- Solana has a bullish market structure.

- The five-month range high poses significant opposition.

As a seasoned crypto investor with over a decade of experience under my belt, I must say that Solana [SOL] has been a rollercoaster ride this year. The latest price action shows a bullish market structure, but the five-month range high poses significant opposition.

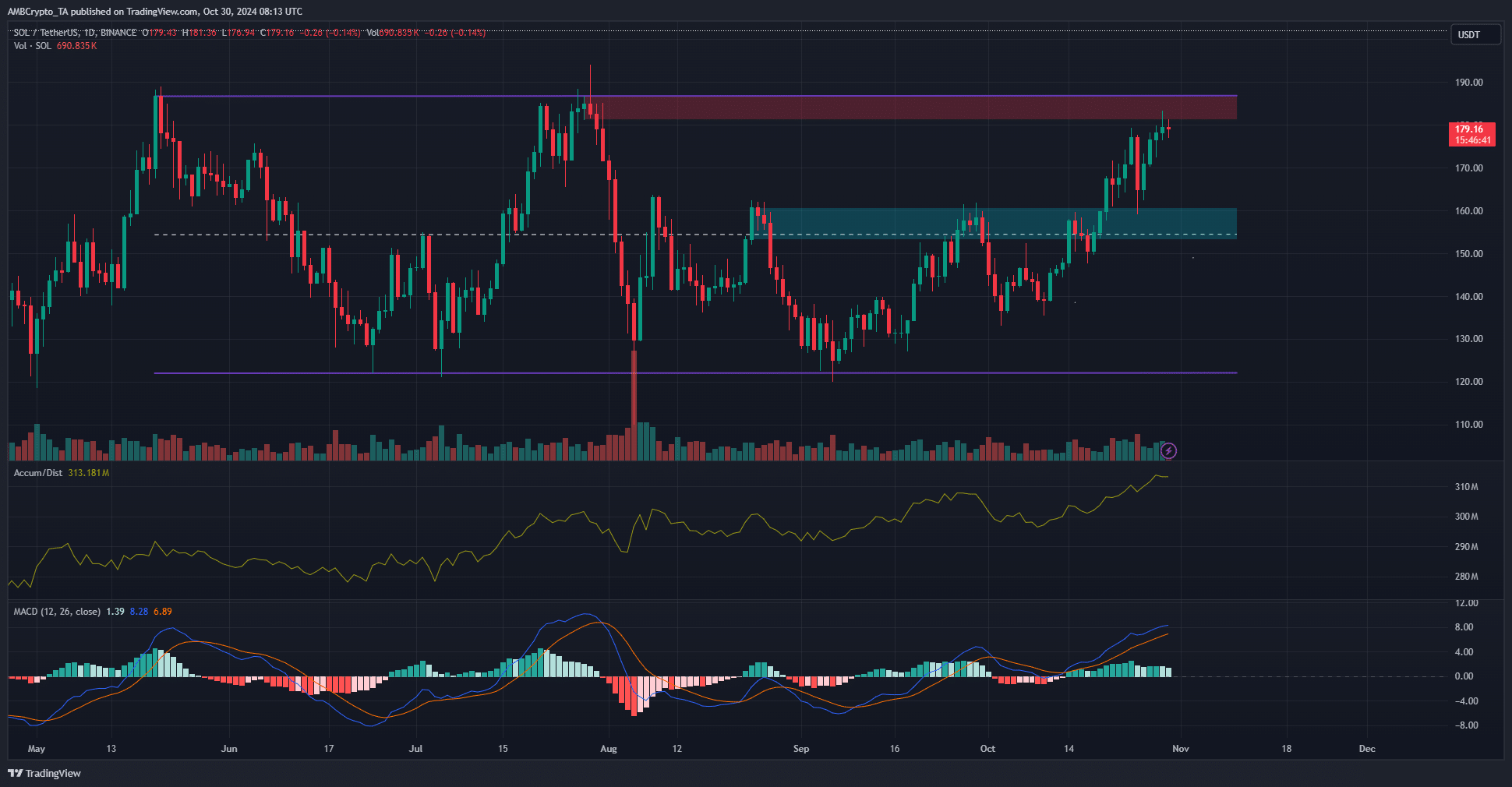

Solana’s price briefly challenged the $180 resistance level, yet it didn’t manage to transform this resistance into a future support. The market activity suggests that despite a positive momentum and overall optimistic sentiments, achieving additional growth might prove challenging.

Starting from June, the price of Solana has stayed within a span that went from around $122 to approximately $187. On October 19th, the middle point of this range at roughly $154 was surpassed, and since then, SOL has been trending towards the upper bounds of its range.

Rejection or breakout for SOL?

On a day-to-day basis, the market showed a bullish pattern as it surpassed the $161 peak from September. Furthermore, during the latter part of October, the A/D indicator has been gradually climbing up, signaling growing purchasing power.

On the daily chart, the Moving Average Convergence Divergence (MACD) suggested a positive trend, indicating increasing bullish momentum. However, it didn’t indicate that the token was overextended or likely to experience a correction soon. Meanwhile, large investors, known as ‘whales’, have recently accumulated approximately $35 million worth of Solana (SOL), fueling optimism among bulls.

Regardless, it’s quite probable that a rejection within the $190-$200 range is due to the pattern of trades (range formation) and the presence of significant buy/sell activity (liquidity pockets).

Instead of constantly searching for a breakout when testing the extremes, it’s often wiser to trade within a given range. A clear illustration of this is the situation on July 29th, where a surge to $194 was followed by a 43.3% drop over the next week. This sequence underscores the significance of time in reestablishing the range highs as support.

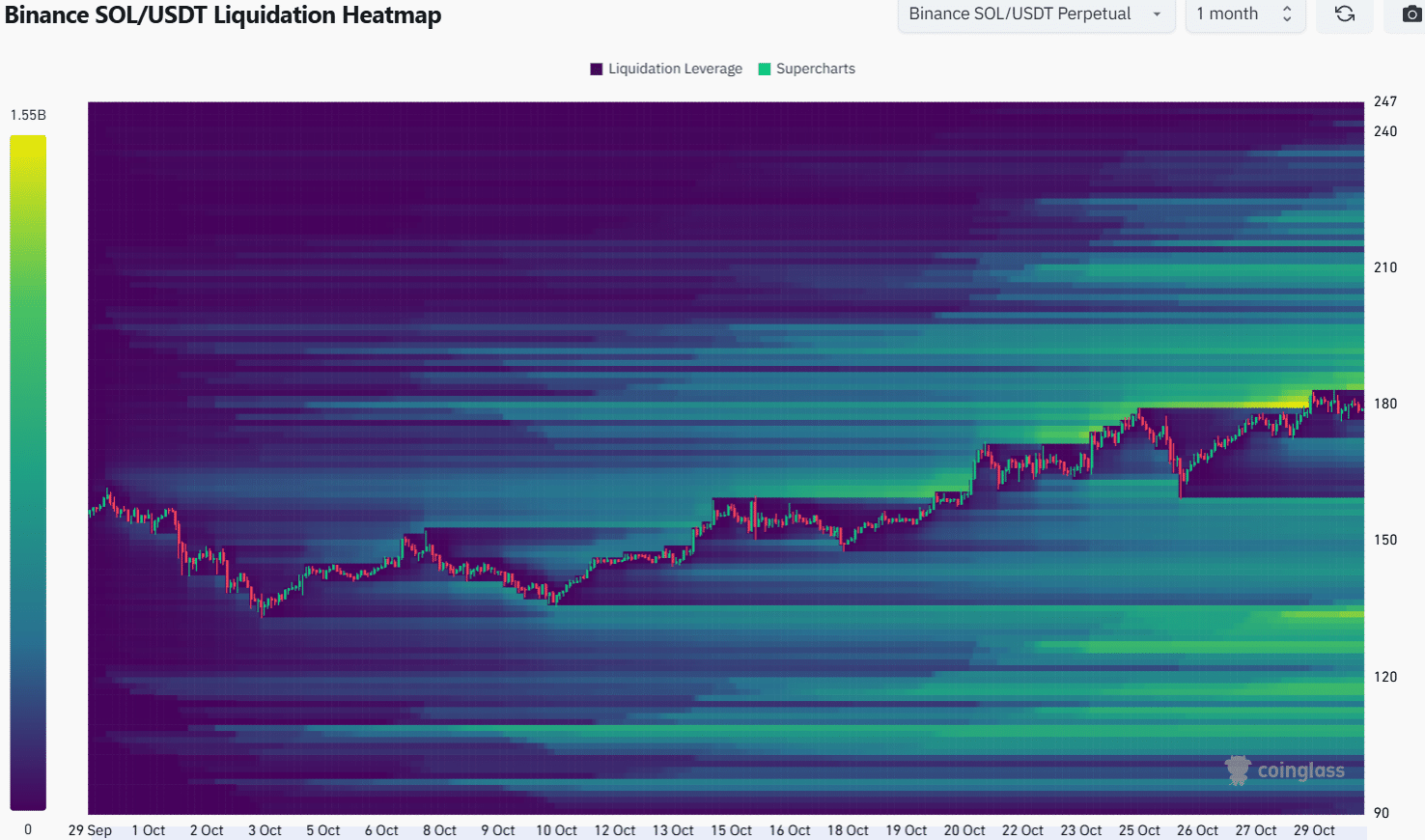

Magnetic zones to the north attract prices

Over the past month, the distribution of potential sell-offs in the price data revealed a significant concentration of selling points between $184 and $196. It seems plausible that the Solana price may gravitate towards this area before a possible price drop occurs.

Realistic or not, here’s SOL’s market cap in BTC’s terms

A flip like this isn’t certain, particularly since Bitcoin [BTC] is approaching its record peak and optimistic opinions are spreading. However, traders need to brace themselves for either scenario.

A move beyond $195 and a retest of $190 in the coming days can offer a buying opportunity.

Read More

2024-10-31 00:07