As a seasoned cryptocurrency investor with years of experience under my belt, I must admit that Coinbase fees have always been a point of contention for me. Having traded on various exchanges, I can confidently say that Coinbase’s fees are on the higher side, especially when you’re dealing with large volumes or specific market conditions.

🚀 Trump Effect: EUR/USD Primed for Wild Swing?

Expert predictions show massive EUR/USD reaction to Trump's latest tariff agenda!

View Urgent ForecastIt’s common knowledge that cryptocurrency trading can be enjoyable, and playing the game can even generate income, particularly when executed skillfully. Unlike traditional brokers or crypto exchanges, you won’t have to shell out hefty fees for your transactions.

However, no one likes to pay increased trading fees, especially on Coinbase, one of the biggest and most well-known crypto exchanges. This article discusses various ways to avoid or minimize Coinbase fees for buying, selling, and other network fees.

So, let’s find out how to avoid paying Coinbase fees and keep as much profit as possible!

What is Coinbase

Coinbase, established in 2012 by Brian Armstrong and Fred Ehrsam, serves as a digital currency exchange headquartered in San Francisco. It provides trading opportunities for more than 350 different pairs and is accessible in over 100 nations, including the United States, Canada, the UK, as well as most European countries.

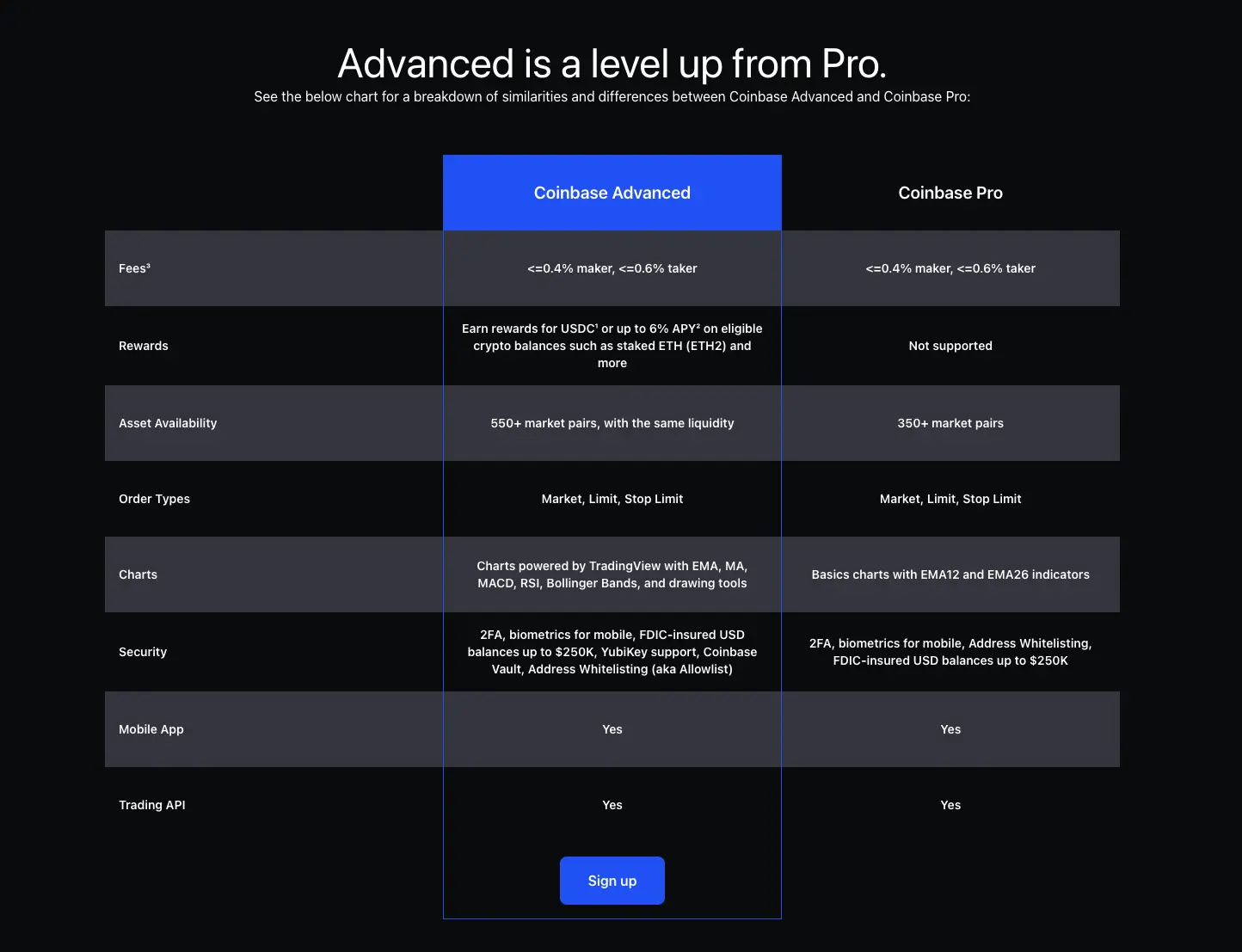

As a seasoned crypto investor, I’ve found that many of us prefer using Coinbase for its intuitive and newcomer-friendly design. However, for those who have honed their trading skills, there’s always the option to upgrade to the verified Coinbase Pro account, also known as the Coinbase Advanced Trade. This version offers a more sophisticated platform for those seeking advanced trading features.

As an analyst, I’d emphasize that Coinbase has robustly equipped itself with various security mechanisms. Given the paramount importance of security in the eyes of cryptocurrency investors, Coinbase stands as a preferred choice for any crypto aficionado, positioning itself among the top contenders in the market.

Back in May 2018, Coinbase introduced Coinbase Pro – a sophisticated trading platform that was previously known as GDAX. This platform caters specifically to seasoned cryptocurrency traders who require a more intricate tool to satisfy their digital asset trading requirements.

How to Avoid Paying Coinbase Fees?

Given that crypto traders view Coinbase’s fees as steep, numerous investors have sought alternatives to dodge these charges or at least reduce them significantly.

However, it would help if you remembered that the golden rule when buying and selling cryptos is to use the Coinbase Pro account, later known as Coinbase Advanced Trade, as per 2022’s update.

Experienced traders often find the Coinbase Pro account useful due to its additional trading features that facilitate swift and smooth transactions.

As a crypto enthusiast, I’ve noticed that the fees I incur when buying or selling digital currencies can vary significantly. Factors such as my location, the amount I’m trading, the market conditions at the time, the method I choose to pay, and the specific cryptocurrency involved all play a role in determining whether I’ll be charged a flat rate or a percentage of my trade value.

Based on my personal experience of using Coinbase for crypto trading, I can confidently say that it’s essential to understand the fee structure to maximize your crypto holdings and minimize transfer or withdrawal costs. Here are some tips I’ve found helpful:

Switch to Coinbase Advanced Trade

Back in June 2022, Coinbase disclosed its plans to transfer Coinbase Pro user accounts to an upgraded trading platform, named Coinbase Advanced Trade, which is based directly on their primary site.

Using a Coinbase Advanced Trade account would essentially function like a Coinbase Pro account, with the key distinction that users wouldn’t need to establish a separate account; they can utilize it alongside their existing Coinbase account instead.

As a researcher, I propose streamlining the user experience on Coinbase by enabling users to leverage the same account for both simple and advanced trading options, thereby enhancing convenience and efficiency in their transactions.

However, the premium version grants you access to comprehensive price graphs, volume graphs, and order information for monitoring and evaluating your trading results.

To minimize (or lessen) Coinbase fees, consider moving to Coinbase’s Advanced Trading platform. Frequent traders can benefit from this change by saving money over time and preserving their budget effectively in the long run.

Just like Coinbase Pro, Coinbase Advanced Trade has different fees.

Coinbase Simple Trade vs Coinbase Advanced Trade Fees

To clarify, Coinbase’s Advanced Trade platform charges fees that vary between 0% and 0.6% for takers, and 0.4% for makers in spot transactions. For stable pairs, the fee is set at 0% for makers and a minimal 0.001% for takers.

In contrast to straightforward transactions on Coinbase, fees may differ due to factors like your location, selected payment method, trade volume, or current market circumstances.

In other words, when you make a large purchase and market circumstances aren’t favorable to you, there’s a possibility that unexpected charges will be applied to your transaction.

Use Bank Transfers Instead of Credit or Debit Card

Previously, we noted that the fees for using Coinbase can vary based on the chosen payment method. Therefore, it might be advantageous to opt for bank transfers over debit or credit cards when making transactions to maximize profitability.

To give you an example, when it comes to banking transfers, the highest charge in countries like the UK and Europe is approximately €0.15. In contrast, the cost in the United States can escalate up to 1.49% of the transaction amount.

Alternatively, when making transactions through Coinbase using a debit or credit card, you’ll likely incur a fee equal to 3.99% of the total transaction amount, regardless of your location.

Suppose you’re thinking about buying 10,000 dollars’ worth of Bitcoin. If you opt for a bank transfer to make this purchase, you’ll incur a fee of approximately 0.15 euros (equivalent to around 0.16 US dollars) if you reside in the UK or Europe. As a result, the amount of Bitcoin you’d receive in your account would be about 9,999.86 US dollars.

As a seasoned investor who has been in the cryptocurrency market for quite some time now, I have learned that the method you choose to acquire Bitcoin can significantly impact your overall returns. Personally, I find it more cost-effective to be a US citizen and pay a $149 fee to keep $9,851 worth of Bitcoin. However, if you opt to buy Bitcoin with a credit or debit card, the steep buying fees of $399 can erode your initial investment, leaving you with only $9,601 worth of BTC. Based on my experience and the lessons I’ve learned in this dynamic market, it’s essential to weigh the costs before making any investment decisions.

In simpler terms, while the distinctions among €0.15, 1.49%, and 3.99% might appear insignificant when dealing with small quantities of cryptocurrency, if you plan on executing larger trades (as in our recent example), it could be more advantageous to carry out the transactions via bank transfers instead.

Though a 3.99% fee might initially appear insignificant, consider buying a digital asset that experiences a significant price increase (x1,000). At that point, would the 3.99% fee still seem negligible?

How Long Does Coinbase Verification Take

The Coinbase Fees

A notable aspect about Coinbase is its fee structure, which some new investors perceive as relatively high compared to their expectations. Consequently, they seek effective strategies to minimize these costs. Now, let’s explore the typical fees charged by this cryptocurrency trading platform.

Transaction Fees

As a researcher, I’ve found that Coinbase employs a multi-faceted fee structure when it comes to transactions. This means that the fees charged vary according to factors such as the user’s location, the scale of their order, prevailing market conditions, the chosen payment method, and the specific cryptocurrency being bought or sold. Consequently, users might end up paying a fixed fee or a proportion of the crypto they’ve traded.

Generally, the transaction fees associated with any financial operation are shown during the final stage before completion. These charges are typically deducted from your intended purchase or sale amount. So, if you’re planning to buy $100 worth of Bitcoin and the transaction fee costs $2, the Bitcoin you receive upon completion will be approximately $98.

Instead, if you decide to sell $100 worth of BTC with a transaction fee of $3, it means that the recipient will actually receive approximately $97 worth of BTC in their account.

Staking Services Fees

Many people recognize that Coinbase enables its users to deposit their digital currencies for staking through Coinbase Prime. At this time, individuals holding cryptocurrencies can leverage Coinbase as a platform for staking the following assets:

-

Ethereum (ETH);

Avalanche (AVAX);

Ethereum Liquid Staking (LsETH);

Solana (SOL);

Tezos (XTZ);

Cardano (ADA);

Polkadot (DOT);

Polygon (MATIC);

Near Protocol (NEAR);

Cosmos (ATOM);

Kusama (KSM);

Sui (SUI);

Axelar (AXL);

Aptos protocol (APT);

Celo (CGLD).

Concerning the cost of staking, Coinbase varies its charges, which can be anywhere between 15% and 35%. The specific fee depends on the type of cryptocurrency being used and whether the user holds a Coinbase One membership or a standard account.

Coinbase Fee for Credit Cards

As an analyst, I can say that the Coinbase Card functions as a Visa debit card, seamlessly connected to your Coinbase account. This card enables you to utilize your cryptocurrencies directly for purchases without being charged any transaction fees. However, it’s important to note that conversions within the Coinbase Wallet incur a 2.49% conversion fee.

Additionally, it’s advisable to review the withdrawal fees associated with the Coinbase Card before using it at an ATM, since there may be charges for certain transactions. Make sure to check the fees prior to finalizing any transactions.

Spread Fees

On Coinbase, a fee known as the “spread fee” applies when you buy or sell cryptocurrency. This fee is typically around 0.5%, though it can vary based on market changes. It’s essential to note that this fee is determined not only by market fluctuations but also by factors such as the size of your order, the payment method you choose, and current market conditions.

Therefore, it’s important to note that although the fee is usually about 0.5%, it can vary significantly based on various factors that Coinbase takes into account when determining it.

Trading Fees

Regardless of whether you aim to buy or sell cryptocurrencies, remember that Coinbase employs a maker-taker fee structure for calculating transaction fees. The potential charges could be as follows:

| Tier | Taker fee (bps) | Taker fee (%) | Maker fee (bps) | Maker fee (%) |

| $0 – $9,999 | 60bps | 0.6% | 40 bps | 0.4% |

| $10,000 – $49,999 | 40bps | 0.4% | 25 bps | 0.25% |

| $50,000 – $99,999 | 25bps | 0.25% | 15 bps | 0.15% |

| $100,000 – $999,999 | 20bps | 0.2% | 10 bps | 0.1% |

| $1,000,000 – $14,999,999 | 18bps | 0.18% | 8bps | 0.08% |

| $15,000,000 – $74,999,999 | 16bps | 0.16% | 6bps | 0.06% |

| $75,000,000 – $249,999,999 | 12bps | 0.12% | 3bps | 0.03% |

| $250,000,000 – $399,999,999 | 8bps | 0.08% | 0bps | 0% |

| $400,000,000+ | 5bps | 0.05% |

Coinbase Advanced Trade Fees

Just like Coinbase and Coinbase Pro fees used to differ, it is the same with Coinbase Simple Trade and Coinbase Advanced Trade. Thus, while Coinbase Simple Trade charges the fees mentioned earlier, Coinbase Advanced Trade has set other fees.

On Coinbase’s advanced trading platform, taker fees are never higher than 0.60%, and maker fees are never higher than 0.40%.

Maker Fees vs. Taker Fees

The main difference between the maker-taker fee model is related to how quickly an order gets a match. Thus, if you place an order that is matched almost immediately, you are a taker and pay the fees accordingly.

If a trading order you submit doesn’t find an immediate counterpart, you will be considered as a ‘maker’, meaning your order gets listed in the order book. When there’s a match later, you can proceed with the transaction and will be charged a ‘maker fee’.

FAQ

Why are Coinbase fees so high?

When discussing Coinbase’s fee structure, it’s important to highlight that their fees can vary based on factors like market conditions, your location, the chosen payment method, and the volume of your orders.

Therefore, trading a substantial amount of cryptocurrency could result in significant charges or penalties if you find yourself in an unfavorable market situation or timing.

Coinbase ranks among the globe’s top and extensively utilized platforms for trading cryptocurrencies. This popularity translates into a substantial trading volume. Yet, it’s essential to note that because Coinbase adjusts its fees based on market conditions, there may be higher costs associated with using this service.

Additionally, the widespread use of Coinbase and its location within the United States have attracted scrutiny from the Securities and Exchange Commission (SEC).

In essence, due to the SEC’s extensive oversight, Coinbase adheres to rigorous regulations, which in turn necessitates higher fees to cover the compliance expenses mandated by the SEC.

One more thing crypto investors should consider is that Coinbase is popular for its beginner-friendly interface. A platform designed for beginners will allow users to buy, sell, and trade crypto through shorter trading processes without requiring traders to have extensive crypto trading knowledge.

Absolutely, simplified trading procedures often carry a cost, which is reflected in increased transaction charges.

Can you deposit on Coinbase without fees?

Typically, Coinbase doesn’t charge deposit fees when it comes to cryptocurrency. But, if you opt to deposit funds through traditional (fiat) currencies, you might need to pay certain fees based on the specific currency involved.

In Conclusion

While Coinbase is well-known for its security features and beginner-friendliness, the crypto exchange surprises crypto traders with high fees, so always keep an eye on the exchange rate. Coinbase uses various fee structures and models, which may confuse some crypto investors.

As a researcher exploring the world of cryptocurrencies, I’ve found an alternative for those seeking lower fees or even fee-free transactions – Coinbase Advanced Trade, Coinbase’s platform tailored for experienced traders. Instead of using credit or debit cards, opting for bank transfers can help you sidestep the usual charges.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-20 12:47