Well, here we are again, folks! U.S. equities are doing their best impression of a cat that just spotted its own reflection-mostly steady but with a hint of confusion as Wall Street tries to digest last week’s market fireworks and settle into a cautious mid-day groove. Investors, bless their cautious little hearts, are positioning themselves ahead of an avalanche of delayed economic data and heavyweight earnings.

U.S. Stocks Play the Sideways Shuffle After a Volatile Week

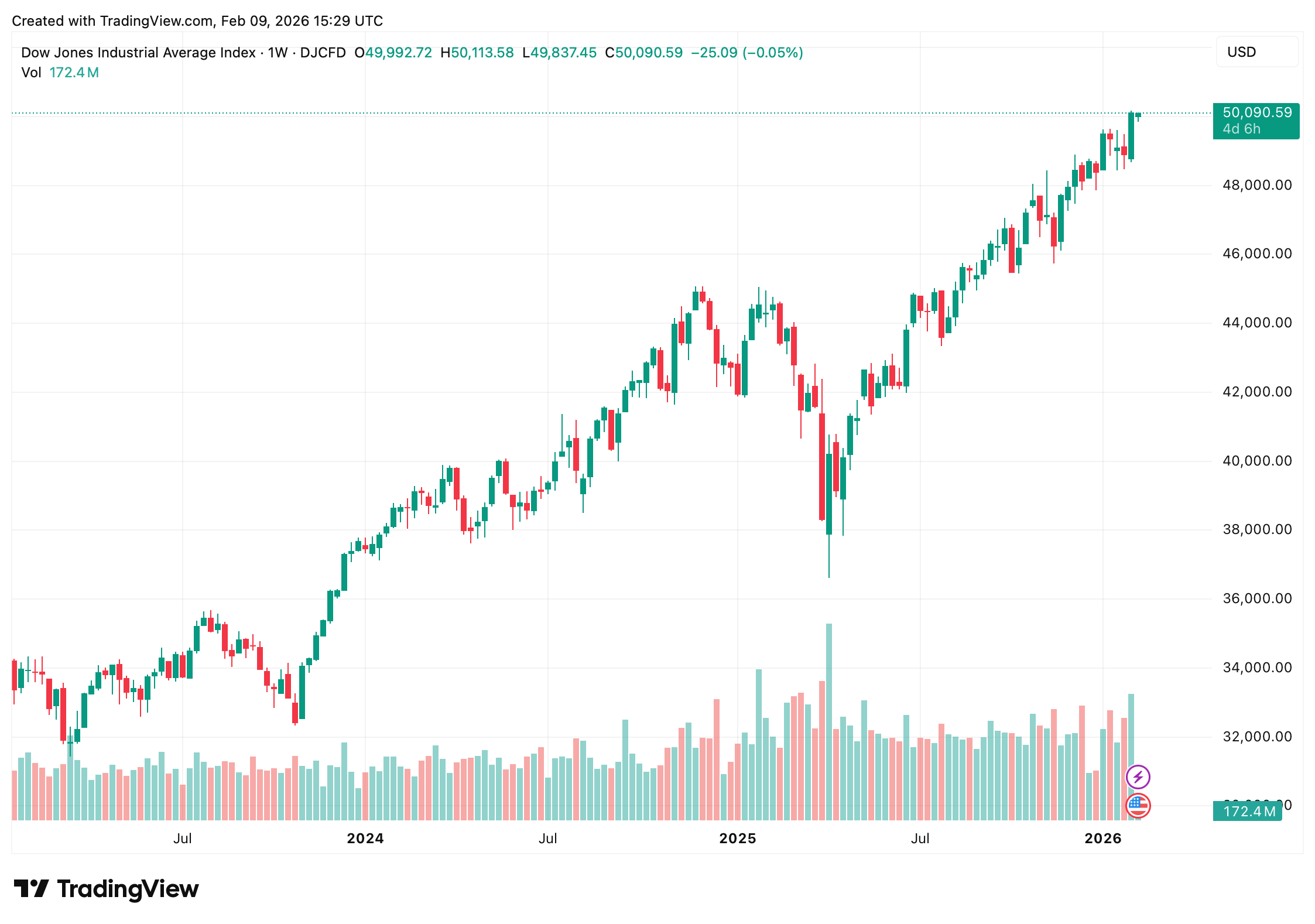

As we approached mid-morning on this fine February day, U.S. stock indexes were making narrow, uneven moves-like a toddler learning to walk. The Nasdaq Composite and S&P 500 were hovering modestly higher, while the Dow Jones Industrial Average decided it was time for a little dip after flirting with the historic 50,000 mark late last week. Talk about commitment issues!

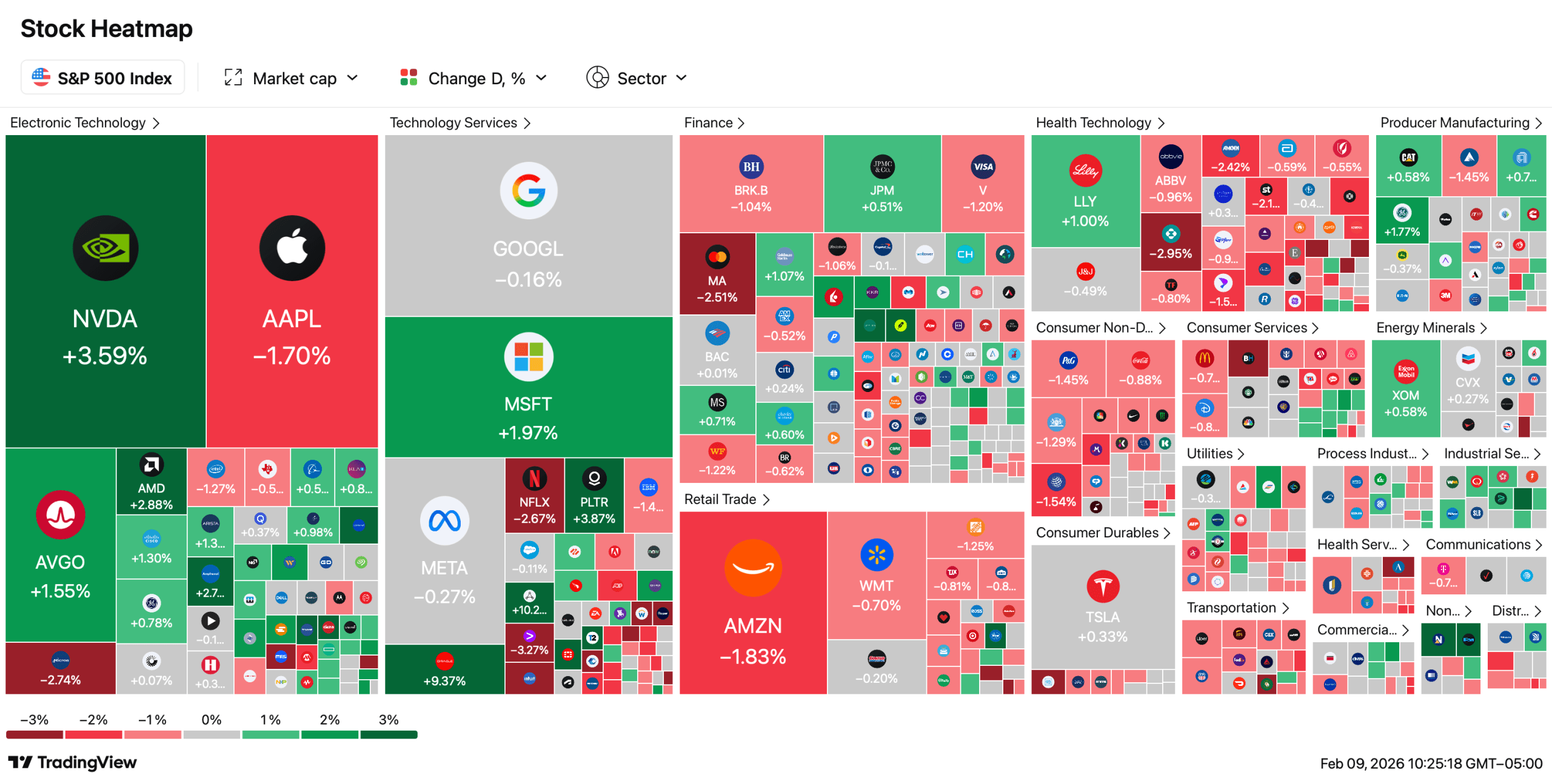

By around 11:10 a.m. Eastern time, the Nasdaq Composite had edged up about 0.3%-thanks to some selective strength in technology and software stocks that seem to be enjoying a second chance at romance. Meanwhile, the S&P 500 was edging higher near record territory, looking as confident as a cat in a room full of rocking chairs. The Dow, however, slipped down by a quarter of a percent, likely reflecting some profit-taking after Friday’s wild sprint that capped a volatile week.

The markets opened softer than a marshmallow left in the sun before stabilizing-classic early-week behavior as traders recalibrate their risk appetite following strong gains. Friday saw the Dow jump more than 1,200 points to finish above 50,000 for the very first time, while the S&P 500 and Nasdaq both logged gains over 2%. All thanks to the relentless charm of industrials, energy, and a tech rebound that felt like a high school reunion.

Now, if we peek under the hood (and hope nothing bites), we find stock-specific moves that tell a livelier story. Applovin, Oracle, Kroger, Corning, and Palantir led the pack of gainers, while Waters, Workday, Best Buy, and General Motors were trading lower-probably contemplating their life choices. This reflects a lovely ongoing sector rotation, with investors deciding that last week’s mega-cap software names weren’t quite as appealing as they once thought, opting instead for cyclicals and value plays like a buffet line.

Macro signals? Well, they’re feeling a bit shy today, with no major U.S. economic releases queued up for Monday thanks to delays from the partial government shutdown. Treasury yields edged slightly higher, with the 10-year yield hanging around 4.22%, suggesting traders are merely adjusting their expectations rather than preparing for a full-blown market meltdown.

Globally, the markets provided a modest support system early in the session. Asian equities advanced overnight, with Japan’s Nikkei 225 reaching new heights-talk about living your best life! Meanwhile, European stocks opened firmer before losing steam faster than your New Year’s resolutions as U.S. trading kicked off. Commodity markets were relatively calm, with oil holding steady and gold staying above $5,000 an ounce. Not bad for a shiny rock!

And now, all eyes are on the rest of the week like a cat watching a laser pointer. Investors are bracing themselves for a packed calendar of rescheduled January data, including nonfarm payrolls, consumer price index figures, and producer inflation reports, alongside earnings from Coca-Cola, Cisco, McDonald’s, Applied Materials, and others. Any inflation surprises or guidance missteps could jolt a market walking a tightrope, and nobody wants to see that show!

For now, Wall Street’s mood can be summarized as “alert but not alarmed.” With major indexes nestled comfortably near all-time highs and February’s seasonal choppiness lurking like an unwanted party guest, traders seem content to wait, watch, and keep risk tightly managed as the next round of macro headlines approaches.

FAQ ⏱️

- Why are U.S. stock markets mixed today?Investors are consolidating gains from last week while waiting for key economic data and earnings. Classic procrastination!

- Which index is underperforming mid-day?The Dow Jones Industrial Average is modestly lower, while the Nasdaq and S&P 500 are slightly higher. It’s always one in the group!

- What data are investors watching this week?Nonfarm payrolls, CPI inflation, retail sales, and producer price data are dominating the calendar. It’s like a game of economic bingo!

- What time of day does this market snapshot reflect?The pricing reflects live mid-day trading while U.S. markets remain open. Perfect timing for a coffee break!

Read More

- Best Controller Settings for ARC Raiders

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- 10 Best Character Duos in Stranger Things, Ranked

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- Meet the cast of Mighty Nein: Every Critical Role character explained

- How to Build a Waterfall in Enshrouded

- These Are the 10 Best Stephen King Movies of All Time

- Best Werewolf Movies (October 2025)

2026-02-09 19:57