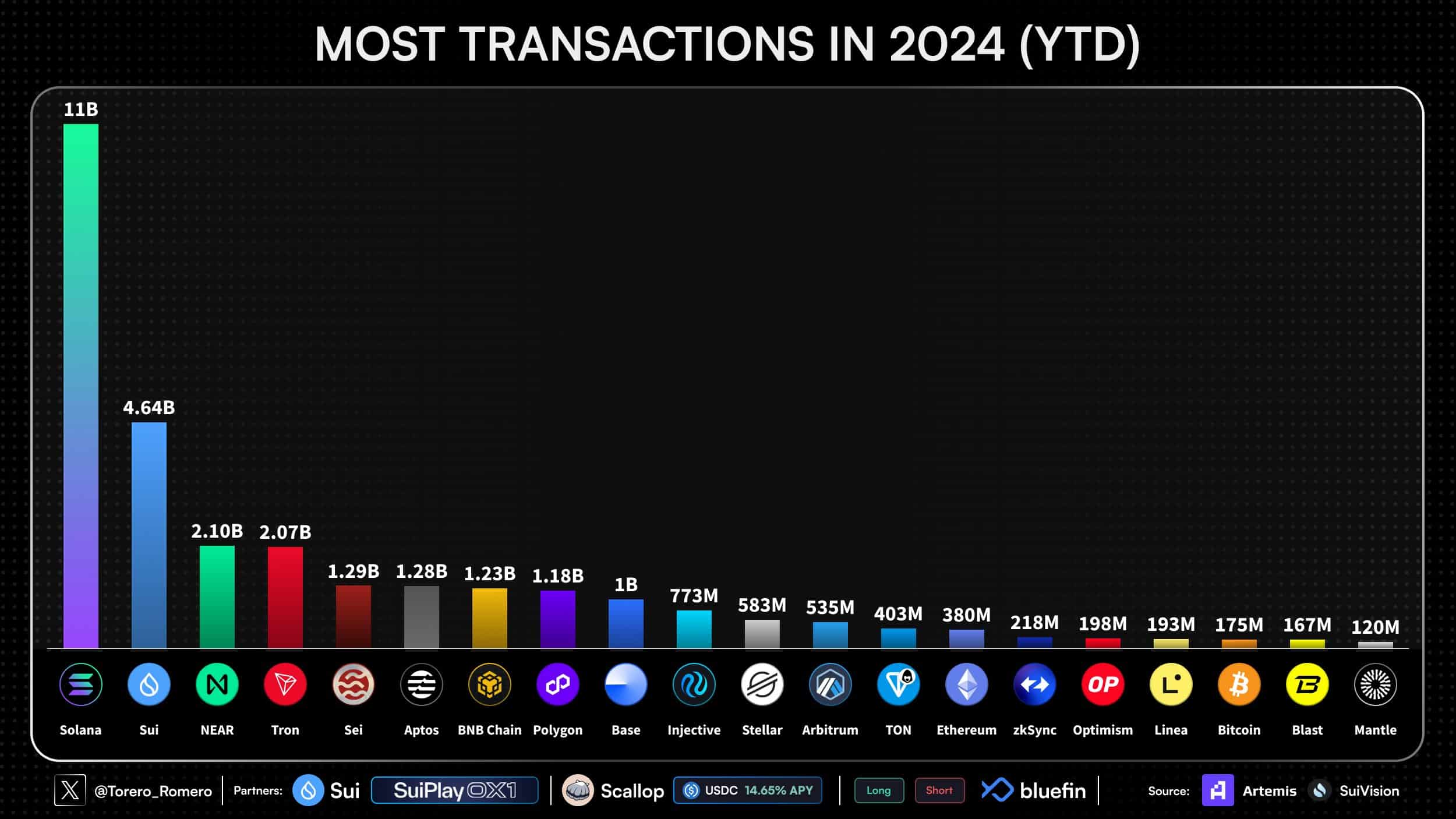

- Sui Network ranks second in 2024 transaction volume, reaching 4.64 billion.

- Its price surges to $3.42, driven by high demand and network utility.

As a researcher who has been closely observing the blockchain landscape for years, it’s always exciting to witness significant breakthroughs, and Sui Network’s 2024 achievements are no exception. I remember when SUI was just another token on the radar; now it’s securing second place in transaction volume, with a price surge that puts it on par with more established players.

2024 saw SUI [SUI] grabbing attention with its impressive performance, ranking second in overall transaction volume. It has also strengthened its reputation as a highly promising blockchain platform within the industry.

As I’ve witnessed this surge in network activity, I can’t help but feel excited about its increasing popularity and future prospects. However, the question on everyone’s mind, including mine, is: What impact will this have on the value of its indigenous token, SUI?

The increase in transactions may point to a stronger network and increased investor trust, potentially signaling a new period of expansion for the token.

A new milestone for Sui Network

2024 sees a significant milestone for the Sui Network as it surpasses 4.64 billion transactions to date, placing it second only to Solana’s 11 billion transactions. This impressive achievement positions Sui Network ahead of seasoned competitors like NEAR and Tron.

The level of transaction volume is an essential measure of blockchain’s overall activity, showcasing not only the user interaction but also the effectiveness of decentralized applications (dApps) within it.

As a crypto investor, I’ve noticed that a consistently high volume of transactions usually signals an increasing appetite for a blockchain’s offerings. Whether it’s the straightforward transfer of tokens or the intricate engagement with smart contracts, this activity suggests that demand is on the rise.

For Sui, reaching this notable achievement indicates a vibrant environment attracting both developers and users. The network’s effectiveness might make it a formidable candidate for enterprise scenarios, NFT platforms, or Decentralized Finance apps.

Transaction volume and its impact on SUI’s price growth

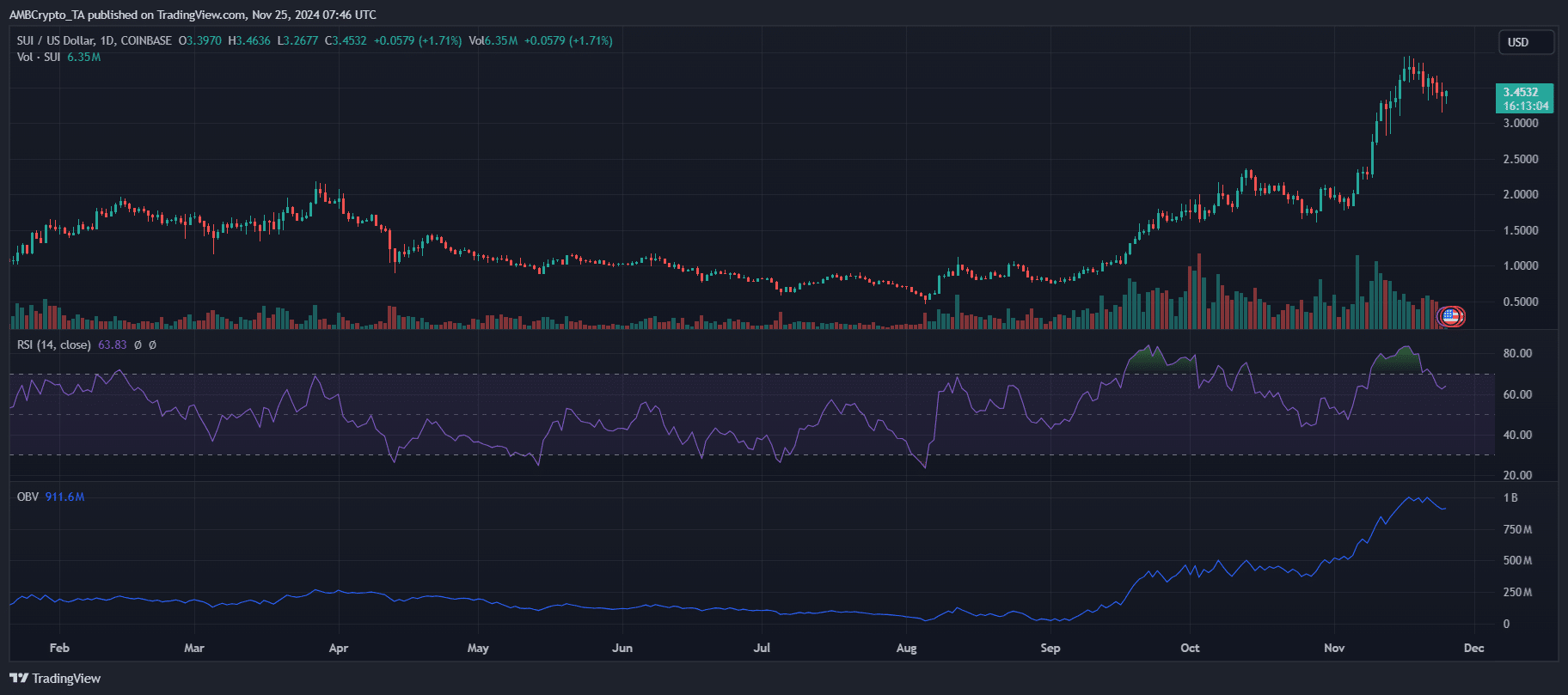

In 2024, Sui Network executed an astounding 4.64 billion transactions, significantly contributing to the token’s price reaching $3.42. This high level of activity highlights the increasing popularity and practicality of SUI, with interest in the token growing due to its employment in gas fees, staking opportunities, and involvement in a bustling dApp ecosystem.

In simpler terms, with the Relative Strength Index (RSI) currently at 63, it suggests a continued upward trend in the market, or bullish momentum. Additionally, the increasing On-Balance Volume (OBV) shows that investors are actively buying Sui, which implies they have faith in its long-term prospects and growth.

The heavy amount of transactions being handled isn’t just showing off the network’s ability to handle large loads and run smoothly, but it’s also proving attractive to both developers and users. This makes Sui a blockchain that can handle practical, real-world applications, which in turn builds more confidence in the market.

The network’s capacity to sustain and expand these activities might fuel persistent price increases, given the emergence of additional use cases and the draw of more liquidity and investments due to ecosystem growth.

Market sentiment and future prospects for SUI

Market sentiment around SUI remains optimistic, supported by the network’s rapid growth and consistent transaction volume. The steady price increase highlights investor confidence in Sui’s long-term potential.

Multiple experts believe that Sui’s emphasis on scalability and user-friendly development resources could be key elements that help maintain its advantage over competitors within the blockchain industry.

Read Sui’s [SUI] Price Prediction 2024–2025

The future outlook for SUI seems optimistic, with the possibility of price increases linked to ongoing development of its ecosystem and real-life usage.

Enhancements like adding more decentralized applications (dApps), forming strategic collaborations, or improving the fundamental technology beneath it, could significantly increase SUI’s usefulness and attractiveness in the marketplace.

Keeping up this pace hinges on the network’s ability to manage increasing demand efficiently, all while outpacing competitors. At present, SUI’s progress suggests a network well-positioned for continuous expansion throughout 2024 and the years that follow.

Read More

2024-11-25 18:16