The world of finance has undergone a transformation with the emergence of cryptocurrencies, providing decentralized and secure options to their central counterparts, traditional fiat currencies. Among these digital currencies, Dash has gained considerable interest due to its unique attributes and expanding use. Dash stands out as a pioneer in this field, delivering unmatched speed, security, and privacy.

Key Takeaways

- Dash offers enhanced privacy and rapid transactions through its PrivateSend and InstantSend features, making it a standout choice among cryptocurrencies.

- Adopting Dash payments reduces fees and accelerates transactions, widening global market access and potentially boosting customer satisfaction.

- To enable Dash payments, businesses should partner with trusted payment processors, streamline their checkout processes, and ensure their setup is secure and customer-friendly through detailed testing and customization.

Understanding Dash

In 2014, Evan Duffield introduced Dash, a short form for “Digital Cash.” Originally called Darkcoin, it was later renamed to highlight its goal of serving as a digital alternative to cash. Based on the Bitcoin framework, Dash brought forth significant advancements to tackle perceived weaknesses of Bitcoin, such as enhancing privacy, increasing transaction speed, and improving governance.

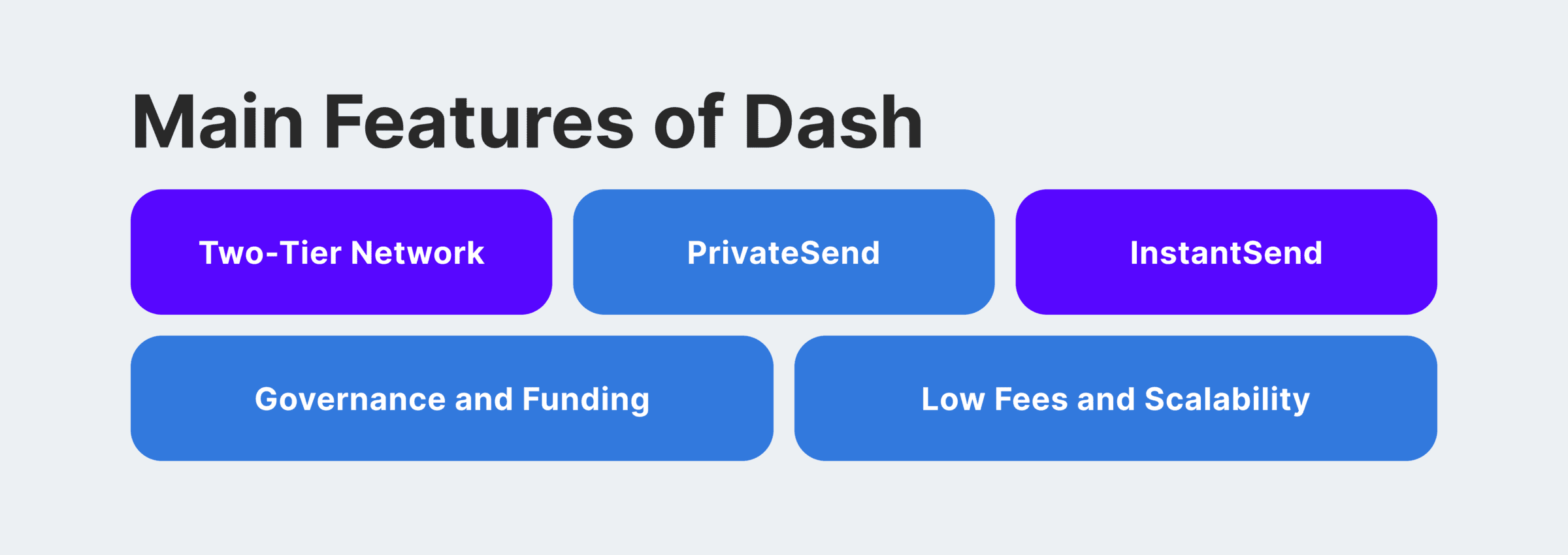

Dash incorporates several features that distinguish it from other cryptocurrencies.

Two-Tier Network

In simpler terms, Dash has a two-level structure where miner nodes maintain the network’s security, while master nodes enable features like PrivateSend and InstantSend with added capabilities.

PrivateSend

With its PrivateSend feature, Dash provides enhanced privacy by mixing coins in a way that conceals transaction histories, thus granting users increased anonymity.

InstantSend

With InstantSend, master nodes quickly secure transaction inputs, leading to lightning-fast confirmations and near-instantaneous transactions within a few seconds.

Governance and Funding

In simpler terms, Dash has a self-governing mechanism called the Treasury. A part of the new blocks’ rewards is set aside for financing developments, promotions, and community suggestions. This process bolsters the platform’s long-term viability and expansion.

Low Fees and Scalability

Transactions processed through Dash generally come with smaller fees compared to conventional payment methods, while its network design allows for greater efficiency in handling larger volumes of transactions.

Compared to other cryptocurrencies like Bitcoin and Litecoin, Dash offers distinct advantages:

- Privacy: While Bitcoin transactions are pseudonymous and Litecoin transactions are transparent, Dash provides optional privacy features through PrivateSend, offering users greater confidentiality.

- Speed: Dash’s InstantSend feature enables rapid transaction confirmation, providing a competitive advantage over Bitcoin’s relatively slower confirmation times.

- Governance: Unlike Bitcoin and Litecoin, Dash implements a decentralized governance system that allows stakeholders to vote on proposals and allocate resources, fostering community-driven development and innovation.

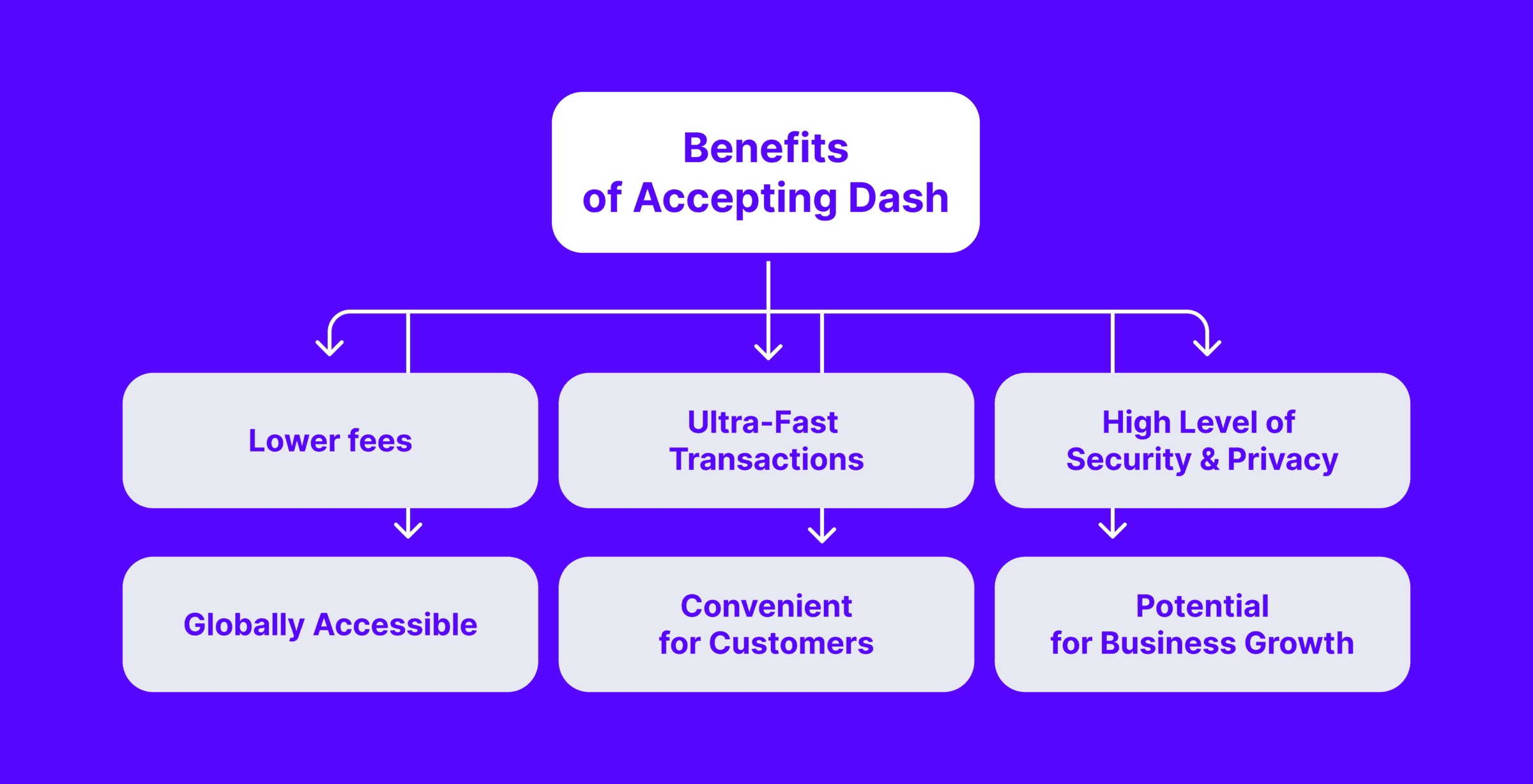

Benefits of Accepting Dash Payments

Businesses can reap several benefits from accepting Dash payments, including reduced costs, heightened security features, and the ability to reach a wider customer base around the world.

Lower Transaction Fees

Transactions made using Dash generally come with lower fees compared to conventional payment methods and other cryptocurrencies. As a consequence, businesses that frequently engage in high-value transactions stand to save a substantial amount of money.

Faster Transactions

As a researcher studying digital currencies, I’ve come across Dash’s InstantSend feature which guarantees confirmation of transactions in mere seconds. This near-instantaneous settlement significantly boosts the payment processing efficiency by drastically cutting down on waiting times. Ultimately, it leads to greater customer satisfaction.

Enhanced Security and Privacy

Dash’s privacy functions, including PrivateSend, provide an extra layer of secrecy by concealing past transactions. This safeguards confidential financial details, lessening the likelihood of unauthorized activities and strengthening client faith.

Global Accessibility and Inclusivity

As a financial analyst, I would rephrase it as follows: By utilizing Dash transactions, businesses can transcend geographical boundaries and connect with customers globally without the restrictions imposed by conventional financial systems. This global reach promotes inclusivity by extending financial services to individuals in underprivileged areas, thereby fueling economic engagement and expansion.

Potential for Business Growth and Expansion

Businesses that welcome Dash payments can access a broader clientele and fanbase, thereby expanding their customer base. This newfound expansion brings about fresh income sources and prospects for advancement. Furthermore, integrating cutting-edge payment methods such as Dash positions businesses as trendsetters in the industry, boosting their market standing and edge over competitors.

The perks of using Dash for transactions go beyond just processing payments, providing businesses with a competitive edge in today’s thriving digital marketplace. From cost savings to expanded reach, Dash offers an enticing proposition for businesses aiming to enhance their payment systems and foster long-term expansion.

How to Accept Dash Payments

For both experienced e-commerce merchants and new business owners, incorporating Dash payments into your commercial endeavors has become an effortlessly achievable goal. To accept Dash payments, you need to establish a safe payment framework and link up processors that will enable smooth transactions.

Setting up a Dash Wallet

- Choosing the right wallet for businesses – Select a Dash wallet that meets the specific needs and preferences of your business. Consider factors such as platform compatibility, ease of use, and security features. Options include hardware wallets for enhanced security, desktop wallets for convenience, and mobile wallets for flexibility.

- Security considerations – Prioritise security when setting up a Dash wallet address for your business. Implement robust password protection, enable two-factor authentication, and regularly update the wallet software to mitigate security risks. Additionally, offline storage options such as hardware wallets should be considered to safeguard against online threats.

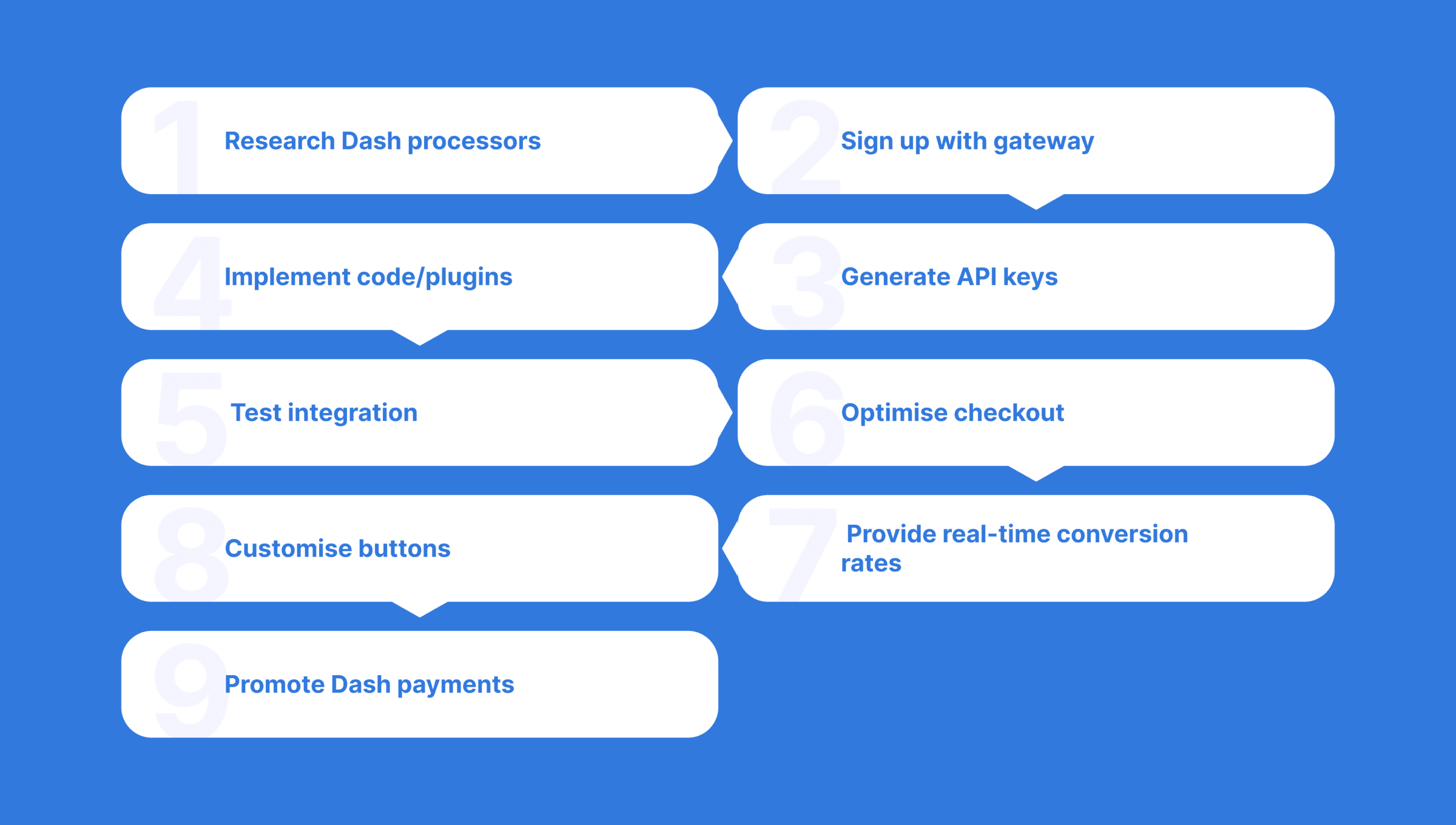

Integrating Dash Payment Gateway

- Research and identify reputable Dash payment processors that support Dash transactions.

- Sign up for an account with the chosen payment gateway.

- Generate Dash API keys or integration tokens to connect your business platform with the payment processor.

- Implement the necessary code snippets or plugins the payment processor provides to enable Dash payments on your website or point-of-sale system.

- Test the integration thoroughly to ensure functionality and compatibility with your business operations.

- Optimize the checkout process on your website to provide a seamless and intuitive experience for customers. Incorporate Dash payment buttons prominently within the checkout to streamline the payment process and encourage adoption.

- Provide real-time conversion rates and transaction status updates to enhance transparency and trust.

- Lastly, customize Dash payment buttons to align with your brand aesthetic and website design, and launch promotional campaigns!

Businesses can seamlessly incorporate Dash payments into their systems by adhering to these guidelines and proven methods. This enables them to provide customers with a hassle-free and safe payment choice, as well as broadening their potential income sources.

Legal and Regulatory Considerations

As a compliance analyst, I cannot stress enough the importance of adhering to legal and regulatory guidelines when deciding to process Dash payments for your business. The regulations can significantly differ from one region to another, influencing licensing requirements, consumer protection laws, and anti-money laundering (AML) policies. Depending on your specific business activities and geographical location, you might be obligated to secure particular licenses or permits in order to accept Dash coin payments lawfully.

In various legal contexts, transactions involving cryptocurrencies such as Dash may be liable for income tax, capital gains tax, or value-added tax (VAT), contingent upon the specific jurisdiction and character of the given transactions. To ensure meticulous compliance with fiscal obligations, it is advisable to maintain thorough documentation of all Dash transactions. This should include details such as sale revenues, dates, and parties involved in each transaction.

As a dedicated researcher focused on ensuring the security of businesses and their valued customers, I strongly recommend taking proactive measures against cyber threats and fraudulent activities. To accomplish this, implement robust security protocols that include:

Promoting Dash Payments

One way to rephrase this is: To encourage people to use Dash for their transactions, it’s important to teach them about the benefits of the payment system, offer incentives for adopting it, devise effective marketing plans, and build relationships with the Dash community and influential figures.

- Educate customers about the advantages of using Dash.

- Offer educational materials, such as blog posts, tutorials, and FAQs, to help customers understand how Dash works and how they can use it for transactions.

- Encourage Dash adoption by offering discounts or special promotions for customers who pay with Dash.

- Provide exclusive offers or incentives specifically for Dash users to attract new customers and retain existing ones.

- Create targeted advertising campaigns to reach Dash users and enthusiasts.

- Promote your business and its acceptance of Dash payments using online advertising platforms, social media channels, and cryptocurrency-related websites.

- Produce engaging content related to Dash and cryptocurrency to attract and educate potential customers.

- Participate in Dash community events, forums, and social media groups to connect with Dash users and enthusiasts. Share updates that your companies receive Dash payments.

- Collaborate with Dash influencers and thought leaders to promote your business and its acceptance of Dash payments.

Bottom Line

Dash stands out with advanced privacy protections and quicker transaction processing, rendering it an attractive choice for businesses as a payment method. With the expanding digital economy, incorporating Dash into your business could help you stay competitive and attract a larger customer base.

As a researcher focused on implementing Dash as a payment option for my business, I would recommend selecting a reputable crypto payment processor that keeps abreast of the ever-evolving cryptocurrency landscape. By doing so, you’ll not only ensure a secure and dependable transaction process but also attract a wider customer base drawn to the latest trends in digital currencies.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-04-29 17:58