- Base’s stablecoin supply crosses $2.3 billion.

- The platform maintains the third-largest TVL market share.

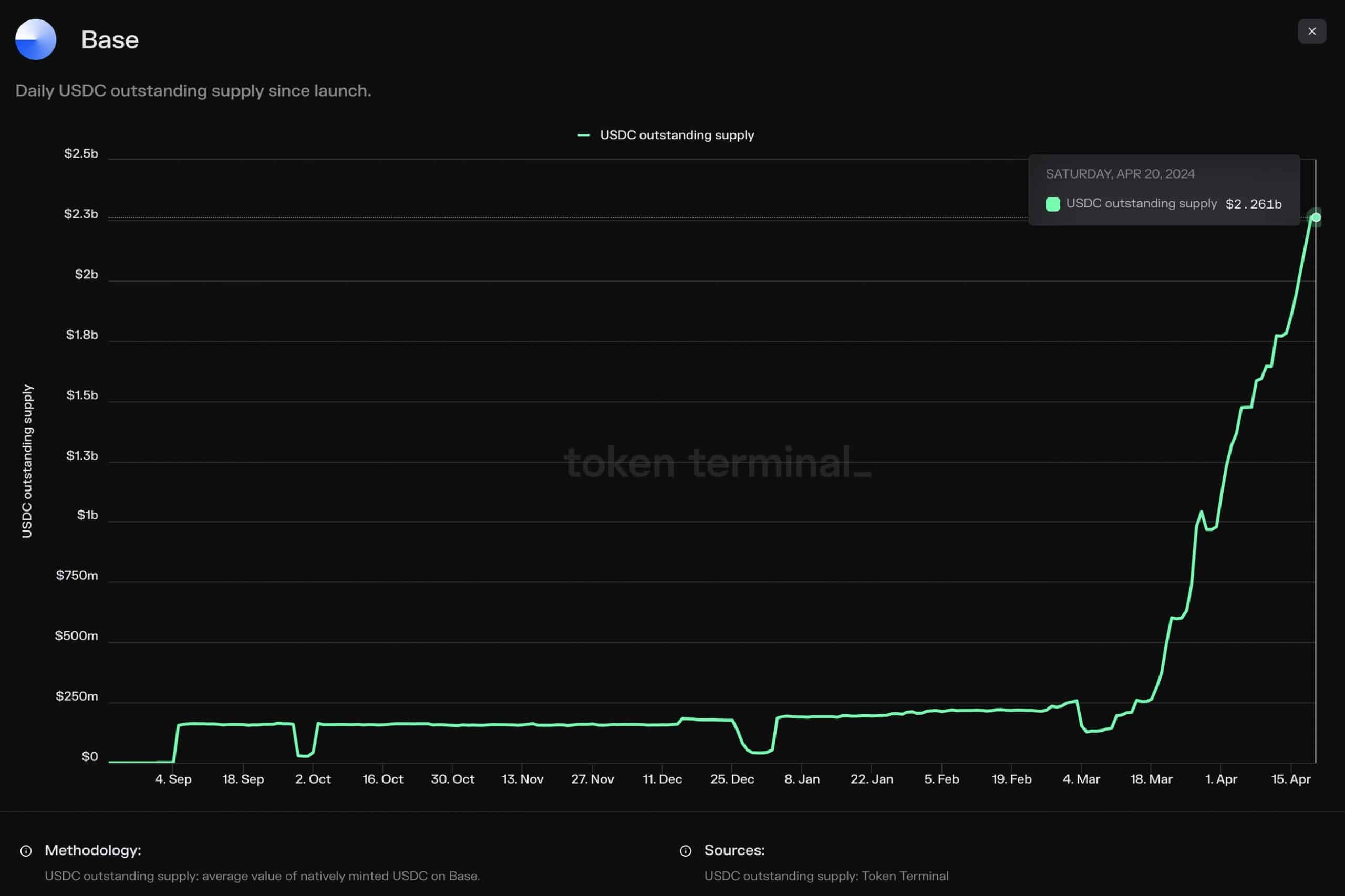

After introducing the native creation of stablecoin USDC, Base has experienced a significant growth in the amount of this digital currency circulating on their system.

The expansion of this project has significantly boosted the value of stablecoins within its system, as suggested by current figures showing a marked increase in the stablecoin market capitalization.

An uptick in the market capitalization has led to a rise in the total value secured on the platform.

Native USDC on Base cross $2 billion

New information from Token Terminal indicates a significant increase in USDC availability on Base due to the platform’s implementation of native stablecoin creation.

The USDC supply has surpassed $2.2 billion according to the data, signifying a substantial rise. Furthermore, the graph suggests a consistent upward trend in the supply.

The significant increase in available supply brings focus to the value of stablecoins within our system’s market.

How the Base stablecoin market capitalization and TVL has trended

According to AMBCrypto’s analysis, the market capitalization of Base stablecoins has been steadily increasing, following the trend of rising USDC supplies.

Currently, the total value of stablecoins in circulation is more than $2.3 billion, representing a significant growth compared to the past few weeks.

The increase in this growth is closely linked to the rise in US Dollar Coin (USDC) availability, implying that USDC holds a substantial share of the stablecoin market capitalization on the given platform.

Furthermore, the Total Value Locked (TVL) has experienced a significant uptick in the past few weeks. Growthepie’s graph indicates that this trend started roughly around the same period as the expansion of stablecoin market cap.

currently, the total value locked (TVL) is more than 5.8 billion dollars. The graphs show a clear increase, suggesting possible growth in volume in the coming days.

How Base compares to other L2s

By examining the Total Value Locked (TVL) of Base and how it stacks up against other Layer 2 platforms, it’s clear that Base has experienced substantial expansion, thereby improving its standing in the rankings.

Based on information from L2 Beats, the TVL (Total Value Locked) of Base is the third largest among Layer 2 platforms, amounting to over $5.8 billion. Only Blast, with nearly $7 billion in TVL, ranks higher.

The graph demonstrates that Base holds more than 14% of the market dominance in terms of TVL at press time. In contrast, Arbitrum presently rules the market with a substantial lead of over 43%.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- THETA PREDICTION. THETA cryptocurrency

- How Potential Biden Replacements Feel About Crypto Regulation

2024-04-22 22:16