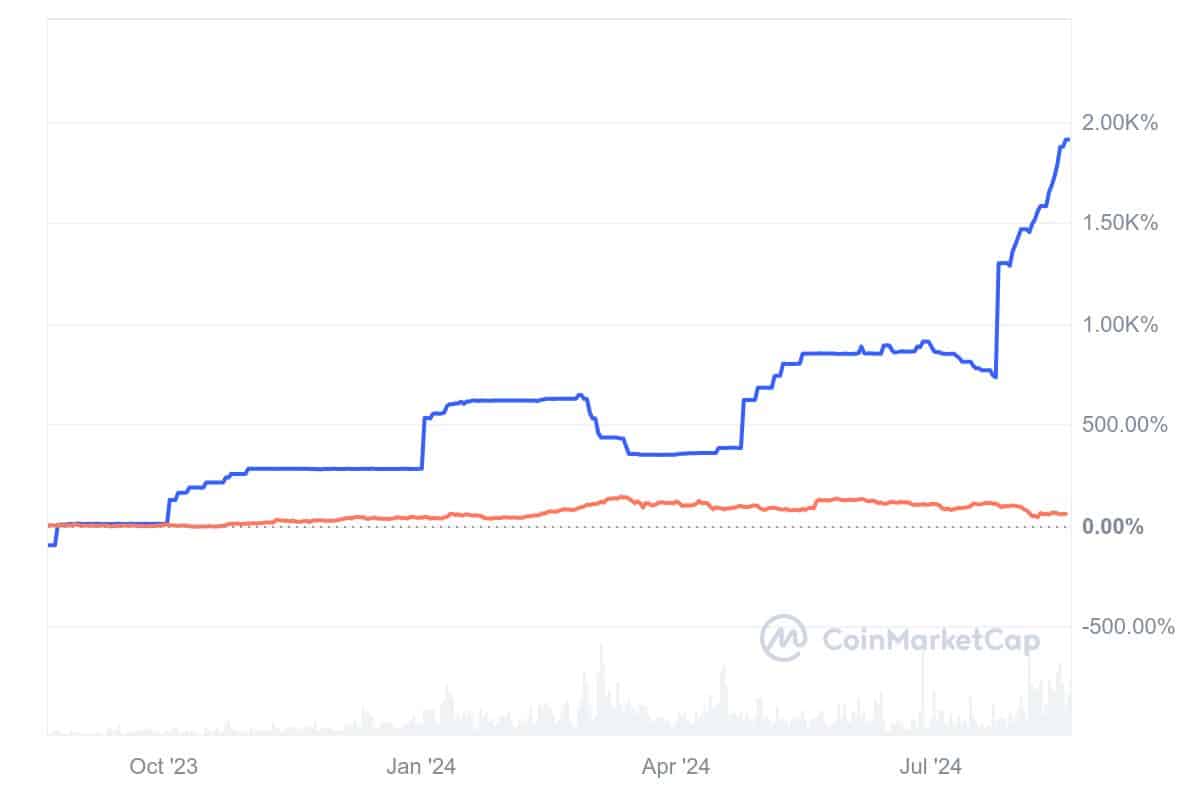

Over the past year, I’ve observed an impressive surge in the market capitalization of PYUSD. Notably, this growth spiked significantly after its integration with Solana back in May, nearly doubling its market cap since then.

At the moment of reporting, PYUSD’s market capitalization stood at approximately $853 million, which is almost reaching the $1 billion market cap threshold. Given its rapid growth trajectory, it’s anticipated to surpass this milestone within a couple of weeks.

Solana’s role in PYUSD success

Integrating the PYUSD stablecoin within the Solana system has undeniably played a significant role in its impressive expansion and widespread acceptance.

The strong returns generated within the Solana network have encouraged a surge in its adoption. Notably, the stablecoin PYUSD has gained significant traction, being widely adopted across DeFi platforms like Kamino Lend and Orca.

In simpler terms, Defillama ranks PYUSD as the sixth-largest stablecoin on the Solana blockchain based on market capitalization. Notably, the market cap of PYUSD on Solana now exceeds its market cap on Ethereum.

For context, here is a chart comparing the PYUSD market cap growth between the two networks.

The bridged amount of PYUSD on the Solana network was up by 36.73% in the last seven days and 117% in the last four weeks.

Over the past week, the increase in this particular stablecoin’s amount on Ethereum stood at 2.71%. Over the last four weeks, it rose by 0.29%. These figures, as reported by DeFiLlama, highlight the importance of integrating the Solana blockchain.

The high APYs have fueled its robust adoption within the Solana ecosystem.

For a while now, Solana has enjoyed lower transaction costs compared to Ethereum. Moreover, its DeFi sector has experienced significant expansion this year. The addition of PYUSD not only opens up new possibilities but also potentially provides access to one of the key entry points in 2024.

It’s possible that Solana played a significant role in promoting the use of stablecoins. There’s been an increasing number of networks and decentralized finance (DeFi) platforms adopting it since its integration with Solana.

1. This research supports the increasing versatility driving the swift expansion of stablecoins, as well as PayPal’s deepening engagement with Web3 technology.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-20 03:03