- Solana users faced heavy fees as 83% of transactions fail on Jupiter Aggregator, fueling centralization worries.

- Despite this, Solana’s market showed resilience, with a 33.97% price increase over the past week.

As a seasoned analyst with years of experience navigating the volatile crypto market, I find myself both intrigued and concerned by the current state of Solana [SOL]. The high transaction failure rate on Jupiter Aggregator, coupled with substantial fees for unsuccessful trades, has raised serious questions about the platform’s decentralization and user protection.

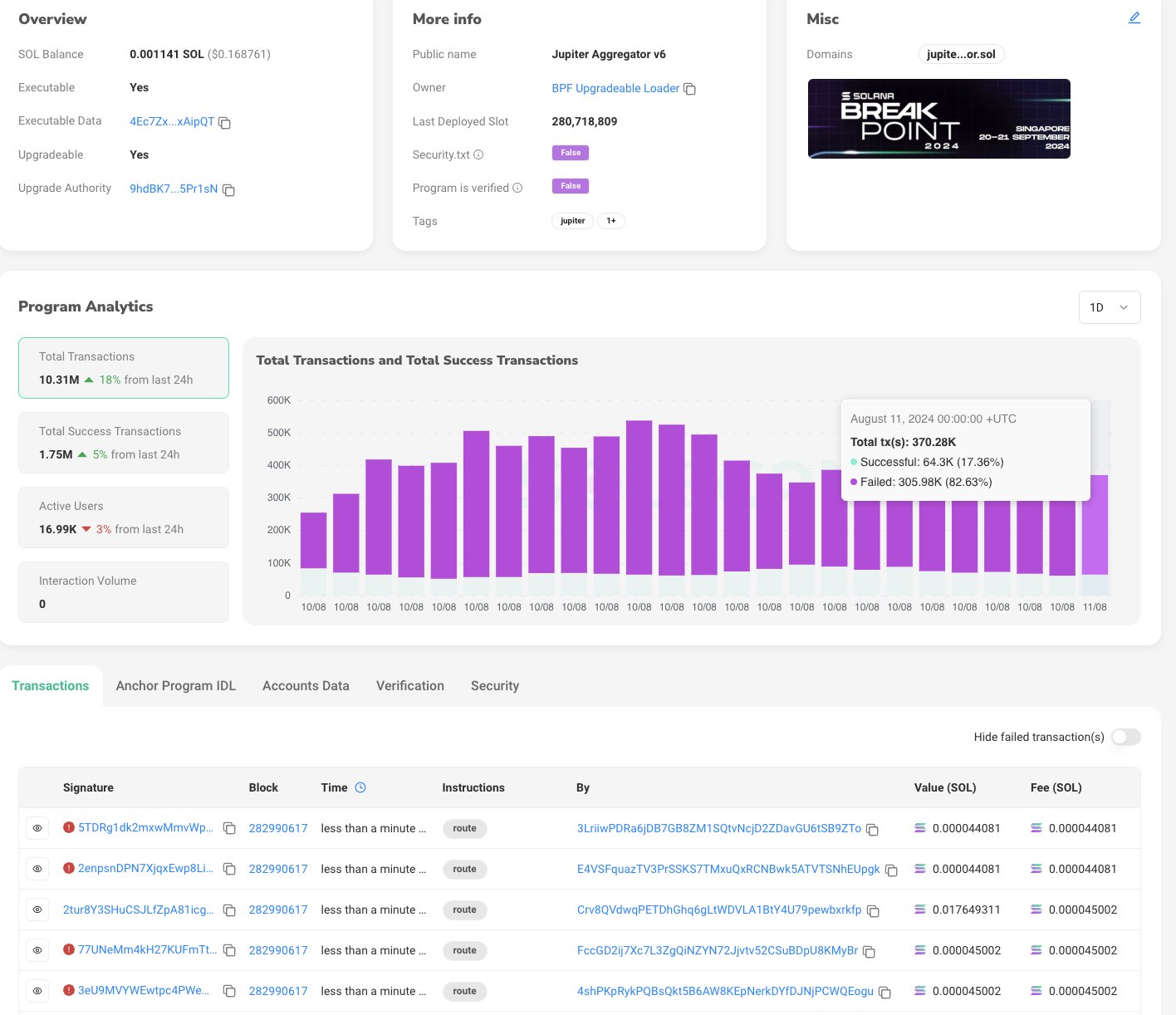

It appears that the transaction success rate for Solana’s [SOL] Jupiter Aggregator has been worryingly low, as more than 8 out of 10 transactions have failed over the last 24 hours.

Among the 10.31 million transactions handled, about 8.56 million were unsuccessful, resulting in significant charges for users even though their trades didn’t go through.

As an analyst, I’ve drawn attention to some concerning data regarding transaction failures. Specifically, I’ve found that on platform X (previously referred to as Twitter), users have collectively incurred approximately $6,334.40 USD in charges due to these unsuccessful transactions, which Dave recently brought to light by posting about it.

Within the Solana community, there’s been a rise of apprehension, specifically about the function of validators and automated tools (like bots) in relation to unsuccessful transactions that have occurred.

As a researcher exploring transactions on the Solana blockchain, I’ve discovered that when a transaction encounters a failure, a modest fee is imposed on the user. This fee can lead users to broaden their slippage tolerance to prevent multiple charge-ups and potentially save costs.

In other words, performing this action may allow bots to anticipate your trade and potentially drain the resources you need for it to be finalized, a practice known as “front-running”.

Dave stated,

“Only validators, bots, and operators of RPC endpoints who can view transactions prior to their addition to the blockchain stand to benefit from this.”

Furthermore, concerns were raised about Jupiter’s dual role as an aggregator and a validator.

Controlling about 1.09% of all Solana’s staked coins, Jupiter could potentially benefit significantly if they rise to a leading position. This is because they would be entitled to receive fees on unsuccessful transactions.

Due to this circumstance, certain members of the community have voiced their disapproval towards Solana’s centralized structure. One individual even noted this criticism specifically.

“They traveled to Solana as a means of safeguarding their funds from the reach of their own government… Solana has less tendency to seize funds compared to their government.”

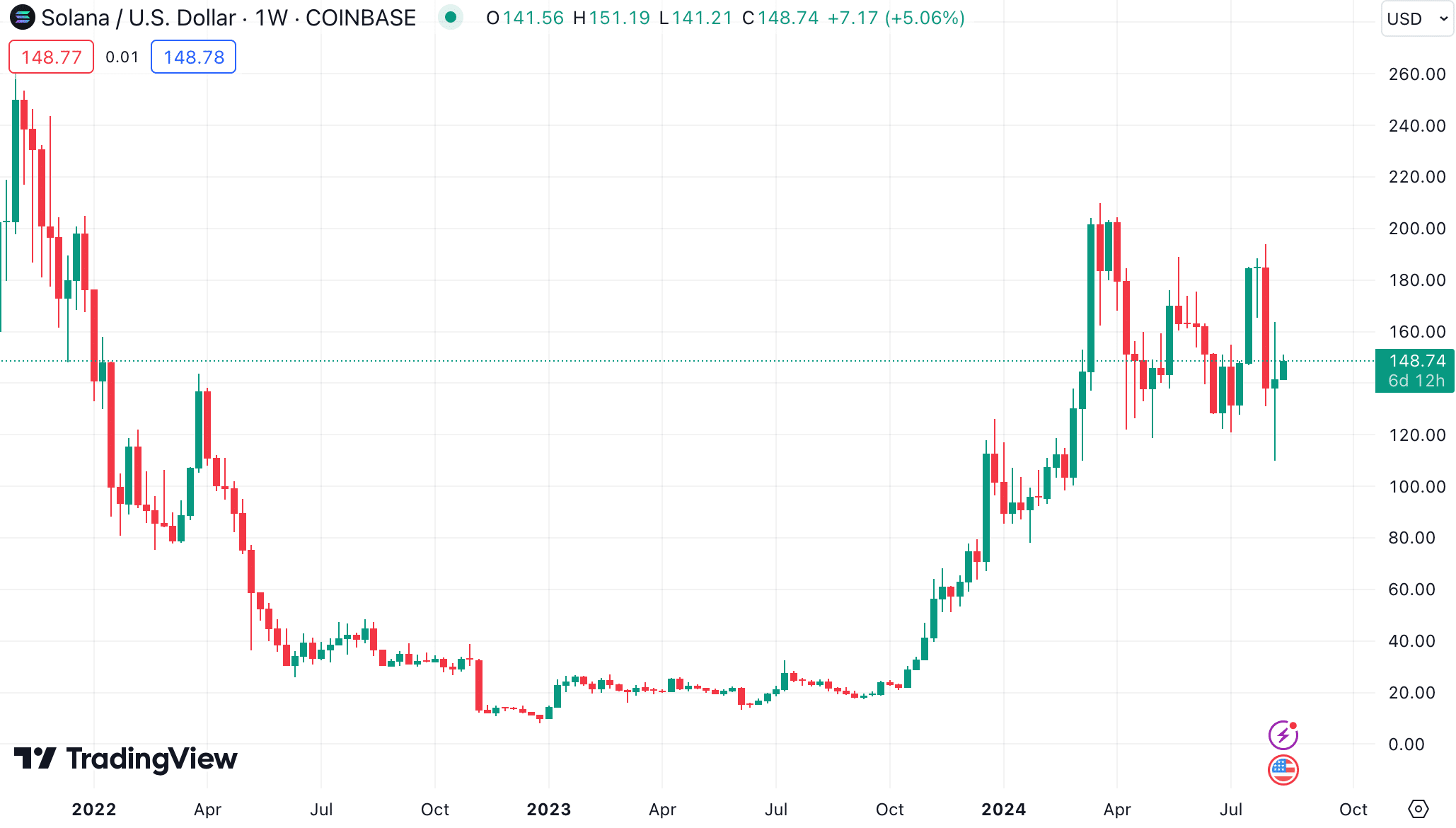

Solana’s market performance amid controversy

Despite these issues, Solana’s market performance has been relatively stable. Solana was trading at $150.38 at press time, with a 24-hour trading volume of over $4.3 billion.

Although the price has seen a 2.08% decline in the last 24 hours, it has increased by 33.97% over the past week.

As reported by DefiLlama, this network boasts a Total Value Locked (TVL) of approximately $4.744 billion. Additionally, it hosts around 867,607 active addresses and has processed over 37.2 million transactions within the past 24 hours.

In a broader context, Solana continues to make strides in the blockchain sector.

According to a recent report from AMBCrypto, Solana secured its initial spot ETF approval in Brazil during August, aiming for a launch within the following three months.

As a seasoned investor with years of experience navigating the complex world of financial markets, I can confidently say that this recent development is a significant step forward. Having observed the evolution of the market in various countries, I have witnessed the transformative impact of exchange-traded funds (ETFs) on investment strategies and portfolios.

In the realm of Decentralized Finance (DeFi), Solana stands out, boasting 78 active projects and emerging as a go-to choice for developers. Remarkably, it has managed to surpass Ethereum in certain areas, demonstrating its growing influence.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-08-12 20:08